- Amid ongoing legal challenges with the SEC, XRP could reach $20 by 2026.

- Our analysis shows that there has been continued downward price pressure and interest in this has increased.

Leading cryptocurrency Ripple (XRP) is facing significant challenges due to ongoing litigation with the US Securities and Exchange Commission (SEC).

To date, the asset has experienced a steep decline of 84.7% from its all-time high of $3.40 in 2018 and has yet to regain a fraction of its peak value.

This sustained price decline has continued. Over the past 30 days, the value of XRP has fallen nearly 20%.

Although there were some gains last week, the cryptocurrency is starting to lose these gains and is currently showing a 2.3% decline in the last 24 hours.

However, despite the bearish pressure, analysts predicted The future of XRP is bright.

The Bullish Case for XRP

Prominent cryptocurrency analyst Armando Pantoja remains optimistic about XRP’s potential and estimates that its value will reach $8-$20 by 2026.

This projection represents a dramatic increase of up to 3,557.6% from current levels.

Pantoja cites the 2017 bull market, in which XRP surged more than 650x to its peak, as a reason why such a surge could be possible, citing it as a “powerhouse of historical precedent” for such growth.

Institutional adoption is a strong driver of XRP’s future price. So far, Ripple, the company behind XRP, has seen significant integration with major financial institutions such as Bank of America and Royal Bank of Canada.

Ripple also recently partnered with HashKey DX to bring its XRP Ledger-based solution to Japan. collaboration SBI Ripple Asia can help boost the price of XRP.

Despite this adoption, moves are still underway to accelerate further adoption.

For example, RippleX, the development arm of Ripple, introduction Significant upgrades to XRP Ledger (XRPL) such as the XLS-68d specification.

These improvements allow the platform to cover someone else’s trading fees without having to distribute free XRP, simplifying the onboarding process.

These developments are essential to broadening the appeal and utility of XRP in the digital economy.

In addition to institutional adoption, Pantoja highlights the impact of market trends and the increasing availability of financial services.

He predicted that XRP would soon achieve legal clarity and the partnership would expand significantly.

Regarding legal developments with Ripple and the U.S. Securities and Exchange Commission (SEC), tensions rose last March when the SEC imposed a hefty $2 billion fine on Ripple for alleged violations related to institutional sales of XRP.

Ripple refuted these claims last week, with Chief Legal Officer Stuart Alderoty releasing the company’s detailed rebuttal.

Ripple’s defense disputes the SEC’s claims and proposes a much lower fine, ideally less than $10 million.

report It is said that the US SEC has submitted a final response to the objection. However, the documents are sealed and not yet accessible to the public.

As the lawsuit approaches its final stages, the cryptocurrency community is closely watching the outcome and whether XRP could potentially surge into double digits beyond its previous highs.

Possible short-term movement of XRP

Meanwhile, technical analysis suggests that XRP may continue to face downward pressure in the near term.

The asset has been consistently breaking structure on the daily and 4-hour charts, gaining liquidity recently and currently targeting swing lows near $0.48.

Source: TradingView

This bearish near-term outlook is reinforced by AMBCrypto’s recent report. XRP’s Chaikin Money Flow was 0.This indicates that capital inflows into the market are not significant.

Realistic or not, the XRP market cap in terms of BTC is:

