- POPCAT has been violated through the recent downstream channel and can increase the main price.

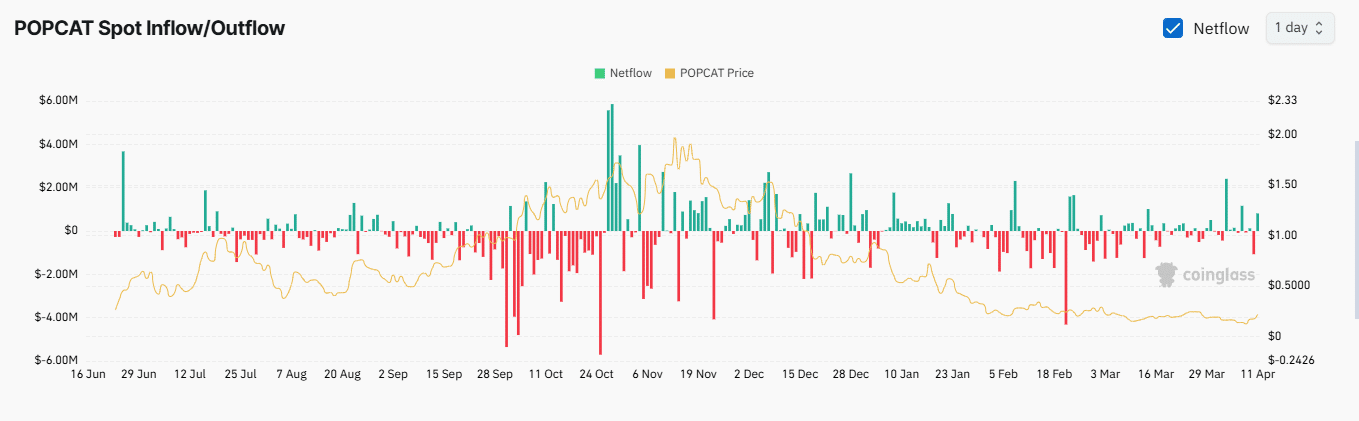

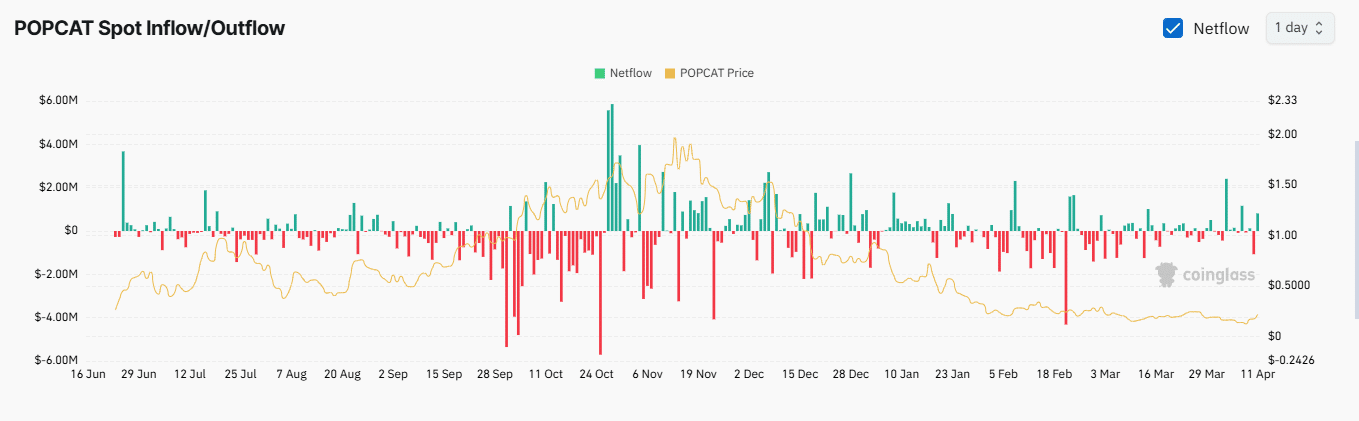

- Despite the sponsorship of Whales of BYBIT, BINANCE and Hyperliquid, the market’s spot trader will play an important role.

