- PEPE and WIF indicated some bearish sentiment over the previous day.

- Their market structure was resolutely optimistic.

Pepe (PEPE) hit a local high at $0.0000108, while dogwifhat (WIF) also hit $3.56. However, over longer periods of time, the trend appears to remain strong.

However, concerns about a market correction were somewhat warranted, with Bitcoin (BTC) down 7% from $73.7,000 to $68.4,000 at press time. Here are the technical analysis results for Meme Coin:

Momentum on the lower period is bullish for both coins

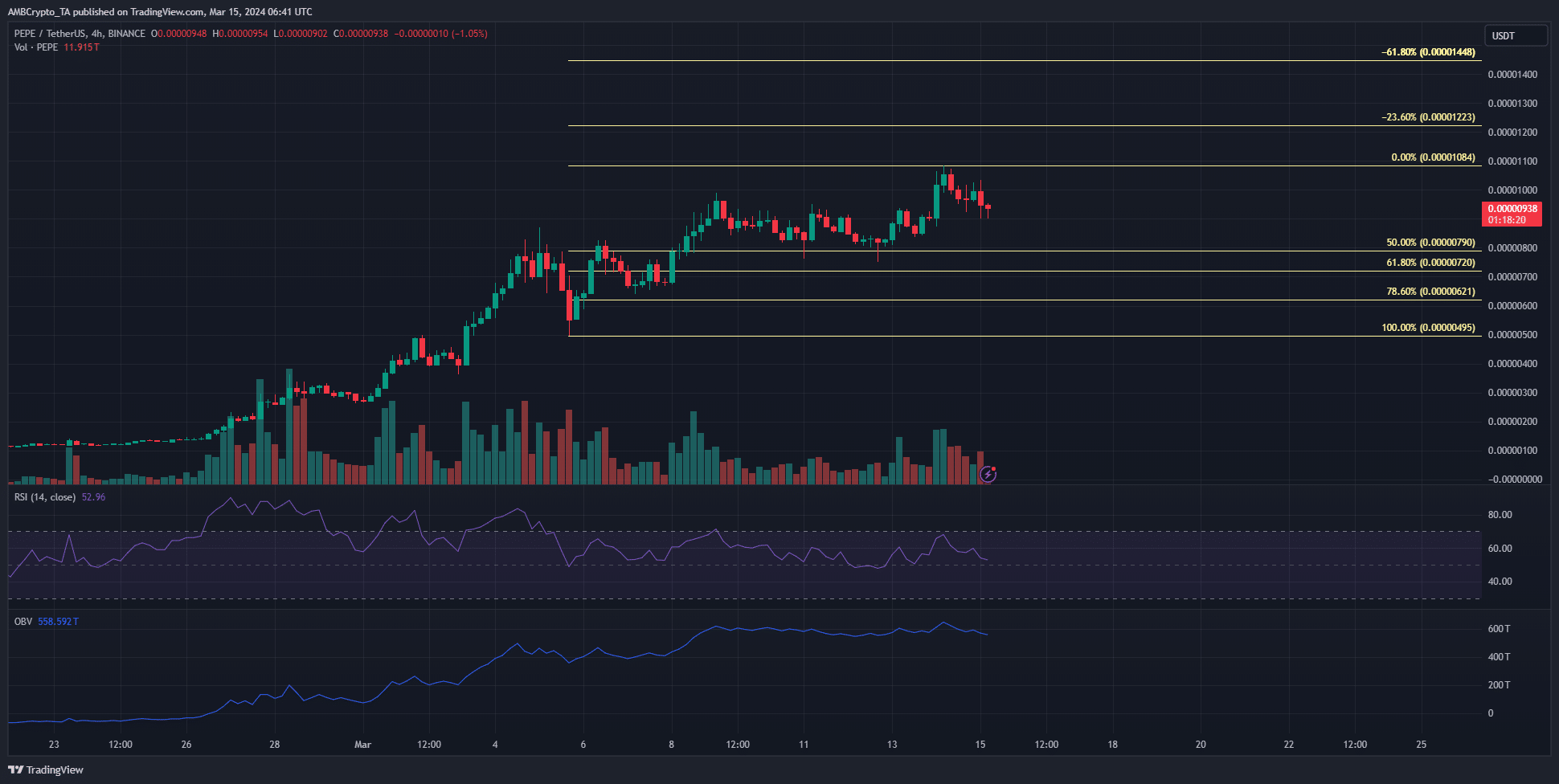

Source: PEPE/USDT on TradingView

On the 4-hour chart, PEPE’s RSI remained above the neutral line of 50 throughout March. This showed that momentum continues to favor the bulls. The market structure was also strong.

