- Public interest in Polkadot has increased over the past few days along with the token price.

- Market indicators looked bullish for the token.

With the market showing high volatility over the past few days, Polkadot (DOT) Investors may be preparing for a bull market. This seemed to be the case when the token price was approaching a key resistance level, which if broken could allow DOT to reach new highs.

Polkadot is preparing for a rally.

FLASH, a well-known cryptocurrency analyst, recently posted the following: Twitter We highlight exciting developments regarding Polkadot. According to the tweet, the price of DOT was approaching a critical resistance level.

meIn fact, a similar pattern was seen on the token chart earlier this year. The token managed to break out of the pattern that led to the previous bull rally.

If DOT follows this trend, investors could benefit in the coming weeks if the price rises above $7.5. That seemed likely to happen since Polkadot had already shown some bullish signals.

According to CoinMarketCap, DOT rose more than 4%. Moreover, the price has surged 4.4% in the last 24 hours alone. At press time, it was trading at $7.48 with a market capitalization of over $10.7 billion, making it the 13th largest cryptocurrency.

Is a bull market inevitable?

Since the price of Polkadot has already gained upward momentum, AMBCrypto planned to look at on-chain indicators.

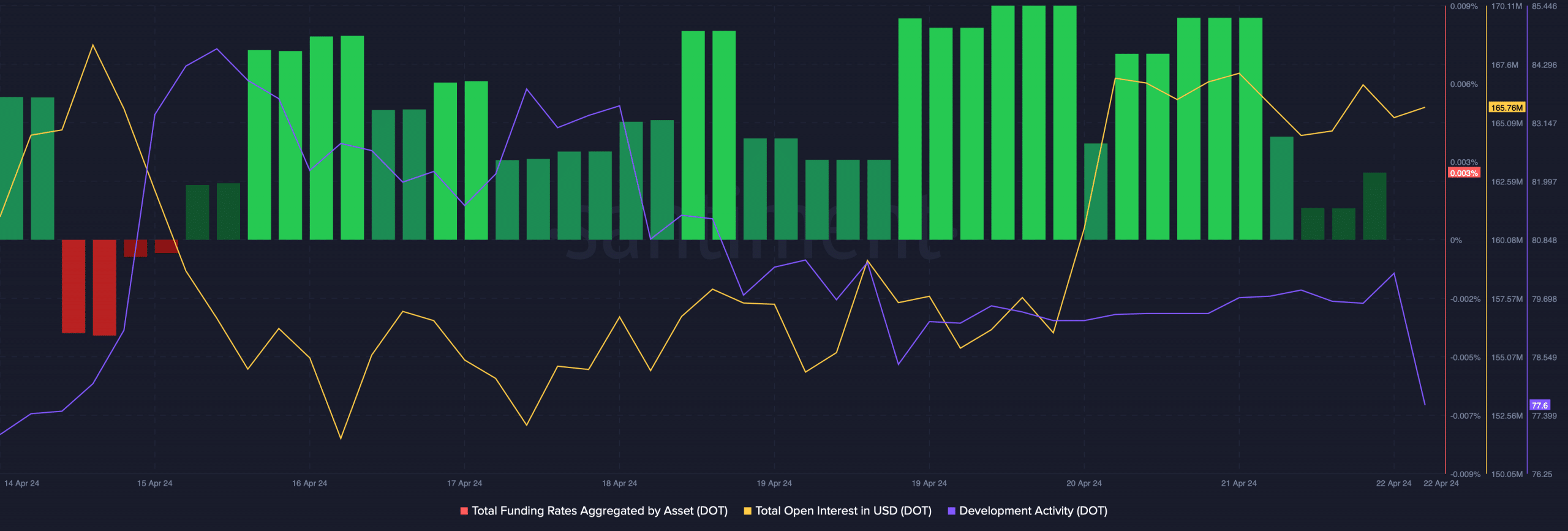

An analysis of Santiment’s data found that DOT’s funding ratio fell on April 22. This was an optimistic indicator, as falling funding rates are often followed by price increases.

In addition, Polkadot’s open interest also rose along with the price, suggesting that the price upward trend is likely to continue.

However, we were surprised to see that Polkadot, which is known for its active development activity, has seen its index decline over the past seven days.

