Summary

Just like that, cryptocurrency and non-fungible token (NFT) digital donations are now the fastest-growing new type of donation to charities around the world. Consider these 5 top points:

1. Over $300M in crypto has been gifted in the last year, and most recipient nonprofits have opted to auto-convert cryptocurrency to dollars or equivalent upon donation.

2. More sophisticated ways to receive crypto gifts, like endowments and trusts, can hold cryptocurrency for future conversion.

3. Nonprofits should move now to set up donation systems so that donors can choose them when making tax-free gifts.

4. To receive crypto donations, many nonprofits need a helping hand to guide them through setting up the right infrastructure for the future.

5. You don’t need a website widget to take crypto donations, but you do need to run a campaign. This is what companies like The Giving Block help with – driving 80% of the donations for you.

This article is for nonprofit organizations – it explains the benefits of accepting crypto donations, and describes how to accept them through reputable philanthropic platforms.

Two related articles describe other perspectives of crypto donations:

A companion article targeted at donors helps them understand how they benefit from making crypto donations.

An article for U.S. Congressional representatives guides them toward resources that help them to accept crypto donations.

Crypto Fundraising is here for Good

This is an exceptional time to cultivate donors who give in the form of virtual currencies like bitcoin and ether (ETH). But nonprofits often need help in establishing a digital platform to receive cryptocurrency gifts, and in connecting with campaigns that support donors in gifting cryptocurrency.

Currently, about $300M each year is donated in the form of cryptocurrency, and this figure continues to increase.

Beyond simply integrating a crypto donation form, nonprofits can gain more awareness and success by taking the time to understand how the donation process works, benefits for donors and nonprofits, current trends in the cryptocurrency landscape, fundraising methods, and other helpful forms of guidance.

Nonprofits seeking to accept cryptocurrency as a new revenue source are in great company. Major global and national players in the charitable sector, including Save the Children, Direct Relief, American Cancer Society, World Vision, No Kid Hungry, and United Way have established crypto and bitcoin donations as a key part of their long-term fundraising strategy. The move toward crypto adoption among nonprofits comes at a pivotal time in philanthropy.

The Pineapple Fund, which gave away bitcoin grants to 50 nonprofits valued somewhere between $55-86 million, thrust crypto philanthropy into the headlines in 2018. Today we can see its continued influence throughout the crypto community, from individual investors to blockchain companies, who see charitable giving as a way to highlight crypto’s potential to make positive change in the world.

Here is a sampling of charities that accept crypto donations today:

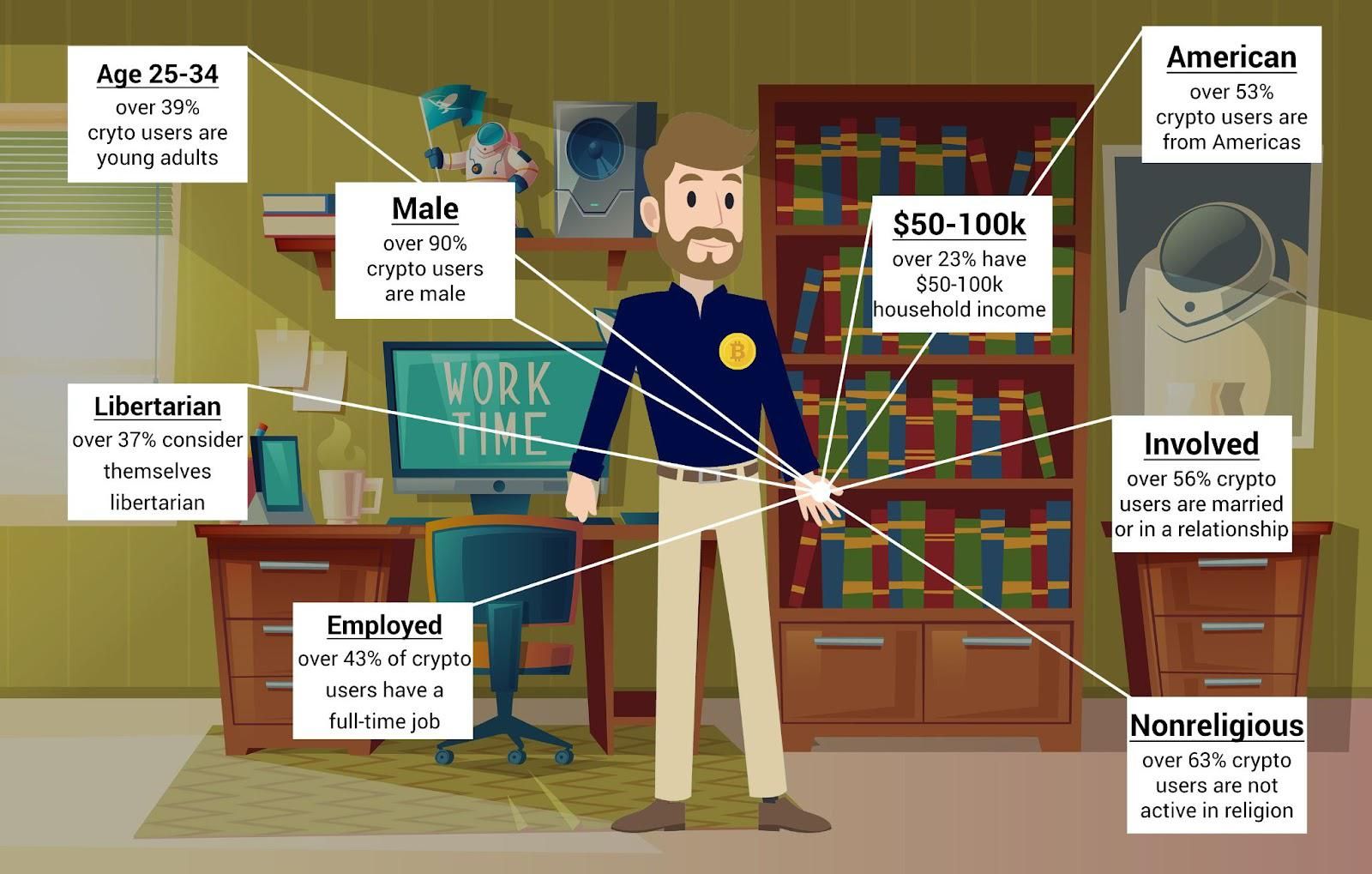

Who donates using cryptocurrency?

Cryptocurrency investors tend to be young and tech-savvy. A study found that 94% of crypto buyers are between the ages of 18 and 40, the majority of whom are millennials. As a generation raised on the internet and mobile phones, millennials and their “Gen Z” peers are quick to adopt new digital and virtual technologies and tend to view crypto as a more reliable investment than traditional stocks.

The strong returns on bitcoin, ether and other digital assets have brought new wealth to many young investors. They see donating a portion of their crypto gains as a way to support causes they care about, while also reducing their tax burdens.

Why should you accept crypto donations?

Amongst the many reasons for nonprofit organizations to accept cryptocurrency donations, three main advantages stand out:

- Cryptocurrency and NFT donations are tax-efficient for both the donor and the charity. Donors pay no capital gains tax, and nonprofits receive 100% of the donation tax-free. Nonprofit charities are exempt from paying capital gains tax when they sell assets, so the full value of the gift stays intact.

- Crypto donations to international nonprofits can be transmitted and tracked more easily.

- Nonprofits have flexibility in how to realize the gift value – they can convert to a currency-based asset type immediately to avoid potential volatility, or they could hold the funds (“HODL”) as an investment in the form of an endowment to fully realize its value and impact over time, e.g., the Charity Water Trust.

Tax efficiency

To illustrate the tax efficiency of crypto donations, consider this example from Fidelity Charitable that shows a calculation of how much more of a donation is received from donated crypto versus if the donor had converted it to cash first.

Fidelity Charitable

- This example assumes that all realized gains are subject to the maximum federal long-term capital gains tax rate of 20% and the Medicare surtax of 3.8%. It also assumes no additional state or local taxes.

- The amount of the proposed donation is the fair market value of the appreciated crypto-asset held more than one year that you are considering donating as determined by a qualified appraisal.

- The tax basis is assumed to be $300,000. If you sold the bitcoin for $1,100,000, you would have $800,000 in capital gains and would pay $190,400 in tax.

Why are crypto donations good for non-profits?

No Chargebacks

Using traditional methods, a donation transaction is conducted via credit card, ACH, or wire transfer – perhaps even via a cheque. These transactions take days to clear, often incur fees, and are subject to chargebacks if there is a problem with the payment.

More Transactional Transparency

Cryptocurrency donations are more efficiently transferred to nonprofits anywhere in the world, usually in less than 10 minutes. Since all crypto transactions are recorded on the Blockchain – a ledger that is publicly accessible – all transactions can be easily tracked and verified by the donor and the nonprofit.

