- The protocol’s active address was 6 times the Ethereum address.

- The price of NEAR may continue to outperform ETH despite the differences in development.

The price of the NEAR Protocol (NEAR) has not only crushed Ethereum (ETH) over the past seven days, but has also outperformed the blockchain in many other ways.

At the time of press, the price of NEAR changed to $7.51, up 39.06% over the past 7 days. On the other hand, ETH was trading at $3,171. This is a decrease of 6.02% over the past 30 days.

But it didn’t end there. According to Artemis data, there were 406,200 active addresses on the Ethereum blockchain at the time of this writing, remaining in the same region.

Source: Artemis

ETH is not an L1 Maestro. Who is it?

For NEAR, it was a completely different story. As of April 7, the protocol had fewer than 1 million active addresses.

However, according to data from a developer analytics platform, there were 2.3 million metrics.

NEAR operates using the same proof-of-stake (PoS) consensus method as Ethereum. However, both users and developers seemed to prefer the chain abstraction stack provided by electron.

Beyond this, not many layer 1 projects have the scaling capabilities that NEAR has. This allows users to make faster and cheaper transactions without having to wait for Ethereum’s Layer 2.

Due to the momentum the protocol has shown, ETH may find it difficult to keep up with the token in terms of price. It’s another catalyst fueling the token’s rise in the buzz surrounding AI.

The result was a huge surge in market capitalization. Until a few months ago, the market for this protocol was not in the top 25. However, as of this writing, the project ranks 17th with a market capitalization of $7.36 billion.

Source: CoinMarketCap

Both sides win on different fronts

Moreover, over the past 30 days, network fees have increased by 51% to an average of $42,000. This could help it almost surpass ETH’s market capitalization, but would also bring its returns very close to Ethereum.

