- ONDO has a strong bullish bias on low and high time periods.

- If the bulls can turn key resistance into support, a further 15% rise is possible.

Ondo (ONDO) has risen 56% since May 23 and has broken out of a two-month trading range. The psychological $1 level also reversed to find bull support.

Bitcoin (BTC)’s recent stagnation has not had a negative impact on ONDO. Is this a sign of strength, or will ONDO reverse its gains? Technical analysis has shown some strong evidence about what kind of results altcoins are likely to witness.

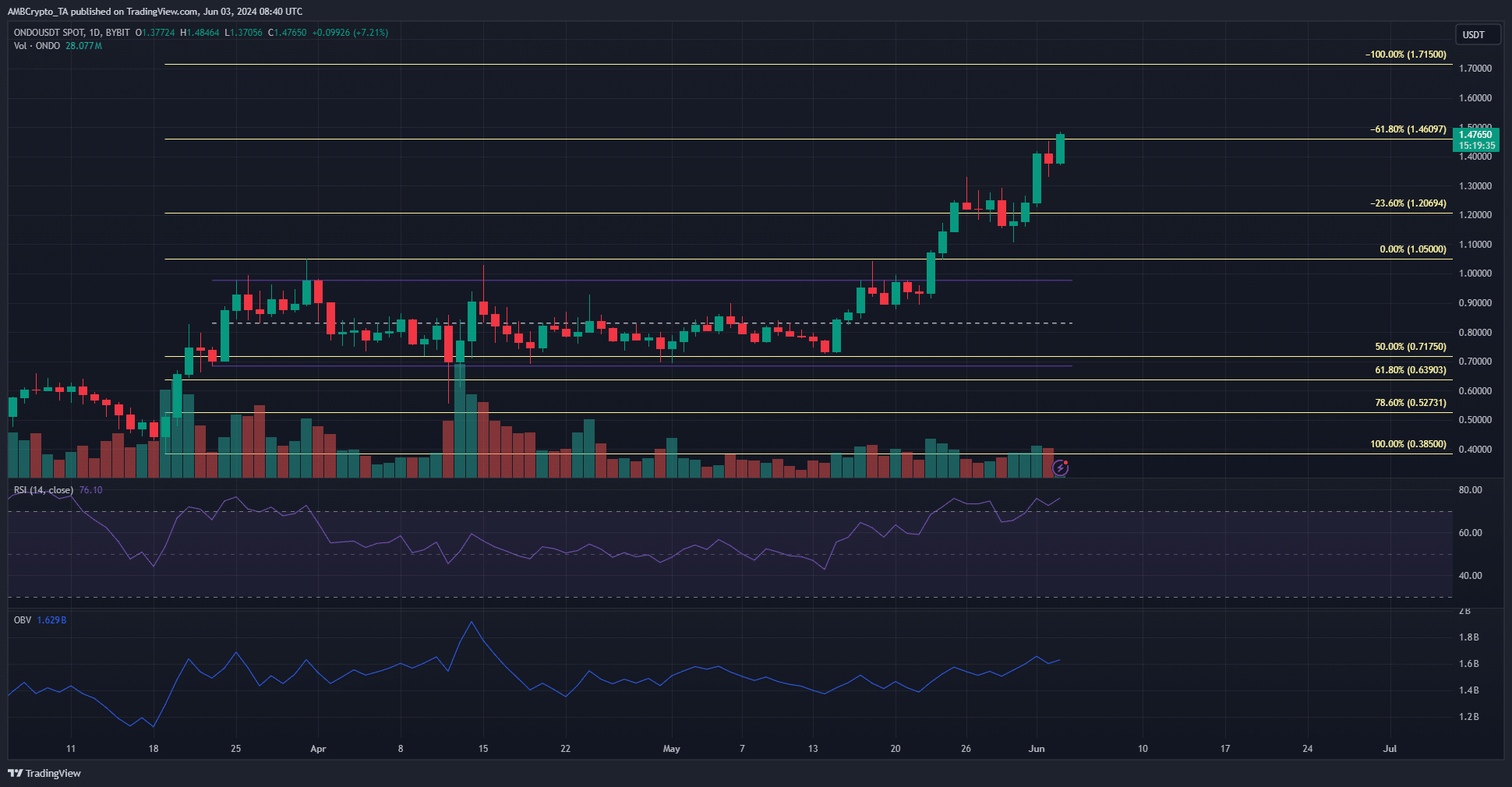

The Fibonacci extension level suggested the next bullish target.

Source: TradingView ONDO/USDT

The mid-March rally was used to mark a series of Fibonacci retracement and extension levels (light yellow). The range formation over the past two months has seen support found at the 50% retracement level of $0.717.

