The following is an excerpt from the latest edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be the first to get these insights and other on-chain Bitcoin market analysis delivered to your inbox, Subscribe now.

New rules from the UK’s Financial Conduct Authority (FCA) have come into effect for UK companies dealing in Bitcoin and other cryptocurrencies, sparking immediate public opposition.

These new rules, quietly imposed in mid-February, came as a surprise to many affected users. The FCA has already affected several payment processors, such as PayPal and Luno, suspending all their ability to allow users to purchase Bitcoin. But the main thrust of these new rules has been to develop what the FCA calls “positive friction”. The FCA will roll out new rules to respond to “social and emotional pressures to invest”, piggybacking on previous decisions in 2023 to combat the rise of “fininfluencers”, including banning refer-a-friend bonuses and other incentives on non-crypto investment sites. I made it a target. “. All in all, this plan was one of the most controversial rules: to prevent users from accessing their funds by conducting quizzes and other competency tests on all major exchanges.

The circumstances behind a new regulation of this scale are, not surprisingly, very complex. First of all, the FCA is a financial regulator that exists at the behest of the UK government, but is not directly controlled by the UK government. Although the Treasury appoints this committee, its day-to-day functions are independent of direct oversight. For example, the FCA’s predecessor, the Financial Services Authority (FSA), was set up in part to curtail industry self-regulatory practices in the financial sector, a type of legally recognized trade association. In fact, CryptoUK, the self-regulatory trade association for the UK digital assets sector, has directly opposed these new regulations.

