- According to the entire chain indicators, the exchange has witnessed the leak of $ 750 million.

- If the XRP does not maintain $ 2.88, it can be reduced by 10% to reach $ 2.55.

In the current weak market sentiment, Ripple Labs has recently attracted attention from encryption enthusiasts with escrow locks.

Ripple fixes 700 million XRP to escrow.

On February 2, Ripple Labs was posted on X (previous Twitter) that Ripple Labs moved 700 million XRP tokens to ESCROW.

This means that these tokens are temporarily locked and cannot be used for transactions or other activities.

This transaction of Ripple Labs occurs when the overall cryptocurrency market experiences a drop in price.

In the weak market sentiment, it seems that movements have been made to prevent the major drop in XRP prices.

Lock and price change with escrow

Moving XRP to ESCROW has a unique advantage. Historically, when Ripple Labs locks the token from escrow, the price seems to experience some slogans and to gain momentum in the weak market.

On the contrary, when Ripple unlocks the token from escrow, the token tends to see the price drop.

Following this current transaction, XRP has made a transaction of nearly $ 2.90 for the press time and has a 3.60%decline over the last 24 hours.

Despite the decline in prices and the weakness of the market, traders and investors showed great interest in tokens, increasing asset trading volume by 65%.

Optimistic chain indicator

However, according to the entire chain analysis company CoingLass, some long -term holders and investors seemed to use the recent price drops while accumulating tokens.

According to the data of the spot inflow/leakage, the exchange has witnessed a significant $ 750 million XRP outflow over the last 48 hours, indicating potential accumulation.

This real leak has further suggested ideal purchase opportunities.

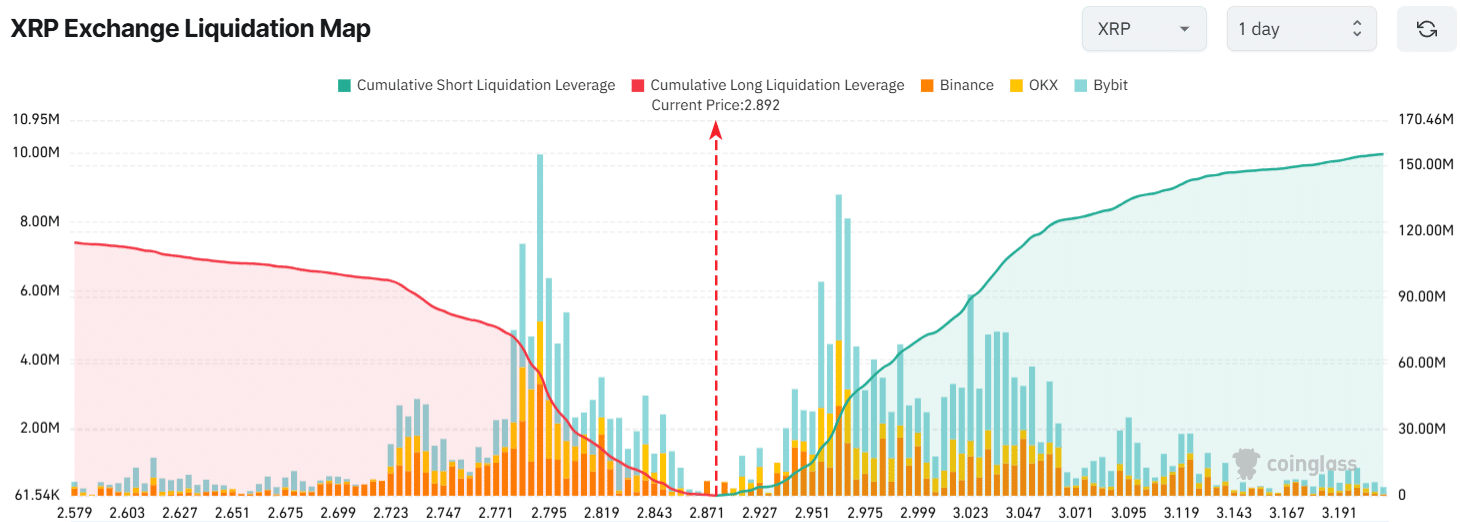

The main liquidation was $ 2.791 at the bottom and $ 2.963 at the top, and the merchant was excessively resolved at this level.

Source: COINGLASS

If the market sentiment does not improve and the price drops to $ 2.791, almost $ 55 million will be cleared.

On the contrary, if the emotions change and the price rises to $ 2.963, the short position of nearly $ 35 million will be cleared.

