Main highlights:

- Pudgy Penguins has decreased 19.6% over the last seven days. This blurred about 175 underwater loans.

- Canary Capital Pengu ETF includes both Pudgy Penguins and Pengu Tokens.

- This crisis can complicate the approval of the ETF by raising concerns about NFT volatility and evaluation.

Pudgy Penguin, a well -known NFT collection, is facing a dramatic recession as the floor price of NFT decreases 19.6% over the last seven days according to Coingecko. The movement caused intense volatility and forced liquidation in the blurry loan market. Influential people and market analysts have been observed that they are warning the default of the terraced, which can lead to significant uncertainty.

Forced liquidation hit Pudgy Penguins

The current situation is dangerous because the 175 Pudgy Penguin loan is in hand and a blurry auction. This provides a clear sign that the borrower cannot repay the loan, and the loan agency has decided to sell the collateral NFT in the public market.

There is also another 50 loan, 90%of LTV (Loan-to-Value). This is in a dangerous position of these 50 loans, and it is cleared when the price of assets is slightly dealt with.

If the buyer does not purchase such an NFT during liquidation and rescues the market, the lender can catch it without returning the money. In the past, there were investors that prevented prices from falling further by purchasing more amounts by purchasing a large amount of NFT. This observation was done by the X of NFT expert Golden Bronny.

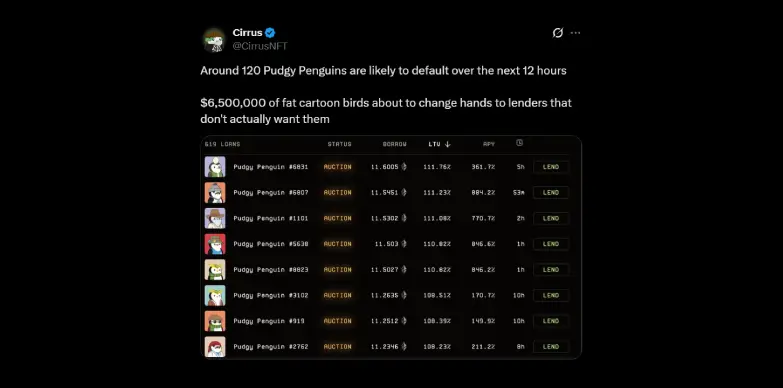

Another NFT expert, CIRUS NFT, emphasized the degree of risk. In his post on X, he stressed that about 120 magnificent penguins are ready to be defeated within the next 12 hours. This indicates that nearly $ 6.5 million NFT value can soon be moved from the borrowers to the loan institution.

Bayc’s other trajectory

On the other hand, BayC (BORED APT YATCH CLUB) seems to have much better than another best blue chip NFT collection, Pudgy Penguins, and Bayc has only 358 loans and 358 close to LTV. This is lower than Pudgy Penguins, depending on Golden Bronny.

The price of BAYC has been elastic over this few years, and the price is slightly popular as a cautious buyer to stabilize the market. If you have continuous purchasing activities, you can maintain the situation included with the BayC holder and make the modification less serious.

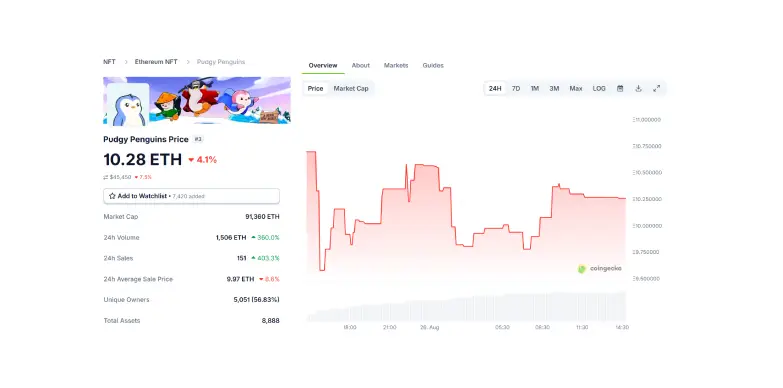

The forced liquidation of the blur will pressure the Pudgy Penguins NFT floor price. The current floor price of NFT is 10.28 ETH ($ 45,450), down 4.1% over the last 24 hours and decreased 19.6% over the last seven days according to Coingecko.

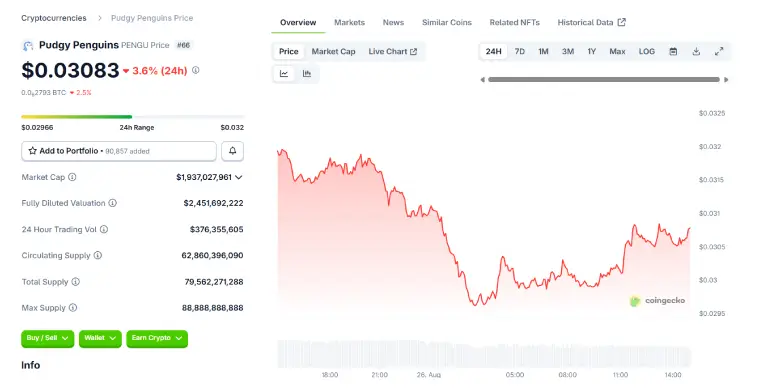

This liquidation can also negatively affect investor trust in penguin tokens and can cause short -term prices. The current price of Pengu Token is $ 0.03083 and has decreased 3.6% over the last 24 hours.

Does this affect the Canary Capital Pengu ETF?

The Canary Capital Pengu ETF is not yet approved and is reviewed in accordance with the Securities and Exchange Commission (Securities and Exchange Commission). This decision has been delayed until October 12, 2025, which is part of the extensive attention of the institutions on cryptocurrency and NFT -related ETFs when evaluating and evaluating regulations, parenting and evaluation issues.

This challenge (PUDGY PENGUIN NFT liquidation) can have a negative impact on the approval of ETFs. Forced liquidation emphasizes the risk of market volatility and NFT evaluation. Such scenarios can slow the regulatory permits by raising concerns about the stability of the ETF structure, investor protection and liquidity, making the SEC more careful. But well -managed interventions or stabilization in the NFT and token markets can improve the entire scenario.

Also read: OKB exceeds $ 200 in increasing momentum.