- Optimism has seen a huge uptick in liquidity over the past few days.

- Operating profit prices continue to fall despite a surge in liquidity

Among other layer 2 networks, Optimism (OP) has benefited tremendously from the recent Dencun upgrade of the Ethereum network, which has reduced gas fees for these networks.

get liquid

Over the past week, Optimism’s liquidity has increased by $62 million. Higher liquidity generally improves market efficiency and reduces slippage, making it more attractive for traders and investors to participate in network trading. This can drive increased trading activity and volume, contributing to an overall healthier ecosystem.

Additionally, increased liquidity can improve Optimism’s overall stability and resilience. Deep, liquid markets can help absorb large buy or sell orders without causing large price movements, increasing user and investor confidence.

Source: Artemis

fierce competition

Despite the high liquidity seen on the Optimism network, the network’s Decentralized Exchange Volumes (DEX) continued to decline. On this front, the network could not compete with networks like Arbitrum and Base. Due to the decline in DEX trading volume, Optimism was also not ahead in terms of Total Value Locked (TVL).

New entrants to the market like Base have been able to outperform Optimism in this regard over the past few days.

Source: Artemis

OP status

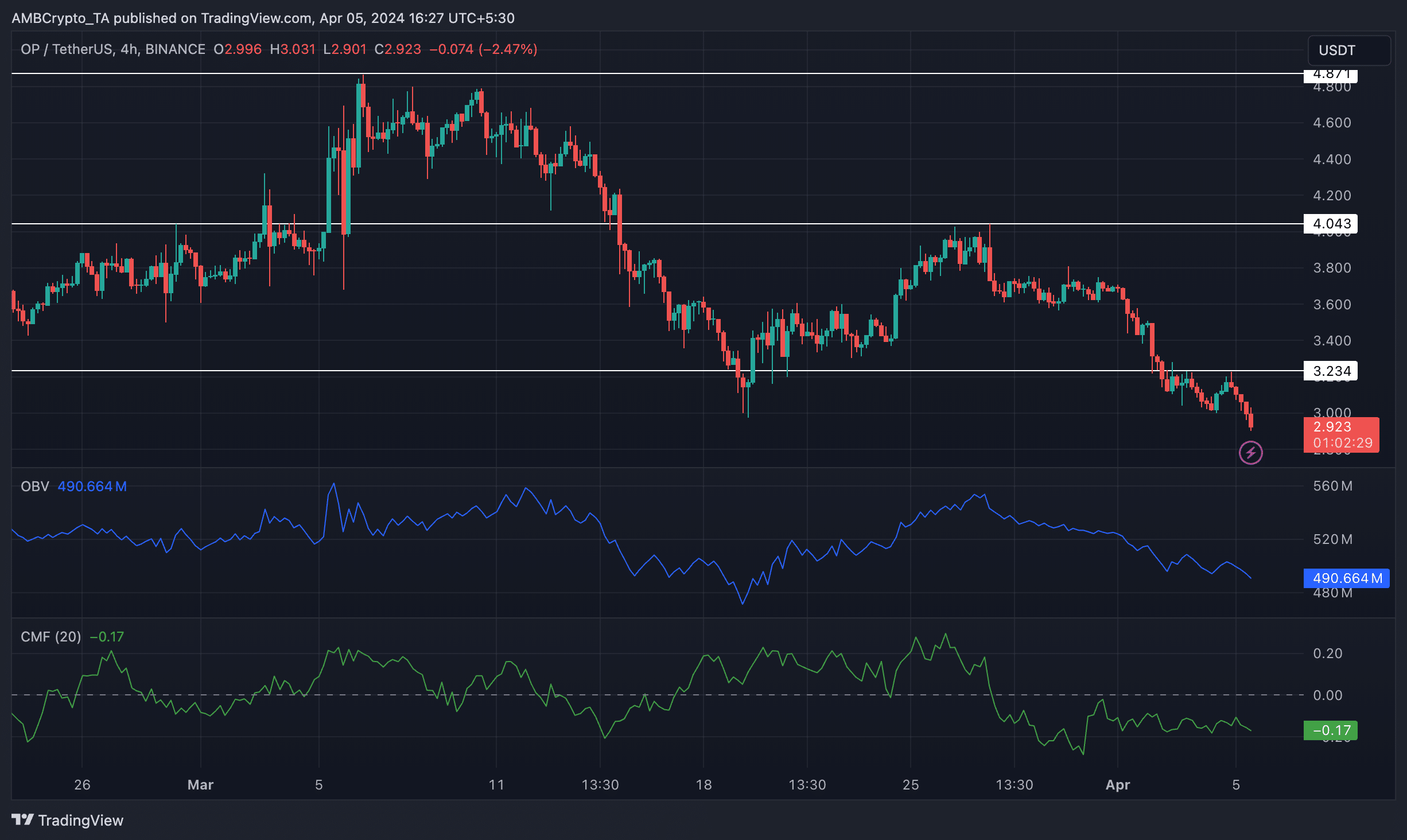

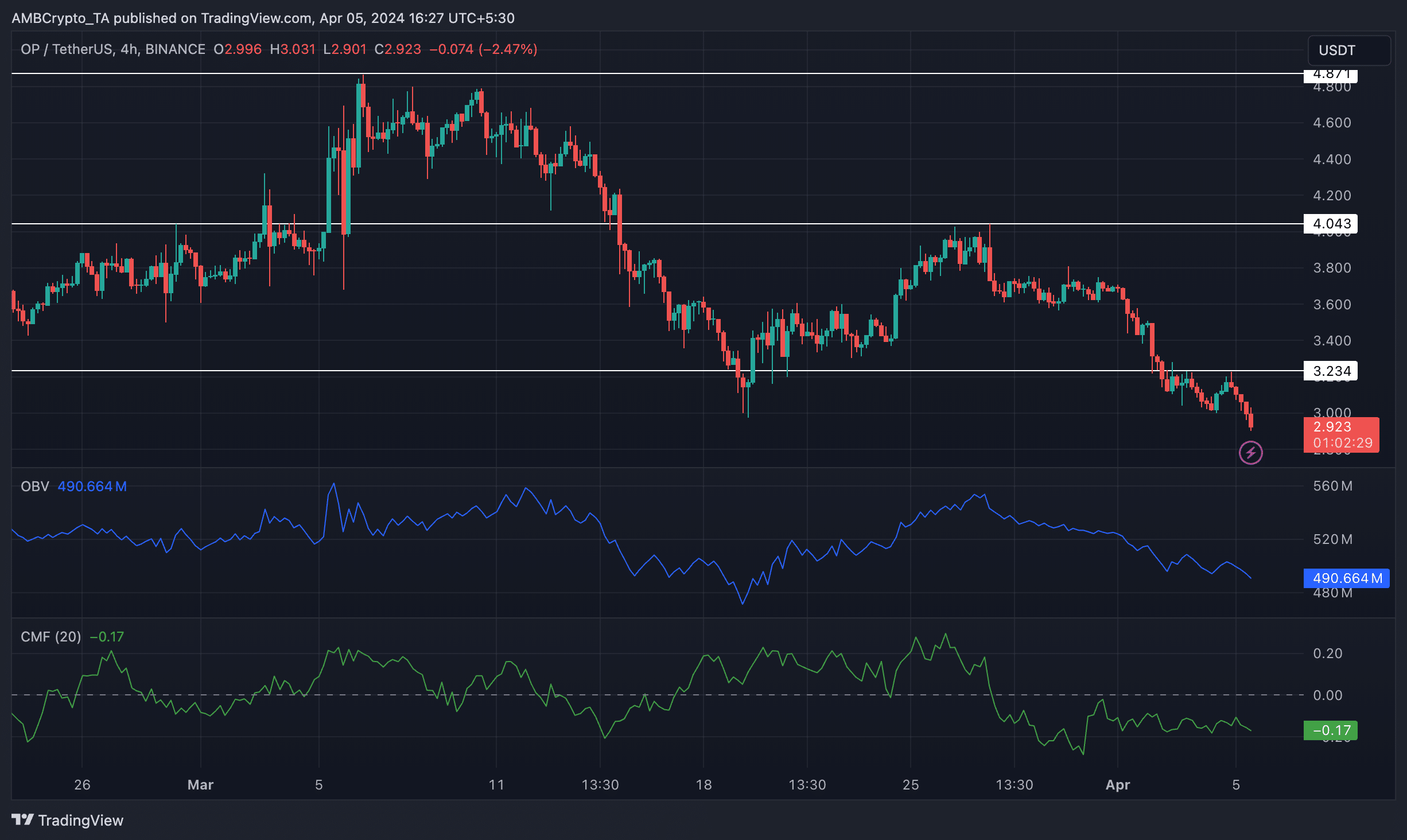

OP hasn’t done very well in terms of price either.

Over the past month, operating profit prices have fallen 39.27%. OP price showed several lows and highs during this period, indicating a bearish trend. At the time of reporting, OP tokens were trading at $2.924, having surpassed the $3.234 level. Moreover, the OBV (Balance of Balance) of operating profit also decreased.

A decline in OBV signals weakening buying pressure and potentially bearish sentiment among traders. Additionally, a decline in OBV could mean less overall market demand and participation, which could further exacerbate downward price pressures.

Realistic or not, the OP market cap in BTC terms is:

Lastly, Chaikin Money Flow (CMF) for operating profit also showed a downward trend. This decrease in CMF means that there are fewer funds flowing into operating profits compared to outflows. CMF is a momentum oscillator that measures the intensity of buying and selling pressure in the market, so a decline in CMF in operating profit indicates that selling pressure may be dominant, leading to downward price pressure.

Source: Trading View