- Despite several integrations, Polkadot development activity has declined.

- DOT’s long/short ratio is increasing, signaling a bullish takeover.

Polkadot (DOT) It’s been a tough week with bears clearly outperforming the market. Meanwhile, Polkadot Insider, a popular X handle that provides updates on the blockchain ecosystem, said: Twitter We are excited to announce some notable developments related to the DOT ecosystem.

Polkadot Weekly Performance

CoinMarketCap’s data Polkadot’s price has dropped 8% over the past seven days. At the time of writing, DOT was trading at $5.81 and had a market cap of over $8.3 billion, making it the 15th largest cryptocurrency.

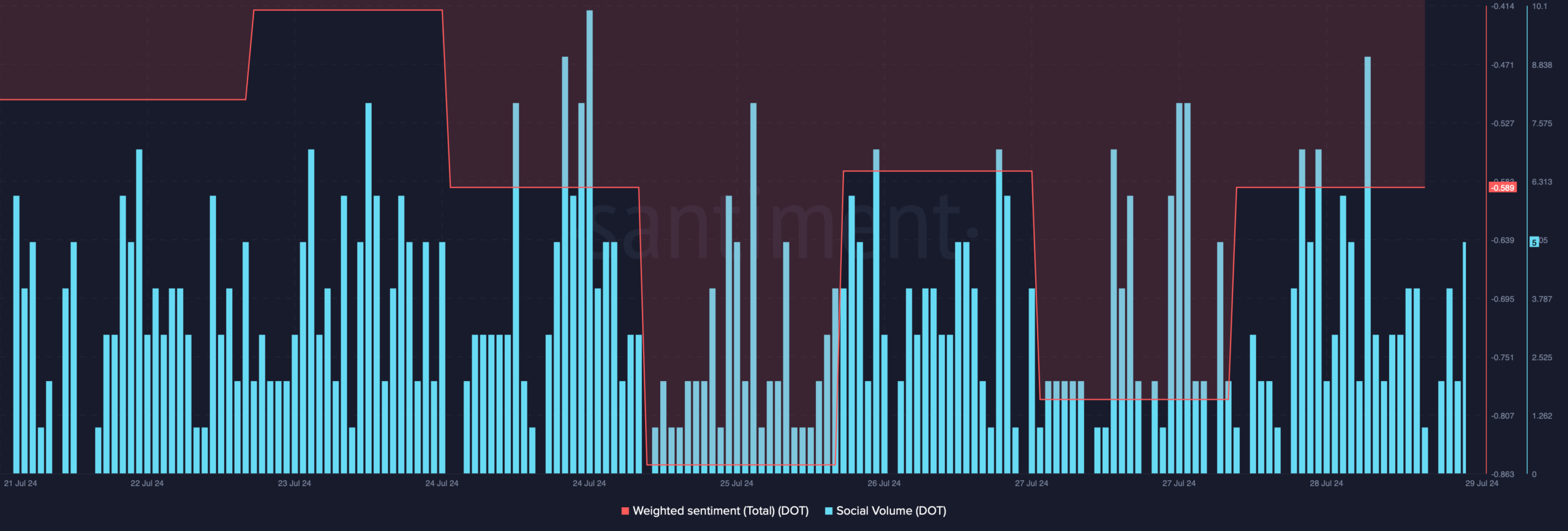

This negative price action also affected the weighted sentiment, which fell. The indicator’s decline suggests that bearish sentiment surrounding the token is dominant in the market.

Despite this, social volume remained high, reflecting its popularity in the cryptocurrency space.

