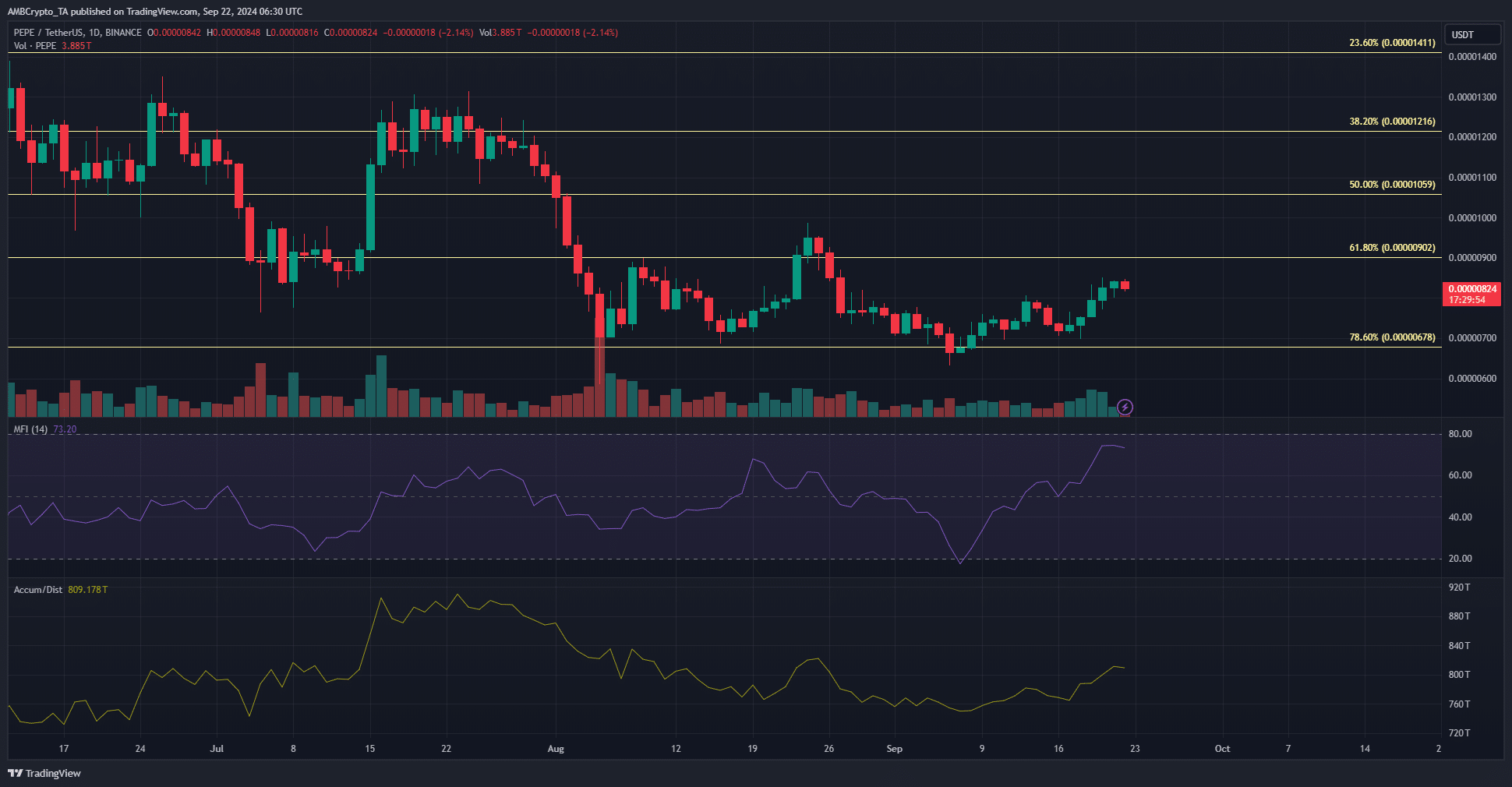

- Pepe has a bullish market structure on a daily basis.

- Price action continues to be limited as trading has been extremely range-bound over the past six weeks.

Pepe (PEPE) was one of the best performing large cap meme coins, outperforming Dogecoin (DOGE) and Shiba Inu (SHIB). It gained 16.71% from Monday’s low, while DOGE gained 10% and SHIB gained 13%.

If the next bull market comes, it will be the first real bull market for a meme coin, while the other two coins have already experienced price expansion in the previous bull market, which means PEPE has more potential.

Pepe hasn’t gotten out of the short range yet.

