- Tether CEO made the company’s position clear on the official blockchain.

- USDT strengthens its position in the stablecoin sector by hitting a new high of $120 billion.

Tether CEO Paolo Ardoino was in the news today after denying claims that the stablecoin issuer was building an official blockchain, the “Tether Chain.”

Ardoino responds to claims made by X (formerly Twitter). clarify The company is supporting some L2s who choose USDT as payment for gas fees.

“You rarely hear a rumor about the Tether chain. Tether currently has no plans to build an official blockchain. Simply put, other independent L2 solutions are working to support USDt dollars in gas fees.”

He added that the company’s neutrality was important to avoid “centralizing everything.”

“One of the main reasons Tether is not launching a chain anytime soon is because neutrality is so important.”

However, it is important to note that Ardoino has not ruled out the possibility of having a chain in the future.

Tether’s USDT Growth

Ethereum L2, such as Polygon, has already adopted USDT for paying gas fees. However, Tether’s moat extends beyond the Ethereum chain.

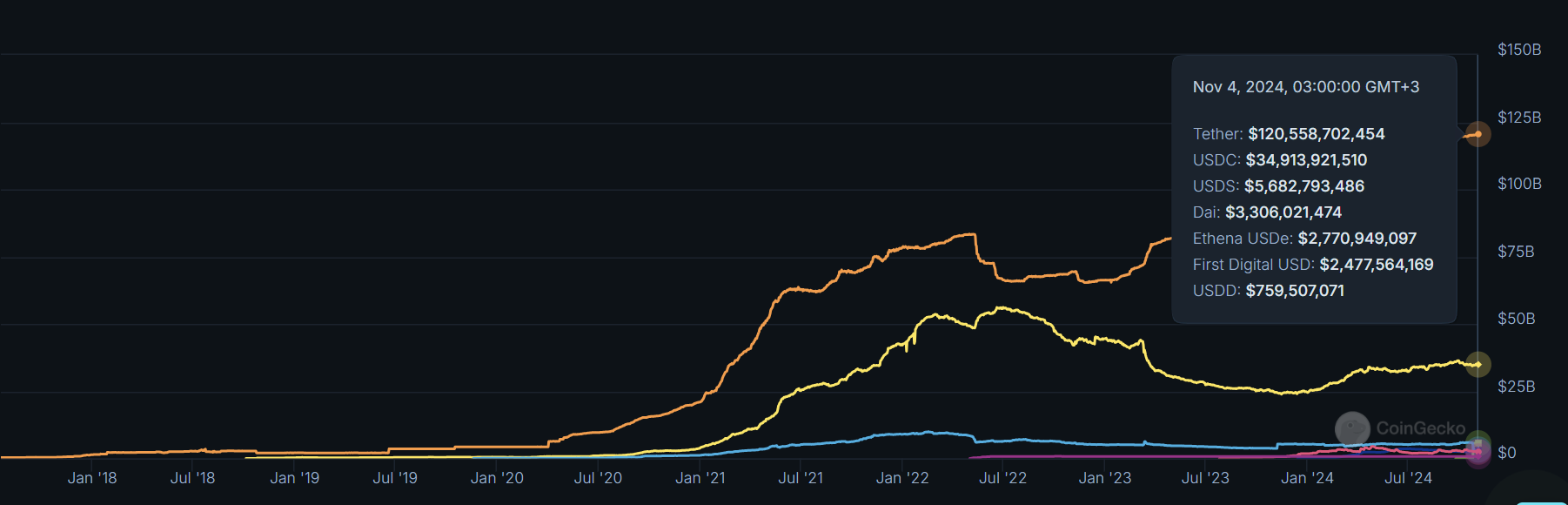

Source: CoinGecko

Tether’s USDT has dominated the stablecoin market for a long time. Its market capitalization recently hit $120 billion, surpassing last cycle’s high of $83 billion. Most market trading pairs on centralized exchanges are based on USDT, which is partly driving Tether’s dominance in the sector.

However, stablecoins pegged to the dollar have also emerged as the most popular coins for cross-border payments. This is especially true in emerging markets that are struggling with large-scale local currency inflation.