The Fibonacci retracement level shows a possible move towards the 61.8%-78.6% area. OBV has remained flat over the past week, indicating a lack of buying volume. So in recent times neither side has been able to control the market.

If PEPE starts to fall below the $0.0000079 support area, buyers may re-enter the aforementioned demand area based on Fibonacci retracement levels.

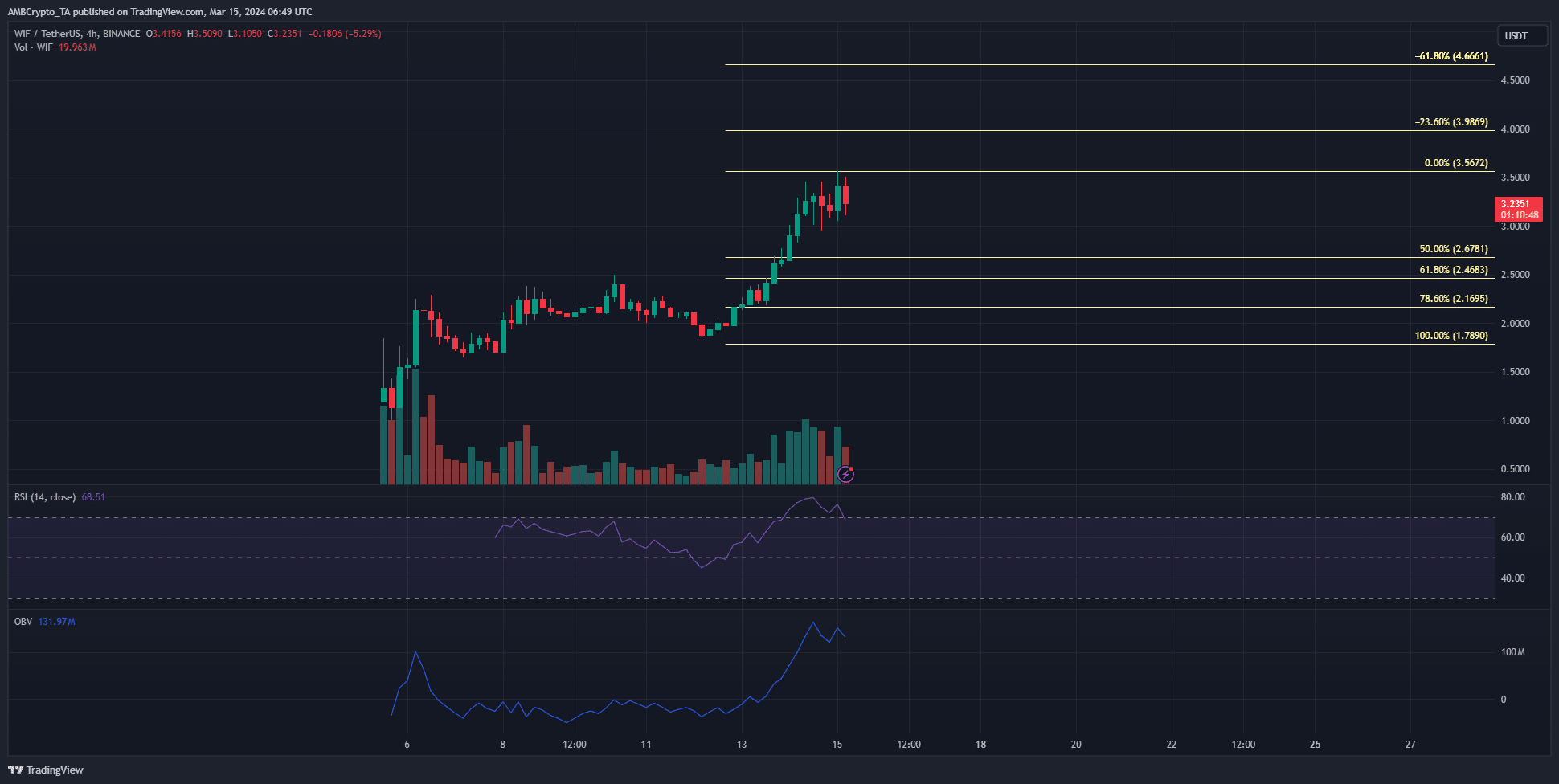

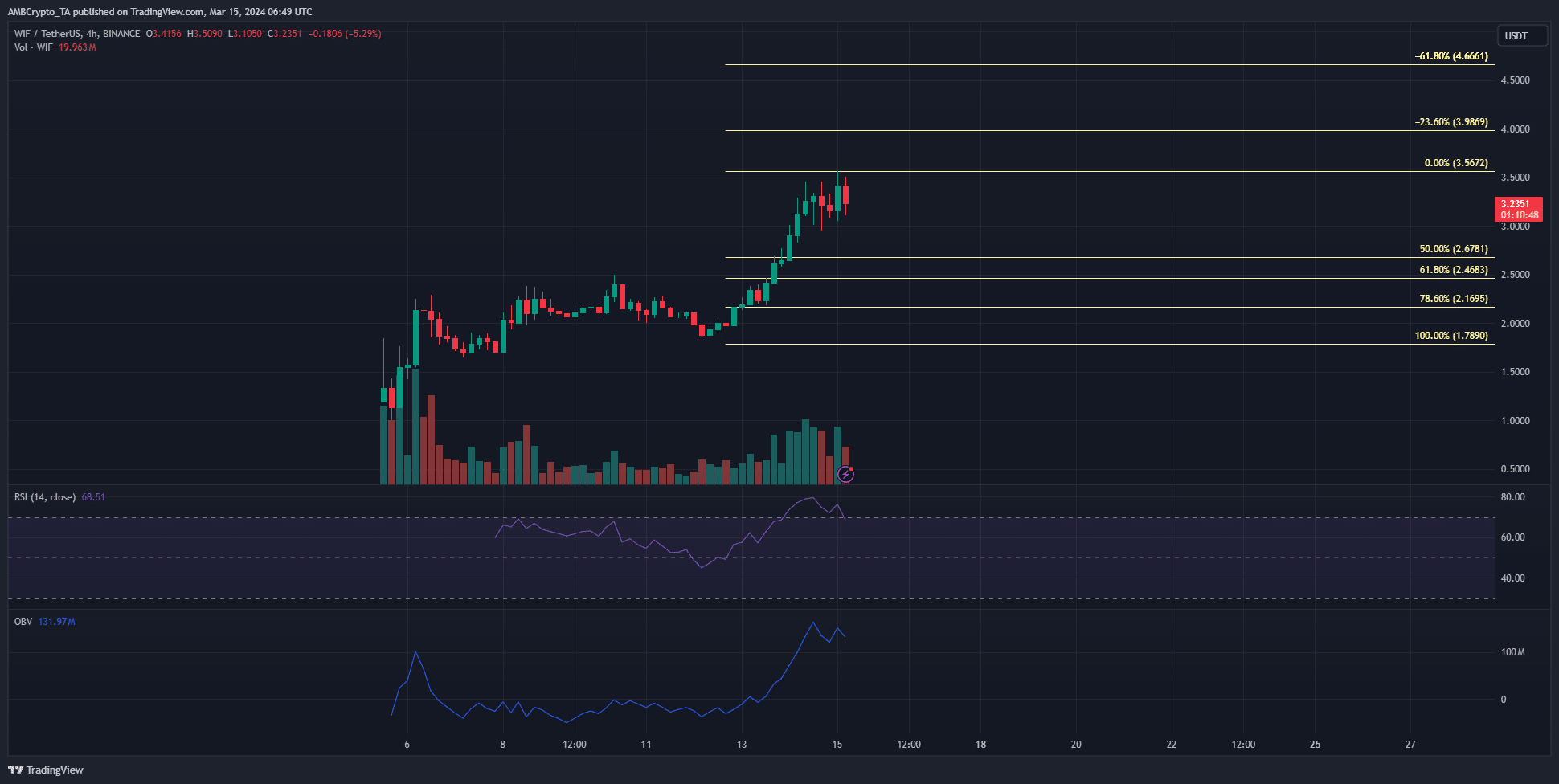

