On-chain data shows that Litecoin faces a potentially massive amount of resistance, making a recovery in LTC price even more difficult.

Litecoin has a massive supply wall waiting at the level just in front of it.

As X user Trader Kamikaze pointed out using data from market intelligence platform IntoTheBlock, many LTC investors have been buying at upcoming levels.

Related Reading

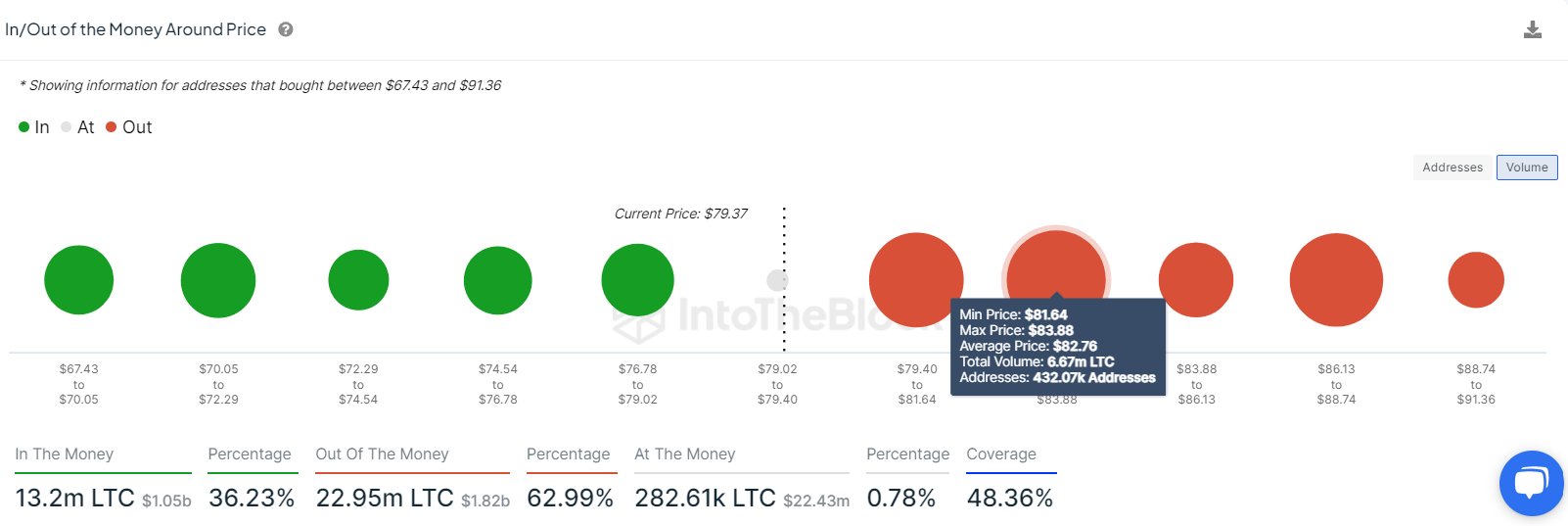

Below is an IntoTheBlock chart showing the distribution of LTC addresses based on the last price the coin was purchased on the network.

Here, the size of the dot is related to the amount of cryptocurrency acquired at that price point. As you can clearly see, there is a large dot connected in the $81.64 to $83.88 range, which means a large number of tokens were purchased while the asset was trading.

More specifically, 432,070 addresses purchased approximately 6.67 million LTC within this range. This amount is worth more than $534 million at current exchange rates.

Now, what relevance could this have to Litecoin? In on-chain analysis, the strength of any level, such as support or resistance, is determined by the number of coins won at that level. Therefore, a thick LTC range with investors could potentially impact the cryptocurrency in the event of a retest.

The reason for this theory is that the cost base is at a critical level for all holders, so they are more likely to see some reaction when a retest occurs. The greater the number of investors sharing a cost basis within a narrow range, the stronger this reaction will be.

What kind of reaction a retest will cause will depend on whether it occurs from above or below. Investors who take a loss just before a retest (i.e. what happens below) may be inclined to sell for fear that the price will soon fall again. Exiting at break-even means you can at least avoid realizing a loss.

Related Reading

On the other hand, green holders ahead of the retest may decide to gamble further, believing that the price will rise again.

Therefore, a level below the current price can be a support point, and a level above the resistance can be a support point. Litecoin has a notable supply wall just ahead of current levels, so a retest of this would likely result in a sell-off reaction.

Now it remains to be seen whether this thick range will hinder LTC’s recovery if it rises to test the cryptocurrency again.

LTC price

Litecoin is currently trading at a price of around $80, so it sits just below the above-the-wall supply.

Dall-E, featured image from IntoTheBlock.com, chart from TradingView.com