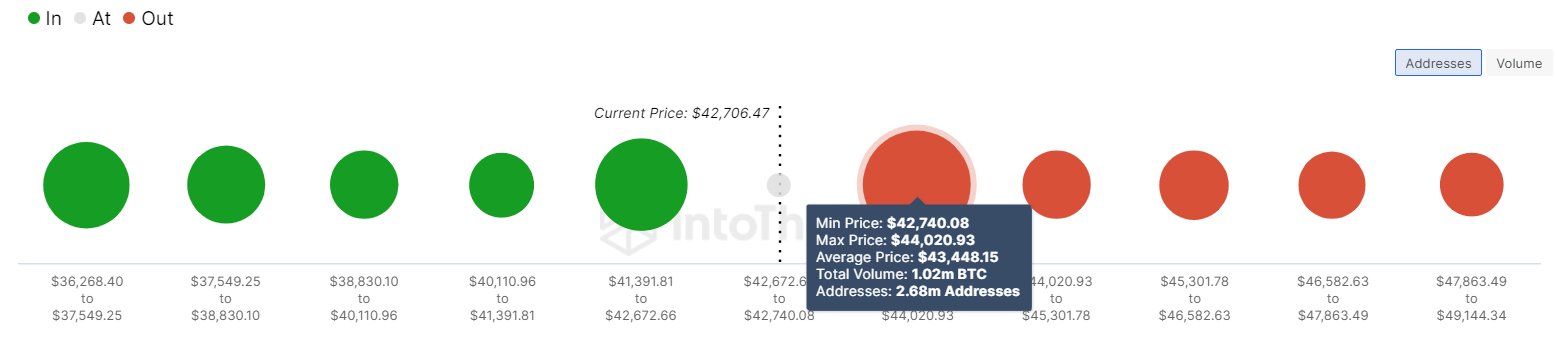

According to on-chain data, Bitcoin currently has a large wall of resistance. The exact levels that make up this important range are:

A large amount of Bitcoin supply was purchased between $42,700 and $44,000.

According to data from market intelligence platforms: Into the Block, BTC is just below the important on-chain resistance zone. In on-chain analysis, the strength of a resistance or support level is defined based on the number of coins acquired by investors there.

For any holder, their cost basis is obviously significant. Therefore, it may be more likely that the cryptocurrency spot price will see some movement whenever it retests the profit-loss boundary.

Investor reactions to these retests may vary depending on the direction of the retest. Holders who have suffered losses can sometimes be desperate to get out of the market, so if the price retests their cost basis (i.e. if the retest occurs below), they may sell so that they can at least recoup their investment.

These sales could provide resistance to the price. Just a small number of investors making such moves may have no connection to the broader market. However, if a significant number of traders have acquired large amounts of BTC within a narrow range, the reaction from a retest could be significant.

On the other hand, investors who were profitable before the retest may see the decline in cost basis as an opportunity to accumulate more assets and think prices will rise again. If these purchases are large enough, they can support the assets.

Now, here is a chart showing what the various Bitcoin price ranges currently look like based on the amount of BTC earned:

The density of cost basis at the different price ranges above and below the current value of the asset | Source: IntoTheBlock on X

As the graph shows, the $42,700 to $44,000 range hosts the cost base for 2.68 million addresses, with a total of 1.02 million BTC won within it. The average price in this range is around $43,400, which is higher than the current spot price of the cryptocurrency.

“Uncertainty could lead holders to sell at breakeven points, creating greater resistance on the upside,” the analytics firm explains. However, if Bitcoin can break this resistance, it may be easier to explore higher levels since there is less resistance.

The chart shows that there is a significant $41,400 to $42,700 support range below the current spot price, which has helped smooth Bitcoin’s decline during the recent correction. So even if the resistance zone rejects BTC, this support zone could at least help it bounce back.

BTC price

As of this writing, Bitcoin is trading around $43,200, down 8% over the past week.

BTC has displayed boring price action in the last few days | Source: BTCUSD on TradingView

Featured image by Kanchanara on Unsplash.com, chart by TradingView.com, IntoTheBlock.com

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.