- The price of NOT has risen by more than 80% in the last 7 days.

- Technical indicators suggest it is poised for further upside.

NOT, the token that powers Notcoin, Telegram’s play-to-earn clicker gaming application, is ready to extend its seven-day earnings.

At press time, the altcoin was trading at $0.02. Its value has increased 84% in the past week, according to CoinMarketCap data.

Key technical indicators confirm growing demand for the altcoin, which could lead to a rebound towards new all-time highs in the near term.

NOT The bull is not ready to give up control.

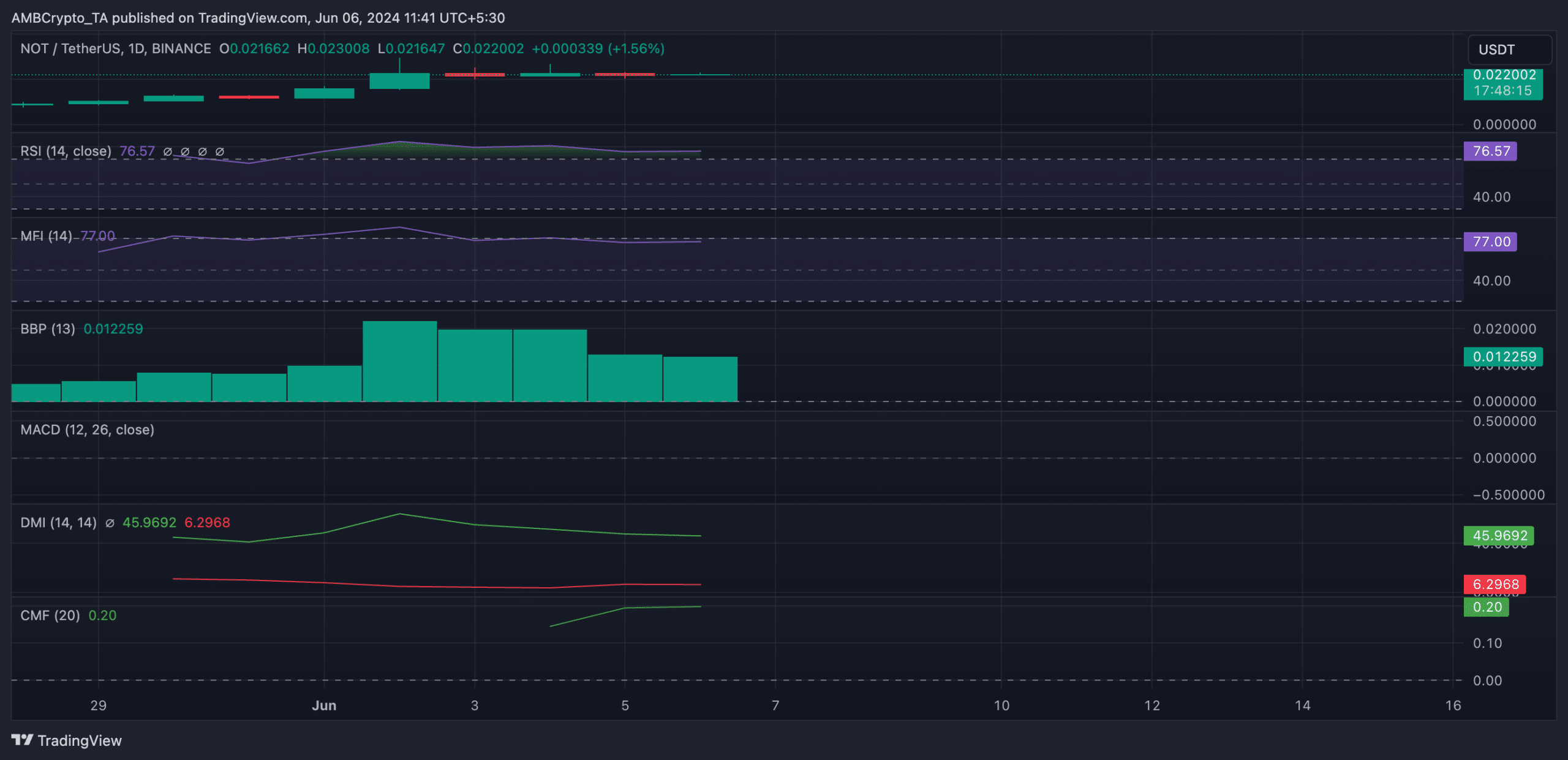

Although there has been some profit-taking activity over the past few days, NOT’s momentum indicator remains well above the 50 neutral line.

