- Not stalling near $0.12 as demand and inflows slow

- However, if we retest $0.014, a potential profit of +10% would be at risk.

In addition to the overall market rally, native tokens of projects linked to Telegram and The Open Network (TON) have benefited from the listing of Toncoin on Binance. Clicker game Notcoin (NOT) was no exception.

NOT jumped up 15% and hit $0.012 on its listing day, August 8. However, since then, the price action has been somewhat stagnant. So what’s next for the viral Telegram game?

NOT – Key levels to watch out for

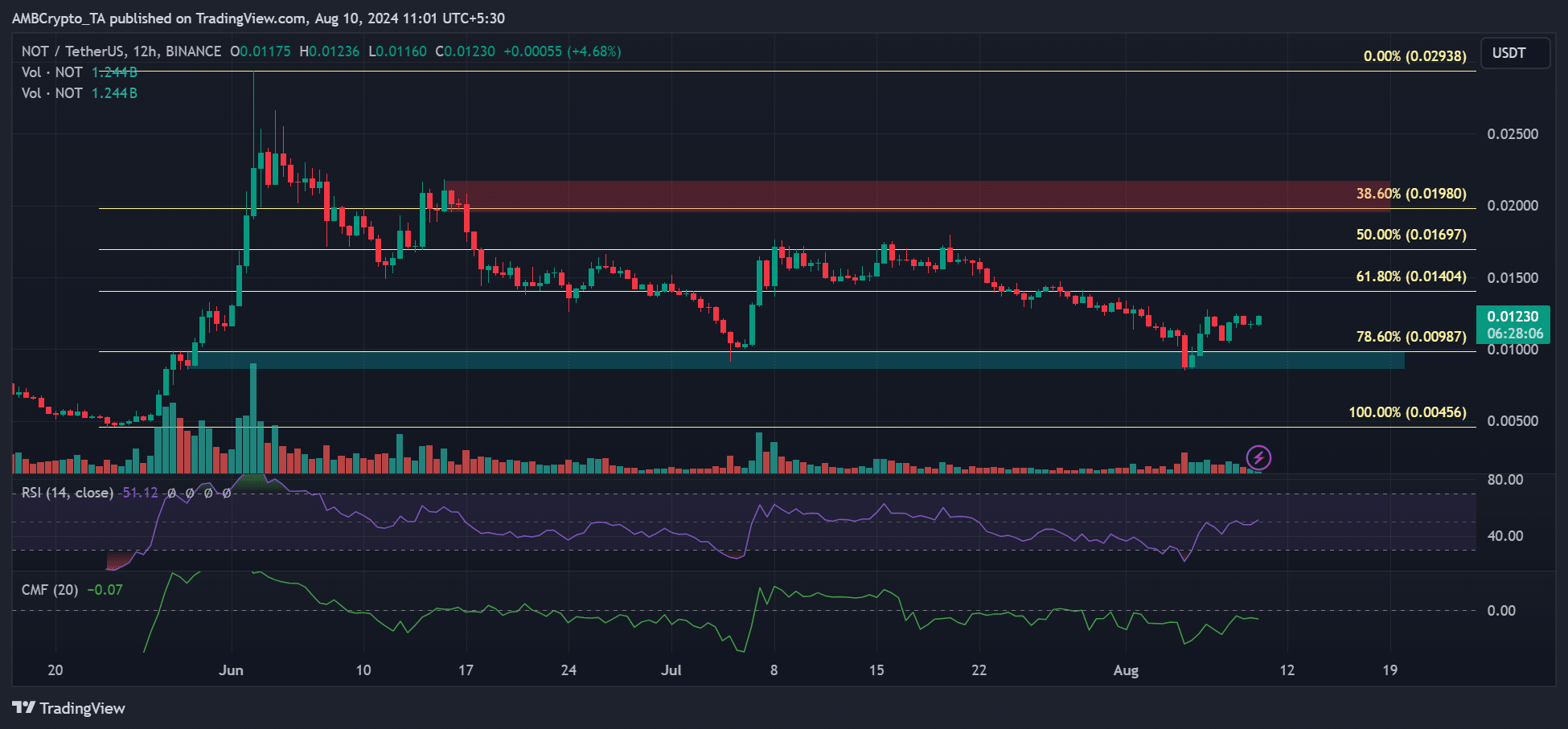

Source: NOT/USDT, TradingView

On the 12-hour chart, $0.01 has acted as a major support for the past two months. It has been a major price point of interest for bulls as it doubles as a bullish order block (OB) and coincides with the 76.8% Fibonacci level.

