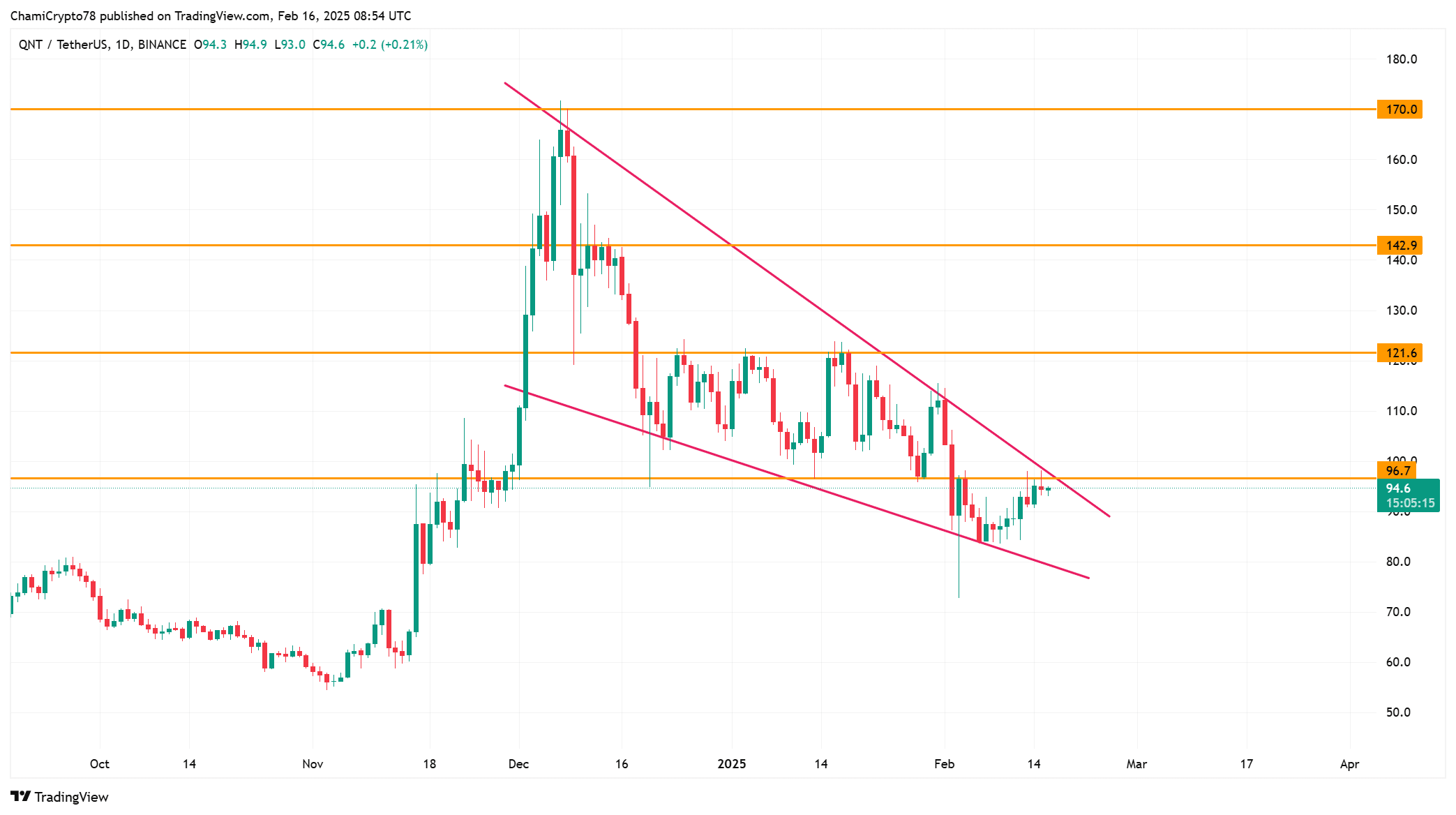

- QNT is testing a $ 96.80 resistance, and the brake out can cause a rally for $ 121.60.

- Exchange reserving is a signal potential sales pressure, but more than $ 98 liquidation can cause rapid movements.

Quant (QNT) The core resistance is tested for $ 96.80, and the brake out can trigger a powerful rally. In the press time, QNT has fallen 1.28% to $ 94.68 over the last 24 hours.

The bull must find this level to confirm the trend movement. But if you do not break through, you can decrease. Will QNT push more high or face other rejections?

Price at the turning point

QNT is moving with optimistic wedges and strong reversal patterns. The resistance of $ 96.80 is a key level of repeated rejection of prices.

When the bull is pushed over it, the amount of exercise can be built, which can lead to $ 121.60. Additional brake outs can expand their profits to $ 142.90 or $ 170.00.

But if you do not stop the stomach, it can cause a full back to $ 85.00 with strong support. In addition, the movement of Bitcoin affects the direction of QNT.

The buyer must maintain pressure to prevent other stagnation. If the volume is almost close to resistance, QNT will soon be able to see the escape.

Source: TradingView

What does the metrics reveal?

The warm chain data has a mixed signal. Pure network growth increased only 0.29%, reflecting adoption weakness. Without a new user, the strength of the strength can be weakened.

However, 1.11%of the holders maintained profits and suggested some positive emotions.

In addition, the level of concentration has not changed, which means that whales have not accumulated or sold significantly. Meanwhile, large -scale transactions decreased by 3.61%, reducing institutional participation.

If whales actively enter the market, QNT can get the propulsion for evacuation.

Source: INTOTHEBLOCK

Increased supply or accumulation of hidden?

Exchange reserve increases only 0.02%, indicating potential increase in sales pressure.

As the reserves go up, more coins can be used for transactions and volatility increases. If this trend continues, the Quant can struggle to maintain the level of support.

However, if the reserves decrease, the accumulation is indicated and the sales pressure is reduced. Market participants should also watch the reserve change closely.

The reduction of reserves will be confirmed that investors have rather than sales. This can strengthen the outlook of the strong.

Source: cryptoquant

Does forced liquidation cause volatility?

The binance liquidation thermap map showed a significant liquidation cluster between $ 96 and $ 98. If you go to this area, forced liquidation can cause rapid price movement.

As a short seller is liquidated, brake out of $ 98 can be pushed to $ 100 for QNT.

But if a rejection occurs, Quant can return to $ 90, with strong liquidity support. In addition, traders should expect volatility near these levels.

Large liquidation clusters often cause sudden prices. If the bull maintains the amount of exercise, the QNT can check the failure.

Source: COINGLASS

Quant is at an important point and breaks $ 96.80 to determine the next movement. Successful brake outs can be priced at $ 121.60. However, if rejection occurs, QNT can drop to $ 85- $ 90.

The bulls should be pushed by the strong volume of resistance to confirm the strong trend.