- PEPE Coin flips two popular layer 2 blockchains with global market capitalization.

- Ten days ago, Coinbase listed PEPE on futures after numerous delays.

- PEPE entered the top 30 cryptocurrencies, surpassing DOGE in futures trading volume.

In a somewhat surprising turn of events, popular frog-themed meme coin Pepe (PEPE) has surged ahead of Arbitrum (ARB) and Optimism (OP). Built on top of Ethereum (ETH), these two popular layer 2 blockchains now cover a smaller market cap than PEPE.

PEPE ink achieves 11% daily profit despite all odds.

PEPE’s price trend reversal occurred on May 1, when the token fell to a monthly low of $0.00000609. As the general cryptocurrency market succumbed to a general decline, leading cryptocurrency asset Bitcoin (BTC) plummeted to $56,000, a level not seen since late February 2024.

Pepe, which boasts a very low price correlation with Bitcoin, was one of the first altcoins to overcome the double-digit deficit it had incurred since last week. In the last 24 hours, PEPE has surged 11%, completing a 50% rise over the past two weeks. This coincides with cryptocurrency whales and sharks turning their attention to PEPE, with a massive $591 million traded in PEPE over the past seven days.

PEPE futures explode to $2.5 billion on demand.

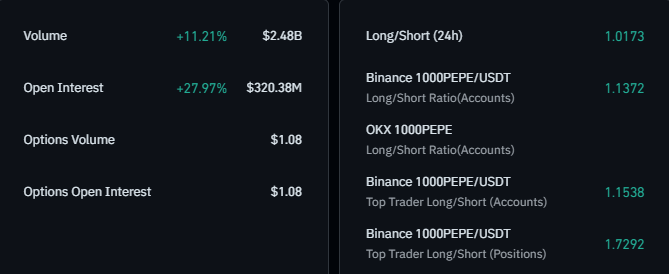

Much of PEPE’s run defying market sentiment can be attributed to the surge in demand for memecoins in the derivatives market. In fact, according to the latest on-chain data from CoinGlass, PEPE Futures currently has a trading volume of $2.48 billion, making PEPE the leading meme coin in the derivatives market.

For comparison, Dogecoin (DOGE), the largest memecoin by global market capitalization, accounted for $2.13 billion in derivatives trading volume over the past 24 hours. Additionally, the open interest (OI) indicator for PEPE futures increased by 27.97%, indicating renewed interest in the token from derivatives traders.

The popularity of PEPE futures comes as Coinbase lists memecoin on its premium and international platform.

However, most PEPE futures trading takes place on Binance and Bybit. Interestingly, Binance users seem to be more optimistic about PEPE than the rest. Binance’s long-to-short ratio is 1.1137 and its overall long-to-short positions are balanced at 1.0239. Judging by recent liquidations, shorts are struggling, with $1.36 million liquidated in the last 24 hours.

On the flip side

- There has also been a significant increase in trading volume in the spot market as PEPE holders await a plausible Coinbase spot listing.

- With a 24-hour volume of $1,707,898,087, spot PEPE sales are still $3 million higher than the bid and a 22% increase in total orders.

Why This Matters

PEPE token is one of the best performing alternative cryptocurrency assets on a year-to-date basis, with a return of 654% over the last 365 days.

Check out DailyCoin’s popular cryptocurrency stories:

BTCC Sets 10 Million USDT Rewards in World Trading Contest

Solana Founder Ridicules Memecoin Scaring Builders’ Claims