- POL’s active addresses and total holders have seen exponential growth.

- The POL transition has caught the attention of many users, and some analysts are expecting the transition.

Over the past few months, many in the cryptocurrency market have been eagerly anticipating Polygon’s MATIC to POL upgrade. As previously reported by AMBCrypto, the MATIC to POL migration officially began on September 4, 2024.

This transition means that MATIC has been upgraded to POL as Polygon’s network token. In simple terms, all transactions that occur on Polygon PoS now use POL as the underlying gas token.

Now, this shift may have breathed new life into the Polygon token, which has been in a constant downtrend on the charts. Before the move, MATIC was on a southward trajectory, down 10.75% on the weekly chart and down 7.38% on the monthly chart.

However, since the transition, the altcoin has seen a moderate uptrend. In fact, at the time of writing, POL was trading at $0.3773 after a 1.45% increase in 24 hours. Also, its market cap has increased by 3.44% over the same period, reaching $2.1 billion.

Without a doubt, the current market conditions are favorable for POL, which shows the importance of the upgrade. For example, Santiment’s analysis showed a surge in network growth and a surge in the total number of holders.

Current Market Sentiment Assessment

According to Santiment’s analysis of the Polygon ecosystem, POL has seen exponential growth in terms of its network. At the time of writing, 487 new daily addresses were created, putting the altcoin in a position to bypass MATIC’s figures in just two weeks.

Source: Santiment

Also, since August 15, thousands of MATIC wallets have liquidated their wallets to facilitate the swap. Over 1,826 POL wallets have been created during the same period. This represents a 64% increase on the chart.

Source: Santiment

Likewise, the market saw the POL supply held by over 1 million wallets drop from 98% to 92% in two weeks. This usually happens when small and mid-sized traders rush to jump into a new asset. The trend will slow down after Binance lists the pair. As previously reported by AMBCrypto, Binance will delist the MATIC pair starting September 10.

Another reason for the increased interest in altcoins is their current price volatility. Altcoins have been extremely volatile over the past few weeks.

Finally, traders are drawn to POL for its long-term benefits, for example, the token allows for multi-chain staking while also giving users enhanced control over governance.

What does the POL chart represent?

As Santiment highlighted, POL has been on a bullish trend in the market over the past three days.

