Binance founder Changpeng Zhao said that fully transparent on-chain transactions expose salaries and business data, blocking the adoption of real-world cryptocurrency payments.

summation

- Changpeng Zhao claims that current on-chain transparency exposes corporate workflows and sensitive financial information.

- He warned that cryptocurrency salaries on public blockchains would reveal personal salaries through a visible sender address.

- Zhao and the industry say that for practical cryptocurrency payments to gain institutional adoption, stronger privacy tools are needed.

Unexplained Chinese bot traffic is colliding with a second quiet crisis. AI-based counterfeiting and identity abuse are something even the most seasoned cryptocurrency industry insiders struggle to analyze.

Ghost Traffic and Twisted Reality

In a recent Wired article, the author noted that the final months of 2025 and into 2026 are seeing analytics flooded with “visitors” from Lanzhou and Singapore, including smaller publishers, corporations, and even U.S. institutions. Although sessions barely touch the server and leave no firewall traces, they are the ones that dominate the GA4 dashboard. As one analytics firm summed it up candidly, these are “ghost sessions” created by bots that can trigger measurement calls while mimicking basic user behavior. The effect is not just technical noise. Inflated sessions distort engagement metrics, ad revenue, and campaign performance. This is especially true for niche sites where hundreds of fake visits can upset a trend line.

