Layer 1 blockchains are the underlying networks that support a variety of applications directly from the protocol, while Layer 2 blockchains operate on top of these underlying layers to improve scalability and efficiency. Comparing the usage and efficiency of EVM-compatible L1 and L2 blockchains and sidechains can help us better understand market value and where most DeFi activity is occurring.

According to Dune Analytics data analyzed by CryptoSlate, Polygon, a layer 2 sidechain, was the leader in the DeFi ecosystem, followed by BNB Chain, an EVM-compatible layer 1 blockchain.

One of the most important metrics when analyzing L1 and L2 is daily gas usage, i.e. the computational effort required to execute operations on the blockchain. Gas fees are paid in the native blockchain currency, and high gas usage usually indicates strong network activity. In particular, the fact that the L2 solution maintains high gas usage at low USD costs reflects an efficient scaling solution that makes transactions cheap without sacrificing blockchain activity.

Polygon utilizes an average of 579.97 billion units of natural gas each day, with associated costs of only $654.8 million. This means that despite processing a high volume of 48.37 transactions per second, it averages $0.76 USD per second. Each transaction on Polygon costs approximately 138,782 gas units. The BNB mainnet has high trading volume but a different cost structure, with daily natural gas usage of 454.89 billion units and daily USD fees of $1.02 million. The cost per second soars to $11.81, far surpassing Polygon’s. The higher cost per transaction, averaging 108,513 gas units, reflects BNB’s higher computing demands per transaction, meaning it is a more resource-intensive operation than Polygon.

| chain | Average base gas usage/day | Average USD gas price/day | Average number of transfers/day | Average base gas per Tx | Average base gas usage/sec | Average USD gas rate/sec | Average number of transfers/sec |

|---|---|---|---|---|---|---|---|

| Polygon Mainnet | 579.97b | $65.48 thousand | 4.18m | 138,782 | 6.71m | $0.76 | 48.37 |

| BNB mainnet | 454.89b | 1.02 million dollars | 4.06m | 108,513 | 5.26m | $11.81 | 47.03 |

| decision 1 | 273.96b | $250.05 thousand | 1.14m | 241,207 | 3.17m | $2.89 | 13.15 |

| base mainnet | 222.37b | $378.72 thousand | 1.26m | 174,229 | 2.57m | $4.38 | 14.59 |

| ON mainnet | 213.30b | $160.26 thousand | 490.83k | 429,129 | 2.47m | $1.85 | 5.68 |

| Gnosis Mainnet | 109.77b | $1.05,000 | 182.58k | 601,244 | 1.27m | $0.01 | 2.11 |

| Ethereum mainnet | 108.14b | $12.63m | 1.19m | 90,758 | 1.25m | $146.20 | 13.79 |

| Phantom Mainnet | 94.86b | $4.89 thousand | 248.93k | 372,521 | 1.10m | $0.06 | 2.88 |

Arbitrum uses 273.96 billion units of gas every day, costing users $250,050. This breaks down to $2.89 per second, or 241,207 gas units per transaction. This makes it more cost-effective than BNB, but less than Polygon. Base Mainnet recorded a similar trend with 222.37 billion units and daily fees of $378.72k, resulting in a slightly higher cost of $4.38 per second and 174,229 units per transaction.

Ethereum has the biggest impact on costs, using 108.14 billion gas units each day, resulting in a whopping $12.63 million in fees. Despite an average of 90,758 gas units per transaction, the cost soars to $146.20 per second, demonstrating Ethereum’s strong security and computational reach and highlighting the scalability issues that the L2 network is trying to solve.