At press time, the token’s Relative Strength Index (RSI) was 76.73 and its Fund Flow Index was 77.

These indicators suggest that non-buying activity is still significant and is exceeding selling pressure.

However, for what it’s worth, it is important to note that NOT’s RSI has signaled that the token is overbought and a potential price correction is imminent. When an asset becomes overbought, buyer fatigue sets in and prices fall.

There is a risk of a slight correction in NOT’s price, but the bulls remain firmly in control of the market. The reading of the Elder-Ray Index shows this. At the time of writing, the value of the indicator was 0.012.

This indicator measures the relationship between the strength of buyers and sellers of NOTs in the market. If the value is positive, bull power dominates the market.

Additionally, at the time of writing, the positive directional index (green) is 45.96, which is higher than the negative index (red) of 6.2. This indicates that the altcoin is experiencing a stronger upward trend than downward momentum, even though some traders have started selling.

Additionally, looking at the Chaikin Money Flow (CMF) at NOT of 0.20, we can see that there is a significant amount of liquidity flowing into the market.

A positive CMF is a sign of market strength. This means capital is flowing in as demand for the asset grows, which is a bullish sign.

Source: NOT/USDT on TradingView

Realistic or not, there is no SOL-based market cap here.

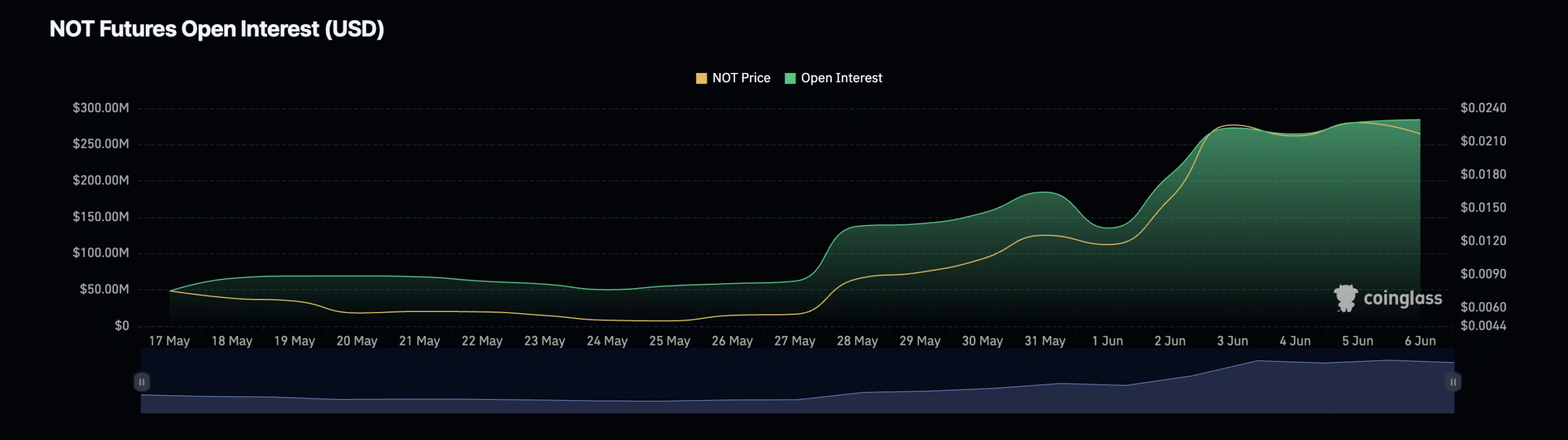

Open interest in NOT’s futures market hit a new high. At press time, it hit an all-time high of $284 million, according to Coinglass data..

An asset’s futures open interest tracks the total number of outstanding futures contracts or positions that have not yet been closed or settled. As it rises in this way, more market participants open new positions.

Source: Coinglass