Lower Processing Cost

According to the 2020 Global Trends in Giving Report, 63 percent of donors worldwide prefer to donate online via debit or credit card. But giving by card can reduce the actual donation that organizations receive since processing fees can range anywhere from 2.2 to over 10 percent (according to Charity Navigator, a nonprofit that rates online donation processors).

How much of a difference might that make? Let’s say you wanted to donate $1,000.

Donate via credit card: the processing fees incurred by the organization could be as high as $75.

Final donation received: $925

Donate via crypto: the same donation made in bitcoin would incur a transaction fee of about $8.70 (calculated using the median transaction fee on April 5, 2021 according to CoinMetrics.io).Final donation received: $991.28

What are the tax implications for crypto donors?

In the U.S., crypto donors pay no capital gains taxes on donations to 501(c)3 organizations. This is a huge benefit for the donor for an activity that would otherwise trigger a taxable event.

In addition to having no capital gains taxes due, the donation of appreciated crypto creates a tax deduction for the donor equal to the fair market value of the donated crypto asset. A win-win situation.

When you compare the costs of making a donation from crypto assets directly with the costs when using post-tax assets, the donor would be subject to a minimum of 23.8% federal long-term capital gains on post-tax asset donations (and perhaps more at the state level, depending on their state of residence). There are currently no federal capital gains taxes levied on crypto donations.

Other countries, including the UK, have also moved to reduce or eliminate capital gains on cryptocurrency rewards.

Additional Resources:

What are the tax implications for nonprofits that accept crypto donations?

What steps should a nonprofit organization take when someone donates cryptocurrency? The first step is proper tax reporting.

A contribution of cryptocurrency valued at more than $250 requires a standard noncash donation receipt.

In addition, the IRS has classified cryptocurrency as property, not currency. Therefore, a donor must file Form 8283, Noncash Charitable Contributions, to receive a charitable deduction if the property is over $500.

Further, if the contribution is valued at more than $5,000, the donor must receive an appraisal prepared by a qualified appraiser to substantiate the valuation, and the organization receiving the donation must sign Form 8283. However, it is unclear whether the cryptocurrency markets are sufficient to establish the valuation. These articles from the AICPA and the Planned Giving Design Center contain more information on cryptocurrency valuation.

Additional Resources:

IRS Crypto FAQ101: Crypto Tax Guide

Crypto Tax Survival Guide

Where are crypto users located?

Crypto Demographics maps show that there are over 300+ million crypto users worldwide, with the majority in Asia (160 million), and roughly comparable numbers in North America (28 Million), Europe (38 million), South America (24 million) and Africa (32 million).

Over 300+ Million Crypto Users Worldwide

https://triple-a.io/crypto-ownership/

In the IS, a typical crypto owner looks like this

https://myaltcoins.info/demography-of-crypto-population/

What are the options for accepting crypto donations?

The simplest approach, and one that maps to receiving stock or property, is to accept the crypto donation and auto-convert the donation into a government-issued currency like US Dollars. This has the benefit of simplifying tax reporting, and the nonprofit doesn’t have to deal with crypto wallets and changing crypto prices.

There are more sophisticated ways to receive crypto donations that can maximize the impact of the donation by holding onto the donation for longer periods. This may require additional agreements between the donor and the nonprofit, and potentially some safeguards from the donor to guarantee a minimum value of the gift. An example of a minimum-value guaranteed crypto donation is the recent $5 million donations in bitcoin made to the Wharton School.

These types of arrangements make sense for Reserve funds, Endowments, Trusts, and Donor-Advised funds.

0. A Guide to accepting crypto donations

Although cryptocurrency trading can be complex and confusing, setting up your nonprofit to receive crypto donations is actually very straightforward. The simplest way of handling crypto donations by default for almost every nonprofit is to auto-convert donations into fiat money: U.S. dollars or your local government-issued currency.

First, your organization will need to pick a crypto donation platform – preferably one that has a multi-year track record, and one that partners with well-known companies to process back-end transactions. Unfortunately, as of this writing, few existing donation platforms support cryptocurrencies – so it makes sense to identify and use one that specializes in crypto donations.

In addition to the crypto donation platform, you will also need to create an institutional-grade account (crypto wallet) with a company that will perform the conversion from crypto into currency (and will charge a trading fee that typically ranges between 3-5%). Examples of companies that do this include Gemini, BitPay, and Coinbase Commerce. You will need to confirm with your crypto donation platform which crypto exchanges they do business with. In many cases, they will handle the setup of this account.

Once both of these accounts are set up, you will be able to place a donation widget on your website, which donors will engage to make their donations.

At this point, you will have joined the first of the nonprofits to benefit from the crypto economy.

