- PEPE has a bullish structure, but momentum and buying pressure have weakened considerably.

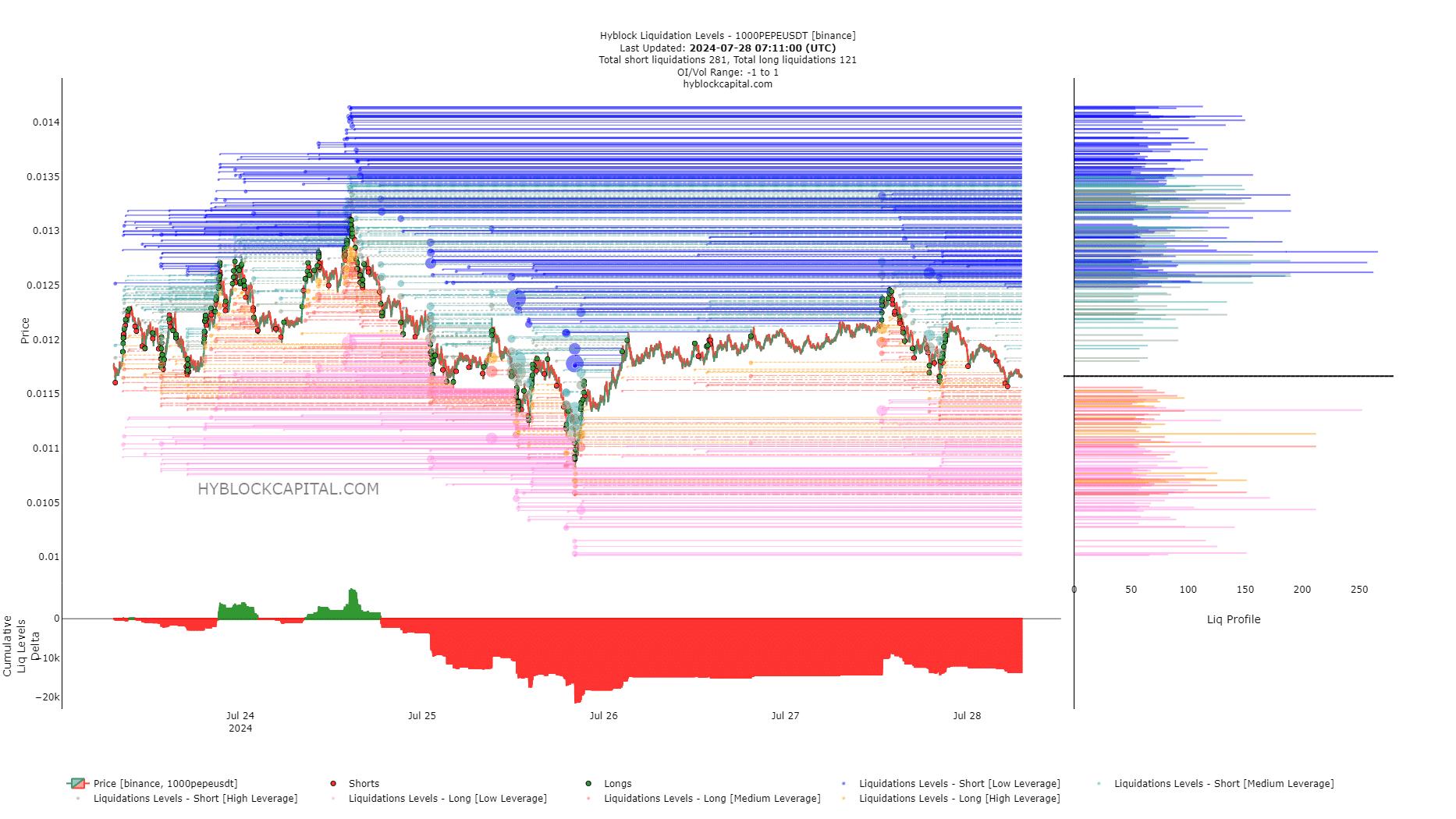

