- Although the asset appeared to be trading in a bullish pattern, it was also facing significant downward pressure.

- Market participants contributed to this trend by moving NEAR onto exchanges.

Over the past month, NEAR has struggled on the charts, down 25%. Even in the last 24 hours, the altcoin lost another 2.80% of its value. However, despite this bearish momentum, a new bullish pattern suggested that the downtrend may be temporarily halted.

The pressing question is whether bullish expectations can withstand continued selling pressure from market participants.

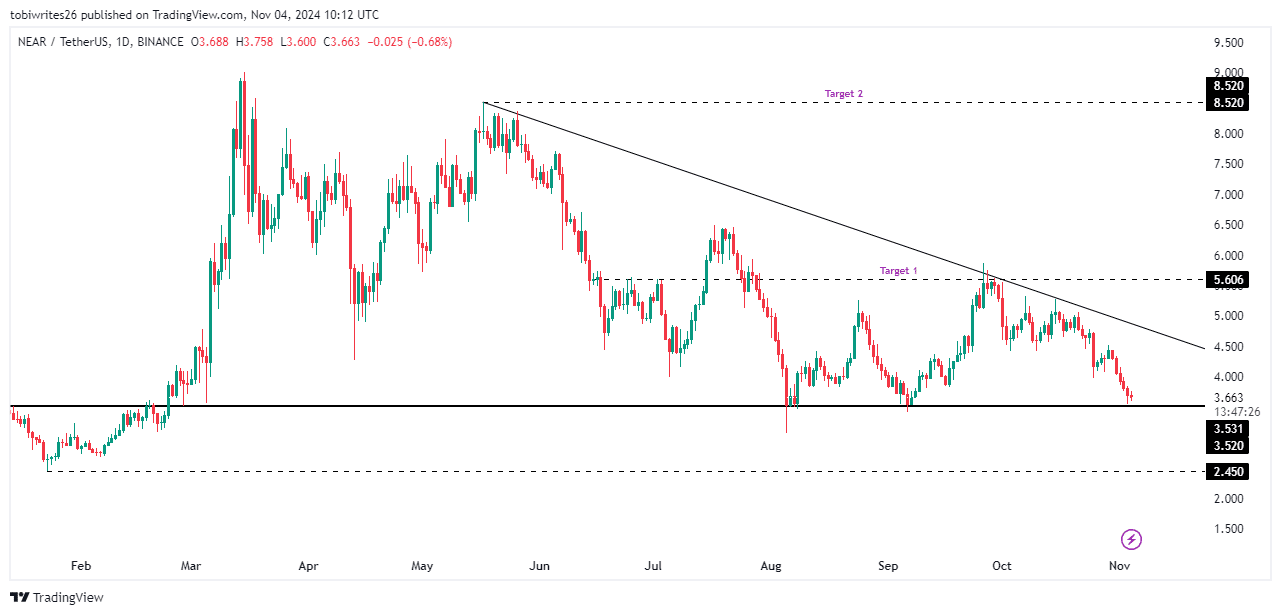

NEAR shows bullish potential on the chart.