Source: Santiment

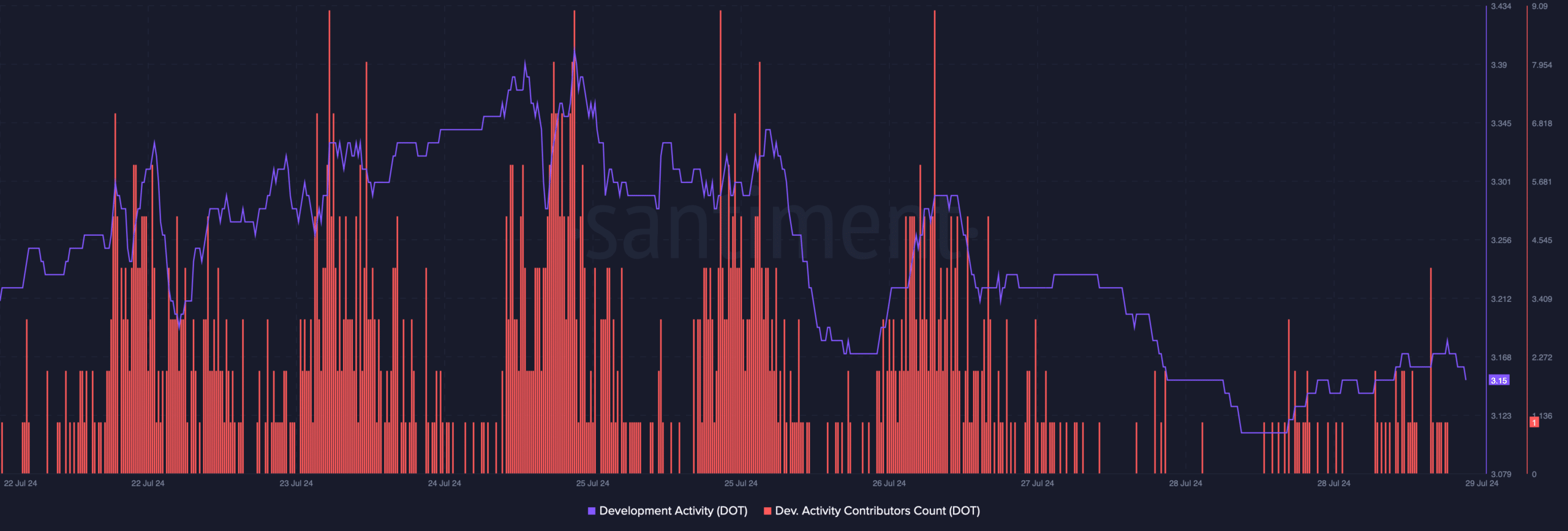

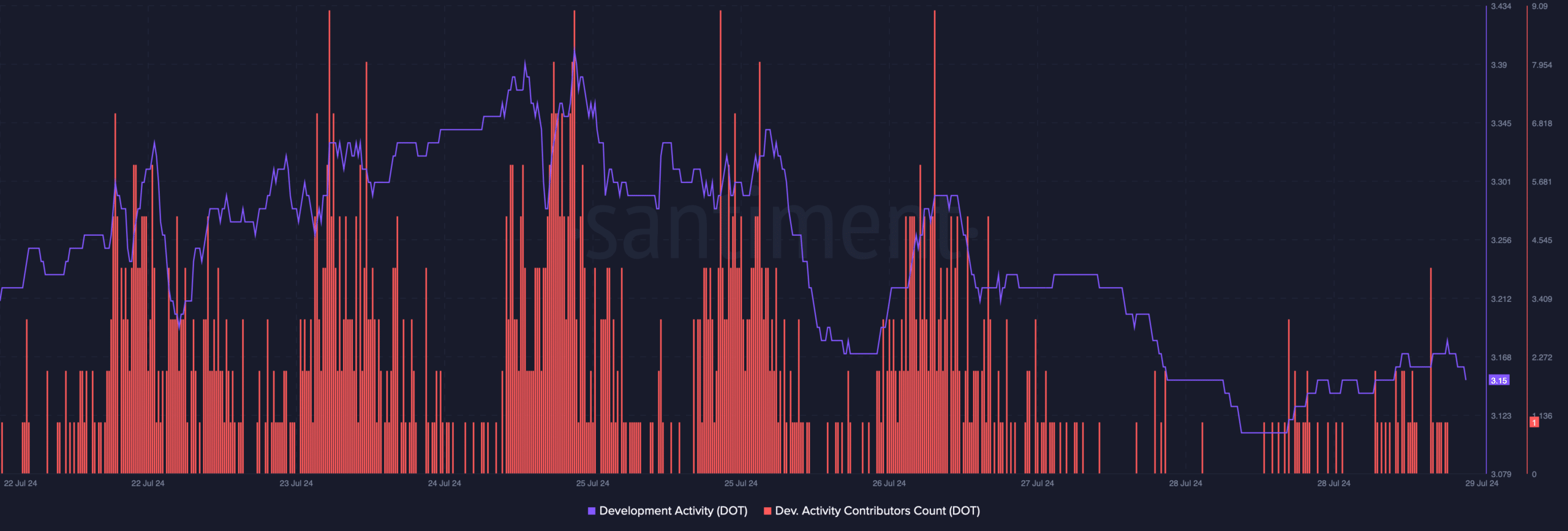

Several new integrations have taken place while the token price has been dropping.

According to tweets from Polkadot Insiders, Band Protocol has been integrated into Astar Network’s ink over the past 72 hours. The blockchain has also released a summary for 2024 (future version) decoded in Polkadot.

However, despite this consolidation, it is surprising that DOT’s development activity has declined over the past week. A similar downward trend has been observed in the number of contributors to DOT’s development activity.

Source: Santiment

So what can we expect from DOT now?

AMBCrypto planned to take a look at Polkadot’s on-chain data daily chart to see if the downward price trend will continue in the coming days.

According to our analysis of Coinglass, dataThe DOT long/short ratio has surged. A rising indicator means that there are more long positions than short positions in the market, which can be considered a bullish signal.

Source: Coinglass

However, the token’s open interest remained somewhat stable during the price decline, suggesting that it may take a little longer for DOT to reverse the ongoing market trend. The technical indicator MACD showed a bearish crossover.

Additionally, the Relative Strength Index (RSI) remained below neutral levels, suggesting that moves could slow in the coming days.

Despite this, Polkadot’s price has reached the lower limit of the Bollinger Bands, which often leads to a price rally.

Source: TradingView

read Polkadot (DOT) Price Prediction 2024-2025

According to data from Hyblock Capital, AMBCrypto suggests that if bulls succeed in taking over the market, investors could see the token hit $6 in the coming days.

However, if the downtrend continues, DOT is likely to fall to the $5.6-$5.5 range.

Source: Hyblock Capital