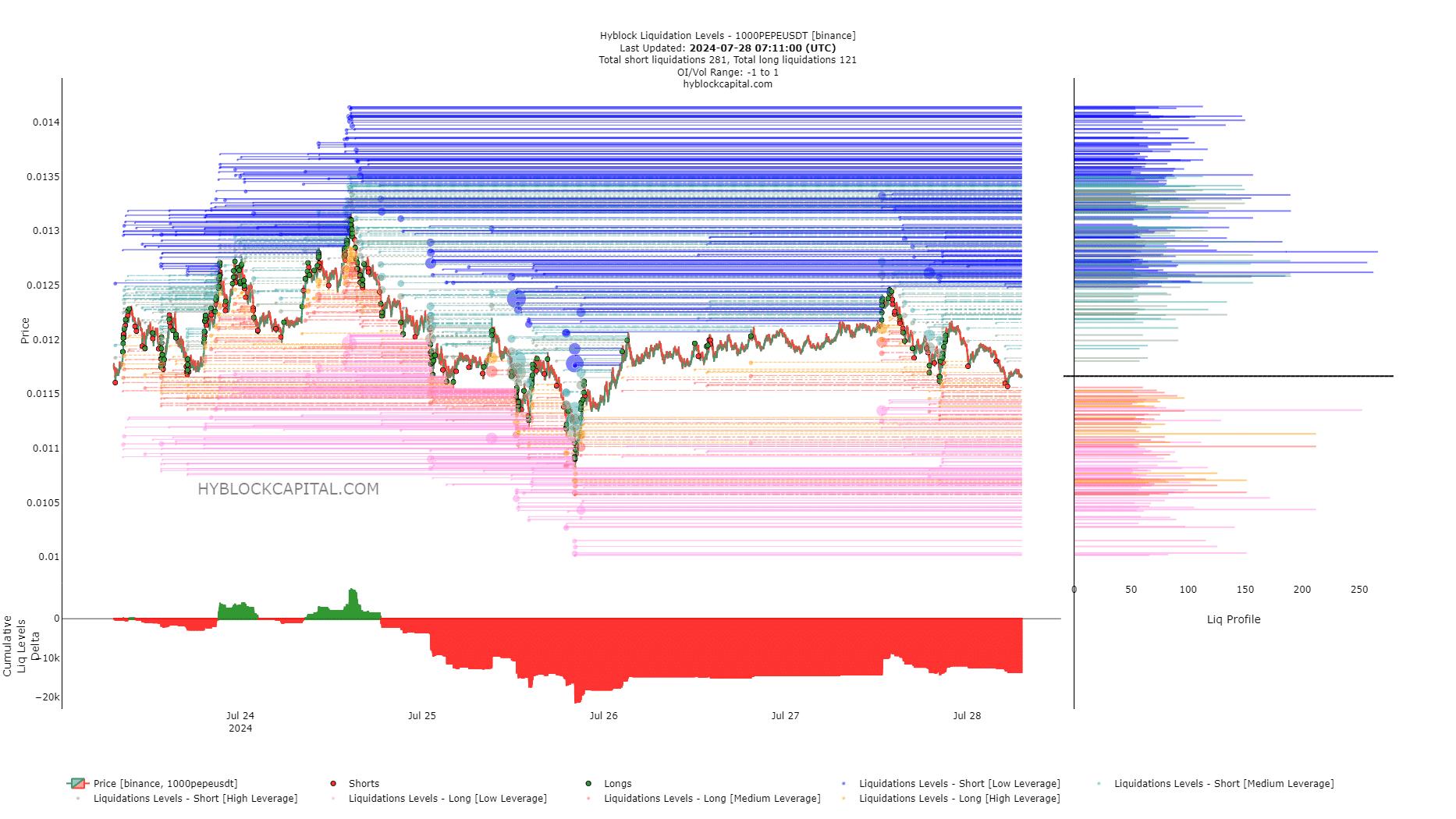

- Liquidation level data showed that a downtrend may soon begin.