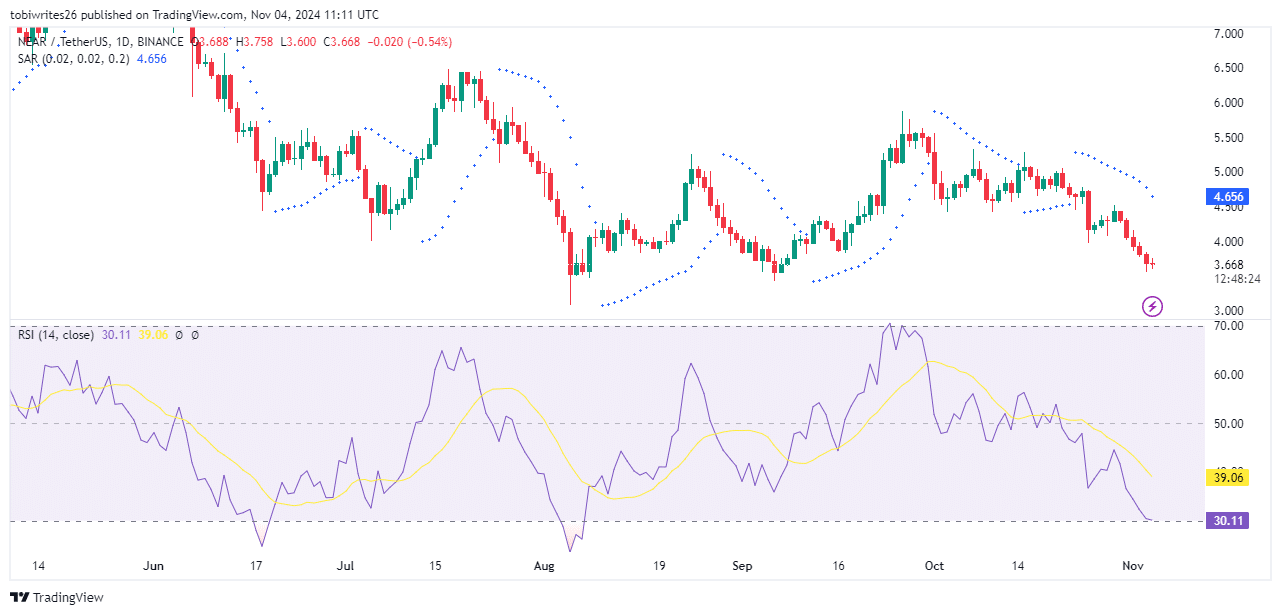

On the daily time frame, NEAR has formed a bullish triangle pattern. This is a pattern that often indicates an imminent rally. This pattern consists of a diagonal resistance line and a horizontal support line.

For NEAR to advance, it will need to test the $3.520 support level. After this test, the asset may revert back to the pattern or break away from it. When a breakout occurs, two main objectives may emerge. The short-term target is $5.606 and the long-term target is $8.520.

However, if bearish pressure dominates, NEAR could fall to the January 2024 low of $2.450, risking further losses.

Source: Trading View

To predict the next price movement for NEAR, AMBCrypto analyzed on-chain metrics to share insights into future trends.

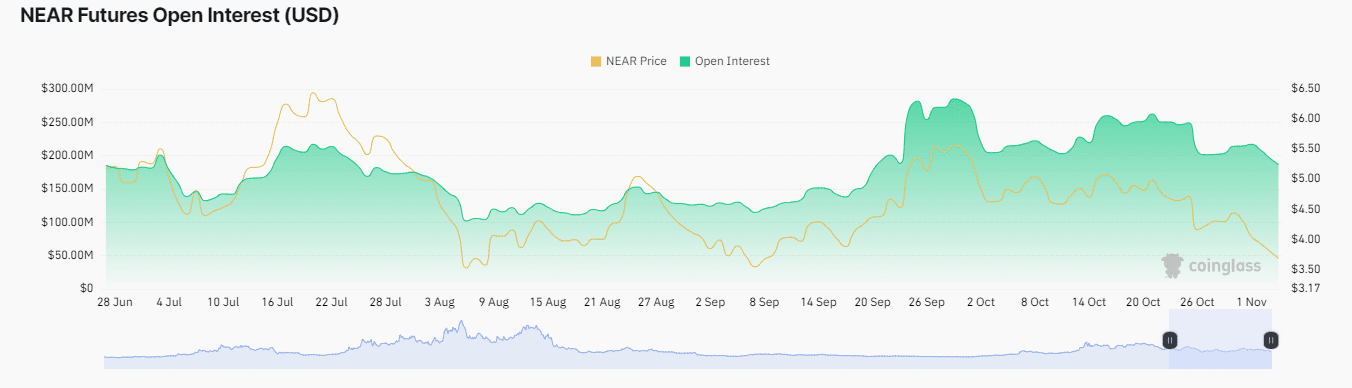

Clearing Data Discrepancies Signal Increasing Selling Pressure on NEAR

Selling pressure on NEAR may increase as major indices reveal strong bearish sentiment that is likely to push asset prices lower.

