- Render transactions exceeding $100,000 jumped from 164,000 to 852,000 in two days.

- This rise coincides with a resumption of buying activity as shown by CMF.

Render (RNDR)At press time, it was trading at $8.73 after rising 3% in 24 hours. Following these gains, Render rose 29% in a week, making it the best performer among AI and big data coins. CoinMarketCap.

These gains seem to have attracted the attention of large addresses. According to IntoTheBlock, large transactions exceeding $100,000 surged more than 400% from 164,000 RNDR to 852,000 RNDR in two days.

Source: IntoTheBlock

Whales account for 76% of Render’s total supply. Therefore, when these large addresses become active, it is bound to have an impact on price volatility.

As shown on the 1-day chart, the surge in large addresses coincided with bullish momentum in RNDR.

Render’s purchasing activity will resume

Chaikin Money Flow (CMF) on Render’s daily chart shows a surge in buying pressure after moving into positive territory. The surge marked the highest level of purchasing activity in nearly three weeks.

Render’s near-term momentum also turned bullish after the altcoin flipped resistance at its 50-day simple moving average (SMA) at $8.22.

If this upward trend continues, RNDR could target the 2.618 Fibonacci level at $13.77.

Source: TradingView

Traders should also watch for support at the 150-day SMA ($6.31). This is because a drop below could nullify the bullish momentum.

As long as the render continues to trade above its short-term and long-term moving averages, momentum will remain positive.