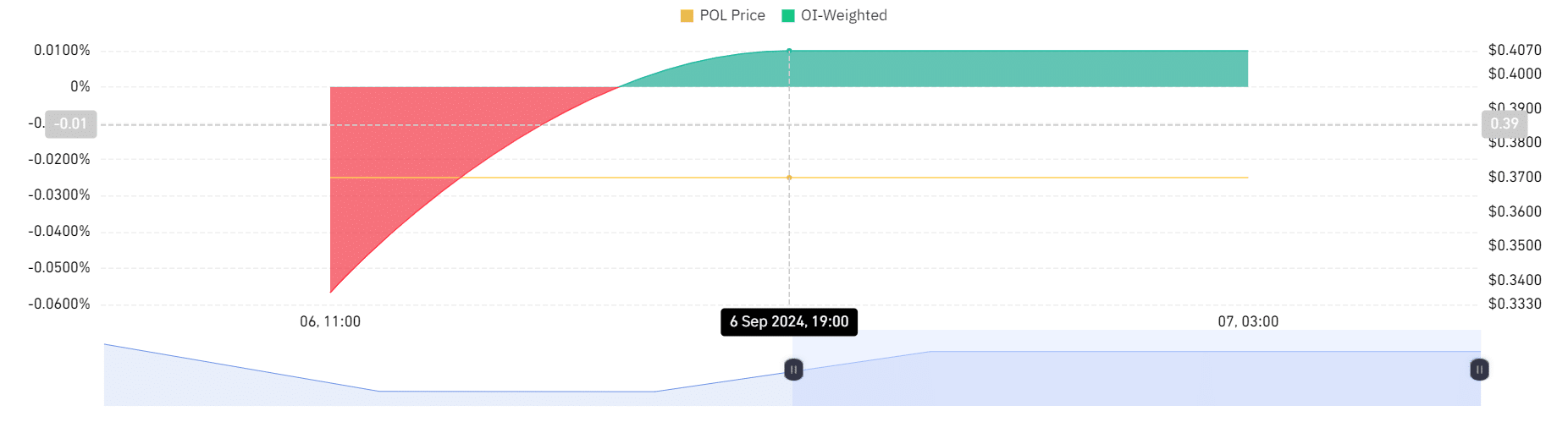

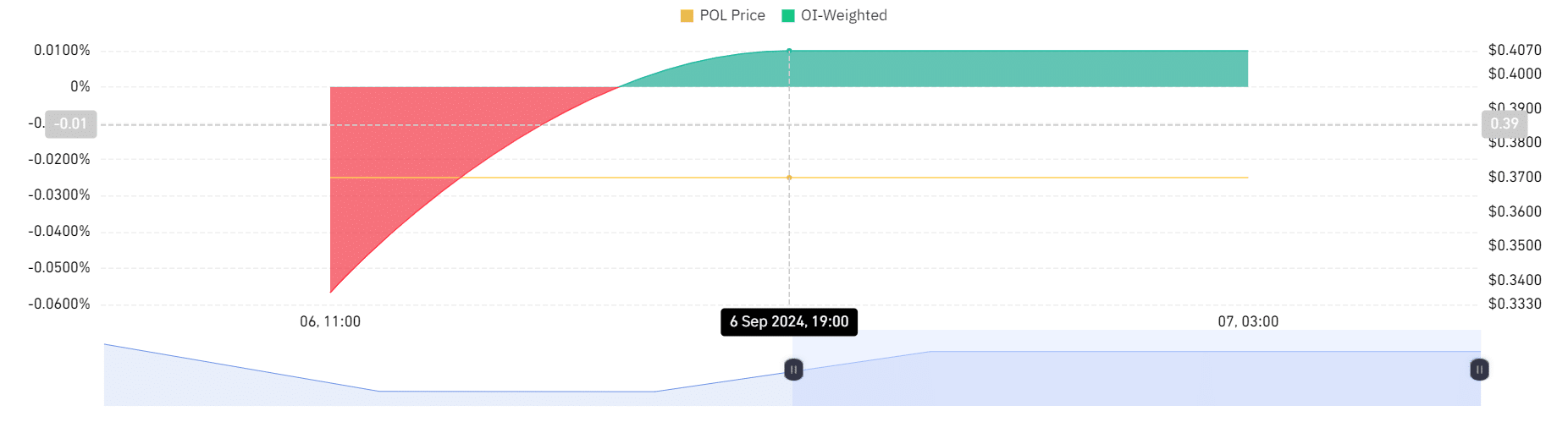

Source: Coinglass

First, the OI weighted funding ratio remained positive for the past two days, reporting a negative value only on one day.

Here, the positive OI weighted funding ratio suggests increased demand for long positions. This also means that investors are betting that the price will continue to rise further. This is a sign of positive market sentiment.

