- Optimism suggests the possibility of a $3 rally soon, with bullish momentum breaking key resistance levels.

- Network adoption surged, with active addresses surging 16.7%, demonstrating strong demand for Optimism.

Optimism (OP) It successfully broke the long-standing resistance zone of $1.80-$1.90, a resistance level that has been firmly maintained for more than 150 days. This breakout, driven by strong volume and bullish momentum, indicates growing interest in the asset.

While OP is reaching $2.28 As of press time, a slight market correction is expected, with a possible decline providing an opportunity for accumulation.

Breaks through $1.80~$1.90 resistance line

The $1.80-$1.90 range served as an important resistance level for Optimism throughout the consolidation phase. A break above this range signals a change in market sentiment and the start of a potential upward trend.

This level previously acted as a strong barrier, and now buyers are showing renewed interest.

Cryptocurrency analyst Michael van de Poppe observed The idea of a breakout is to set optimism on a bullish trajectory. He said:

“This correction (to $1.80-$1.90) gives us a second chance before hitting $3.”

Source: X

Historical trends show that these pullbacks often act as retests, reaffirming previous resistance as support before the price resumes its upward movement.

Path to $3.00 and above

OP’s next major resistance is $3.00, which could be a key target for traders. If the $1.80-$1.90 range is maintained during the adjustment period, operating profit is expected to consolidate and gain another upward momentum.

A break above $3.00 could pave the way for continued price gains in the medium term.

According to data, Optimism has a circulating supply of 1.3 billion tokens and a market capitalization of $2.87 billion. With a 24-hour trading volume of $796 million, operating profit decreased by 2.39% over the past 24 hours but remains up by 32.55% over the past 7 days.

This recent surge highlights the increasing market activity around the token.

On-chain data shows adoption is increasing.

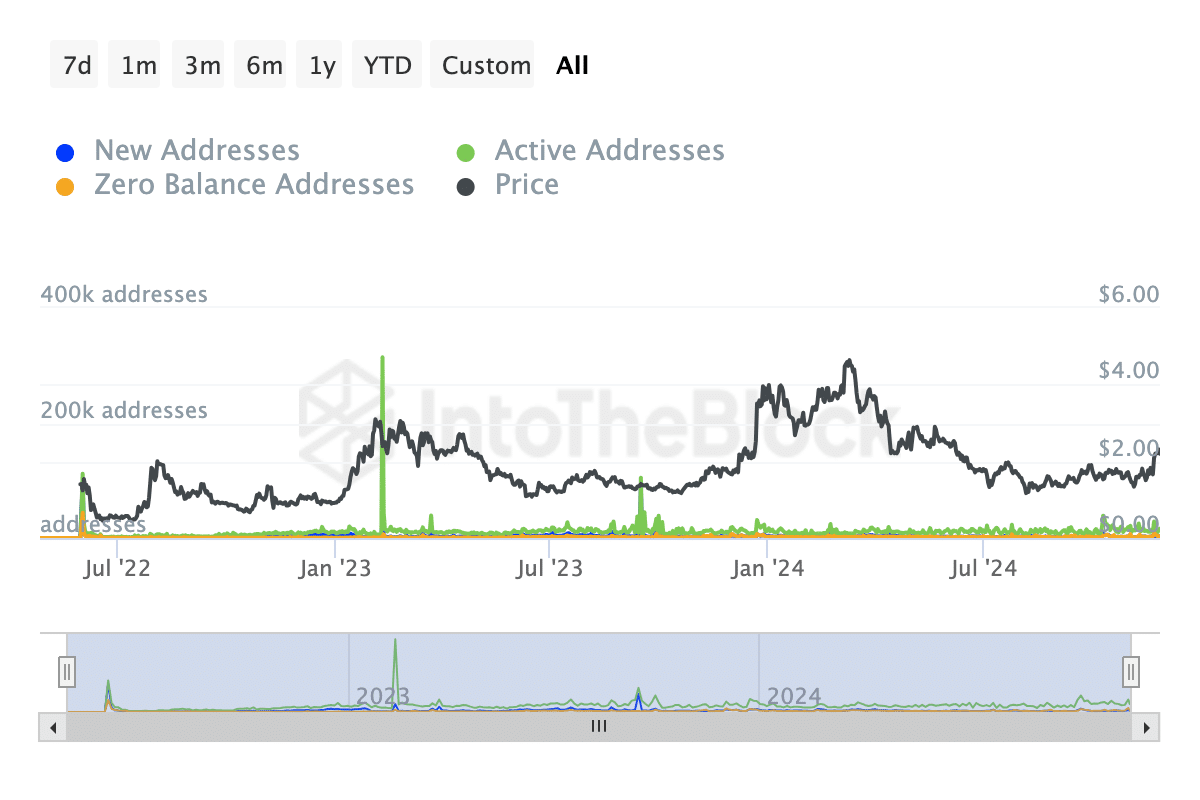

On-chain data Into the Block It reflects steady growth in network activity. 2.84k new addresses were created in the last 7 days, contributing to the current 16.37k active addresses.