On the upside of the price action, immediate bullish targets were the 61.8% Fibonacci level ($0.014) and the 50% Fibonacci level ($0.016). The 50% Fibonacci level was an important short-term supply as it blocked further upside in July.

So, where should we go next?

At the time of writing, the price chart indicators were neutral and did not favor an uptrend or a downtrend. This was highlighted by the sideways movement of the RSI (Relative Strength Index) and the CMF (Chain Money Flow), which were close to the average level. This meant that demand and inflow were flat.

However, a further pump towards the immediate bullish target of 61.8% ($0.014) is still likely, which would lead to a potential profit of +10%.

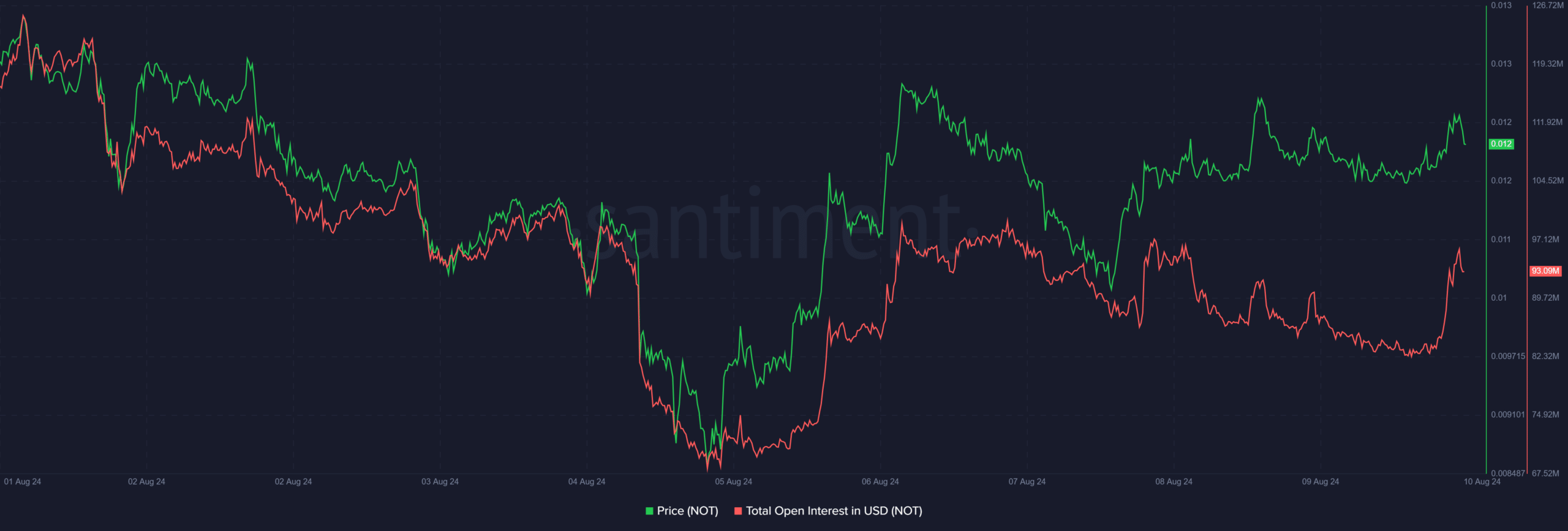

The additional upside theory can also be confirmed by the rise in Open Interest (OI), which rose by about 10%, from $80 million to over $90 million on August 10. This suggests that more liquidity is flowing into the NOT futures market, which could help to fuel the recovery.