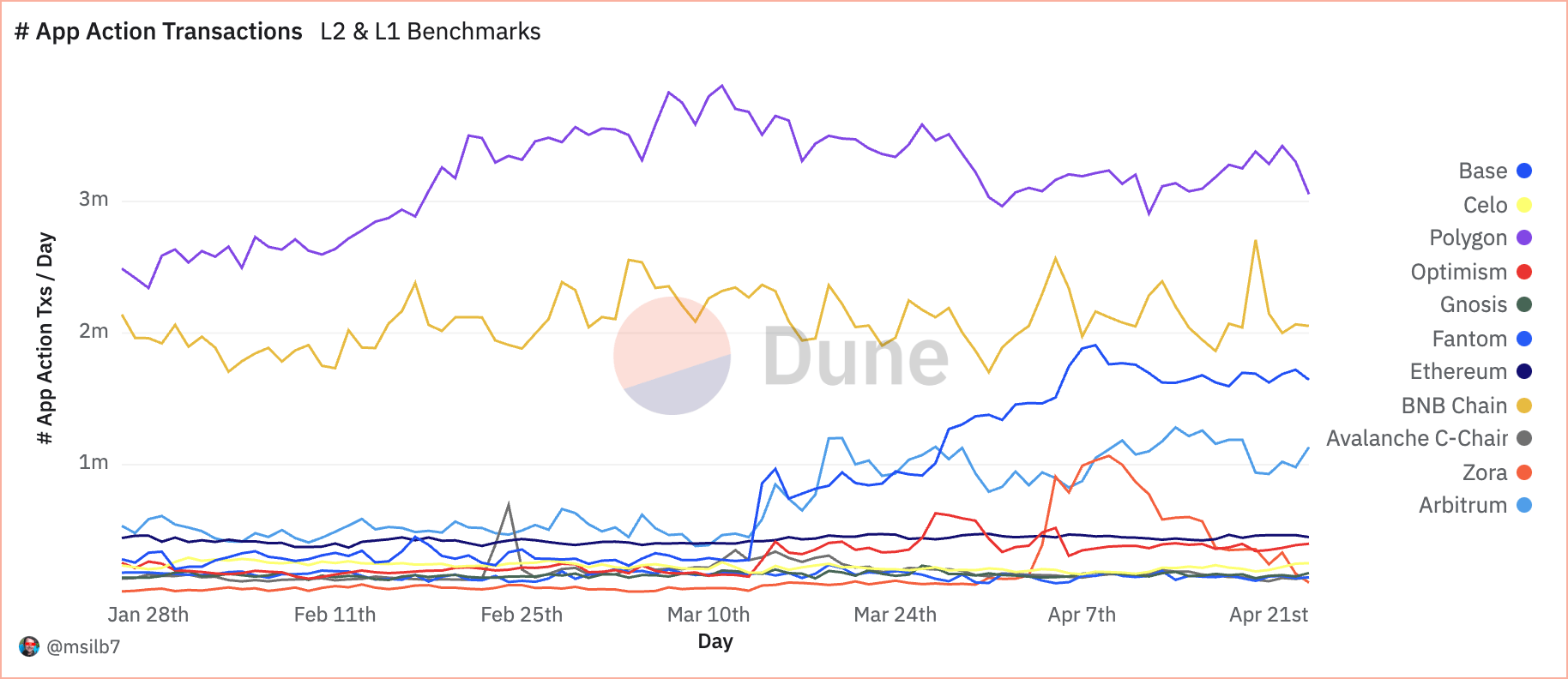

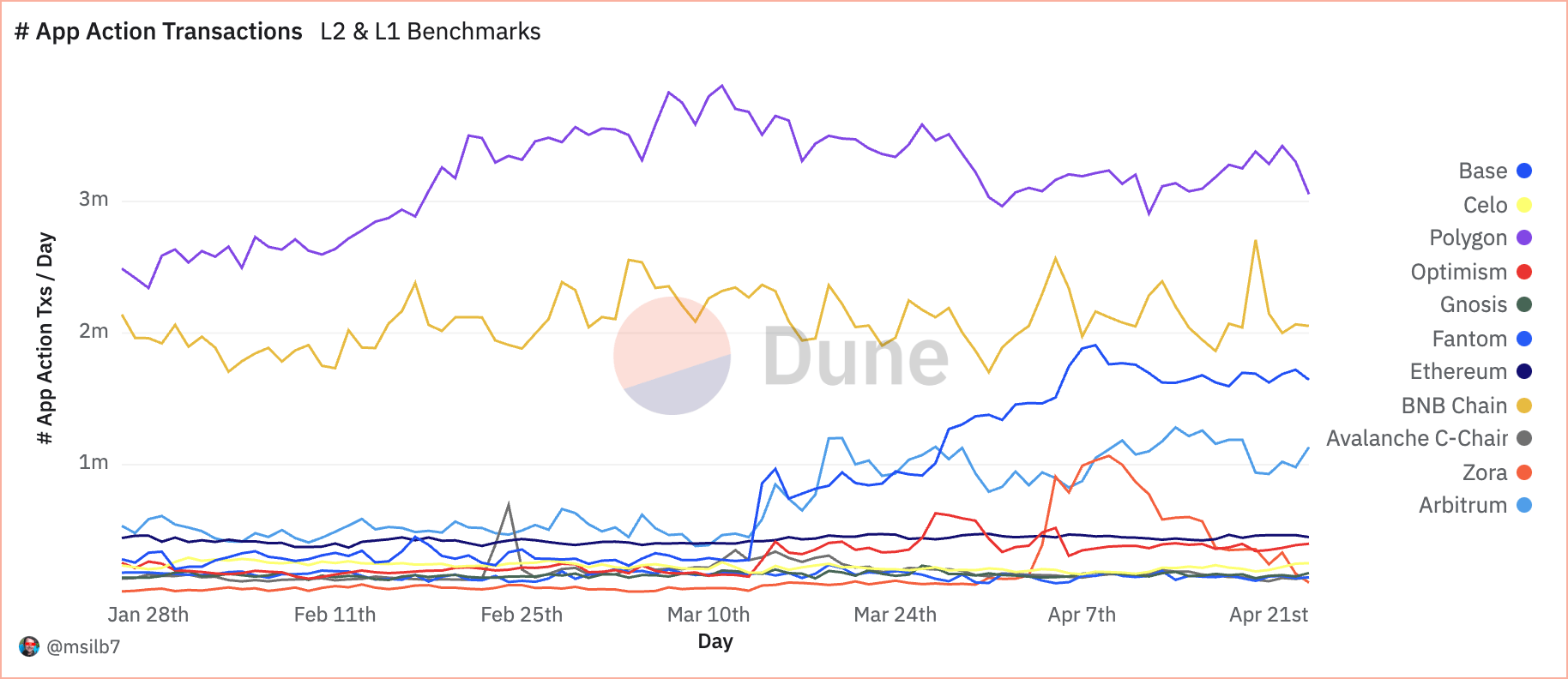

Looking at trading metrics, data from April 23 shows that Polygon took the lead with 4.02 million transactions, followed by BNB Chain with 3.9 million. These figures demonstrate strong user engagement and network usability, accounting for 25.8% and 25.1% of total transactions (excluding known system transactions) respectively.