Enabling the mechanics of accepting crypto donations is a good first step, but nonprofits can maximize their donations by leveraging fundraising networks that work 24/7 on fundraising from crypto donors. Getting listed on these networks is a huge advantage – some nonprofits receive 80% of their crypto donations via fundraising networks like The Giving Block that have been built over a span of years.

Donor campaigns are critical – they not only build awareness of your cause but also educate donors that they can save a lot of money and deliver a larger impact by donating in crypto. Look to your donation platform to see what they offer from their network – it is a big advantage to have your donation platform find and educate potential donors for you.

We are still at the beginning of a financial sea change that reflects the world just beginning to use cryptocurrency, and there is a first-mover advantage by showing up now on lists of nonprofits accepting crypto donations. When a donor has decided that they want to make a crypto donation, donor platforms offer them an easy way to direct that donation. The Giving Block offers a convenient and effective way of enabling donors to select nonprofits from their website, augmenting the nonprofit’s own fundraising efforts

The following sections outline four easy steps to get started with a donation platform:

- Choose a crypto donation platform and associated crypto account.

- Add the donation platform’s donation widget to your nonprofit’s website.

- Receive donations from donor campaigns.

- Enjoy the visibility of a listing on the donation platform’s website.

1. Choose a cryptocurrency donation platform

There are a variety of crypto donation platforms, which currently have little overlap with traditional donation platforms (although traditional platforms will in time also support crypto). There are several categories of donation management platforms:

- Complete end-to-end crypto fundraising platforms like The Giving Block, which help nonprofits set up their donation accounts, perform auto-conversion of donated crypto, add website widgets, run donor campaigns, and advertise nonprofits as donation targets.

- Every.org is a nonprofit for nonprofits that help 501(c)3 organizations fundraise – uniquely, they don’t charge nonprofits to fundraise on Every.org and never take a cut of any donation.

- Donation management platforms that simplify the mechanics of receiving crypto donations, like Engiven.

- Crypto payment processors like BitPay that handle commercial crypto transactions and provide services to donation platforms. (There are circumstances like special endowments where you might choose to handle the crypto donation directly in a customized way.)

- Platforms like NYDIG that focus on endowments and other sophisticated gifts of digital asset donations for universities and charitable institutions.

- Other platforms that are focused on providing donors with tax advantages via Donor Advised Funds (DAFs), including Endaoment a tax-exempt community foundation that helps nonprofits receive their very first crypto grants, Fidelity Charitable, the largest donor-advised fund in the United States, with over $35 billion in assets, and its main competitor, Schwab Charitable, with over $17 billion.

“So far this year, Fidelity Charitable has received $150 million in cryptocurrency, up from $28 million for all of 2020 and $13 million in 2019. The appreciated value of cryptocurrency is prompting more donors to use this asset to fund their charitable giving as well as increasing the average size of each contribution.”

– Stephen Austin, Fidelity Charitable

Some Crypto Donation Platform links are:

The most popular platform: The Giving Block

In researching the space, The Giving Block is the #1 donation platform that donors and nonprofits choose. It acts as both a payment processor and a fundraising platform. On average, it supplies 80% of the donations given to the organizations that use its platform. Some of its campaigns, like Bitcoin Tuesday, drive seasonal traffic, and other campaigns, like the Crypto Giving Pledge, run throughout the year. By using The Giving Block, you plug into a network that has been built over several years. There is a customer success team to help nonprofits navigate through this new territory. The platform takes care of automated receipts, auto conversion of funds and deposits, and offers a donation widget for the recipient organization that can be put anywhere, not just on the nonprofit’s website. The Giving Block network strives to offer the best technology, compliance, and customer support around.

The most cost-effective platform – free forever: Every.org

In a sea of commercial options that charge fees for receiving donations and in some cases fees for setup and ongoing campaigns (albeit essential expertise), Every.org stands out as a nonprofit for 501(c)3 nonprofits. Their platform is simple to setup, free for nonprofits forever, and they don’t take a cut of donations. An excellent choice for a first step in the world of crypto.

2. Install your website donation widget

Nonprofit organizations are familiar with traditional donation website widgets that go on campaign landing pages and their own websites. Crypto donation widgets are just as simple.

Here’s an example of a landing page from a nonprofit: OutRight Action International. In addition to benefiting from a dedicated donation page on their own website powered by The Giving Block, OutRight Action is also listed on The Giving Block’s searchable network of nonprofits, which allows donors to select them directly from The Giving Block’s website or from specialized #CryptoGivingTuesday or #CryptoGivingPledge campaigns.