As of this writing, NEAR’s liquidation data reveals serious imbalances. This means that for long liquidation, it is over $1.02 million, while for short liquidation it is only $45,81,000. These differences highlighted a decidedly weak market position and signaled further declines in the asset.

Liquidation data, which tracks the forced closure of leveraged positions when margin requirements are not met, reveals market sentiment by showing where losses are concentrated among currently long positions.

Meanwhile, NEAR’s open interest, which measures sentiment based on active derivatives contracts, fell 1.65% over the past 24 hours to $185.65 million. This added weight to the bearish outlook for altcoins.

Source: Coinglass

Both liquidation and open interest data point to continued bearish pressure, so NEAR’s expected bullish support may not hold.

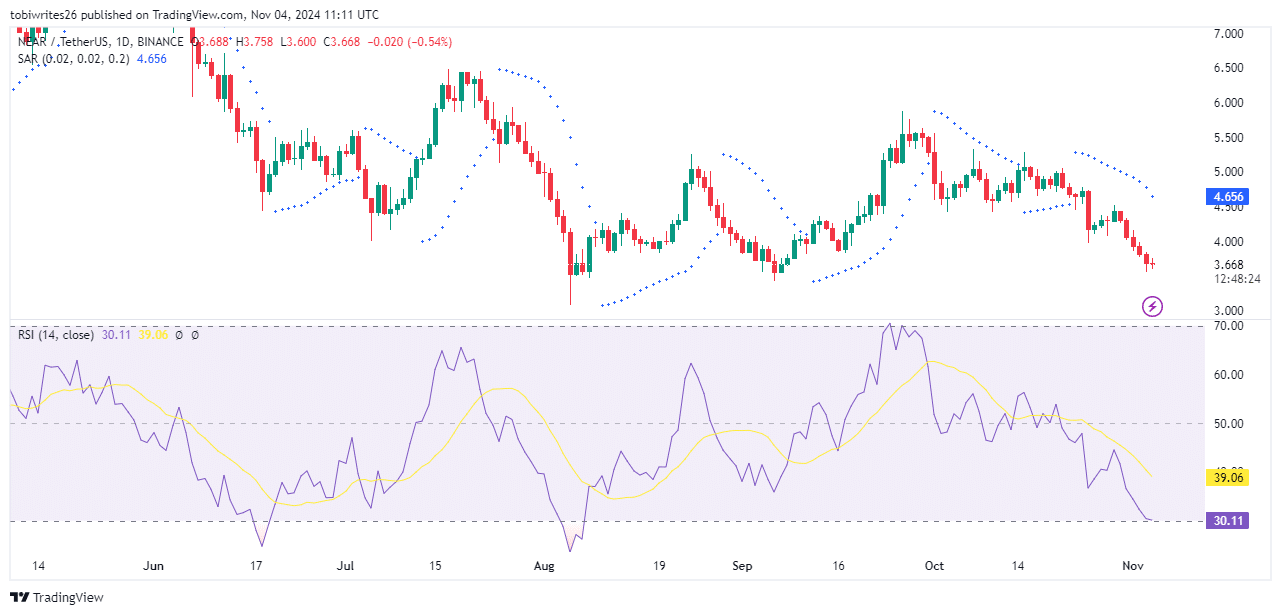

The bearish trend continues as major indicators confirm the downtrend.

At press time, the prevailing trend for NEAR remained bearish as confirmed by key technical indicators. In fact, both the Relative Strength Index (RSI) and Parabolic SAR have continued to decline.

RSI showed a downward trend to 30.69. A break below the important 30-point line could mean more downside for NEAR.

Source: Trading View

Likewise, the parabolic SAR’s dotted mark was positioned well above the candle. This is another bearish signal.

With both on-chain and technical indicators showing bearish signals, the low target of $2.45 could move higher.