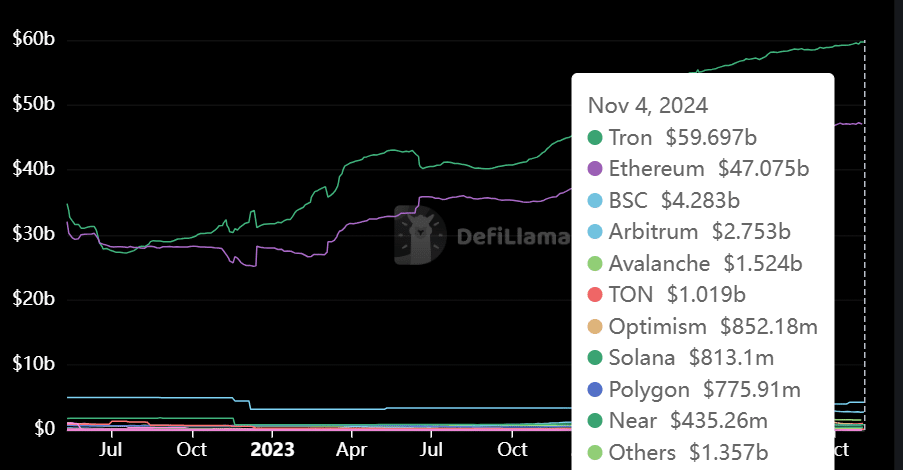

To this end, Tron (TRX) has emerged as the top chain for low-cost USDT transfers (about $60 billion), surpassing Ethereum. However, other low-cost alternative chains are also emerging to drive cheaper USDT transfers. Telegram integration ton (Open Network) applies here.

Source: DeFiLlama

The company’s current position has made it a target for critics and regulators. In fact, Ardoino recently slammed shut Another FUD claimed that the company is currently under investigation for illegal activities.