3. Donor fundraising campaigns and social giving

Just as traditional corporate donations achieve the dual goals of helping nonprofits and creating good publicity, corporate crypto donations demonstrate a positive commitment to social good and to the future of the crypto industry.

Crypto donations can be magnified with regular opportunities for donors to join forces with other donors to give cryptocurrency that can be matched by generous philanthropists:

- #CryptoGivingTuesday – similar to #GivingTuesday

- #CryptoGivingPledge

- #BAGSeason – Bitcoin Annual Gift

Look for these events on social media.

Many initiatives are designed to structure corporate crypto donations effectively. One such initiative is the Crypto Giving Pledge, which enables individuals and companies to donate 1% of their crypto assets every year. This results in an immediate, annual impact for targeted nonprofits and their missions, and enables donors to conveniently offset their crypto capital gains tax burdens every single year.

If the entire crypto community took the Crypto Giving Pledge today, that would generate $20 Billion for nonprofits.

4. Donation platform website listings

There is no universal approach to making a crypto donation. However, there are many service providers that work with nonprofits to make it easy, simple, and safe to make and receive donations from their websites. By far the most helpful of these service providers is The Giving Block. (The Giving Block also offers this helpful Crypto Glossary for Nonprofits.)

The first step that many donors take is searching for a nonprofit that can accept cryptocurrency donations. These sites help donors find worthy organizations that can accept crypto and that meet their philanthropic goals:

(If you are a nonprofit: get yourself on these lists!)

What should your organization consider about gift acceptance policies for crypto?

If your organization decides to accept cryptocurrency, be sure to include any required donor or donation characteristics or limitations in your gift acceptance policy. This will guide your finance team in knowing whether to accept a specific donation, and the steps to follow when it is received.

How can you accept NFT donations?

NFTs are unique records of physical or digital assets that are transacted on blockchain networks in similar ways to cryptocurrency, and as such, can be donated to nonprofits in much the same way.

So what makes NFTs suitable for charity? Well, according to a report by the World Bank, people are more likely to donate to charity if they feel they will receive something in return. This explains why many fundraising efforts employ the use of auctions and events to raise money. In the case of NFTs, this effect can be compounded by the social status that owning an NFT from a charity auction can provide; users can prove that they have been charitable, which makes them more likely to donate.

In addition, blockchain technology allows the funds donated to charities to be tracked, ensuring there is greater trust and accountability for charities that can demonstrate that their funds have been effectively used – making blockchain potentially a game-changer for the charity sector.

There are several ways to gift an NFT:

- Gift an NFT outright – Most NFT platforms enable you or the original creator to gift an NFT, which is then transferred to the nonprofit’s crypto wallet address.

- Select an NFT to be auctioned by the donor, with proceeds sent directly to the nonprofit in cryptocurrency. There are lots of NFT platforms, and Foundation.app, in particular, has done a good job of enabling proceeds to be sent to a variety of charities automatically.

- For creators – Decide on a physical or digital asset to donate, mint the NFT, and configure the smart contract in such a way that whenever the asset is sold, in perpetuity, a percentage goes to a nonprofit’s crypto wallet.

Right-Click, Give! (RCG)

Right-Click Give! is the largest charity fundraising event in NFT history. The world’s top projects, artists & collectors are joining forces in a one-of-a-kind charity auction. 100% of proceeds are going to Blankets of Hope, a 501(c)3 nonprofit on a mission to inspire a global movement of kindness.

Over 50 of top NFT projects and artists in the world, including Gary Vaynerchuk’s VeeFriends, Tom Bilyeu’sMerry Modz, and other global brands such as Cool Cats, CyberKongz, Doodles, GutterCatGang, PixelVault & World of Women just to name a few. Click here to see all projects and artists involved.

How does it work?

1. Projects/artists/collectors donate NFT(s) to RightClickGive.eth

2. All NFTs will be placed for auction at RightClickGive.com from Dec. 20-24th

3. 100% of proceeds will be donated to Blankets of Hope, 501(c)3Blankets of Hope is on a mission to inspire a global movement of kindness, one blanket at a time. Blankets of Hope has already partnered with schools across 43 states and 3 countries to donate over 50,000 Blankets of Hope to those in need. This year, their goal is to donate another 50,000 blankets in just one school year.

With Right-Click, Give!, Blankets of Hope aims to grow their movement of kindness even further!

What are some examples of NFT donations?

What are the tax Implications for NFT donations?

