- The potential increase could preserve holders’ gains of more than 17.34%.

- A decrease in MVRV Z-score would nullify the bias and allow MATIC to fall to $0.61.

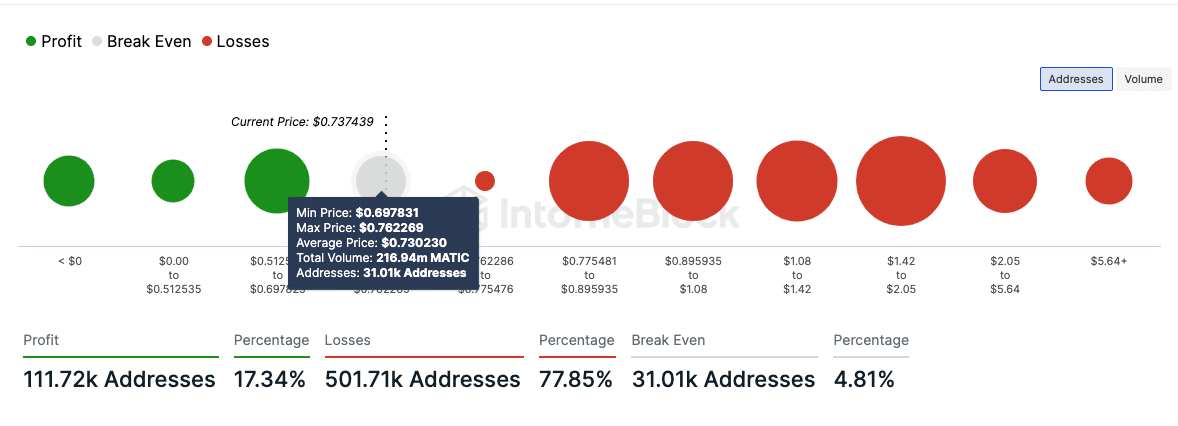

According to IntoTheBlock, Polygon (MATIC) was at the point where 216.94 million tokens were purchased from 31,000 addresses at an average price of $0.73.

This was breakeven for these holders, but could be critical for MATIC. At press time, 111,724 addresses were profitable, representing 17.34% of total supply.

On the other hand, 501,710 addresses were short of money, a whopping 77.85%. Depending on where the Polygon native token moves, the $0.73 area could be either support or resistance.

This group holds the key

Above $0.73, MATIC could rise to $0.76, where it would accumulate 36.69 million tokens. In this case, the cryptocurrency price may begin to break through to $0.83.

However, a breakdown could send it plummeting to $0.61, which is when most profit holders entered. At press time, the price of MATIC is down 4.37% in the last 24 hours.

Source: IntoTheBlock

If the token maintains this momentum, MATIC’s next move could be an increase between $0.83 and $0.89.

Apart from the participants, Ethereum (ETH) is one altcoin that can influence the next direction of the token.

According to our research, the correlation between Polygon and ETH was 0.93. For Bitcoin (BTC) it was 0.87. Correlation readings range from -1 to +1.

If the reading is close to -1, it means there is a price difference. On the other hand, a number close to 1 means that the value of the cryptocurrency moves in roughly the same direction.

So if ETH avoids falling below $3,000. MATIC could rise to $0.83. However, if the price of the second most valuable cryptocurrency declines, the price of MATIC may begin another correction towards $0.61.

This time, success or failure depends on it.

