- TRON achieved the second highest monthly revenue in October with $205 million.

- Despite high trading volume and revenue growth, TRON’s total value locked (TVL) has recently declined.

TRON (TRX) capped off a very successful month in October, hitting a record profit milestone. In fact, rAccording to recent data shared by Justin Sun, the network generated $205 million in revenue.

This is the second highest monthly figure, following $220 million in August.

Key drivers included a surge in trading volume due to growing interest in memecoins on the TRON network.

However, while network revenue soared, TRX’s Total Value Locked (TVL) fell. This means that the network’s recent performance has certainly been somewhat mixed.

Tron’s profits recorded the second highest figure.

October was a big year for TRON, with sales reaching $205 million. This is the second highest figure on record, following August’s $220 million.

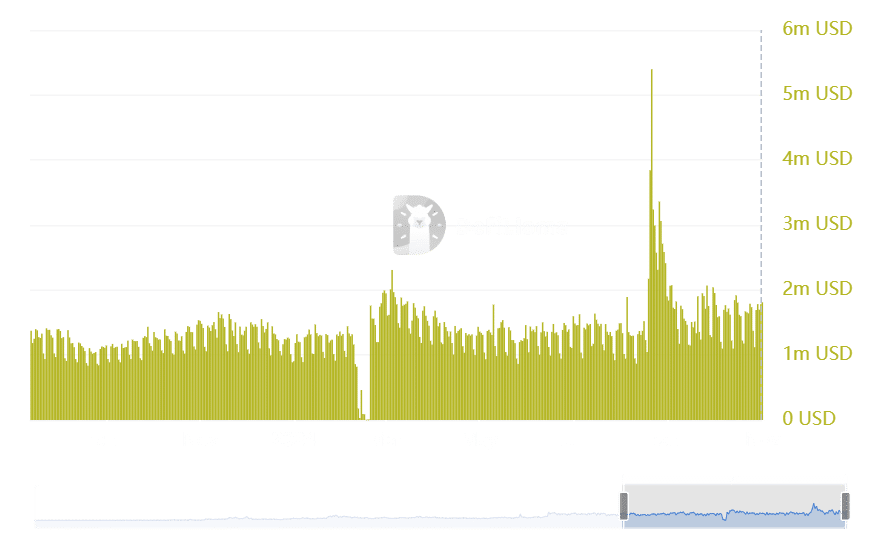

Data from DefiLlama shows an increase in trading volume. Daily transactions increased in June and remained consistent through August.

Source: DefiLlama

However, activity surged in October, reaching over 10 million daily transactions on October 24th.

This marked the highest number of daily transactions this year. Over the next few days, daily transactions continued to exceed 9 million.

However, these levels were not seen in August. This acceleration of network activity can directly contribute to increased revenue.

Memecoin activity drives TRON network participation

The growth of MEMCOIN has fueled much of the network activity. According to data from CoinGecko, the market capitalization of TRON’s memecoin has now reached approximately $249 million.

This increase is consistent with the broader market trend of memecoins growing in popularity within the broader cryptocurrency landscape. Currently, the total market capitalization of these tokens is over $68 billion. And as TRON’s memecoin activity increased, trading volume increased.

This increase may have played a role in October’s sales figures.

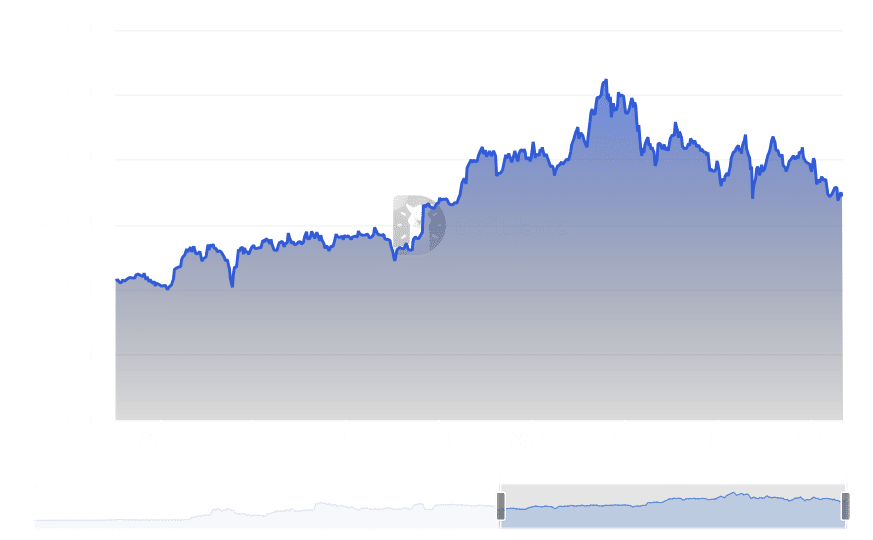

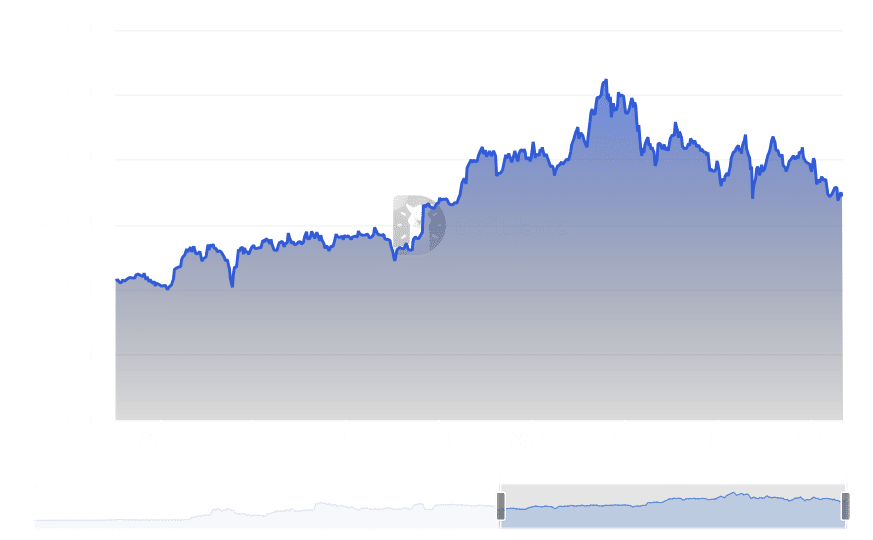

TVL continues to decline despite sales growth

Despite record transaction numbers and revenue growth, TRON’s Total Value Locked (TVL) has been on a downward trend over the past few months.

In fact, after hitting an all-time high of $10.3 billion in March, TRON’s TVL stood at approximately $6.9 billion at press time.

Source: DefiLlama

TRON’s DeFi ecosystem has expanded over the years, but the recent TVL drop suggests that the network is struggling to maintain its high peg value. This is despite increasing trading volume and memecoin activity.

Nonetheless, TRON remains one of the best networks in terms of TVL and shows resilience in a volatile market environment.

– Is your portfolio environmentally friendly? Check out the Tron Profit Calculator

TRON’s strong revenue performance, driven by increased trading volume and interest in memecoins, is a sign of continued growth. However, the network’s ability to regain its previous TVL levels is critical to its long-term growth sustainability.