Per the IRS, any crypto-to-crypto transaction is a taxable event. Since NFTs are crypto assets and are purchased using cryptocurrencies such as Ethereum (ETH), buying an NFT is considered a crypto-to-crypto trade by the IRS – and this means that you’re subject to taxes when buying and selling NFTs.

Thus, simply creating an NFT is not a taxable event. But all of the following NFT activities are taxable:

- Purchasing an NFT with cryptocurrency

- Trading an NFT for another NFT

- Disposing of an NFT for a cryptocurrency

- Disposing of an NFT in exchange for fiat currency, or a non-crypto asset.

When you purchase an NFT with cryptocurrency, you’re also disposing of that cryptocurrency. This means that you are also liable for capital gains taxes on any increase in that cryptocurrency’s value.

For example, if you purchased a CryptoPunk NFT for a price of 5 ETH when ETH was $1,000 (for a total purchase price of $5,000), and later sold it for 3 ETH when ETH was $2,000 (for a total sales price of $6,000), you would recognize a taxable gain of $1,000 from your NFT sale.

But there are really two transactions in this scenario: the first, when you bought the NFT, and the second later when you sold the NFT.

For the first transaction – when you spent your 5 ETH to buy the CryptoPunk – let’s say that ETH’s value had increased from $600 to $1,000 during the period of time that you held it. So when you used that 5 ETH to buy your NFT, you were disposing of $5,000 worth of ETH for which you had only paid $3,000, and therefore you would have owed tax on that $2,000 capital gain.

In other words, when you first bought your CryptoPunk, you incurred capital gains tax on the gain that you enjoyed from an increase in your ETH’s value. And then several years later, when you sold your Punk, you incurred more tax from your gains on the NFT itself.

In sum, because crypto is considered an asset, you will incur tax liability when you trade crypto for an NFT—and when you dispose of said NFT for crypto.

Profit earned from an increase in the demand for a cryptocurrency is generally subject to the regular capital gains tax rate. However, this is not necessarily true with NFT transactions, as many NFTs may be considered collectibles, and thus subject to a higher capital gains rate, or in rarer cases, as inventory, and thus subject to income tax rates.

From a charitable giving perspective however… the proceeds from an NFT sale can be transmitted to the nonprofit in cryptocurrency, and therefore be exempt from Capital Gains, and a full deduction is available.

Source: Excerpted from NFT Tax Guide by Token Tax.

Are there more sophisticated methods for accepting crypto donations?

It is possible to hold on to crypto donations for longer periods to maximize the impact.

So far we have discussed the scenario where a crypto donation is made by the donor and the nonprofit auto-converts that donation into cash – as is usual with appreciated assets. However, with cryptocurrency and NFTs, there is an opportunity to make a far more lasting impact with the gift – if paired with appropriate safeguards against volatility.

Many charities now accept crypto endowments. For instance, Charity Water set up a trust that receives crypto donations and holds them for 5 years, after which time, the crypto assets can be sold.

Similarly, the Wharton School has received large bitcoin donations intended to stimulate more crypto giving. These donations are backed by the donor to ensure that the school receives a minimum value in case the price of crypto goes down.

Donor-advised funds, Charitable Trusts, and Community Foundations can also receive gifts in bitcoin and ETH – if the nonprofit can accommodate.

Example: charity: water’s Bitcoin Water Trust

The global safe drinking water nonprofit charity:water announced the launch of its first crypto-native Bitcoin Water Trust initiative. The trust will allow the trust to receive and “hodl” bitcoin donations to fund global water projects until 2025. In line with the values of the donors, the trust’s funds will be held in bitcoin, and the intended execution of the water projects that it funds and constructs will be conducted in bitcoin.

Since the organization received its first bitcoin donation from Tony Hawk in 2014, the price of that seminal cryptocurrency has exploded, increasing by more than 100 times. After learning more about bitcoin, watching its price skyrocket, and becoming captivated by the vast potential of the blockchain technology that powers it, charity:water established the Bitcoin Water Trust Initiative in hopes of sparking a paradigm shift in the charitable sector. Learn more at https://www.charitywater.org/bitcoin.

Example: The $5M long-term Bitcoin donation to the Wharton School

“The $5 million bitcoin gift in May was more complex. The donor wanted it to be large enough to attract attention that would help the university get similar donations. At the same time, the donor wanted the money to fund research and programs at the Stevens Center for Innovation in Finance at the Wharton School.The donor wanted the university to hold at least some of the donation in Bitcoin, but the issue of what would happen if it plummeted in value had to be resolved.