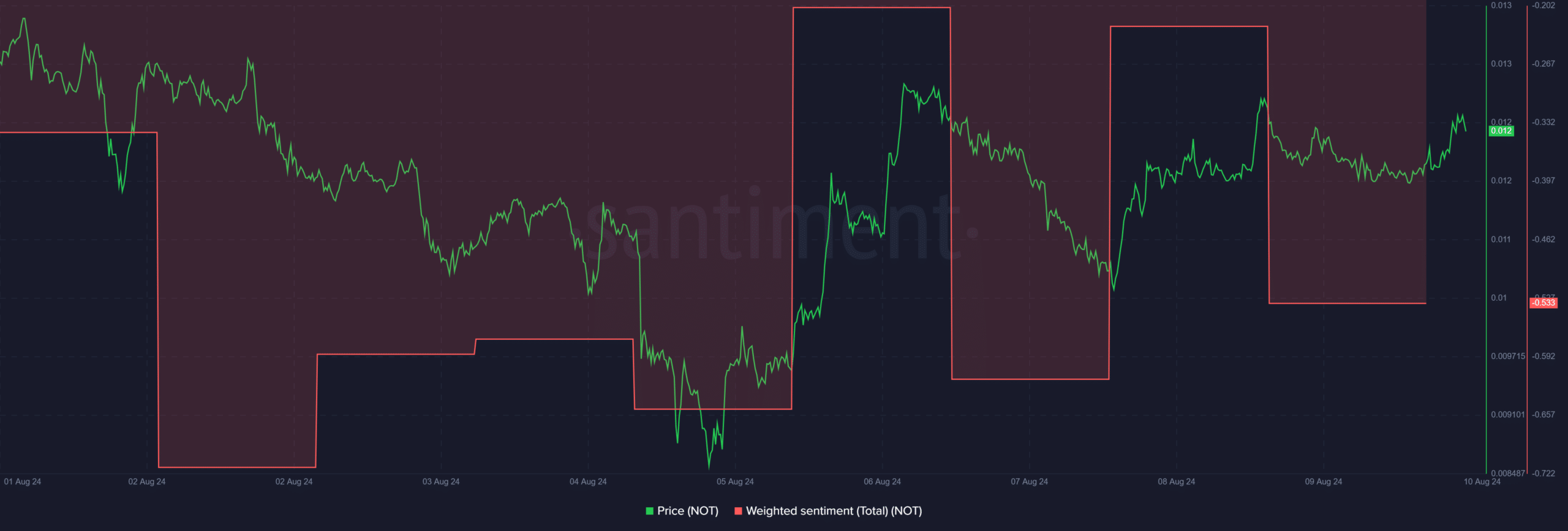

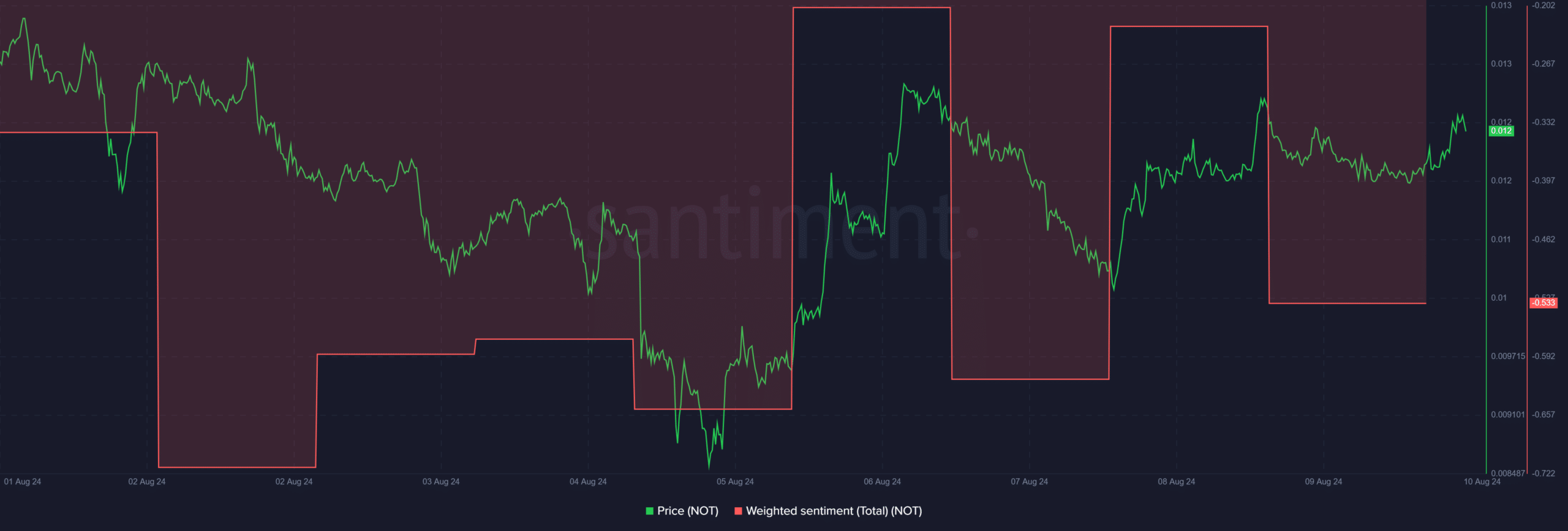

Source: Santiment

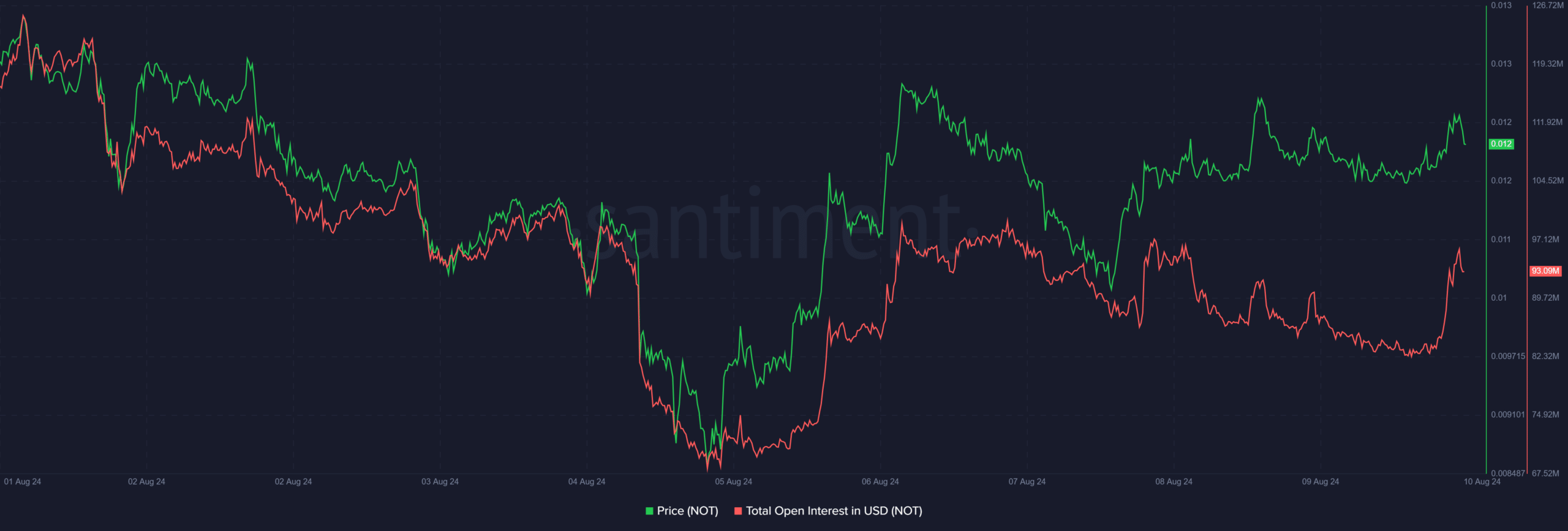

Despite the overall bullish sentiment reading based on the rise in OI, NOT’s weighted sentiment fell into negative territory.

The further decline in the previously weighted sentiment has delayed the price recovery of NOT and a similar scenario would also delay the retest of $0.014.

read Notcoin Price Prediction 2024-2025

Source: Santiment

In conclusion, NOT has benefited from two catalysts: the overall market rebound and interest in the Telegram project after Toncoin was listed on Binance. A recovery and retest of $0.014 is still possible, but if negative sentiment over the weekend holds, such a scenario may be delayed.

Disclaimer: The information presented does not constitute financial, investment, trading or any other type of advice and is solely the opinion of the author.