- Raydium emerged as the top Solana DEX with a strong lead in network fees and revenue.

- RAY hits a new ATH as market excitement returns to the charts.

Solana’s ecosystem is exciting once again, and Raydium remains the most popular means of access. This means that it is maintaining the same trend observed last year when Raydium was the king of Solana DEX.

Raydium has maintained a strong lead as the most dominant DEX in the Solana ecosystem over the past 12 months. This phenomenon was especially evident when looking at the fees incurred during the aforementioned period. In fact, Solana earned about 80% of the DEX fees generated.

Source: DeFiLlama

According to DeFiLlama, Raydium generated $751.16 million in fees over the past 12 months. Annual sales were $53 million. For context, Orca came in second with the second-highest fees, with $43.1 million in fees over the past 12 months.

This strong lead confirms that Raydium has been the most popular of all Solana DEXs over the past year. DEXs are still recording impressive levels of network activity, especially thanks to the market’s latest performance.

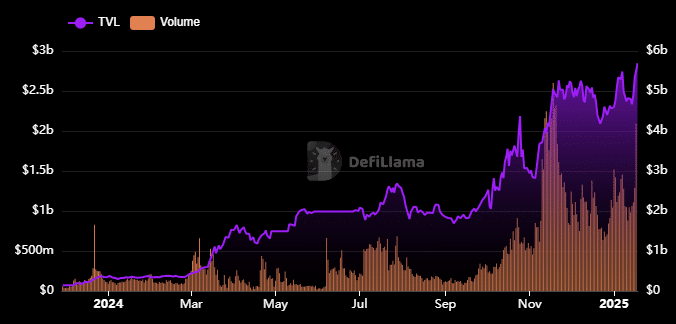

Source: DeFiLlama

Raydium’s total locked value has increased significantly over the past 12 months, from a low of $164.16 million in early 2024. In fact, in the last 24 hours, new ATH hit $2.84 billion.

Raydium DEX volume surges with RAY demand

Raydium’s TVL growth has also been accompanied by impressive daily trading volumes since September last year. Speaking of trading volume, the DEX just surged to $4.18 billion in trading volume, its highest level in seven weeks. In fact, daily trading volume has increased by more than 248% in the last 24 hours.

The surge in trading volume is mainly related to the increased demand for the newly launched TRUMP memecoin. This also generated significant interest in the RAY token. The latter has been rebounding since January 13 and has soared to a new ATH of $6.88.

Source: TradingView

RAY is not yet overbought at press time, indicating potentially more time for price discovery.

Based on recent market activity, it seemed clear that RAY’s performance could largely depend on Solana network activity. This means that the token could continue to see more demand if the network maintains strong activity in the coming months.

RAY’s market capitalization was $1.96 billion at the time of reporting, and its token circulation was relatively small at 290.88 million. Recent organic demand is likely to lead to more speculative inflows in the coming months, highlighting potential upside.