“Our policy had been to traditionally sell everything immediately, even if it had been $5 million in stock,” Mr. Zeller said. “So the donor and the university agreed that he would backstop it. He gave us $5 million in bitcoin. We liquidated some; we’re holding some. But he said, ‘I guarantee that at the end of the day you’ll get $5 million whether it’s in bitcoin or something else.'”

Excerpted from “Nonprofits Get a New Type of Donation: Cryptocurrency” by Paul Sullivan, July 30, 2021

(Subscription may be necessary to read the original article.)

Example: The Pineapple Fund’s large anonymous crypto donor

In December 2017, an anonymous crypto investor named “Pine” created the Pineapple Fund as “an experiment in philanthropy with cryptocurrency.” Pine donated $55 million worth of bitcoin to 60 different charitable organizations — focused on everything from the environment and mental health to social justice and homelessness.

How can you take action now to secure early-mover advantage for crypto donations?

We recommend that nonprofits not wait for their existing systems to catch up with crypto donations, but rather take the initiative to secure an early-mover advantage and plug into the networks of the many crypto donors who will seek tax relief this year and in subsequent years.

While a lot of attention has been paid to large crypto gifts, there is just as much opportunity in connecting with new, younger donors who will donate smaller amounts, and likely for much longer.

Want to read more? Here’s another great article.

Crypto Tax Services from Mike Minihan and BX3

Mike Minihan, Managing Partner, BX3 Capital

Mike joined BX3 Capital in 2018 after more than 20 years as an international tax attorney and entrepreneur. He has seen virtually every aspect of international taxation, having worked for the Internal Revenue Service, in private industry, and for Big Four public accounting and tax consultancies KPMG and PwC. Mike was a founding partner of WTP Advisors, a boutique international tax consulting firm that specialized in assisting the world’s largest companies with the thorniest of tax structuring and compliance issues.

Over the years, Mike has also founded or co-founded several other tax focused start-up ventures. After the successful sale of WTP in 2014, Mike joined the international income tax practice of Ryan, LLC, a specialized tax service firm, where he stayed until the start of his second consultancy career at BX3. Over the years, Mike has also founded or co-founded several other tax focused start-up ventures.

Mike joined BX3 to help build the business side of growth-stage companies. BX3 helps companies secure growth capital but also manages numerous C-Suite functions for its founders, including accounting, tax, legal, marketing, and public relations. Utilizing his experience as an entrepreneur, attorney, and taxation expert, he is helping guide BX3’s clients through the inevitable issues that plague start-ups in these areas.

Mike holds both a BBA (Finance) and a JD from Pace University, and an LLM in Taxation from New York University. He is admitted to practice law in New York, Connecticut and the District of Columbia.

His entrepreneurial feats were chronicled in Fortune’s “David vs. Goliath” segment, and he has been a frequently used source by the Wall Street Journal on matters related to international taxation. He has written numerous articles and lectured copiously on taxation issues. In September 2018, Mike provided guidance to a Congressional panel consisting of numerous members of the House and Senate on the taxation of cryptocurrencies. Mike has also served as a visiting professor at Fairfield University’s Dolan School of Business.

BX3 is staffed by passionate professionals with decades of combined experience in finance, investment banking, marketing, accounting, tax, and law. BX3 uses its expertise to raise funds and provide the necessary tools and framework to turn ideas into successful businesses across a variety of sectors. It works exclusively with clients and partners who reflect its own core principles of collaboration, ethics, and transparency.

Crypto Legal Services from Philip Berg and Otterbourg P.C.

Philip Berg is chair of Corporate Practice at Otterbourg P.C., and has twenty-five years of legal experience specializing in corporate mergers and acquisitions, finance and securities offerings, and blockchain and cybersecurity law. Phil is Chairman of Otterbourg’s Corporate department and Chairman of the firm’s Privacy and Cybersecurity practice.

At Otterbourg, Phil has led a push into the field of blockchain-based smart contracts and crypto assets, including representing clients in exempted security token offerings. He has represented public and private businesses, private equity firms, financial institutions, and entrepreneurs in the acquisition and divestiture of businesses, private placement of equity and debt securities, joint ventures, commercial financings (secured and unsecured), and general corporate matters.

He is an active member of the International Association of Privacy Professionals and is a Certified Information Privacy Professional (CIPP/US). He is also active with the Wall Street Blockchain Association and the Chamber of Digital Commerce, both influential industry groups for the cryptocurrency and digital assets industry.

