If we do the research, you can get alpha!

Get exclusive reports and key insights on airdrops, NFTs, and more! Subscribe to Alpha Reports now and enjoy the game!

Go to Alpha Report

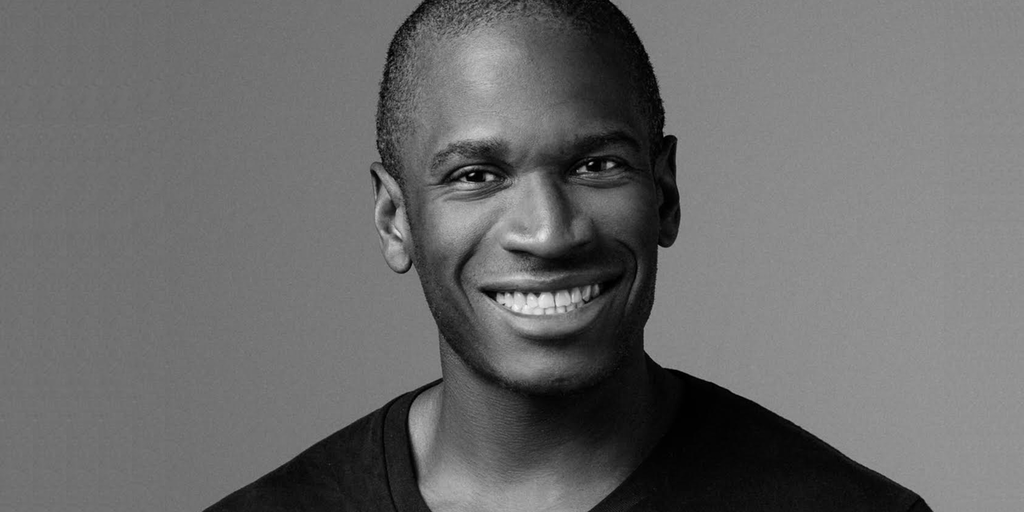

According to BitMEX co-founder Arthur Hayes, recent policy moves by global central banks suggest that the time has come to emulate Bitcoin and high-trust shitcoins.

Earlier this week, the Bank of Canada and the European Central Bank became the first G7 countries to cut interest rates, something neither region has done in years. According to Hayes, this pivotal move will “push cryptocurrencies out of the Northern Hemisphere summer recession.”

“The trend is clear. Central banks on the edge are starting an easing cycle,” the 39-year-old entrepreneur wrote in a post on Thursday. “We know how to play this game: buy bitcoin and then buy shitcoin.”

As for his personal portfolio, Hayes said he will be switching back from Ethena’s synthetic dollar stablecoin USDe to “confidence shitcoins” (almost zero-value tokens and meme coins). He said he would name it only after he made the purchase.

“For Maelstrom Portfolio projects that ask for my opinion on whether to launch a token now or later, I say Let’s Fucking Go!” He added:

Historically speaking, both stocks and Bitcoin tend to perform well when central banks lower borrowing costs. One example is the rise of Bitcoin from under $4,000 to $64,000 between March 2020 and April 2021, shortly after the Federal Reserve lowered its benchmark interest rate to 0.25%.

Most analysts and market participants do not believe the Federal Reserve will follow its global neighbors in cutting interest rates immediately at its June meeting. However, inflation appears to be becoming more persistent in the United States.

Nonetheless, Hayes argues that the U.S. central bank is under enormous geopolitical pressure to lower the dollar to provide relative strength to the Japanese yen. Therefore, it is highly likely that an interest rate cut will occur soon. That won’t be the case during election season, when inflation is a hot political topic.

By contrast, Hayes said the Bank of England would surprise the world with a rate cut on June 20, following US orders to keep the yen strong.

“Suffice it to say that the cryptocurrency bull market is reawakening and will gnaw at the skin of profligate central bankers,” Hayes concluded.

Edited by Ryan Ozawa.

daily report newsletter

Start your day today with top news stories, original features, podcasts, videos and more.