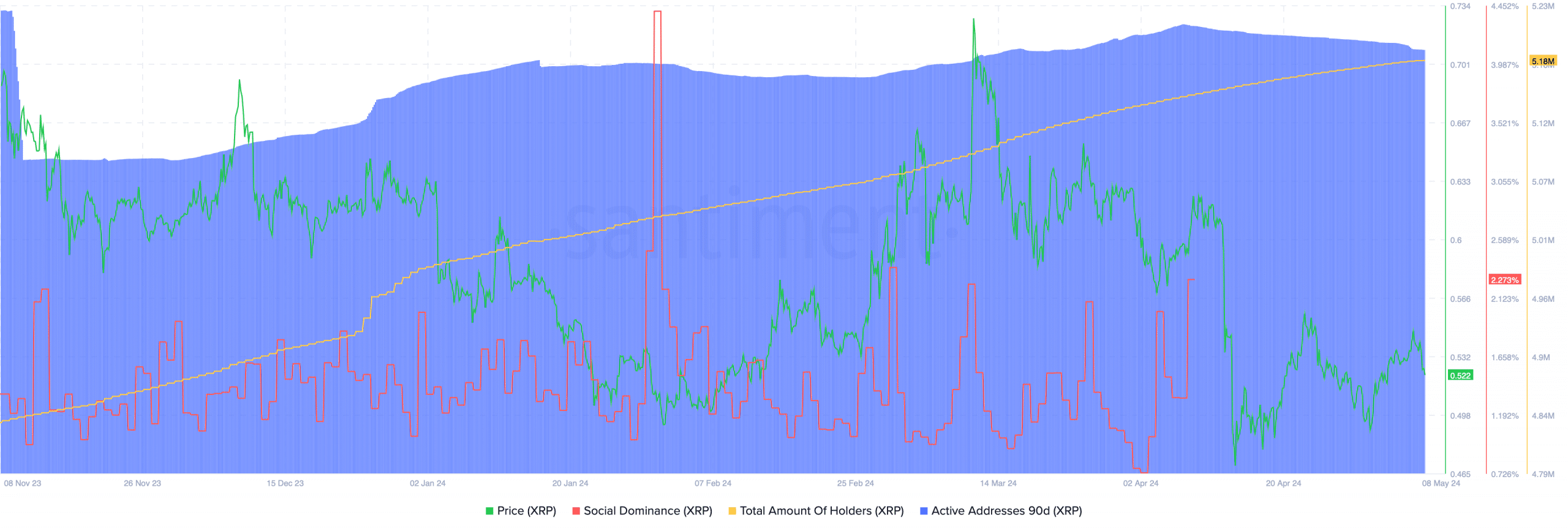

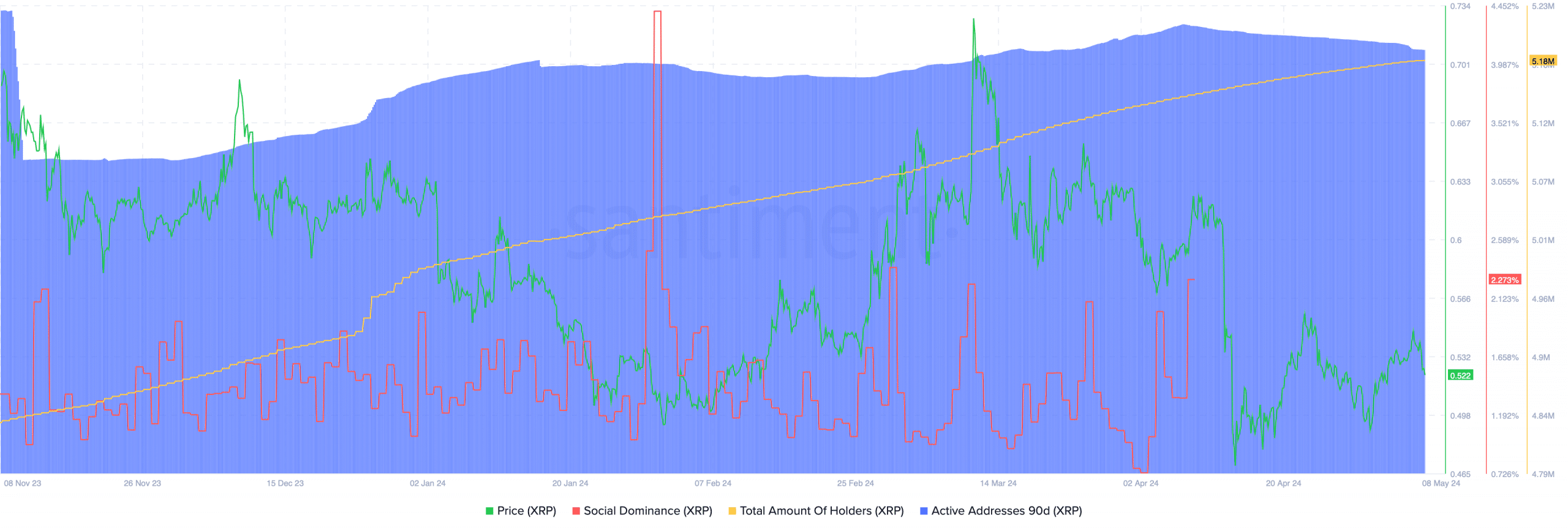

But despite these bearish indicators, data Santiment’s data shows an increase in indicators such as XRP’s social dominance, total holders, and active addresses.

This suggests that many in the community are optimistic and confident about the future of the asset.

Source: Santiment