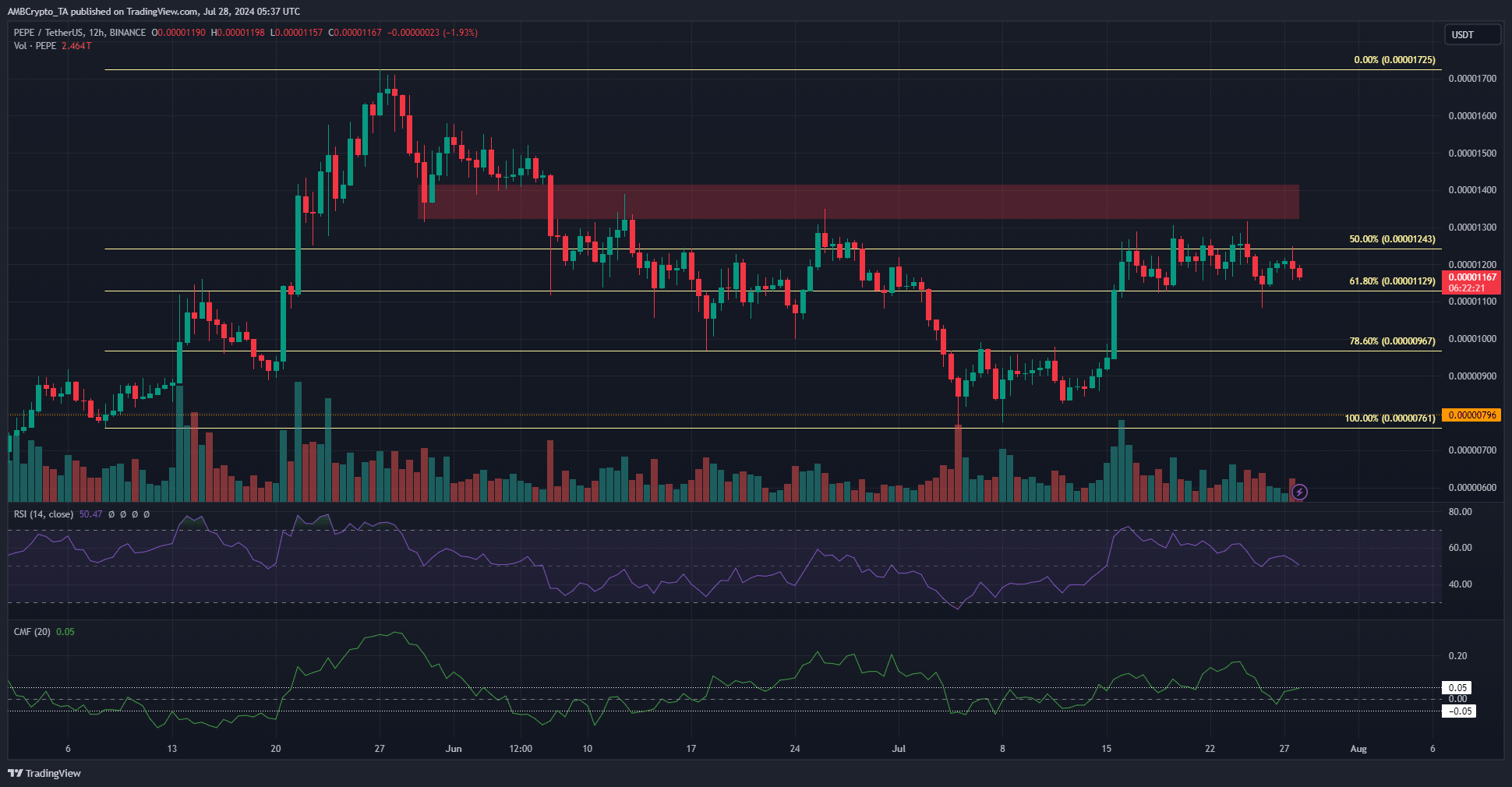

Pepe (PEPE) has been in a consolidation phase for the past 12 days. It traded above the $0.00001129 support level but could not break above the $0.000014 resistance level.

A recent analysis of meme coins shows that most holders are profiting.

Analysis of the liquidation levels shows that unless Bitcoin (BTC) shows a short-term downtrend, traders can expect the price to rise in the coming days.

Overhead resistance is respected.

Source: PEPE/USDT on TradingView

On the 12-hour chart, the RSI has been in a slow downtrend since July 15. At the time of writing, it was at 50.47, showing neutral momentum.

CMF has remained below +0.05 since July 25, indicating that capital flows have not been very strong.

Together they highlighted the consolidation of PEPE over the past two weeks. The $0.0000113 and $0.0000127 levels represented the extremes of the short-term range.

With volumes declining, PEPE has yet to show any signs of a breakout.

The magnetic zone around $0.000014 will be interesting for traders.