Phil previously served as a corporate attorney at Cravath, Swaine & Moore LLP, where he completed over $1.5 billion in corporate transactions and financings for Fortune 500 clients. He also served as a corporate acquisitions executive at PRIMEDIA, Inc., a Kohlberg Kravis Roberts affiliate, where he structured the acquisition and divestiture of numerous divisions and businesses, as well as a broad array of minority equity investments.

Additionally, Mr. Berg served as law clerk for Hon. Thomas H. Meskill, Chief Judge of the United States Court of Appeals, Second Circuit. In law school, he was Executive Editor of the Harvard Journal of Law and Public Policy. He has served on the boards of directors of several privately-held companies. He is admitted to practice in the State of New York.

Otterbourg offers clients a unique combination of legal insight and practical solutions and is known for its integrity, stability, and business knowledge. Otterbourg attorneys represent financial institutions (including banks, asset-based lenders, hedge funds, finance companies and insurance companies) and corporations and other business enterprises. It helps clients with financing transactions, acquisitions, investments, litigation, and alternative dispute resolution, real estate transactions, workouts, restructurings, and bankruptcy proceedings.

After more than 100 years, the firm continues to expand its capabilities in order to meet its clients’ needs. Prospective and current clients, law students, lateral attorneys, and legal staff are encouraged to explore the Otterbourg website, and to connect via its “Contact us” page for more information.

Protecting cryptocurrency and NFTs with Blake Commagere and Wasim Ahmad, Vault12

Blake Commagere is the Chief Operating Officer and co-founder of Vault12, and a serial entrepreneur, angel investor, and advisor to several companies in the San Francisco Bay Area. He has started seven companies and sold five of them. In 2007, he created the social gaming category by building some of the biggest apps ever (over 50 million players) on Facebook, including the iconic games Zombies, Vampires, and Werewolves.

Blake also wrote and designed the first version of “Causes on Facebook,” which has over 120 million users, and has raised over $100 million for various charities. He regularly gives talks on subjects including Philanthropy, Growth Hacking, Fundraising, and Psychology Management.

Blake graduated with a Bachelor’s degree in Computer Science from Rice University.

Wasim Ahmad is the Chief Crypto Officer of Vault12 and is a serial entrepreneur with five exits. Wasim is an advisor in the fields of AI, the blockchain, cryptocurrency, and encryption solutions. At Vault12, he led the private and public fundraising, and focuses today on expanding the Vault12 ecosystem. His crypto experience began with AlphaPoint, where he worked with the founding team to promote the world’s first crypto trading exchange solutions.

Previously he was a founding member of Voltage Security, a spinout from Stanford University, that launched Identity-Based Encryption (IBE), a breakthrough in Public Key Cryptography, and pioneered the use of sophisticated data encryption to protect sensitive data across the world’s payment systems.

Wasim serves on the board of nonprofit StartOut, and is a Seedcamp and WeWork Labs global mentor.

Wasim graduated with a Bachelor of Science degree in Physics and French from the University of Sussex.

Vault12 enables crypto investors to create a digital vault where assets can be stored (no cloud, no personal footprint to be hacked/lost). Seed phrases put in a vault are encrypted and split (using Shamir’s Secret Sharing), and then distributed to designated trusted people, Guardians, from amongst friends and family – e.g., 5 or 10 people. Digital Vault users can set a minimum threshold of confirmations to retrieve assets, such that for example 3/5, or 5/10 confirmations may be needed to unlock and access an asset or to recover a vault.

The Digital Vault innovation includes a seamless end-to-end consumer experience that gracefully handles situations such as losing a phone and recovering the crypto vault assets, or replacing a trusted crypto Guardian.

To support crypto inheritance, one of your Digital Vault trusted Guardians is identified as a beneficiary and has the ability to recover all the assets – with appropriate safeguards for preventing unauthorized access of assets. For more information and to download the Vault12 app, please visit vault12.com.

DISCLAIMER

The information provided on this website is of a general nature. It is intended for guidance only. It is based on our understanding of current legislation and is correct when going to press. It is not a substitute for specific advice in your own circumstances. You should obtain specific professional advice from a professional accountant before you take any action or refrain from taking any action.

Furthermore, this website contains links to external sources of information that we believe you will find useful. However, we are not responsible for the content or integrity of any external websites and, as such, accept no liability for any viruses or malware connected to those sites, and any resultant damage caused.Whilst we endeavour to use reasonable efforts to furnish accurate, complete, reliable, error-free, and up-to-date information, we do not warrant that it is such. We and our associates disclaim all warranties.

The information can only provide an overview of the regulations in force at the date of publication, and no action should be taken without consulting the detailed legislation or seeking professional advice.