Zero balance addresses decreased by 11.72%, indicating that previously inactive wallets are now participating in the network.

Source: IntoTheBlock

These metrics indicate increased user adoption and heightened engagement levels for Optimism’s Layer-2 blockchain.

The increase in active addresses, up 16.7% in the past week, indicates strong interest in the network’s potential.

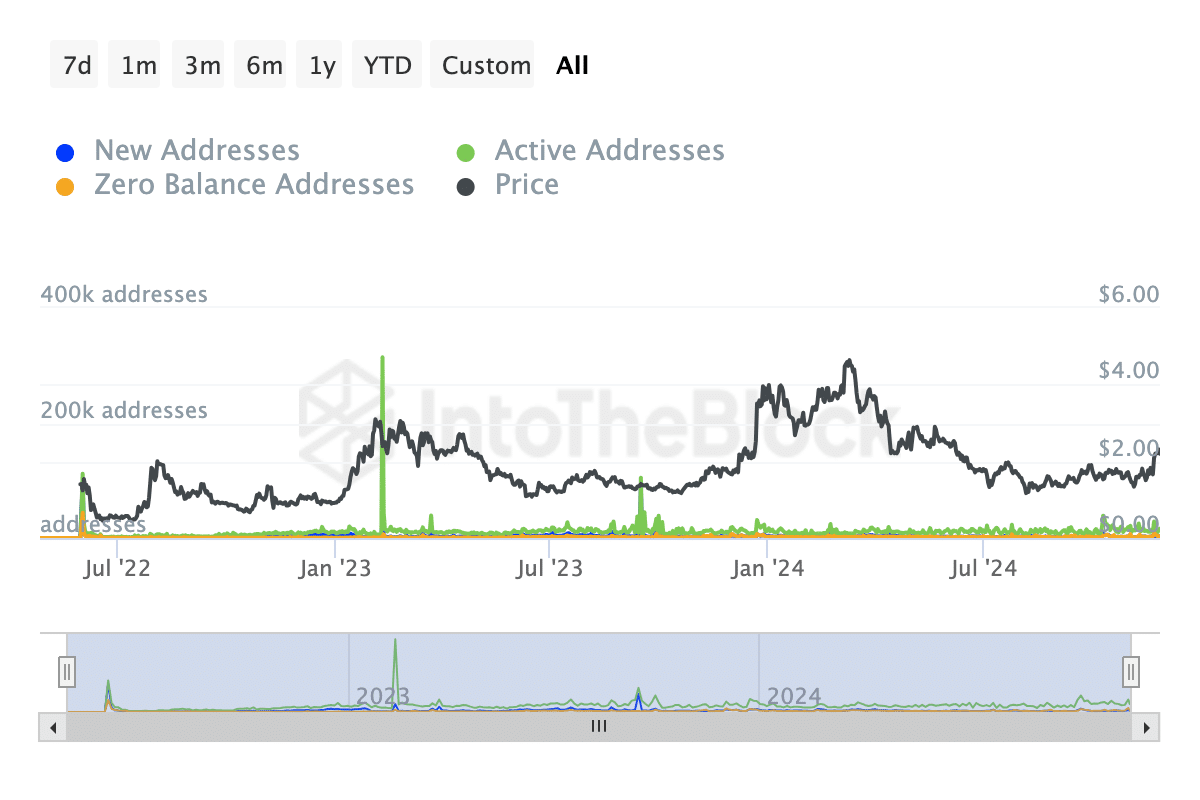

Trading volume reflects healthy network activity.

Optimism’s trading volume has also been volatile but remains solid. The 7-day average operating profit was 212.62 million operating profit, and the highest operating profit was 271.01 million on November 22.

Realistic or not, the OP market cap in BTC terms is:

The lowest volume during this period was OP 148.75 million recorded on November 25.

Source: IntoTheBlock

These fluctuations suggest active trading and availability on the network, indicating traders and users are participating in the ecosystem amidst ongoing market movements.