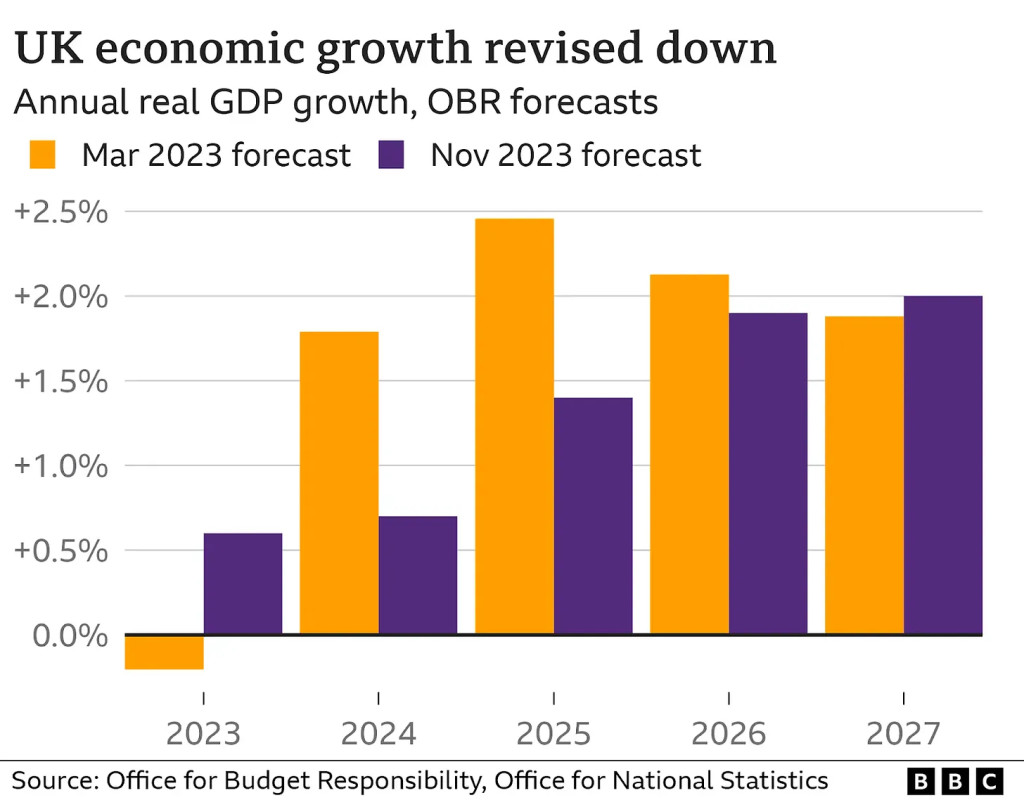

That said, it is not surprising that the FCA feels empowered to take action unilaterally, especially if it may contradict some of Parliament’s long-term economic goals. UK Prime Minister Rishi Sunak has set out ambitious policies to promote the growth of the cryptocurrency sector. Sunak wants to turn the country into a “cryptocurrency hub” through friendly regulation, attracting international capital and boosting industry development. It comes as no surprise that Sunak has identified Bitcoin as a key growth area. Much of the UK’s existing economy is driven by similar long-standing international relationships in the world of banking and finance, and expectations for the current economy have lagged behind.

So, if the same source of income is not meeting your expectations, why not look for a fast-growing industry where you can undoubtedly benefit from these existing relationships? Sunak has insisted that the first item on his Bitcoin advocacy agenda is to pass clear legislation on stablecoins, but that new FCA regulations are also very high on his list of priorities. Then there is only one question. Why did the intention to place exchanges under “the same legal framework encompassing investment banking and insurance” lead to such excessive results?

First of all, the FCA has been known for its notorious hostility towards Bitcoin over the past few months. The United States’ approval of a Bitcoin spot ETF made headlines around the world, but futures ETFs, which are more indirectly tied to Bitcoin’s actual valuation, have been legal long before then. However, the FCA has decided to close Bitcoin-related derivatives entirely in 2021 and has made no indication that it wants to change this position. This backward attitude has left Britain behind not only the United States but also most of its other largest trading partners. The European Union and major member states of the English-speaking world, including Canada and Australia, have all begun to embrace the multi-billion dollar derivatives market. Even Hong Kong, which has a long-standing economic relationship with Britain, has shown much greater receptivity to the issue.

Needless to say, the FCA’s conservative attitude towards such a large and growing industry has not gone unnoticed. Lisa Cameron, Member of Parliament and Chair of the Cryptocurrency and Digital Assets All-Party Parliamentary Group (APPG), made a public statement very similar to the report released by the APPG, arguing that the Bitcoin universe is of great economic importance. Announced. “The APPG has been clear in its recent investigative report that the UK must ensure that it has strong standards in terms of regulation and consumer protection,” Cameron said. She said: “APPG is aware that the new financial promotion scheme has caused problems for some cryptocurrency and digital companies, and there have been reports that many operators have paused their cryptocurrency purchases while they adapt to the new scheme.” She added: “Consumer protection must remain a top priority, but governments and regulators must be careful not to inadvertently discourage responsible, regulated operators from choosing to invest in the UK.”

So concerns about these regulations are shared not only by the community but also by actual legislators. Cameron’s criticism seems particularly noteworthy given that she has been a member of Sunak’s party since October 2023, after previously winning three elections on the SNP ticket. Coinbase also made headlines in January when it hired former Chancellor of the Exchequer George Osborne in an advisory role. Considering Coinbase is one of the exchanges most directly affected by these new regulations, someone who has been in charge of Treasury for six years might have some helpful advice.

That said, there may be cause for opposition across sectors, as both government figures and industry leaders have voiced opposition along with consumers at large. However, the FCA’s timeline for policy changes is anyone’s guess. Meanwhile, there have been several other significant interactions between the UK legal system and the Bitcoin world. Craig Wright, the so-called “fake Satoshi,” is currently embroiled in a court case over his continued claims that he is the true inventor of Bitcoin. If the court rules against him, it may prove to be the end of a recurring episode in the Bitcoin subculture. Likewise, while the United States is known to have made the largest seizure of Bitcoin, British law enforcement seized more than 1.4 billion pounds worth of Bitcoin in late January.

It is likely that the FCA’s rules will eventually be relaxed one way or another, as the UK government has prioritized making these new rules industry-friendly. If the backlash is large and diverse, it will become clear that a new course is needed. Bitcoin’s economic star has continued to rise over the past few years, and its influence is too powerful for unelected regulators to insist at a high level. If we can see this in the US fight for a Bitcoin ETF, we can see it in the backlash against the FCA. There is no one strong enough to challenge Bitcoin’s crown.