Source: WIF/USDT on TradingView

WIF’s chart showed that memecoin has a bullish trajectory. Trading volume has been high over the past few days and OBV has also surged. This indicates that demand is much greater than selling pressure.

RSI fell below overbought territory. Momentum has slowed but remains strong. The Fibonacci levels shown were provisional as the upward move was not yet complete.

The $3 psychological support area has held firm so far, but a break below this level could lead to a retest of the $2.17-$2.46 area. This probably provides an optimistic response.

While speculative bullish confidence in WIF was solid, PEPE was not.

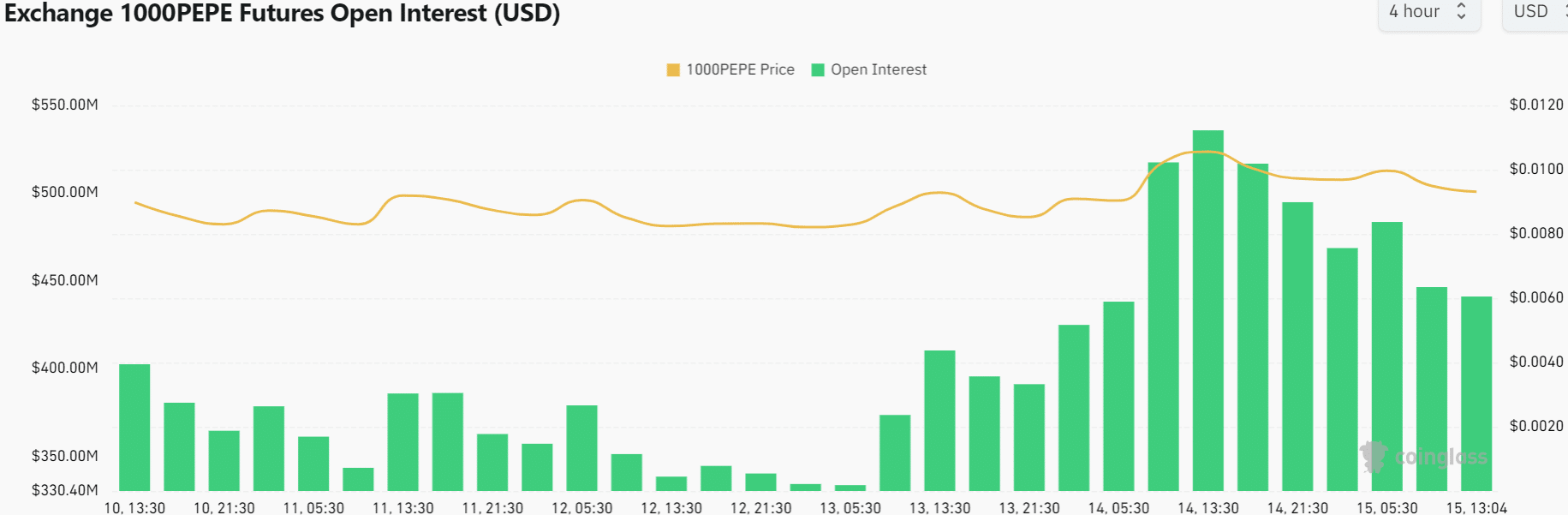

Combining price action with open interest charts for meme coins can provide insight into what speculators are feeling. WIF was strong, but PEPE traders were not so optimistic.