Source: Santiment

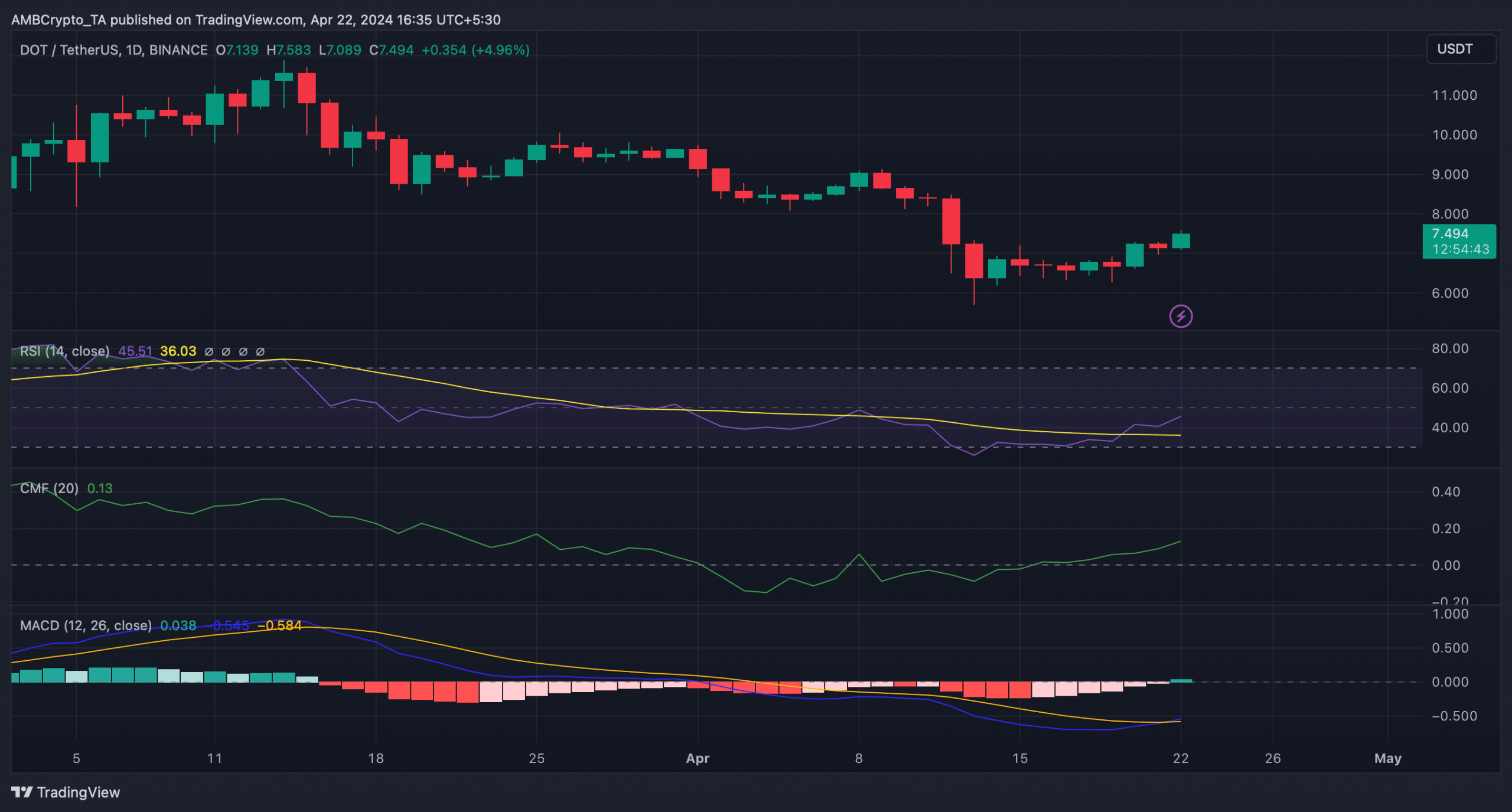

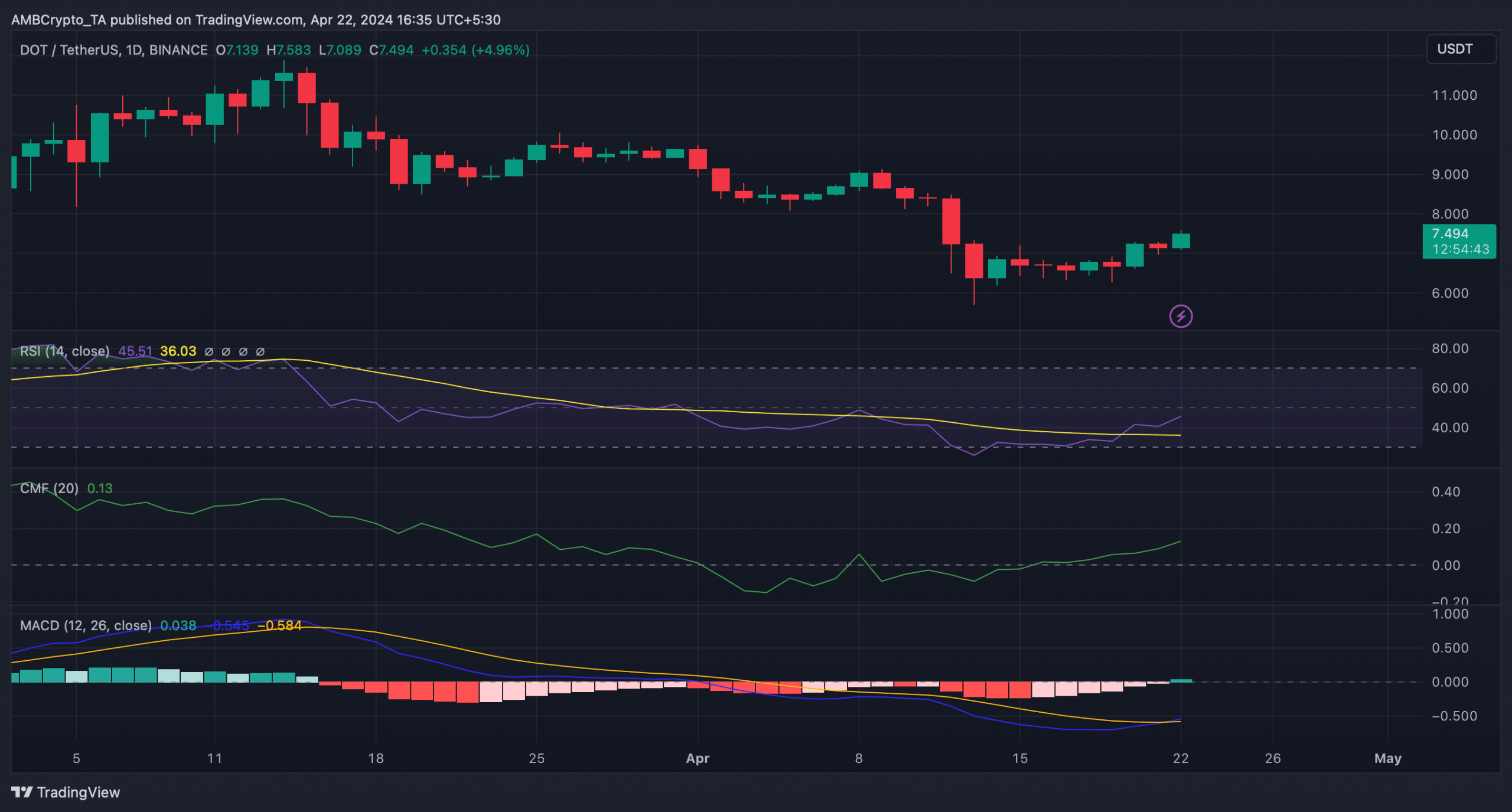

We then checked the daily chart of the token to better understand whether further price increases are likely to occur, allowing DOT to break above the $7.5 resistance level. Technical indicator MACD indicated a bullish crossover.

The relative strength index (RSI) showed an upward trend and moved towards the neutral line. The token’s Chaikin Money Flow (CMF) also followed a similar upward trend, further indicating that DOT’s upward rally may continue.