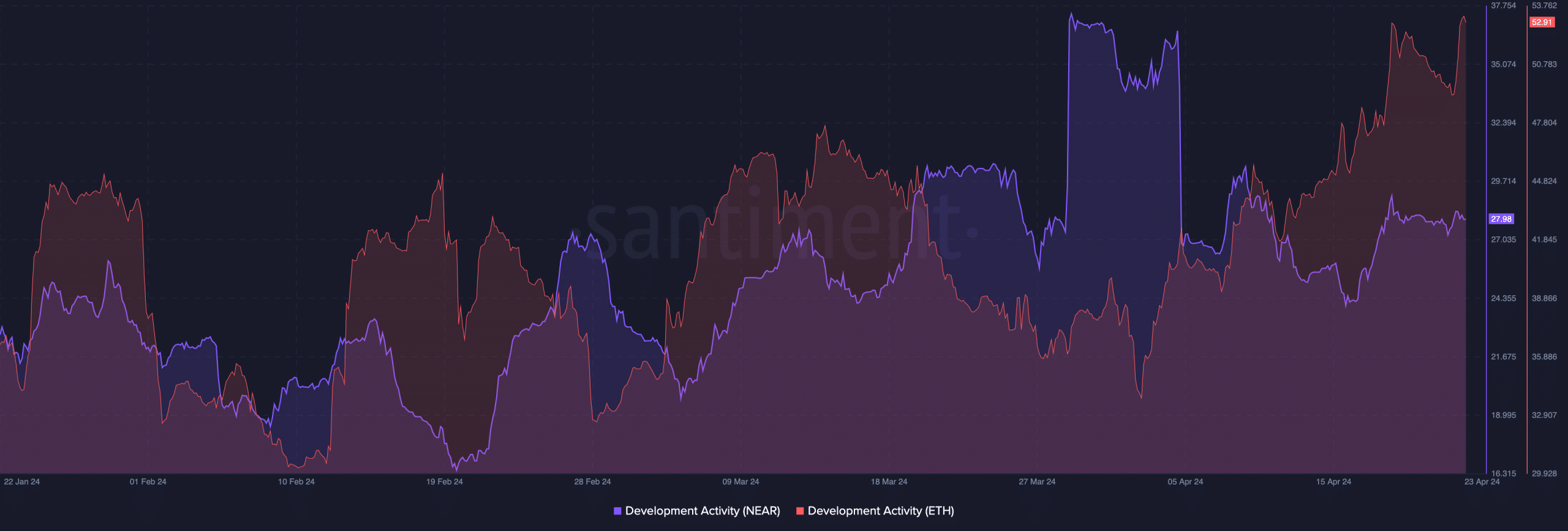

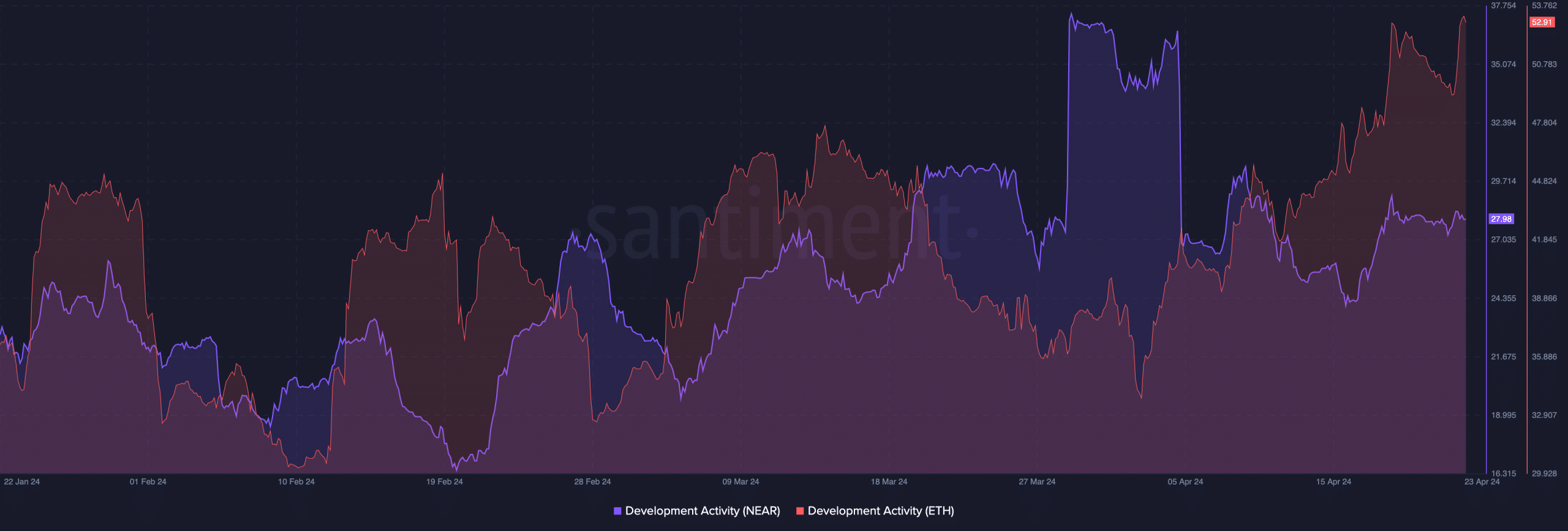

Another metric that AMBCrypto examined was development activity. According to Santiment, the development activity of the NEAR protocol was 27.98. This is a significant increase compared to the April 16 figures.

For Ethereum, the indicator is 52.91, indicating that the code applied to new features and security of the blockchain is NEAR or higher.

Source: Santiment

Using this data, NEAR may not outperform Ethereum when it comes to public GitHub repositories. However, depending on the price, it may be a different experience.

Realistic or not, the market cap of NEAR in ETH terms is:

For example, ETH has been lagging for some time. If this continues in the near term, price action may not be able to compete with NEAR’s growth.

However, if ETH starts to move in the long term, things may change. However, in the coming weeks and months, NEAR may continue to outperform Ethereum’s on-chain indicators and price.