POPCAT has increased 37% over the last two weeks in addition to the strength of the last two weeks. Similarly, Altcoin now returns 41% of investors who purchased their assets last month.

Emotions are especially strong, especially with whales’ interests and optimistic technology settings, but AMBCRYPTO has found some factors that can interfere with the potential rally of assets.

Breakout with optimistic on the edge

POPCAT has formed a descent price channel and announced the price rally settings available on the chart. This pattern is formed by parallel support and resistance line.

Similarly, if the momentum that promotes the movement of the popcat persists and the asset can violate the resistance level, the price can reach $ 0.9822. This represents a 370%price boom.

Source: TradingView

In order for a 3.7x rally, the price, not a single rise, is likely to return along the road. However, if the overall strong market sentiment is true, Popcat can eventually make a high deal of $ 2.08 in violation of this level.

Whales are after rally

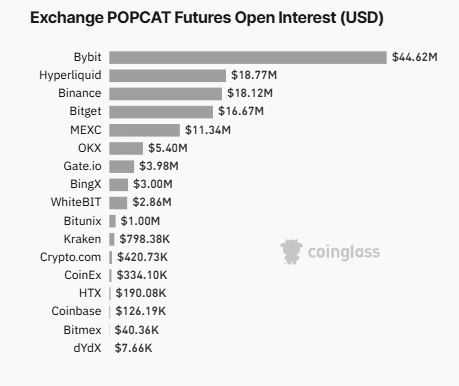

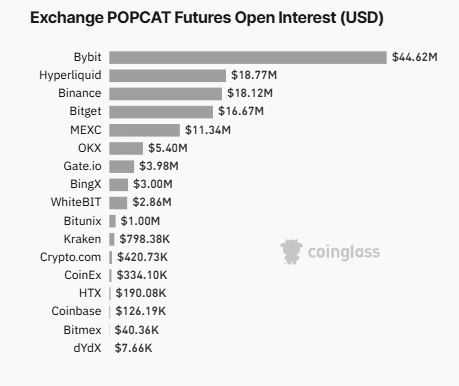

The analysis of CoingLass’s long proportions and the public interest in the market revealed that whales are promoting the main price rally.

First of all, the wider market sentiment is still optimistic and the market purchase volume exceeds the sales volume of the seller. This has been proven at a long -term ratio with a read value of 1.0513.

If this ratio crosses 1, it means optimistic market stage. On the contrary, less than 1 bears or sellers are dominant and there are more disadvantages in the future.

Further analysis shows that most of the purchase contracts in the derivatives market were led by whales or top traders with major positions with major positions in assets.

Source: COINGLASS

At the time of writing, BYBIT, Binance and Hyperliquid Whales dominated unstable contracts in the market. The merchant’s Cohort has a group position of $ 87 million out of $ 128.9 million as a public interest on the market.

Since the general market is optimistic, the purchase volume is especially dominant, but this whale means that the short contract is short.

In fact, the traders who bet on this whale saw their major market losses as their position was strongly closed. In the last 24 hours, short traders have lost $ 12.4 million as prices have shifted. This type of major market liquidation emphasized the power of the bull.

Profit creation can slow the rally speed

However, it is worth pointing out that strong feelings are not consistent with market spot traders. Press time had a significant sales activity among the spot traders. It has reached about $ 850,000 according to Exchange Netflows.

Source: COINGLASS

If the main assets are sold in the midst of strong market setting, long -term traders are likely to benefit. Especially when they move popcat to the exchange to sell them in their personal wallets.

If this trend continues between long -term spot traders, the chart can interfere with potential violations of the parent resistance of the popcat on the chart. This will slow down the prospect of strength as expected.