- Memecoin Normie recently suffered a serious hack.

- The token suffered a major crash following the attack.

- Normie’s developers are negotiating with the hack perpetrators.

Hacks and fraud have plagued the cryptocurrency industry over the past few years, causing widespread concern and significant losses for investors and projects alike. Recently, Normie (NORMIE), the base memecoin project, fell victim to smart contract abuse, causing a sharp crash in the value of its token.

Afterwards, negotiations took place between the Normie hackers and the project developers, and the hackers outlined their demands.

Normie Hack: No Token Release, No Refunds

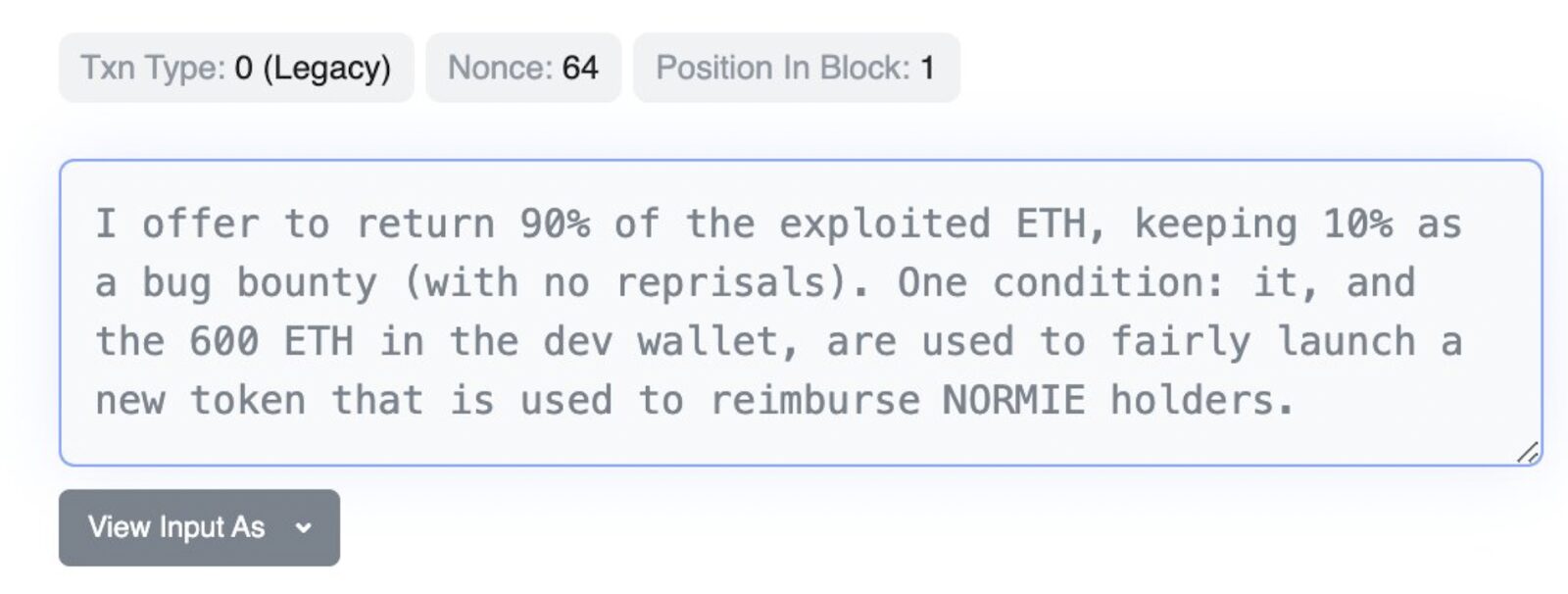

According to an on-chain message highlighted by blockchain security company Lookonchain, the perpetrators responsible for the Normie hack have expressed their intention to return 90% of the stolen funds.

However, the hackers’ demands included the right to keep 10% without retaliation and the condition that developers must use the returned funds to launch new tokens.

According to the hackers, the proposed token launch will aim to reimburse affected NORMIE holders, 79,000 of whom reportedly suffered significant losses. Additionally, the perpetrator ordered 600 ETH, worth approximately $2.3 million, in the developer’s wallet and used the returned funds to build new tokens.

Normie’s developers quickly accepted the offer, claiming they were ready to meet the hackers’ requirements. The team stated that new tokens will only be released after retrieving official X accounts that have been suspended due to exploits. However, the hackers remained firm, insisting that new token requirements must be met before refunds can be issued. But how did the exploit occur in the first place?

NORMIE HACK: Here’s what happened.

The flash loan exploit, which occurred on May 26, 2024, was the result of exploiting a loophole in the contract’s tax mechanism. Hackers accused the project’s developers of Normie’s “copy-paste” smart contract code, raising questions about the level of security ensured before deployment.

In response to the crash, the token suffered a major plunge. The value of NORMIE plummeted around 3:00 AM (UTC) the same day, falling approximately 99% from $0.0427 to a low of $0.00002, and continues to struggle.

Security firm QuickIntel further highlighted security concerns, noting that it discovered the vulnerability in early March 2024. This indicates that this issue has existed for some time and remained unresolved.

One investor reportedly lost around $1.6 million in the Normie collapse, and his portfolio of 11.23 million tokens purchased on March 25 is now worth just $150. Other community members criticized Normie’s developers’ response to the incident, accusing them of being reluctant to engage with the community about next steps.

Learn more about how this BTC hacker refunded victims after the attack.

$71M Bitcoin Fraud Refunds Victims After Negotiations

Is another Kardashian name crypto scam imminent? Read more here:

Caitlyn Jenner Token Shill Raises Concerns: Will History Repeat?