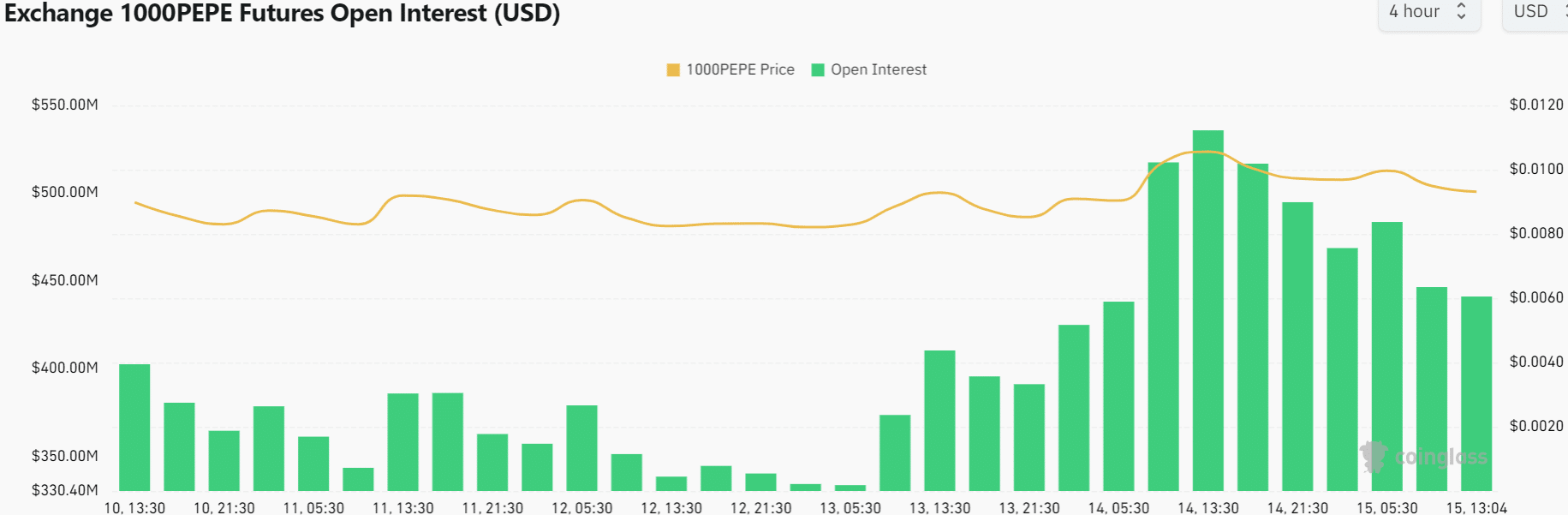

Source: Coinglass

From March 14th, OI began to decline. During that period, PEPE prices fell by more than 10%. The decline in prices and OI highlighted short-term changes in confidence.