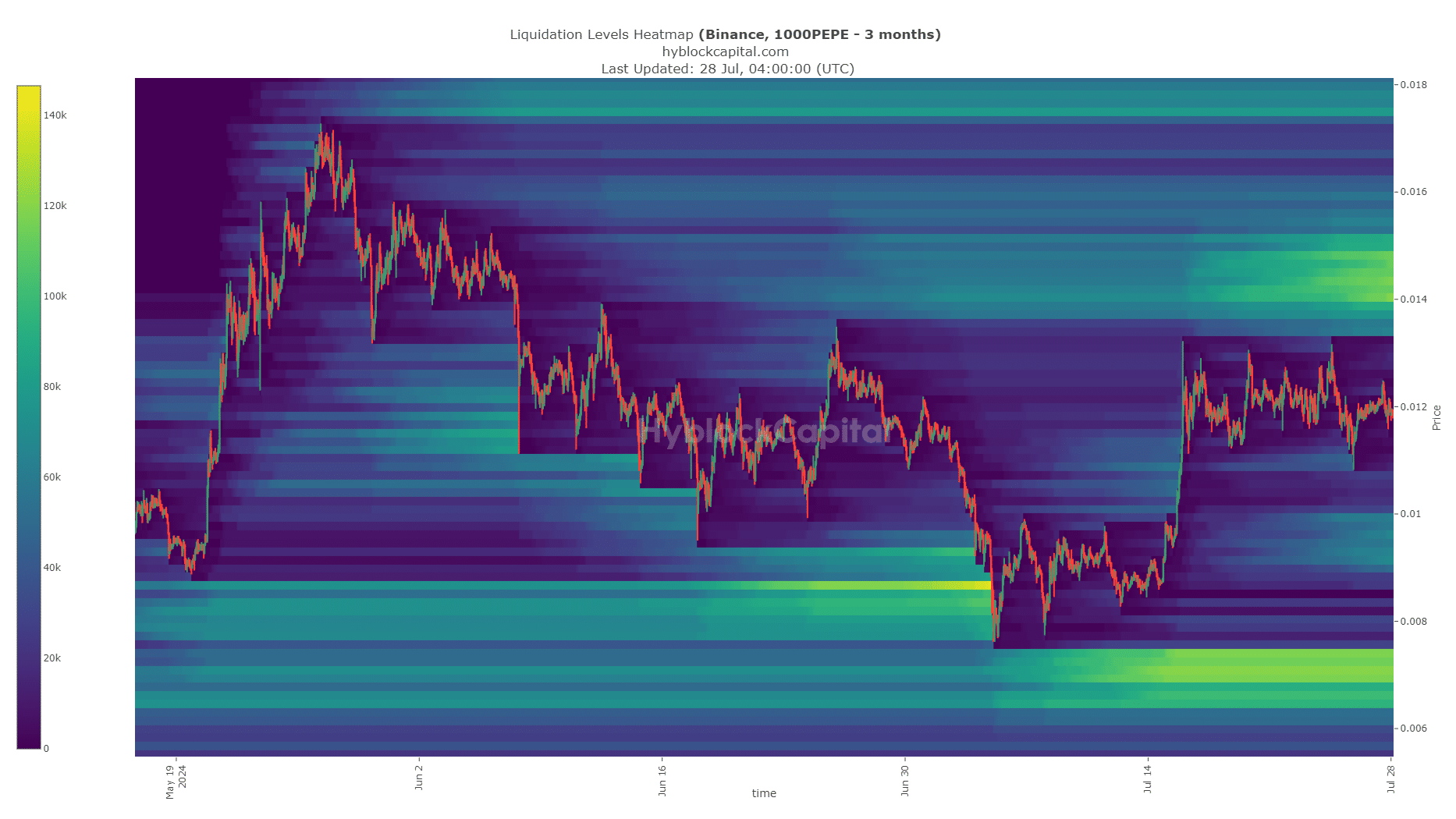

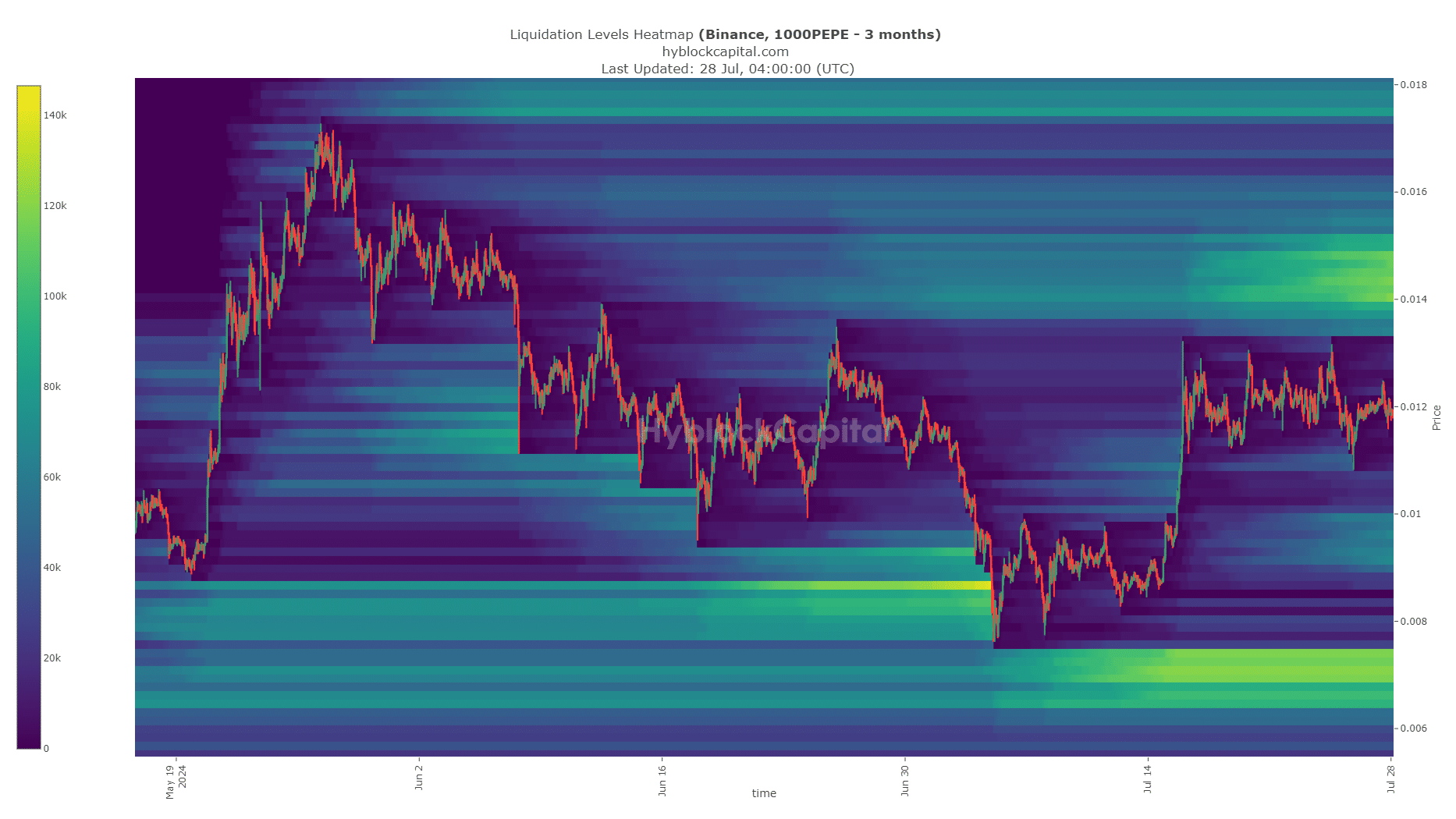

Source: Highblock

AMBCrypto analyzed Pepe’s liquidation heatmap and noted that the $0.000014-$0.0000148 zone is densely packed with liquidation levels. This magnetic zone is likely to pull the price in that direction.

The consolidation over the past two weeks has helped to increase the liquidation level in the region, making it more likely to be wiped out in the next week or two.

To the south, the $0.000007-$0.0000076 zone is targeted.

Source: Highblock

The liquidity levels chart shows that there are more short positions than long positions. This can be seen as a short squeeze, i.e. price is moving up to hunt short sellers.

The $0.0000123-$0.0000126 level, i.e. the short-term high, was a viable bullish target for the next 48 hours.

Realistic or not, PEPE’s market cap in BTC terms is as follows:

Overall, PEPE could rally to $0.000014 before a bearish reversal. A breakout seems unlikely, especially since BTC has been pulling back from the $69k resistance level in recent hours.

Disclaimer: The information presented does not constitute financial, investment, trading or any other type of advice and is solely the opinion of the author.