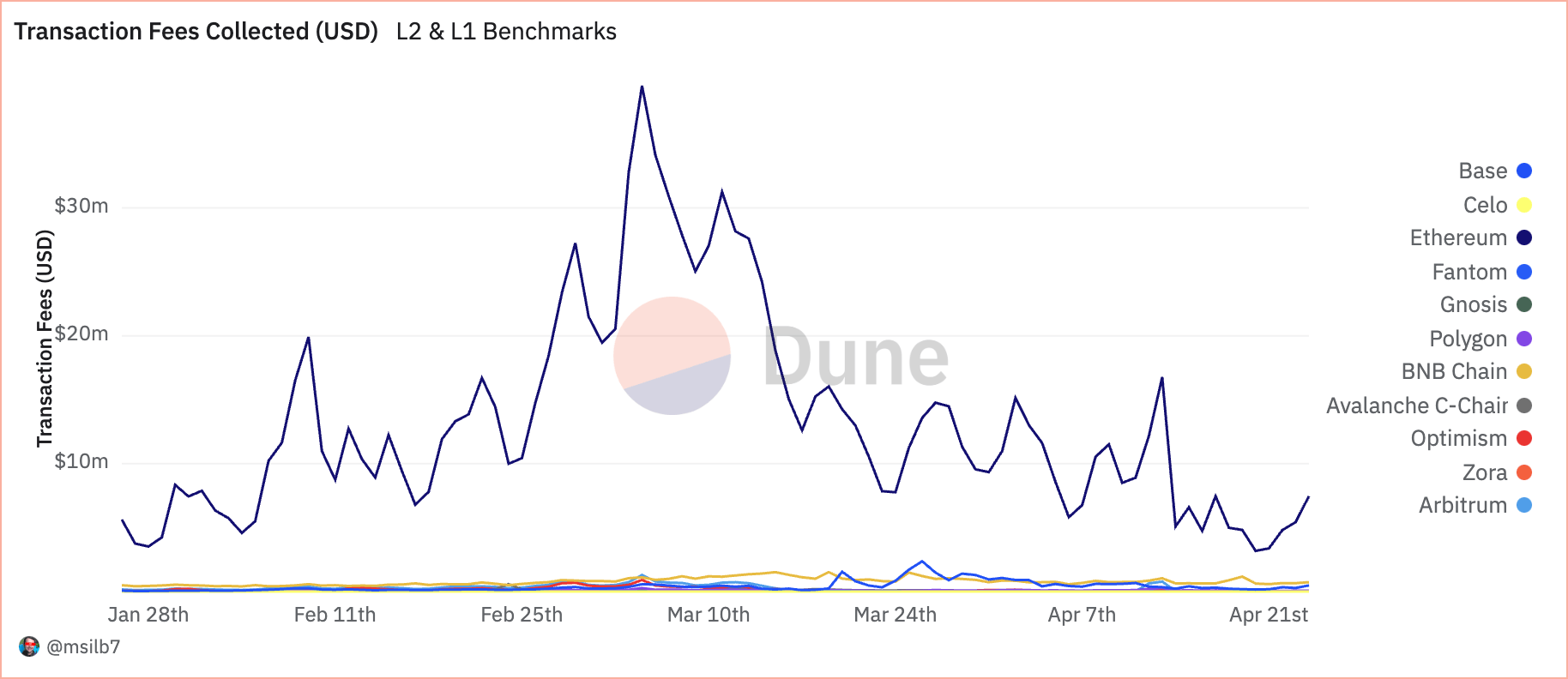

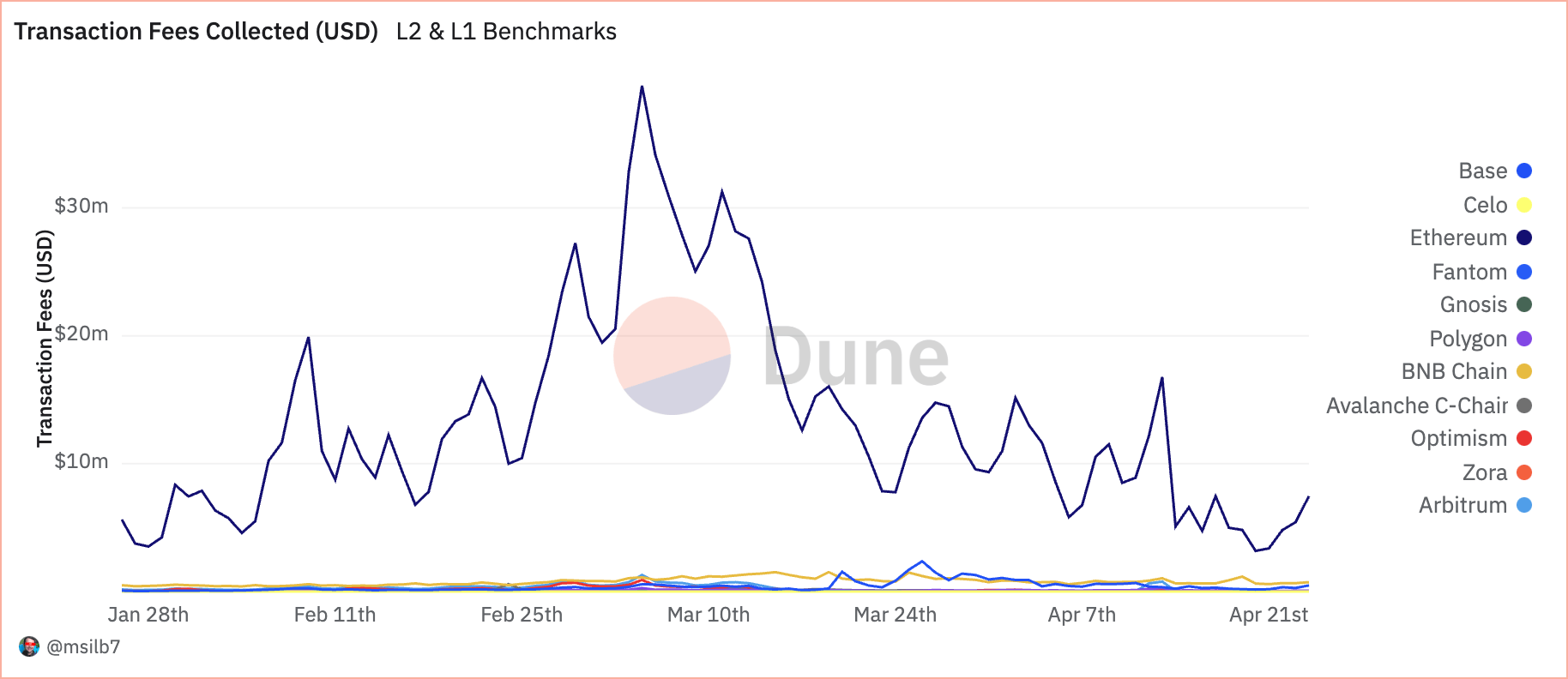

However, looking at transaction fees tells a different story. Despite the lower number of transactions, Ethereum accumulated $7.46 million in fees, accounting for 83.9% of total fees. This discrepancy means that Ethereum processes fewer transactions, but its higher transaction costs reflect its underlying layer state and the intensive computational resources required to operate it.