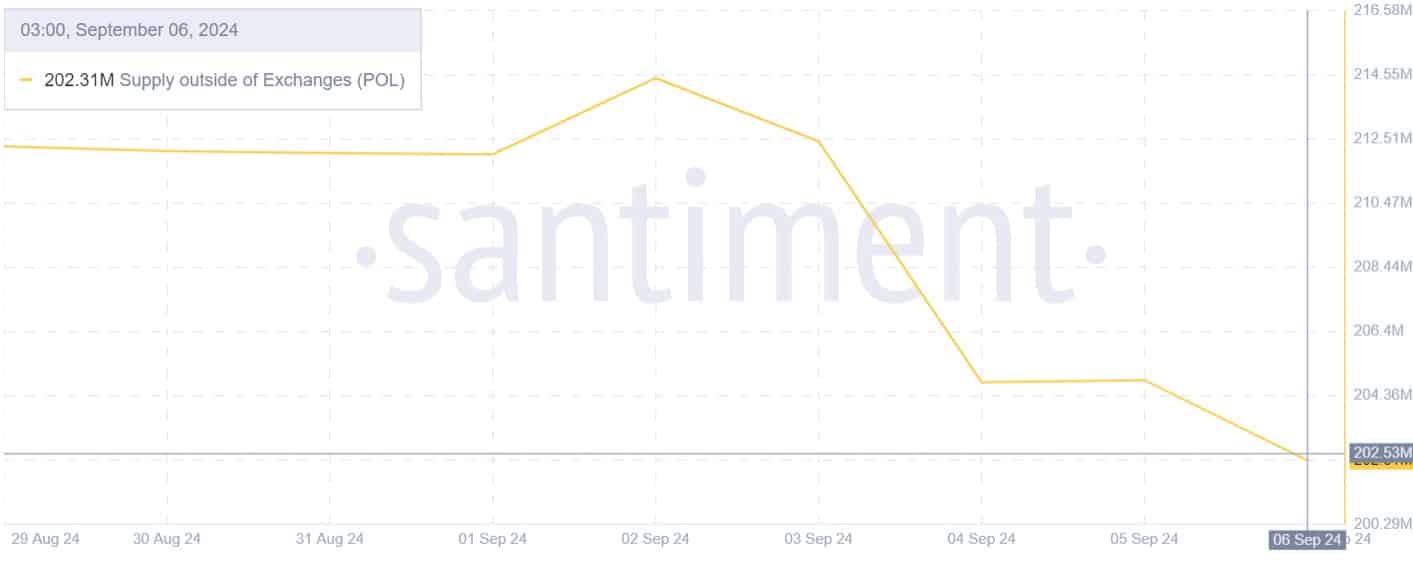

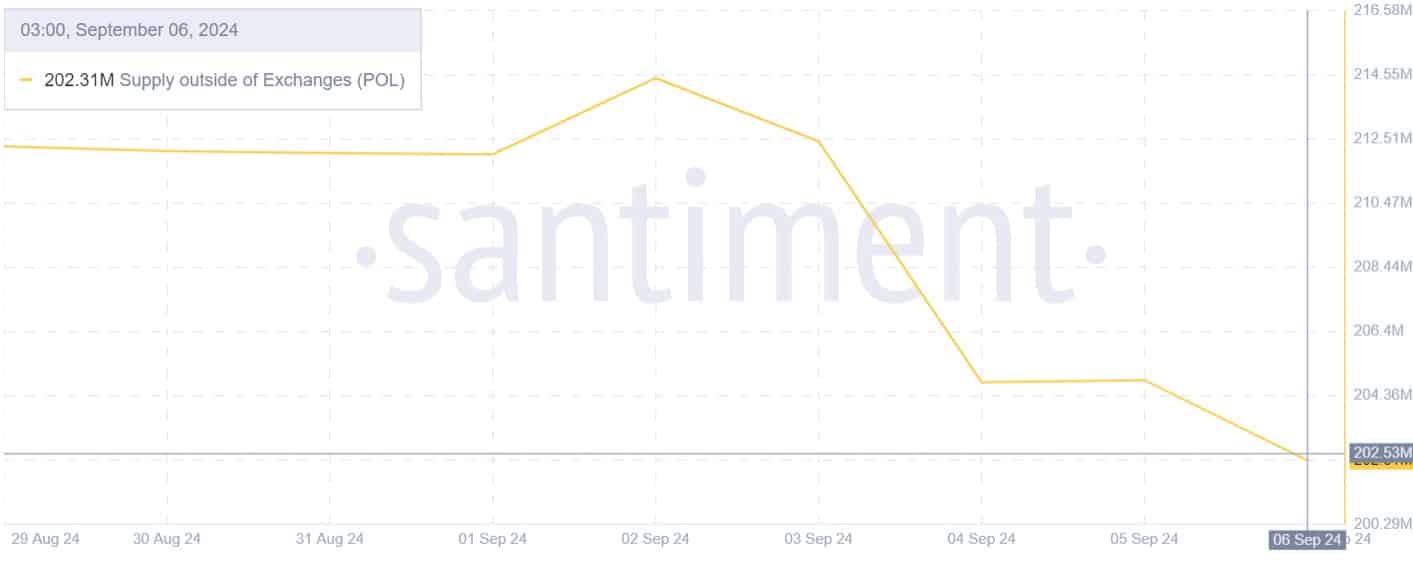

Source: Santiment

Also, POL’s off-exchange supply has decreased from $214 million to $202 million since the previous day. This market trend suggests that investors are taking a long-term view and are less likely to sell in the short term. This approach shows investors’ confidence in the future prospects of this altcoin.

Therefore, if market conditions are favorable, the altcoin is likely to break out of the $0.38 resistance level and reach $0.4 in the short term.