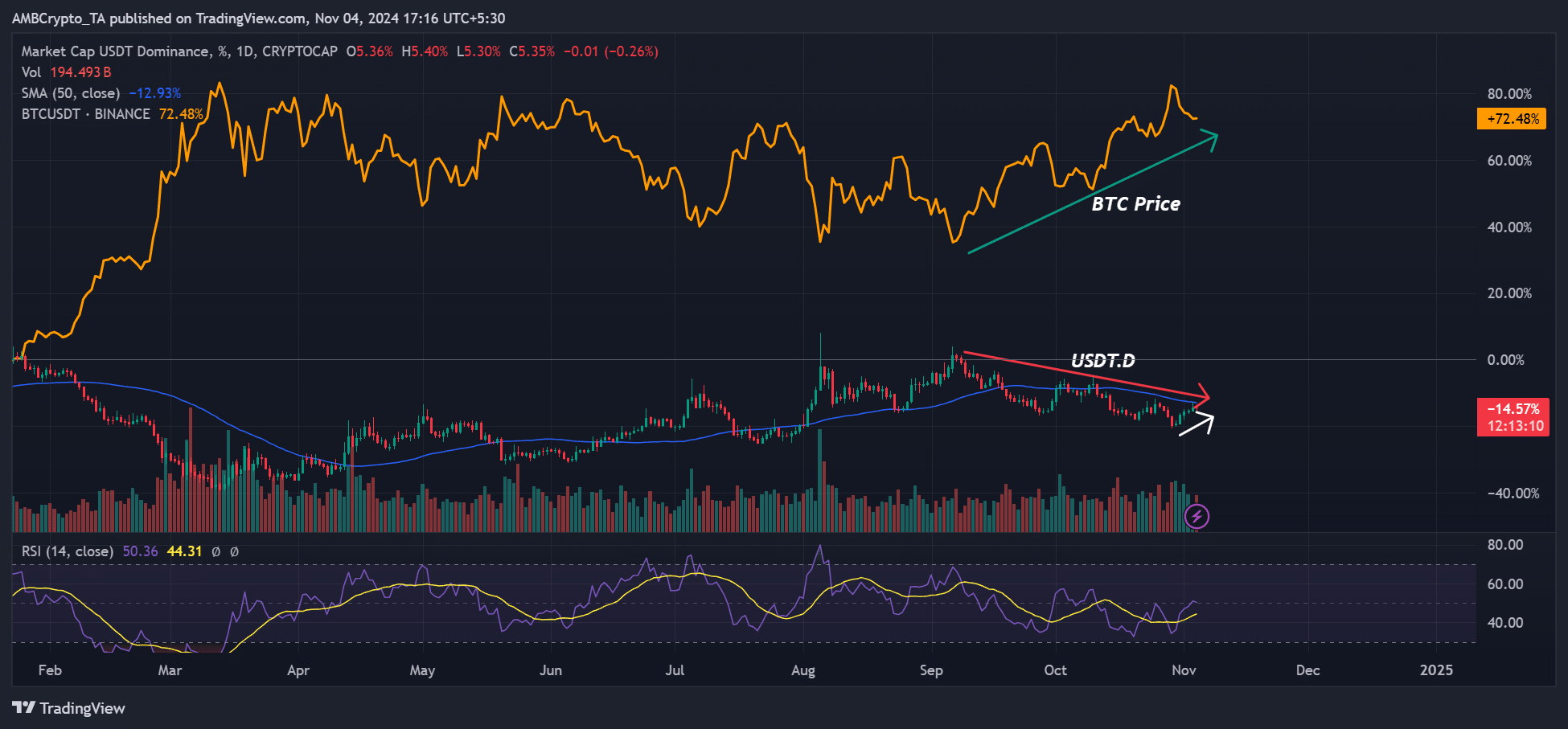

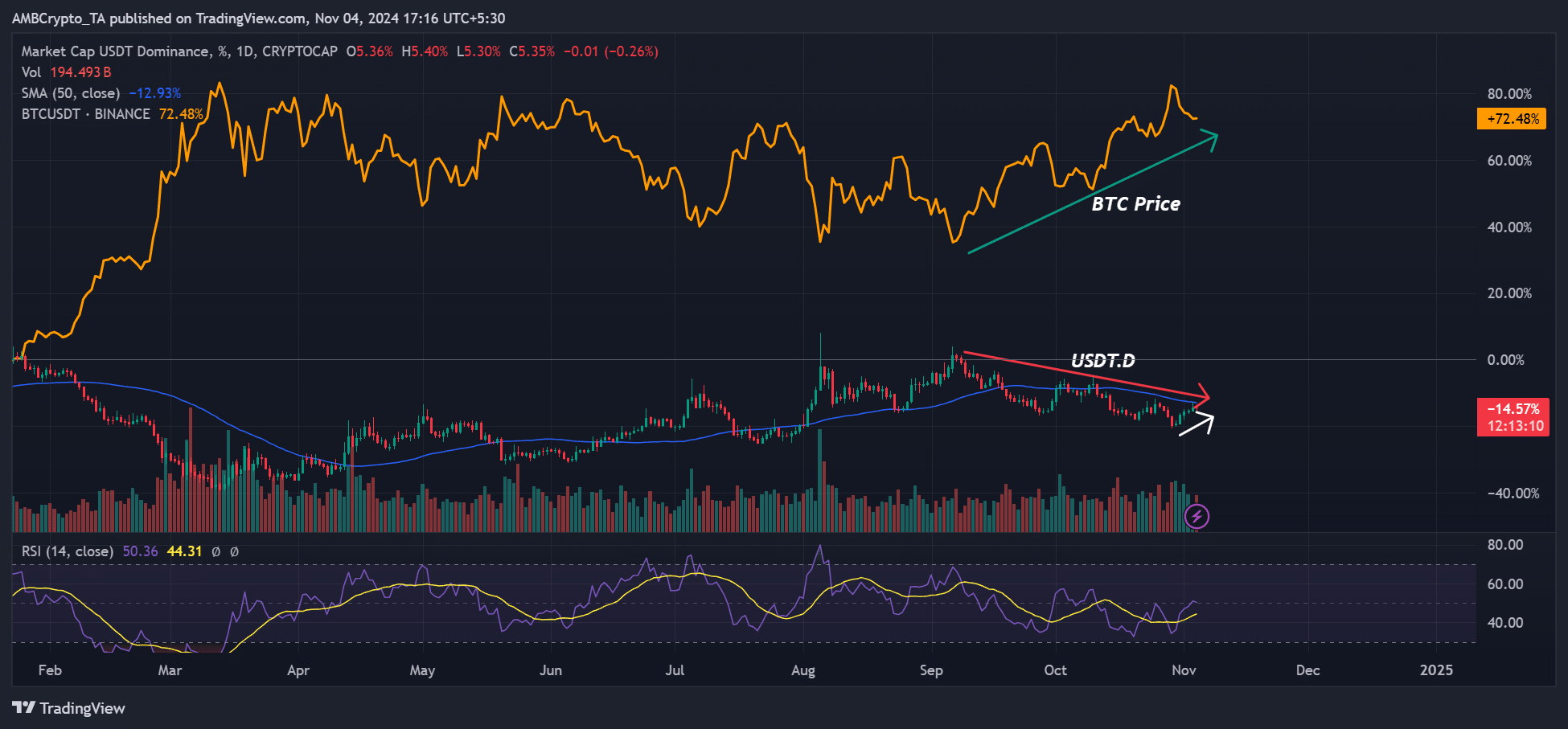

That said, USDT’s dominance also doubles as an indicator of the sector’s health and sentiment. An increase in market share means increased market liquidity, but USDT’s dominance (USDT.D) also measures whether investors are fleeing to the stables (risk-off) or accumulating massively (risk-on).

At press time, USDT.D appeared to be in a long-term downtrend, corresponding to BTC’s surge. Conversely, a strong USDT.D would suggest risk aversion and panic in the market.

Source: USDT.D, TradingView