Be with us telegram Channel to maintain the latest state for news reports

Norges Bank, the world’s largest sovereign asset fund with $ 1.7 trillion assets, has increased its stake in Bitcoin in the second quarter, and mainly purchases Michael Say Clair’s strategy and Japanese -based metapla net.

NORGES BANK has raised its total indirect retention to 11,400 BTC at 6,200 BTC during this period, according to the standard charter.

GEOFFREY KENDRICK, head of digital asset research at Standard Chartered, explained this surge as a “pre -position” and reflects the widespread trend of sovereignty and government agencies that strengthen indirect bitcoin exposure through financial -centered companies.

Kendrick reached his conclusion by analyzing 13F BTC ETF (Exchange-Traded Funds), Strategy and Submission with the US Securities and Exchange Commission (SEC) with stake in strategy and metaplanet.

Kendrick recently raised the year-end BTC goal to $ 2 million in conjunction with Canary Capital CEO STEVEN MCLURG, which predicted that BTC could record $ 1.4 million-$ 150K this year during the federal reserve rate cuts this year.

Norges Bank UPS Bitcoin Exposure 11,4K BTC

Norges Bank built BTC exposure by mainly holding stocks in strategy. But through the latest analysis, Kendrick has been somewhat shifted from this trend, and it is often regarded as a “Japanese strategy.”

Norges Bank seems to diversify its stake in Bitcoin Financial Company, but Kendrick says this fund is still focusing on strategy. Currently, the fund’s stake in Metaplanet corresponds to 200 BTC.

Norges Bank Investment Management, which supervises Norwegian sovereign assets, doubles Bitcoin. $ mstrer and $ mtplf. https://t.co/wiqna2ynhd pic.twitter.com/17KC5ZFQX0

-Dylan leclair (@dyllanleclair_) August 15, 2025

Strategy and Metaplanet have been one of the most active Bitcoin financial companies in recent months.

The MSTR is the largest company Bitcoin Holder with 628,946 BTC in the current balance table. data In Bitcointreasuries. MetAplanet, meanwhile, ranked seventh with 18,113 BTC.

Kendrick adjusts the year -end goal to $ 200k by the end of the year.

Kendrick’s analysis said that at the end of the year, sovereignty funds and government agencies are mainly purchasing stocks in strategy, increasing indirect exposure to Bitcoin in the first quarter. He also predicted that this trend would continue all year round.

Last month, the analyst of the standard car raised the Bitcoin price target to $ 1.35 million by September 30. I also repeated $ 200K price target at the end of the year.

These goals match the goals shared by Canary Capital McClurg.

speaking He said on August 15 that BTC is still likely to reach $ 150 million, $ 14 million before the Bear Market War next year.

MCCLURG has warned of a wider bear market without sure about the current macroeconomic outlook.

He predicted that cuts will be announced in September and October, claiming that there should be interest rate cuts in the United States.

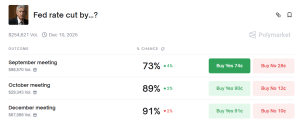

Polymarket Bettors also believes that interest rates will soon be announced. no way contract On the distributed betting platform, asking if the early federal reserve interest rate cuts will increase in September and October.

The probability of fed rate cuts is monthly (source: polymarket)

Based on EST 2:03, the next cut is likely to be 73% in September after an increase of 4% over the last 24 hours, and the probability of October cuts in 89% after an increase of 2%.

Related article:

Best wallet -diversify the encryption portfolio

- Easy to use and function -oriented password wallet

- Access early token ICO

- Multi -chain, multi -vehicle, non -parenting

- Now Google Play at App Store

- You can get the best token $

- 250,000+ Monthly active users

Be with us telegram Channel to maintain the latest state for news reports