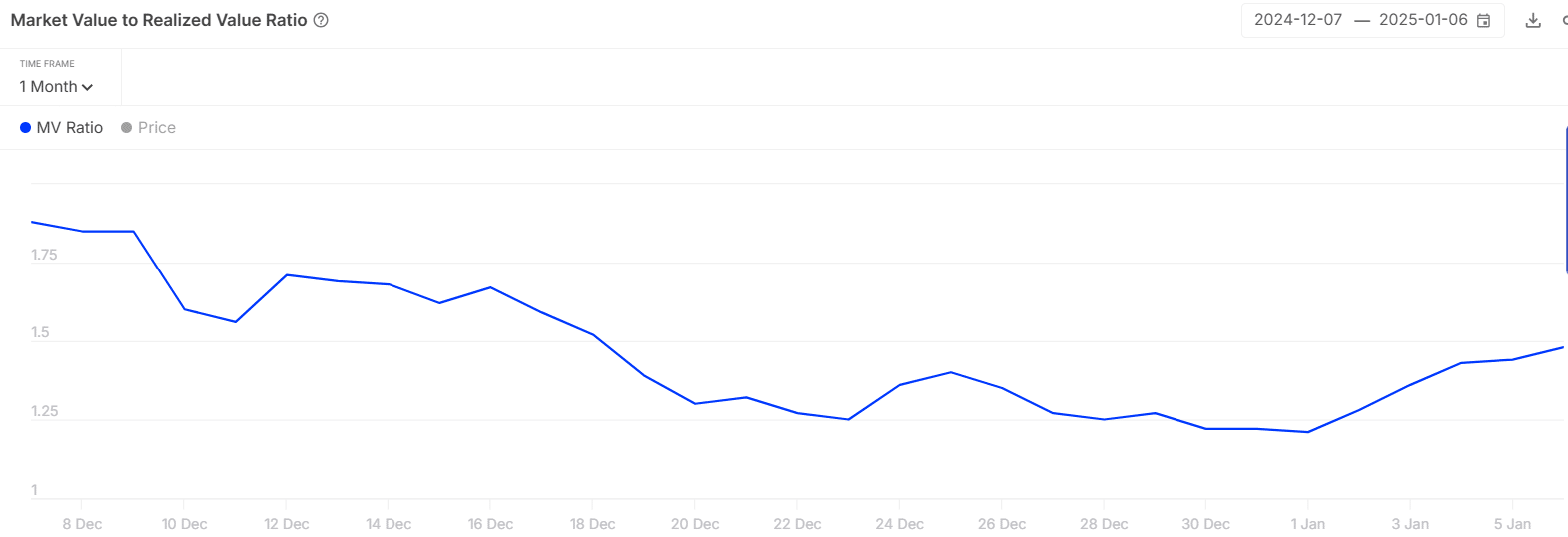

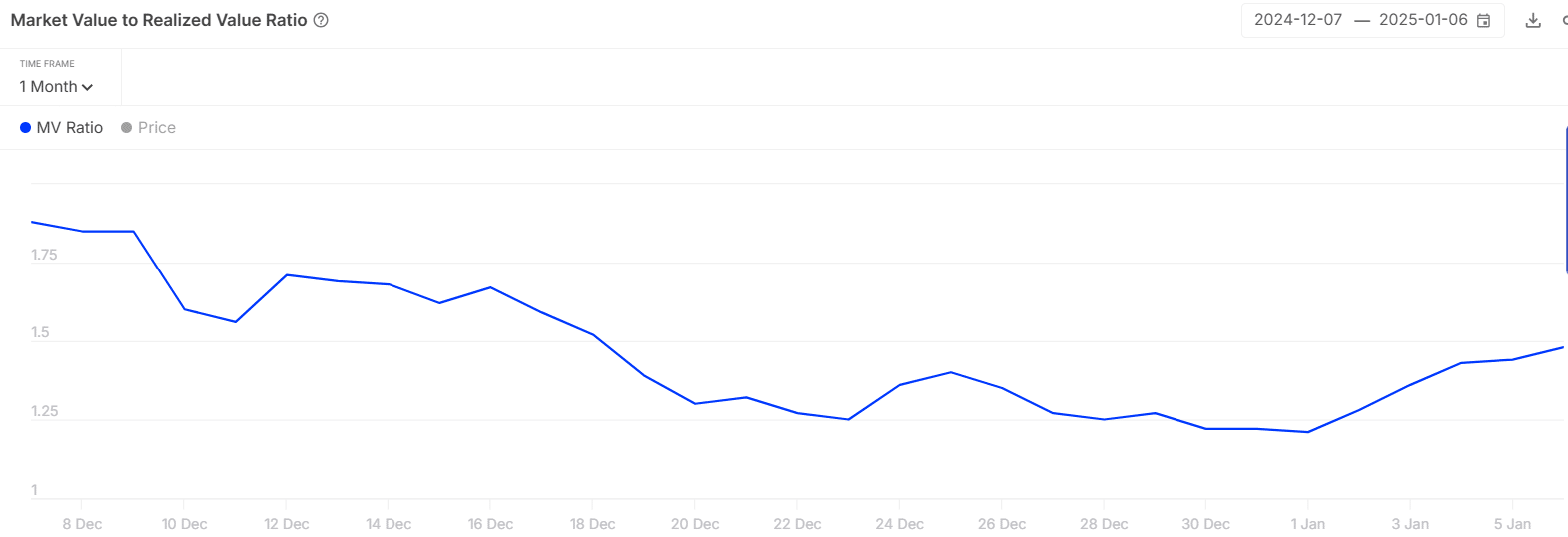

Rising MVRV suggests…

Render’s Market Realized Value (MVRV) ratio has surged to its highest level in three weeks. This rise shows increasing profitability for holders, which creates bullish momentum.

Despite the rise, MVRV is still below its monthly high, indicating that the render is not yet overvalued. So, despite a 29% increase in one week, RNDR still has room to grow.

Source: IntoTheBlock

The MVRV ratio of 1.48 suggests that RNDR is in the early stages of a bull market cycle, further confirming its continued upward trend.

Realistic or not, RNDR’s market cap in BTC terms is:

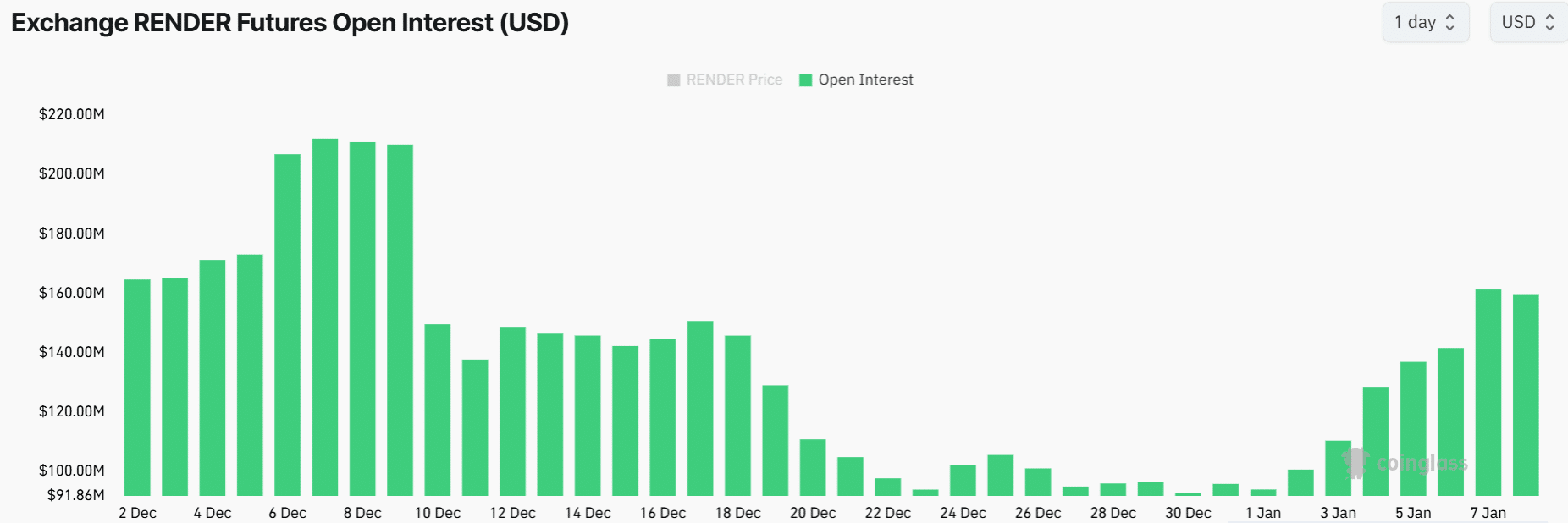

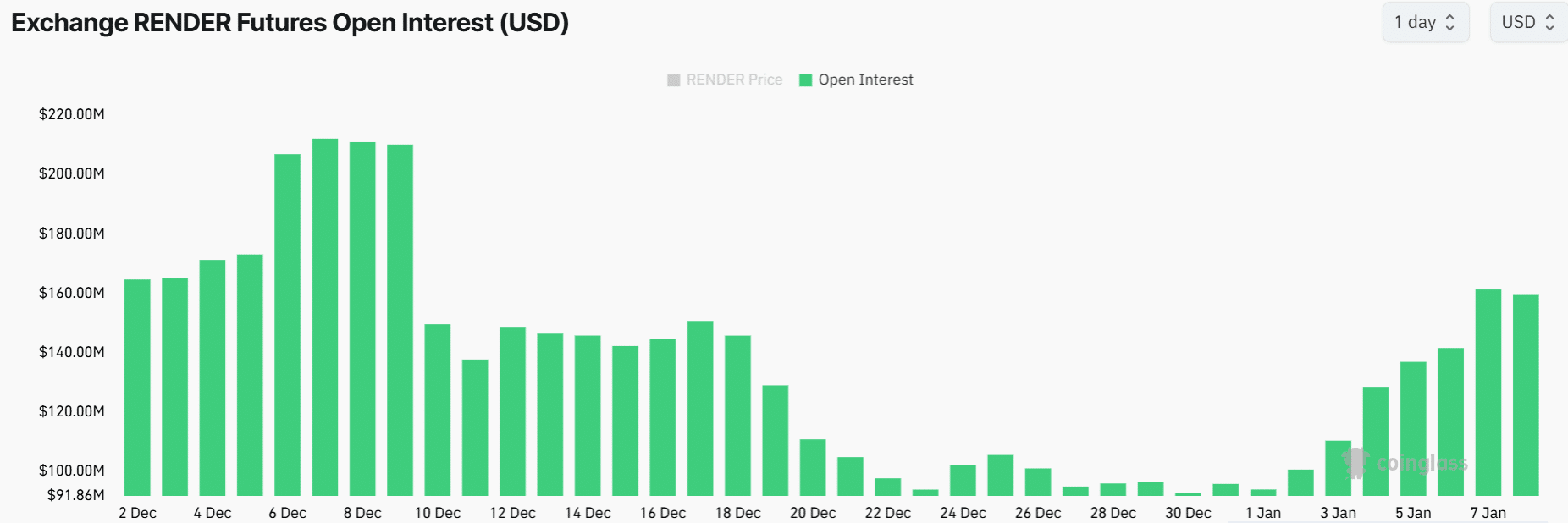

Render’s open interest surges

Render’s open interest has increased significantly in recent weeks. At press time, OI was at $161 million, the highest in almost a month.

Source: Coinglass

This increase in OI along with the price increase shows bullish momentum and high confidence among traders. It also shows that traders are opening new positions in RNDR, which could lead to further price fluctuations.