- Optimism Superchain has amassed a huge amount of revenue for the protocol over the past few weeks.

- Despite the protocol’s performance, interest in OP tokens has plummeted.

Despite increasing competition in the layer 2 sector, Optimism (OP) has continued to see growth in a variety of areas.

Super Chain Gets The Dough

One of the reasons for the same is Optimism Superchain. Optimism Superchain has recently become a magnet for capital, attracting over $6 billion in deposits on Ethereum L1. This surge in popularity can be further highlighted by the fact that assets bridged to superchains account for a significant portion (25%) of the total value locked (TVL) bridged on Ethereum L1.

For context, Optimism Superchain is like a collection of L2s. It ties multiple L2s together technically and economically. This combined approach offers several benefits, including streamlined operations and potential cost efficiencies.

As an incentive for participating in Superchain, Optimism provides developers with access to the OP Stack & Governance framework, a valuable toolkit. This common toolset simplifies development and streamlines the governance process for L2 within a superchain.

In April 2024, Base demonstrated its commitment to Superchain by paying Optimism $1.86 million for Superchain membership fees. These financial contributions help ensure the continued development and maintenance of Superchain.

Source: X

However, concerns have been raised as Base appears to have more monthly active users than the OP mainnet. In fact, data from Token Terminal shows that despite having a higher number of monthly active users, Base does not necessarily undermine the OP mainnet’s position within the Optimism Superchain.

OP Mainnet can maintain its role as a hub for superchains by providing a shared governance framework to all member chains. The strong performance of individual member chains like Base can benefit the entire ecosystem. This is because high-performance chains contribute more fees to OP, further supporting the development of superchains.

How is OP doing?

Despite the progress of the Optimism network, overall interest in OP tokens has declined. Additionally, the operating profit price fell 5.59% in just 24 hours. At press time, OP was trading at the following prices: $2.96. Operating profit trading volume also decreased by 22.75%.

Realistic or not, the OP market cap in BTC terms is:

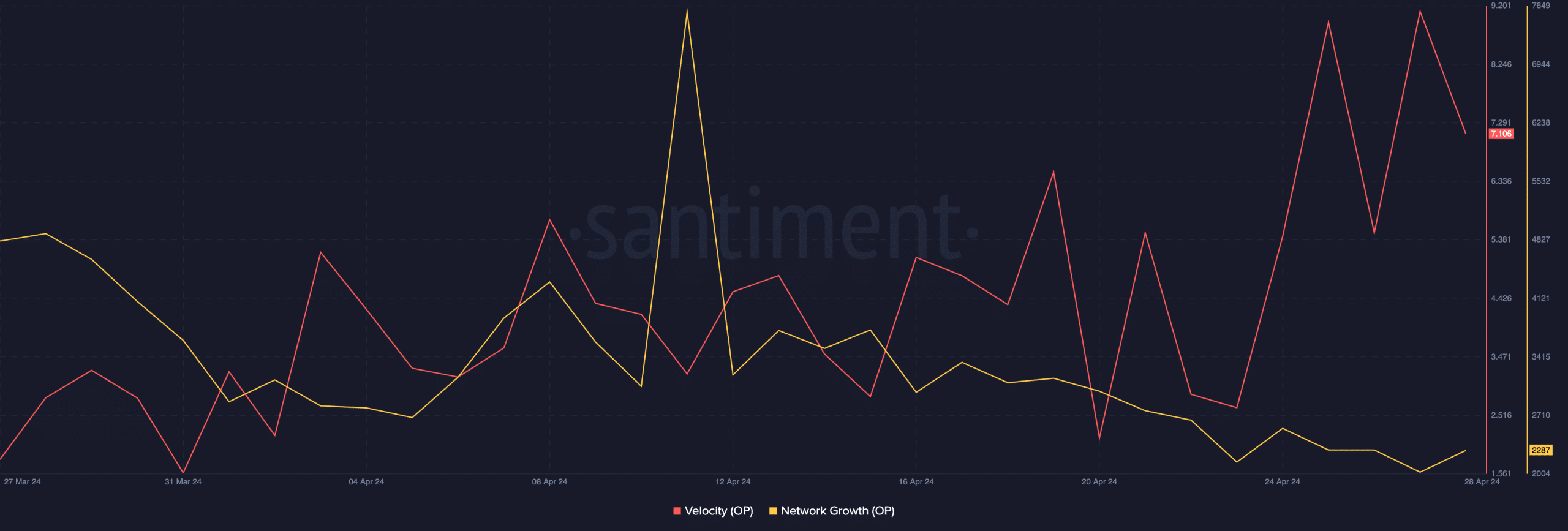

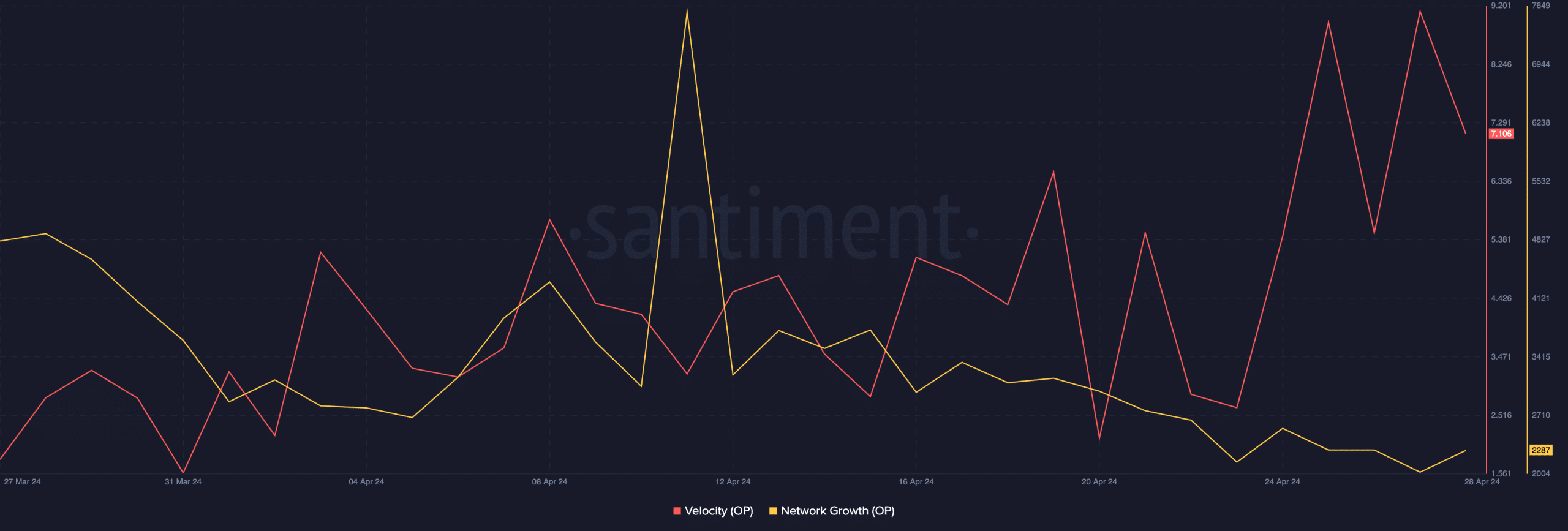

Additionally, network growth around OP tokens has decreased significantly, indicating a decrease in the number of new addresses showing interest in OP.

If interest in new addresses continues to decline, OP prices may be adjusted in the near future.

Source: Santiment