Source: PEPE/USDT on TradingView

The range formation was not a true range as there was a significant deviation above and below the $0.000009 and $0.00000678 levels, but these levels represented the rough extremes of the range.

The $0.0000077-$0.000008 zone served as resistance for the past month but was recently broken through in the rally.

This rally is showing strong uptrend momentum as seen in the Money Flow Index and no divergence has been found yet. Therefore, the MFI has not yet shown a sell signal.

The A/D indicator has been trending upward over the past two weeks, reflecting increased buying pressure on Pepe.

Before the bulls retreat, there is a high possibility that the price will rise to the $0.000009-$0.0000095 area resistance zone. Swing traders who are already long can retest this zone and take profits.

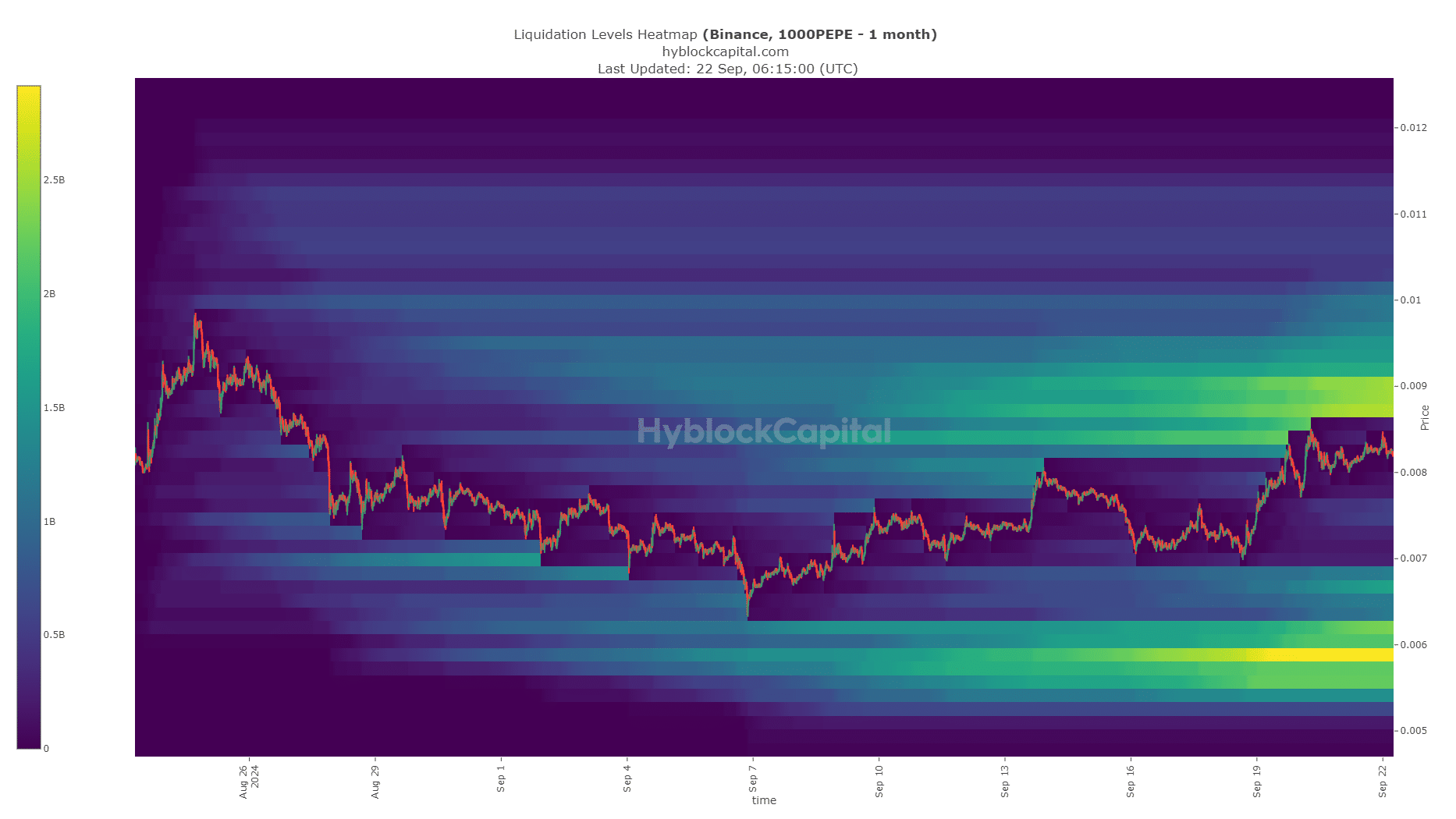

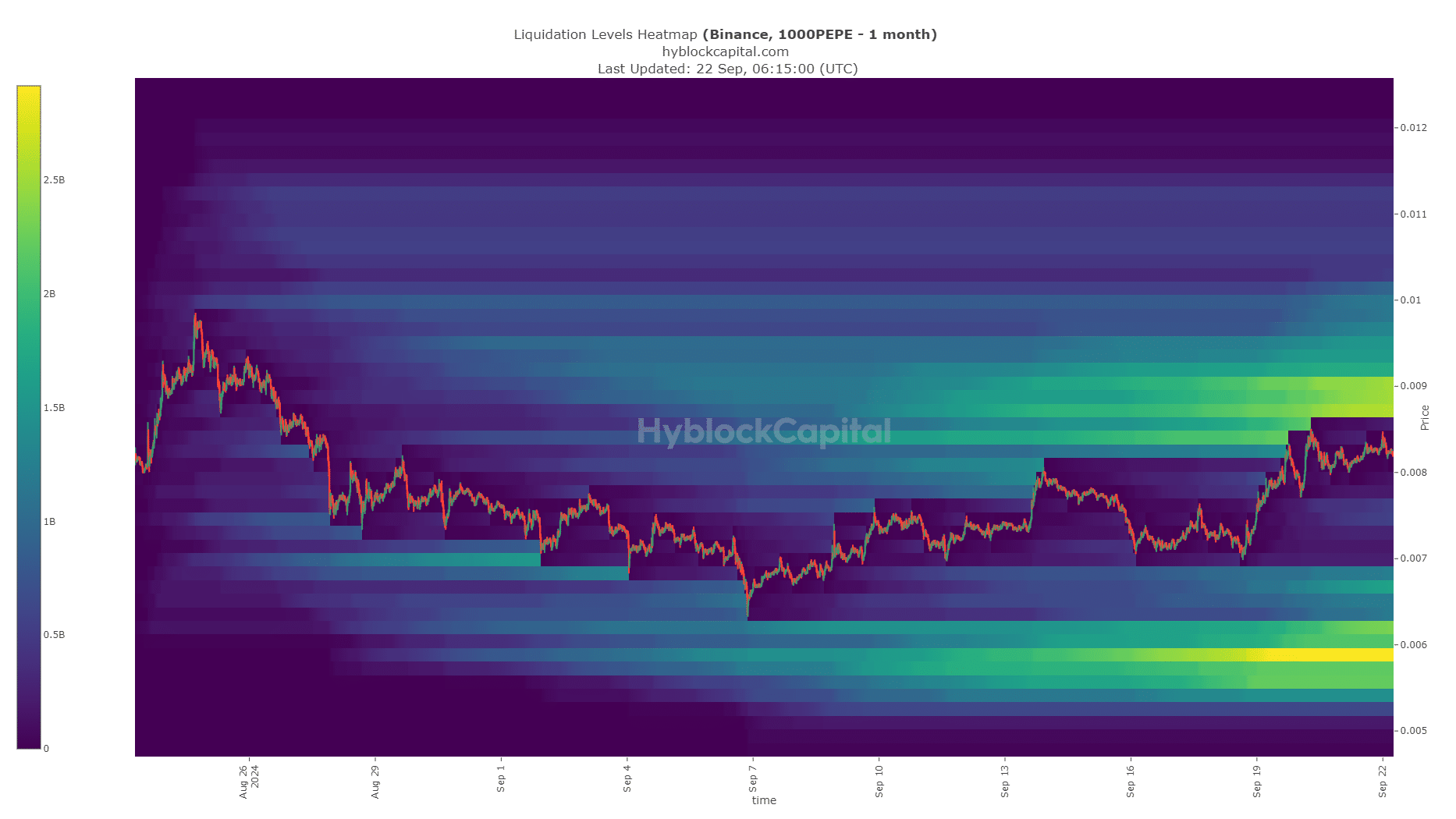

The liquidation heatmap highlighted the short-term range.

Source: Highblock

The liquidation heatmap shows that $0.000009 and $0.000006 are key magnetic zones for the coming weeks. A sweep of both liquidity pools would likely result in a trend reversal.

Read Pepe (PEPE) price prediction 2024-25

This is not a guarantee, as strong sentiment across the market could push Pepe prices well beyond the range extremes. However, until such confidence takes hold of the market, traders can continue to expect range-like price movements.

Disclaimer: The information presented does not constitute financial, investment, trading or any other type of advice and is solely the opinion of the author.