Over the past two weeks, ONDO has maintained support by reversing the 23.6% expansion level to $1.2 and trying to break above the 61.8% expansion level of $1.46. A 100% expansion level of $1.71 is the next target.

The RSI on the 1-day chart was 76, indicating strong bullish momentum. No divergences were formed during this period, indicating continued bullish momentum. OBV was rising at a more sedate pace.

As with other markets, volume was weak but price action was strong.

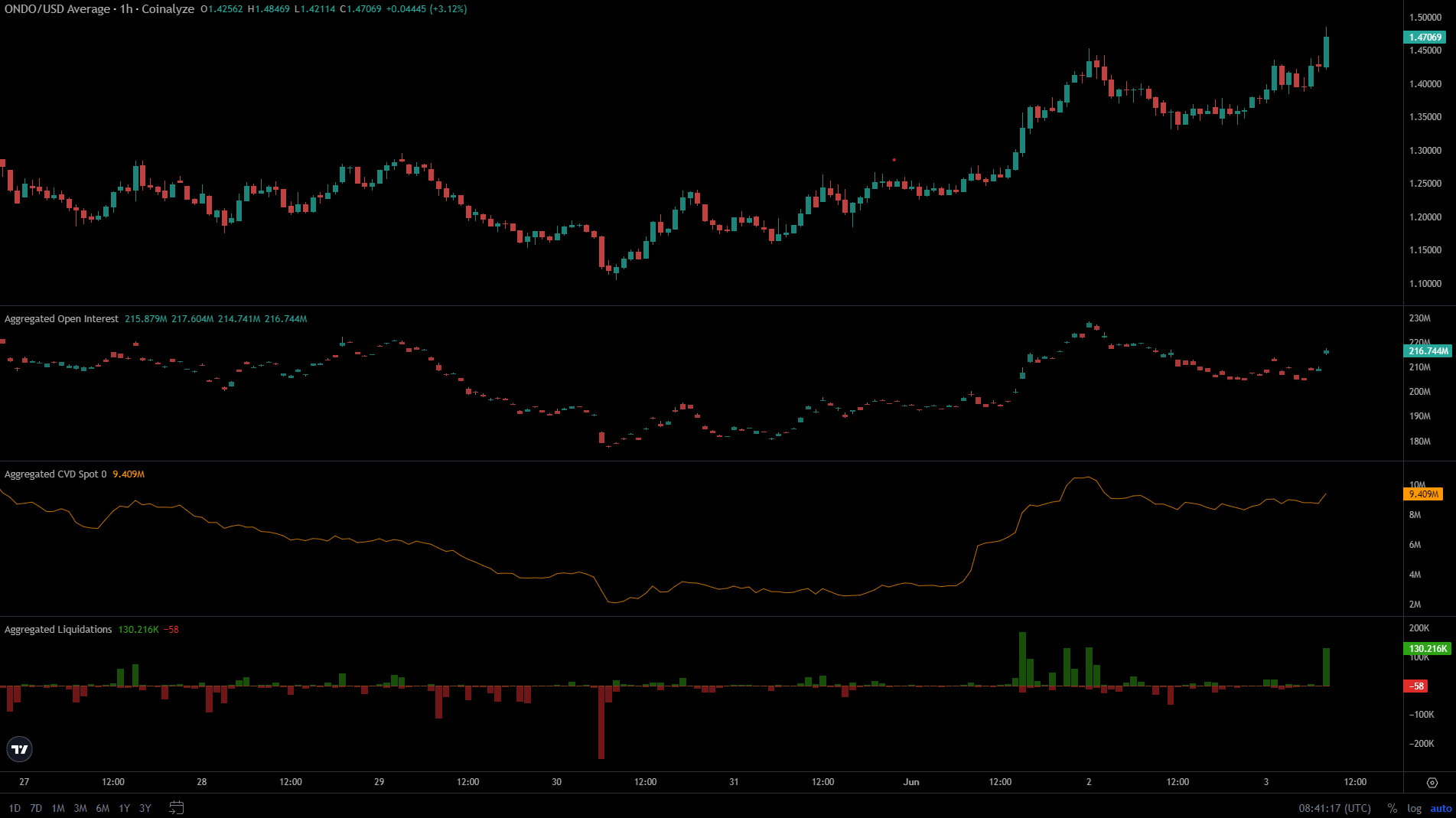

Spot demand and speculative interest were encouraging.

Source: Coin Analysis

Coinalyze data shows open interest rising and falling along with ONDO’s price action. This meant that traders were optimistic and willing to enter long positions as the price rose.

Read Ondo (ONDO) Price Prediction for 2024-25

Spot CVD has also slowed over the past two days but has maintained an upward trend.

Short-term liquidations due to recent price surges have added to market buying. Overall, buying pressure was present during the low period.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.