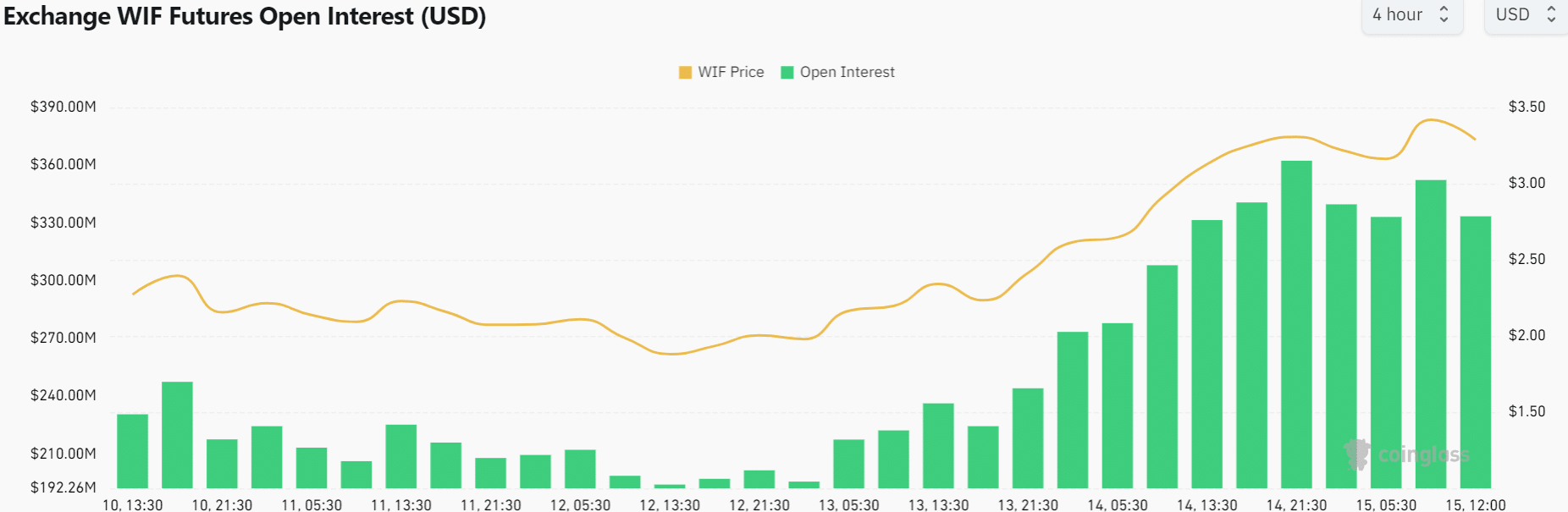

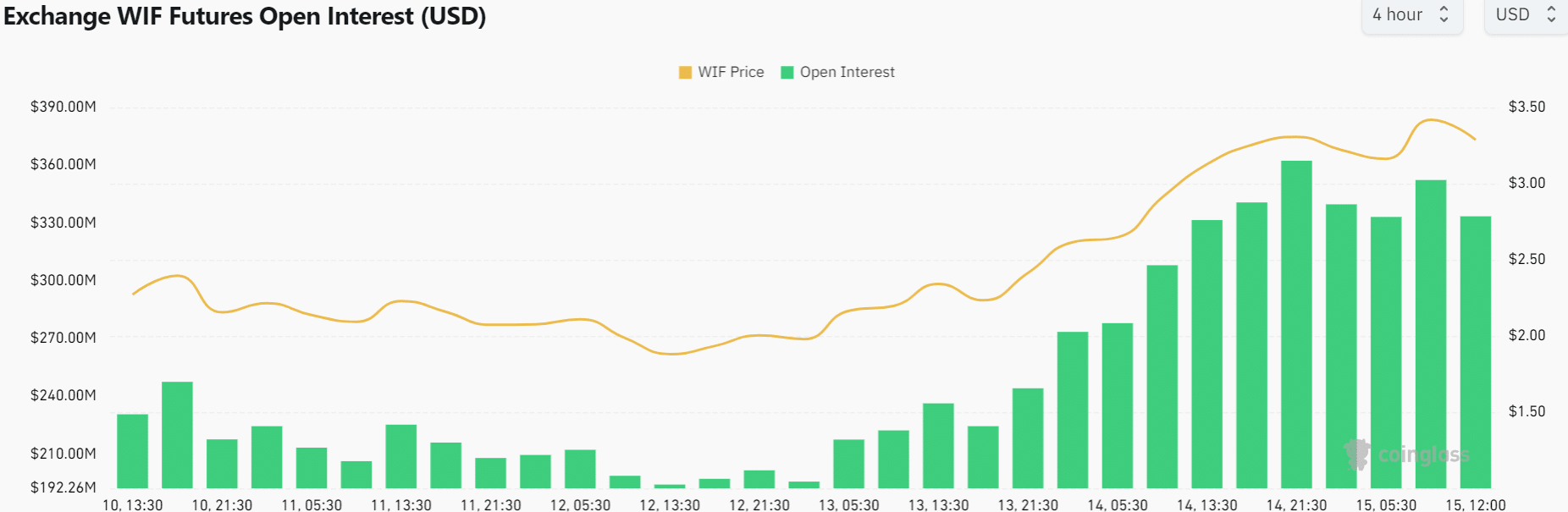

Source: Coinglass

On the other hand, WIF OI did not decline significantly. At the same time, prices also increased, but OI could not keep up. This once again suggests a slightly bearish outlook for the near term.

Realistic or not, PEPE’s market cap in BTC terms is:

With the price of Bitcoin falling, there is a possibility of a continued decline if the prices of both meme coins remain the same. However, the charts on higher time frames were very bullish.

Buyers can therefore add more of these tokens if the key support level is revisited.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.