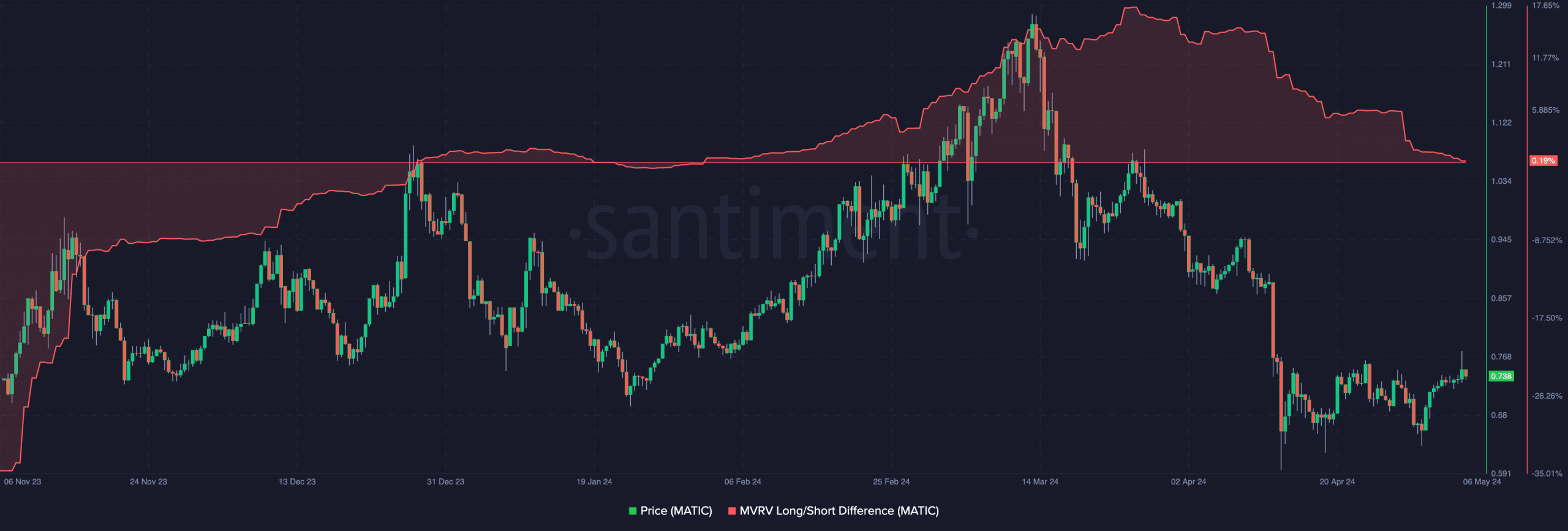

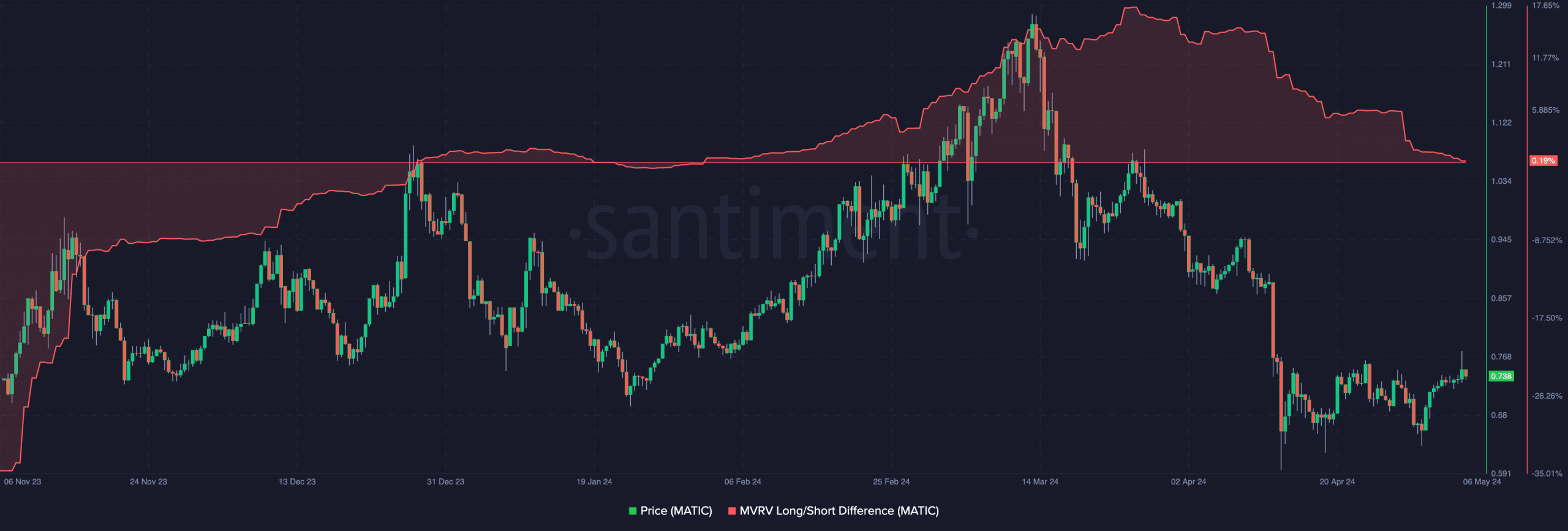

On the correction side, Santiment’s on-chain data shows that another decline in the token could lead to it entering a bearish phase.

AMBCrypto arrived at this inference after checking the Market Value to Realized Value (MVRV) Z-score.

If the MVRV Z-score is below 0, it means the token is weak and may struggle to rise in price.

However, a rising indicator in the positive area indicates that prices tend to rise. At press time, Polygon’s MVRV Z score was 0.19.

Source: Santiment

A further drop in the numbers could invalidate the bullish forecast mentioned above. Conversely, a rapid rise in the indicator could prevent MATIC from falling into another difficult phase.

Realistic or not, the market cap of MATIC in ETH terms is:

Therefore, traders may need to be wary of the consequences before taking a position. At the same time, reading the indicators may indicate that the token is undervalued.

If millions of addresses start accumulating MATIC at $0.73, it may be impossible to get caught in a bearish cycle.