- Polygon points out bearish market structure and is ready for more losses

- The rise in dormant circulation warned of a wave of selling pressure.

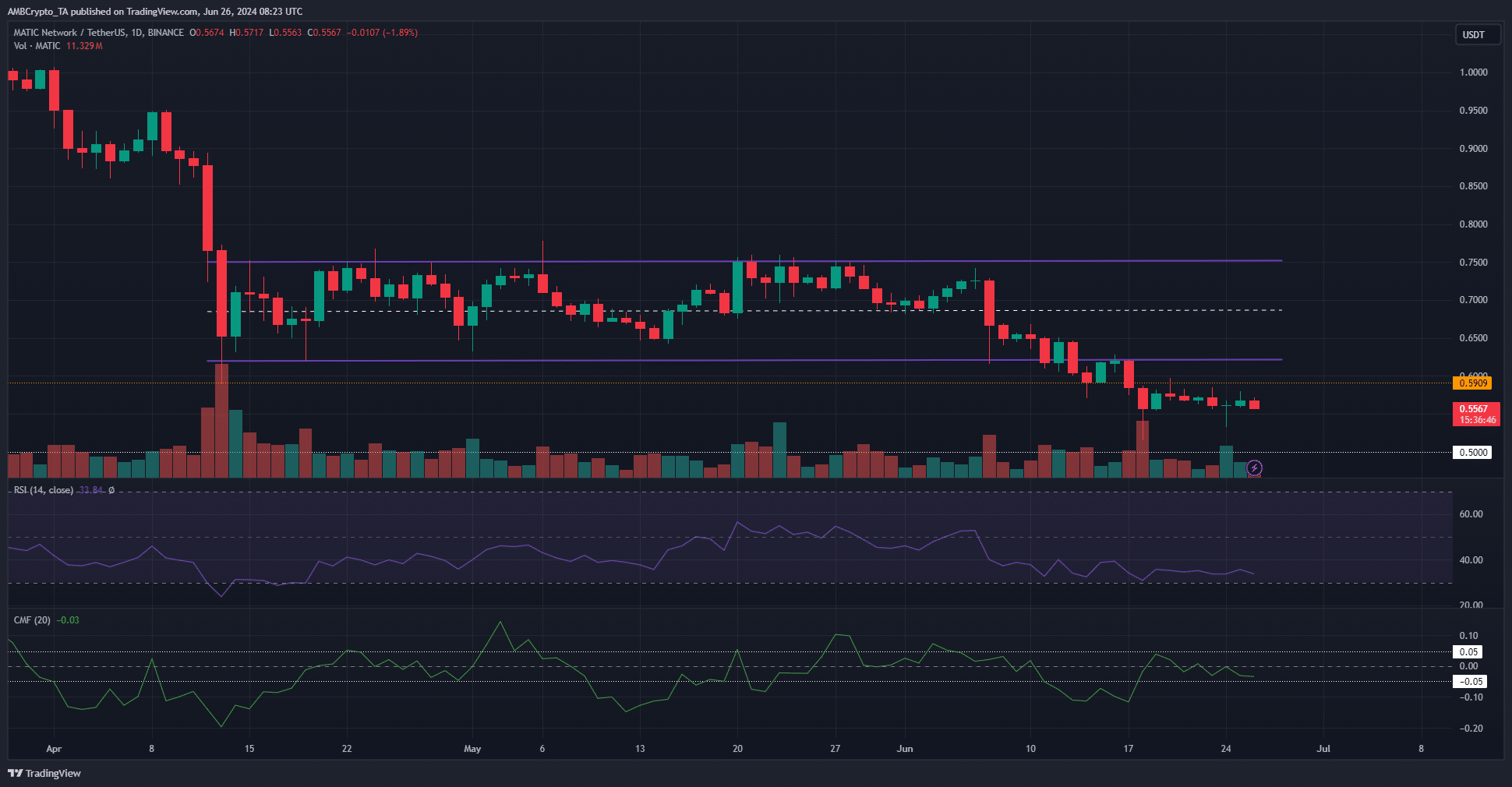

The Polygon (MATIC) cryptocurrency experienced a deepening decline in June. It started on June 11th with prices falling below the two-month range. The low of $0.621 was retested as resistance on June 16th.

This solidified the bear’s possession and opened the way for new migrations south. At press time, the $0.59 level was the next major resistance. Should bulls expect more losses and retreat from the market?

The next level of HTF support was also psychologically important.

Source: MATIC/USDT on TradingView

With the $0.59 level turning into a resistance level, $0.5 becomes the next psychological and technical support level. This was significant in September and October 2023, kicking off a massive rally that saw the Polygon cryptocurrency reach a high of $1.29 in May 2024.

Therefore, a move towards this support in search of liquidity is expected. The market structure on daily time frames is showing a serious downward trend.

Therefore, the $0.5 level may not immediately reverse the downtrend, but it may temporarily halt it.

CMF was -0.03 and traders may be waiting for CMF to fall below -0.05 to indicate a lot of capital is leaving the market. The RSI is 33, indicating a firm downtrend underway.

If the indicator continues to decline, it will have a negative impact on the bullish defense of the $0.5 support line.