When it comes to DeFi apps, Polygon again leads the number of transactions with 3.3 million app transactions, showing it to be the best platform for DeFi activity.

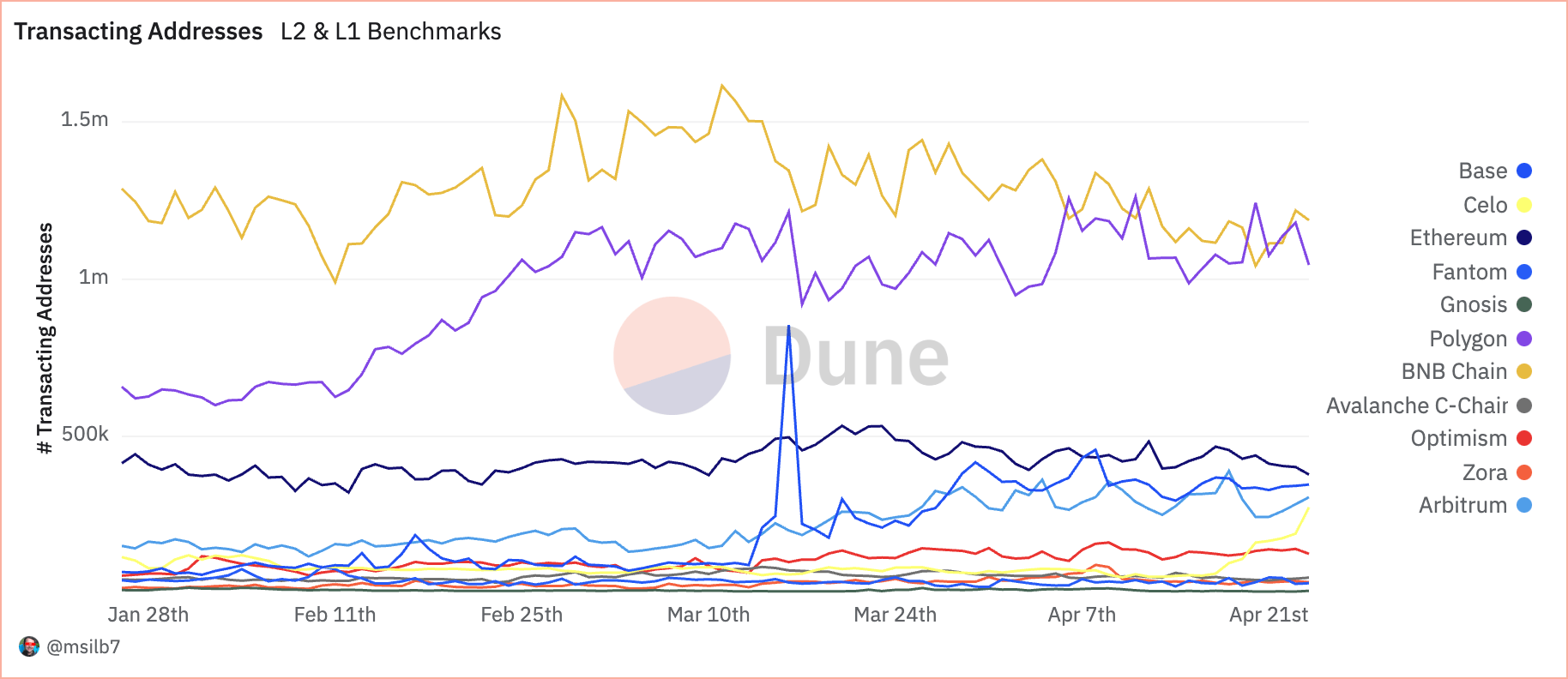

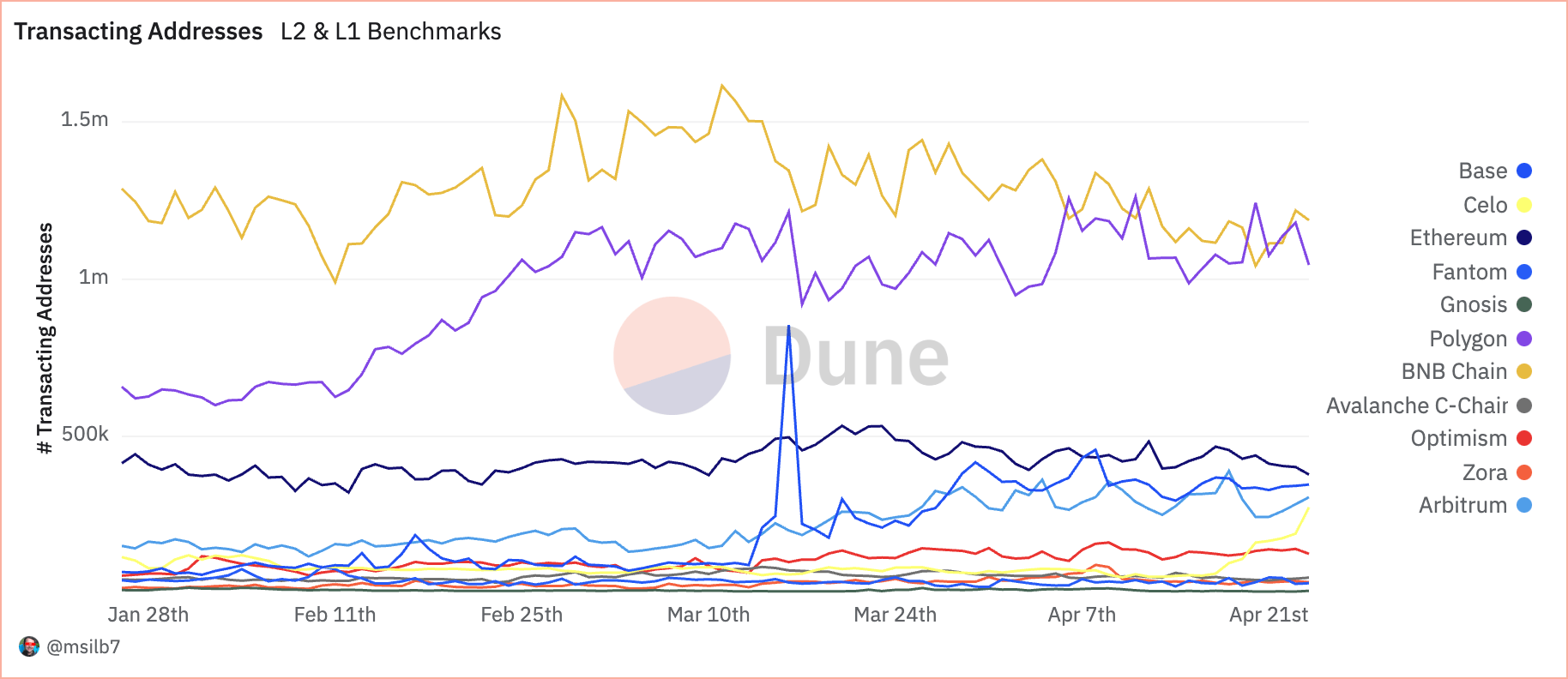

The BNB chain had 1.22 million transaction addresses, with polygons slightly behind at 1.18 million. These numbers, in contrast to Ethereum’s 402.77k, suggest that other EVM-compatible networks are becoming preferred platforms for regular DeFi users due to their cheaper structures.

Analyzing the performance of these blockchains side by side shows the battle between native security and improved scalability. While L1 blockchains like Ethereum continue to secure high-value transactions with significant fees, scaling solutions like Polygon capture the majority of daily transactions and application interactions, leading to a more efficient and user-friendly blockchain infrastructure in DeFi. It means transition.

It is important to note that despite being classified by many as a Layer-2 blockchain, Polygon operates as an L2 sidechain for Ethereum as it relies on its own set of validators and does not rely on Ethereum for security. This allows Polygon to support more experimental activity than a “true” L2 blockchain without impacting Ethereum. Another thing worth mentioning is that although the BNB chain is an EVM-compatible layer 1 blockchain, it has positioned itself in the market as a competitor to other L2s rather than a competitor to Ethereum, another L1.