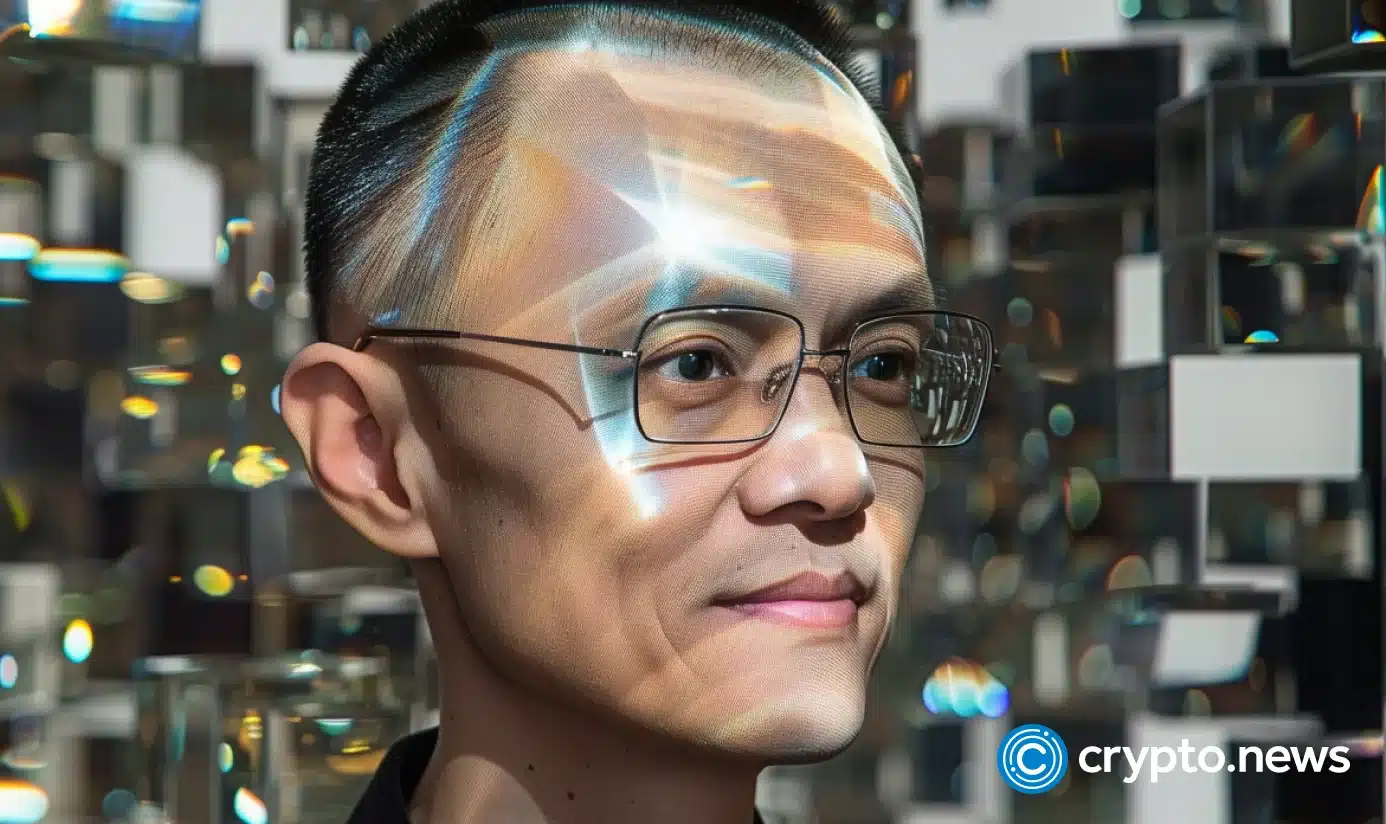

This fog of synthetic traffic coincides with waves of deepfakes that outpace human intuition. Changpeng “CZ” Zhao recently admitted that an AI-generated perfect Chinese clip was so accurate that “I couldn’t distinguish it from (his) real voice,” calling the reality “scary” and warning that “confirming video calls will soon be impossible.” His alarm followed a scam in which conference attendees, entirely AI-generated, persuaded Hong Kong’s finance team to transfer around $25 million in corporate funds.

CZ’s privacy paradox

Zhao began to connect these threats to deeper structural flaws in today’s internet and public blockchains themselves. He argues that while privacy is a “fundamental human right,” “current blockchains… provide too much transparency.” This is especially true when KYC data links your real-world identity to your on-chain address. He described “lack of privacy” as “the missing link holding back the adoption of cryptocurrency payments” and warned that a fully transparent ledger would make it easier to track salaries, supplier flows and even “ice cream preferences.”

The irony is cruel. On the one hand, exaggerated transparency, such as hyperindexed traffic logs and fully public transaction graphs, creates a rich attack surface for nation-scale scrapers and commercial data brokers. On the other hand, AI systems are now generating fake humans, fake traffic, and fake “evidence” at an industrial scale, undermining trust in all digital signals, from GA4 sessions to board-level video calls. Even basic questions (‘Who visited my site?’) become non-trivial as analytics floods in from servers routed through Singapore while GA4 looks at and ‘thinks’ about Lanzhou.

Zhao’s answer is not to abandon transparency, but to strengthen it. That means pushing privacy tools like zero-knowledge proofs and verifiable identity rails that can display deepfake personas without exposing your entire financial life on-chain. In practice, this means building systems that can cryptographically verify origin, integrity, and consent, while ensuring detailed data, whether web sessions or payroll flows, is protected by design. An alternative can be found in today’s dashboards. The web may seem “busy” but it is becoming increasingly unreadable.

Markets: Cryptocurrency as a Stress Indicator

This move comes as digital assets continue to trade as the purest expression of macro risk appetite. Bitcoin (BTC) is hovering around $68,531 in the 24-hour range, trading between $68,096 and $70,898 on about $39.4 billion in trading volume. Ethereum (ETH) is trading near $2,053 after rising about 5.5% in 24 hours, on volume of over $22.5 billion and recent lows below $1,910. Solana (SOL) has recently been trading in the $200-$220 range, with on-chain liquidity exceeding $1 billion and bulls eyeing the $236-$252 range.

Today, “Lanzhou’s” bots and face-changing executives share common lessons. In an AI-saturated market, privacy and transparency are no longer opposites. This is a common prerequisite for any data stream that investors can still trust.