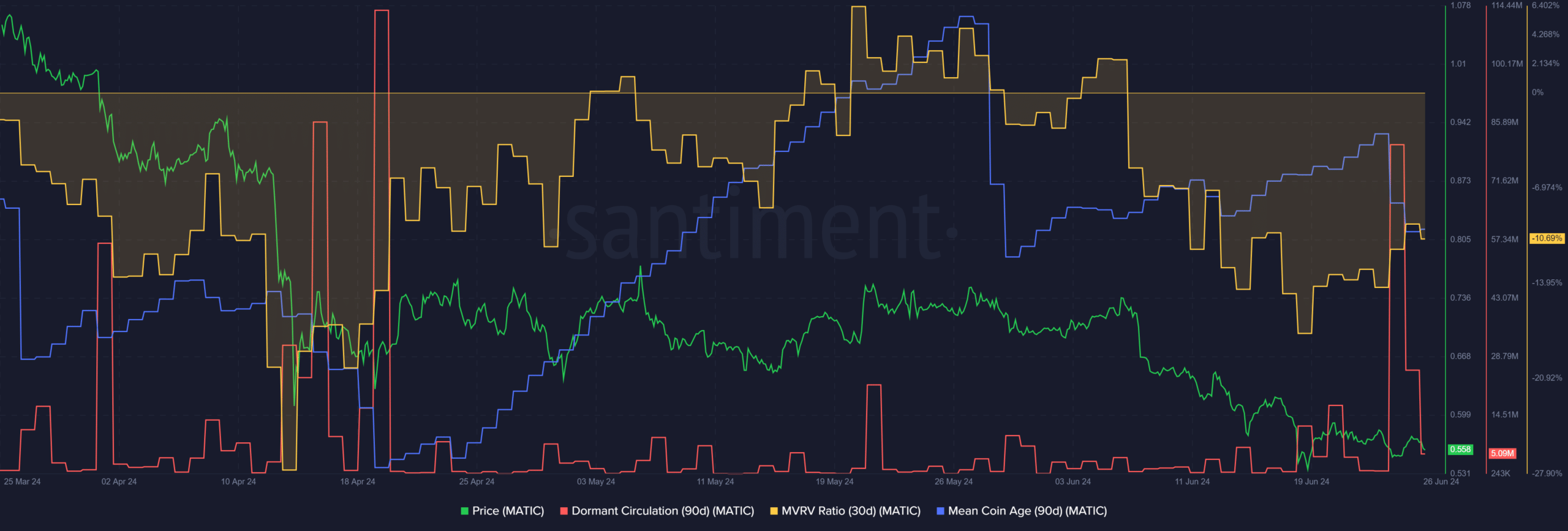

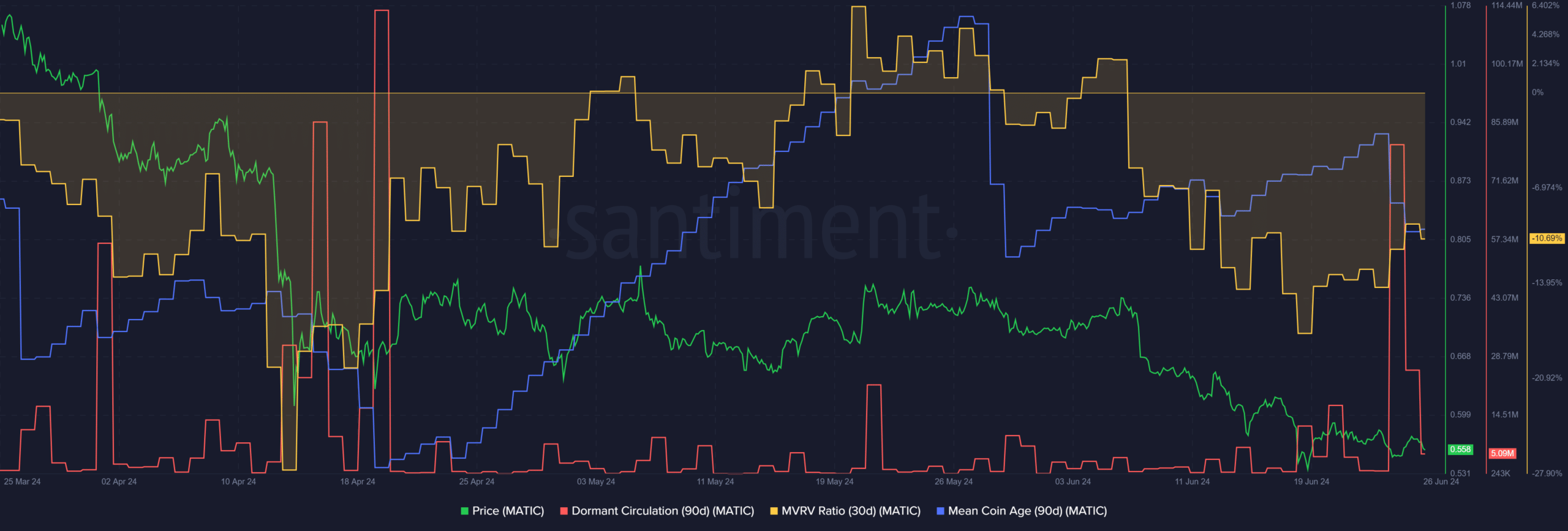

A surge in dormant circulation suggests the next price action.

Source: Santiment

On June 24, there was a significant spike in dormant circulation. A similar percentage jump was last seen in mid-April when the price tested the $0.6 support several times.

Read Polygon (MATIC) Price Prediction for 2024-25

This meant the capitulation of Polygon cryptocurrency buyers, and a similar scenario was happening again.

This could cause prices to fall further. The MVRV ratio is significantly negative, showing that short-term buyers are suffering losses. Any bounce may result in sales being made to allow these traders to break even, making recovery more difficult.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.