Technical analysis and coming level

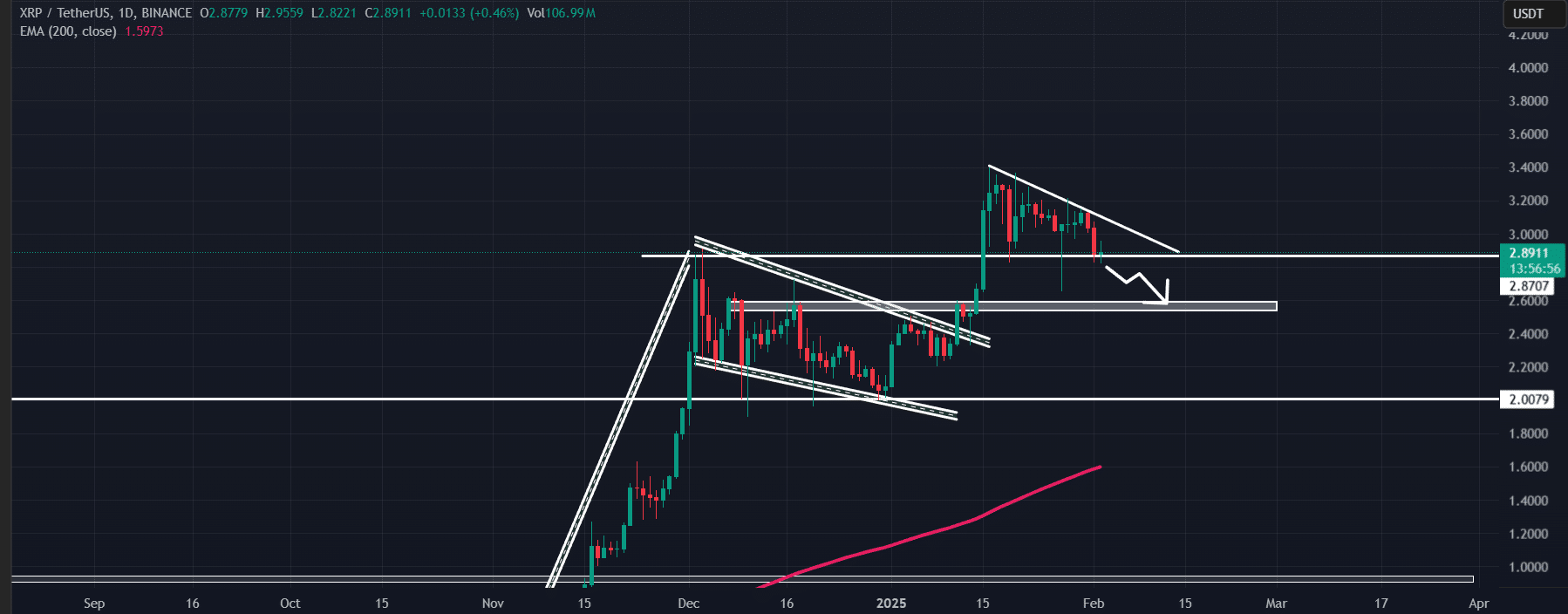

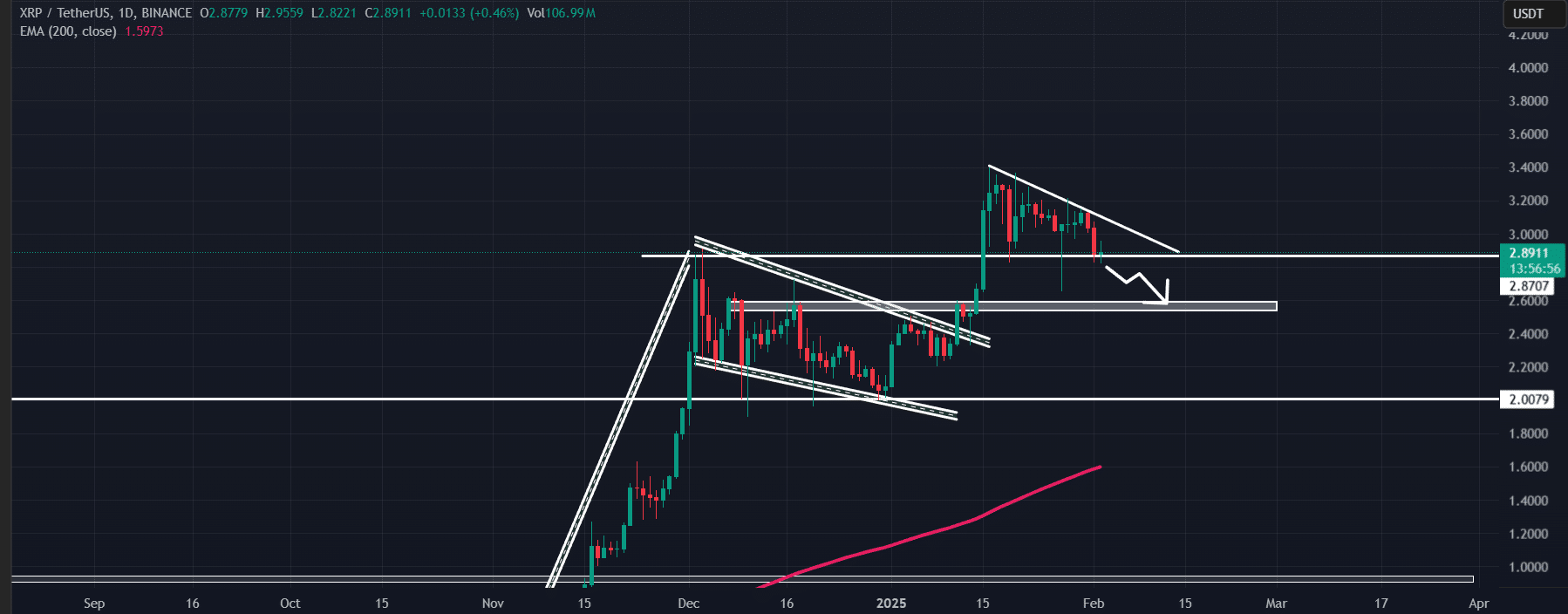

According to AMBCRYPTO’s technical analysis, XRP was at an important level of $ 2.88 and momentum seemed to decrease.

Source: TradingView

Read the price prediction of XRP 2025–2026

According to the recent price measures, if the XRP does not maintain $ 2.88, it is likely to decrease by 10% to $ 2.55 for the next support.

In a positive side, XRP suggests that assets are rising, exceeding the 200 index moving average (EMA) over the daily period.