Source: TradingView

Realistic or not, the following is Market capitalization of DOT in ETH

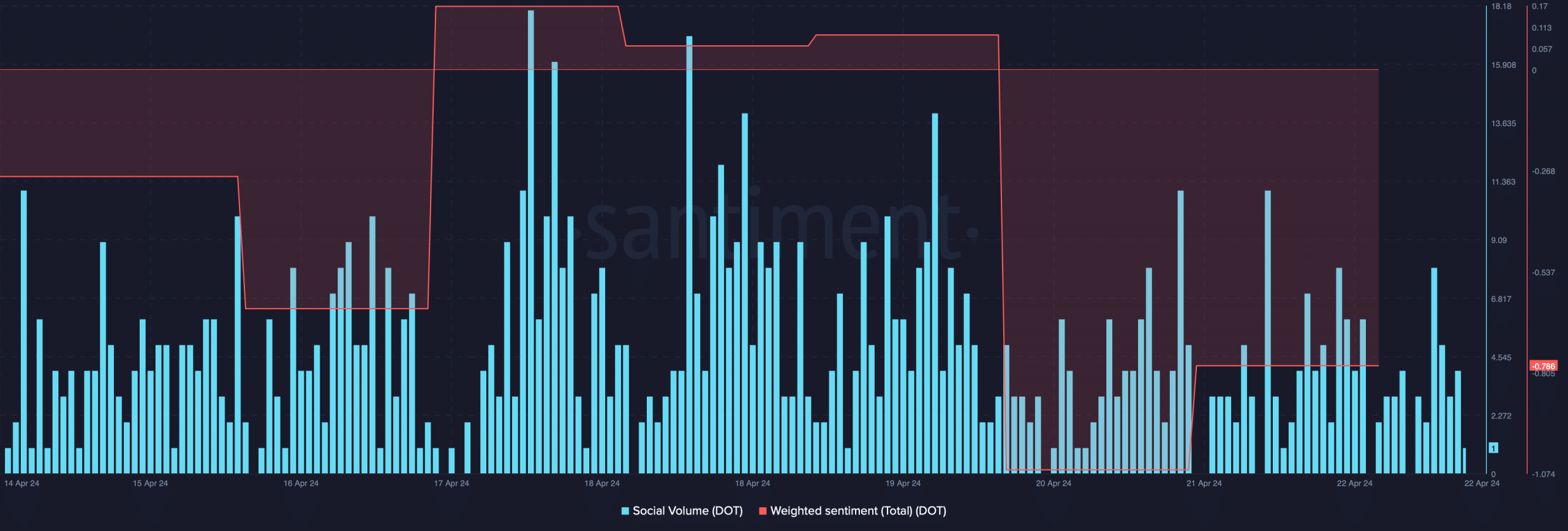

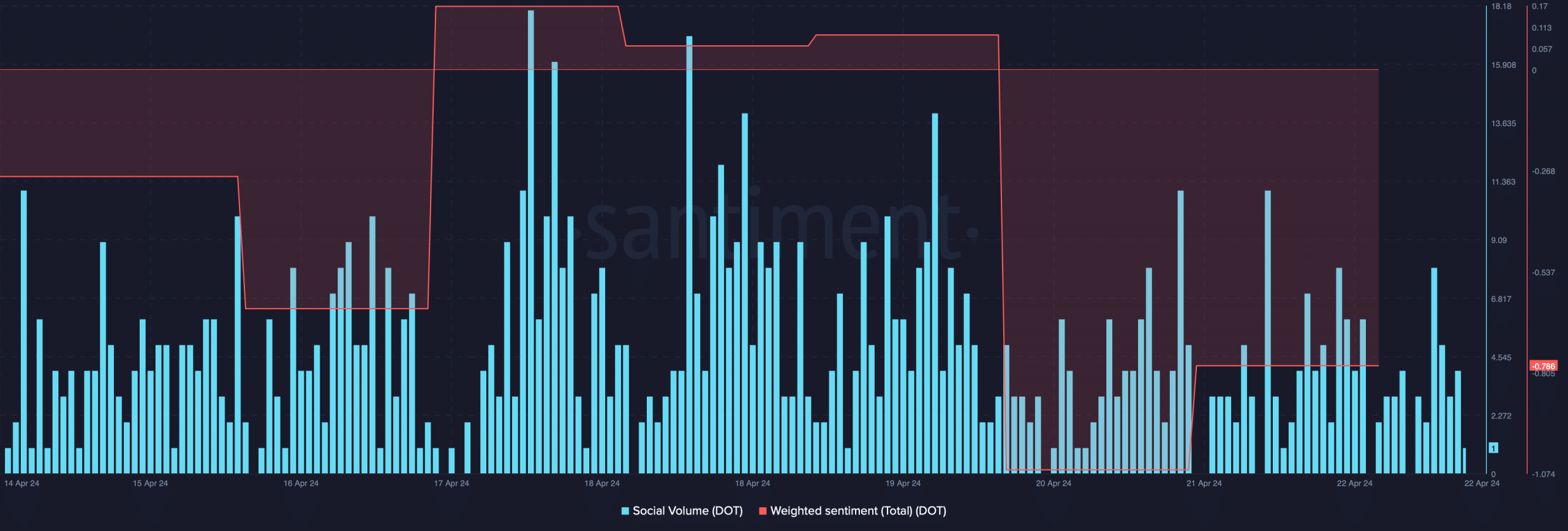

However, despite these bullish indicators and positive price action, sentiment surrounding the token remained bearish. This can be seen in the significant decline in weighted sentiment.

Social volumes also plummeted last week, reflecting the decline in popularity in the cryptocurrency space.

Source: Santiment