Nvidia Inc. has reached $3 trillion in market cap, effectively surpassing Apple.

Meanwhile, the price of AI tokens is falling as the trading volume surges by 10%, which is a typical situation of ‘buy on the rumor and sell on the news.’

NVIDIA surpasses Apple with market capitalization of $3 trillion

Chip manufacturing giant Nvidia has reached a market capitalization of $3 trillion and was one of the most traded stocks in the last trading session, second only to GameStop’s GME, according to data. This follows a 10-1 split between the chipmakers. This will make it easier and more affordable for company employees and retail investors to purchase NVDA stock.

“NVIDIA has surpassed the $3 trillion market cap and now all its employees are worth $102 million,” Radar, a cryptocurrency watchdog tool, highlighted in a post.

Data shows that NVDA stock is currently worth five times more than Apple Inc. (AAPL) stock. Immediately after the split, NVDA soared to $120 per share and then fell to its current price of $102.

Read more: AI Stocks: Best Artificial Intelligence Companies to Know in 2024

Only recently did Nvidia Corp outpace the Russell 2000 Index by the $10 billion range, hitting its peak trading volume of $45.94 billion on June 3rd. This comes despite recent moves by the U.S. Department of Commerce to impose new restrictions on exports of AI processors to several Middle Eastern countries. . The measures aim to address security concerns, particularly the risk of high-performance chips being resold to China.

“With respect to the most cutting-edge technologies, we conduct extensive due diligence through an interagency process and thoroughly review license applications from applicants seeking to bring these cutting-edge technologies to market globally,” the Commerce Department said.

This resolution led to a decline in NVDA’s stock price at the end of May. That’s because chipmakers AMD and Nvidia have struggled to get approval to export their AI accelerators due to a licensing slowdown. Prior to this news, there was general speculation that AI and big data-related cryptocurrency tokens would rebound, especially if NVDA outperformed AAPL. These expectations stem from the positive correlation between AI tokens and past events related to the GPU giant and its stock price.

AI Token Surges to Record Trading Volume

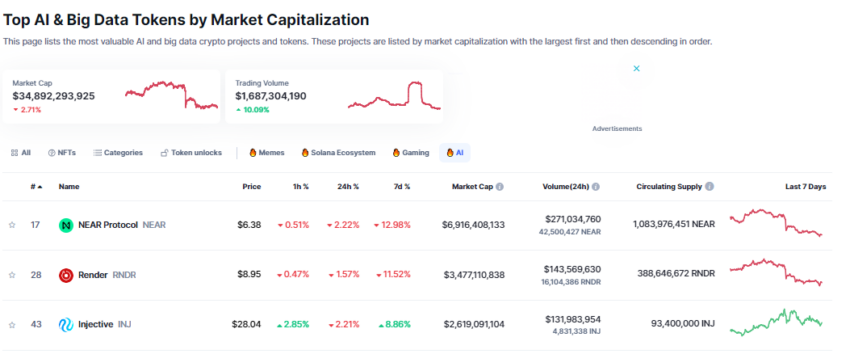

Expectations of a 10-for-1 split from Nvidia Corp have sparked interest in AI-related cryptocurrencies as market observers speculate about the potential impact. Among them, the price of Render (RNDR) surged 5% from a low of $8.921 to a high of $9.262 on Sunday. Likewise, Near Protocol (NEAR) rose 3%, while Injective (INJ) price surged 10% to an intraday high of $29.31.

The surge was a typical ‘buy on the rumor’ situation, while the typical ‘sell on the event’ reaction saw these tokens fall. AI cryptocurrency trading volume increased by 10%, recording huge profits. As a result, the market capitalization of AI cryptocurrency decreased by approximately 3% to $34.8 billion.

Read more: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

The adage “buy on the rumor, sell on the news” is a contrarian investment strategy based on predictions about the expected market reaction to rumors, events, and news announcements. Investors try to capitalize on price movements by acting before the public can disseminate and process information (rumors). This strategy works by allowing enlightened traders to purchase assets based on speculation (rumors) when rumors surface about certain events that could have a positive impact on the price of the asset.

Selling occurs when the news breaks if the market has already priced the anticipated event. This allows enlightened people (early investors) to realize profits.

disclaimer

In compliance with Trust Project guidelines, BeInCrypto is committed to unbiased and transparent reporting. These news articles aim to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to check the facts and consult with experts. Our Terms of Use, Privacy Policy and Disclaimer have been updated.