- The price of MATIC has fallen more than 2% in the last 24 hours.

- Selling pressure was low, but other indicators looked bearish.

After a comfortable rise last week, Polygon (MATIC) The daily chart has turned bearish. But investors don’t need to worry just yet. This is because MATIC was breaking out of a bullish pattern on the price chart at the time of going to press.

Therefore, AMBCrypto checked out MATIC’s metrics to see if the token could reach its 2023 highs in the coming weeks.

Polygons emerge from the bull pattern.

Investors profited last week as Polygon’s value surged more than 4%. But in the last 24 hours, the scenario has changed. Because the price fell by 2%. CoinMarketCap.

At press time, it was trading at $0.9802, with a market capitalization of over $9.4 billion.

Meanwhile, World of Charts, a popular X (formerly Twitter), recently posted the following. Twitter It highlights the fact that MATIC is breaking out of a bullish triangle pattern.

Source: X

AMBCrypto then checked MATIC’s liquidation heatmap to identify areas of resistance that Polygon could face in the near term.

It seemed likely that MATIC would face strong resistance near $1.11. This is because liquidations can increase rapidly at that level. Increased liquidations can put selling pressure and ultimately push prices down.

Source: Hiblock Capital

Are rallies inevitable?

To better understand whether investors should expect a bullish rally from MATIC, AMBCrypto analyzed its indicators. According to CryptoQuant dataMATIC’s exchange reserves were declining at press time.

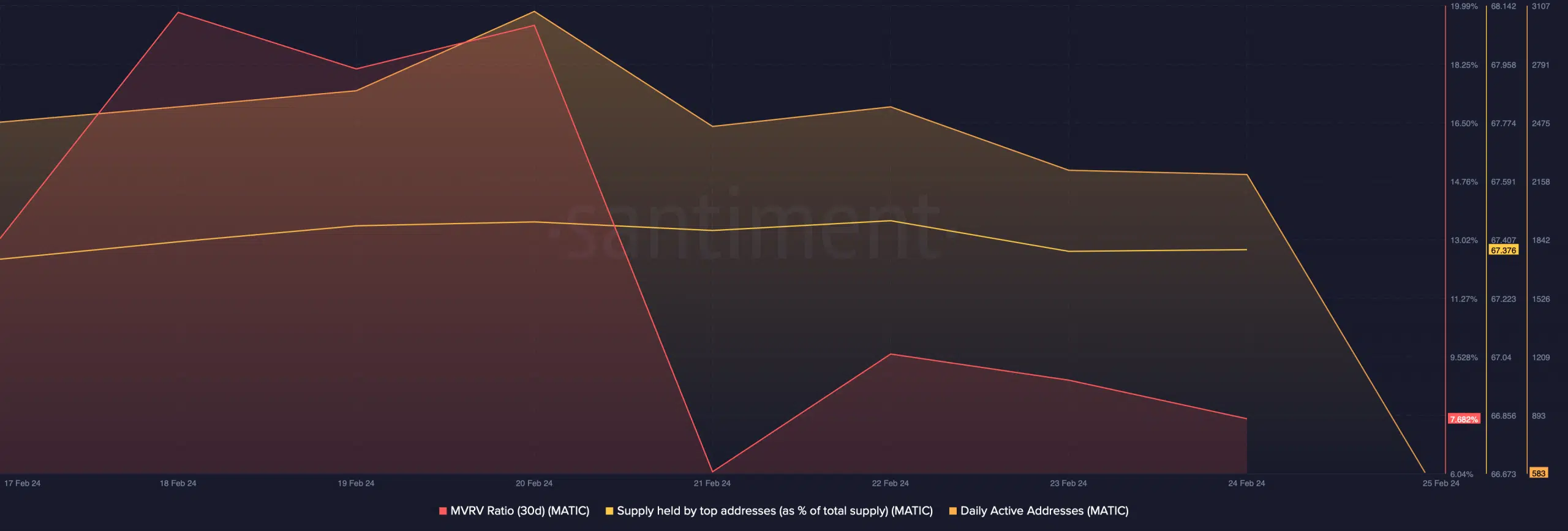

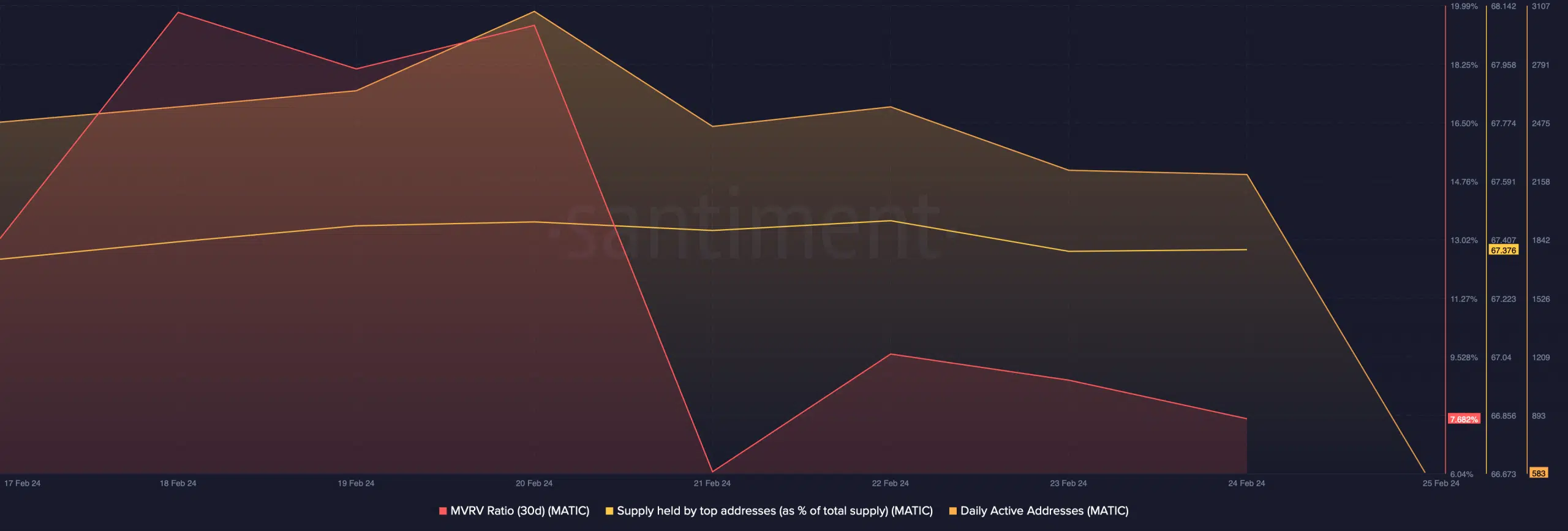

This was a classic bullish signal indicating low selling pressure. However, the remaining metrics appeared to be concerning.

For example, the token’s MVRV ratio fell last week. The supply held by the top address also remained unchanged. This means the whales are not accumulating MATIC.

MATIC’s network activity has also decreased slightly over the past week, as evidenced by a slight decrease in daily active addresses.

Source: Santiment

Technical indicator MACD indicated a possible bearish crossover. Polygon’s price also fell slightly as it reached the upper limit of the Bollinger Band.

Is your portfolio green? Please confirm MATIC Profit Calculator

Nevertheless, the Money Flow Index (MFI) remained well above the neutral line.

MATIC’s price is still above its 20-day simple moving average (SMA) at the time of this writing, which acts as key support and could help MATIC rebound.

Source: TradingView