- XRP is up 7% in 12 hours and more gains may follow.

- The accumulation trend supported the move towards $0.7.

Ripple (XRP) has recorded sharp price gains in recent hours following speculation that the U.S. Securities and Exchange Commission (SEC) may appeal its ruling in the SEC v. Ripple case.

In a post for

He also said it “makes no sense” for the SEC to appeal the court’s ruling, “so someone like Gary Gensler might appeal.”

October 7 is the deadline for either party to appeal the ruling. As this deadline lengthens, XRP price volatility may increase to another level.

On-chain metrics show accumulation across the network.

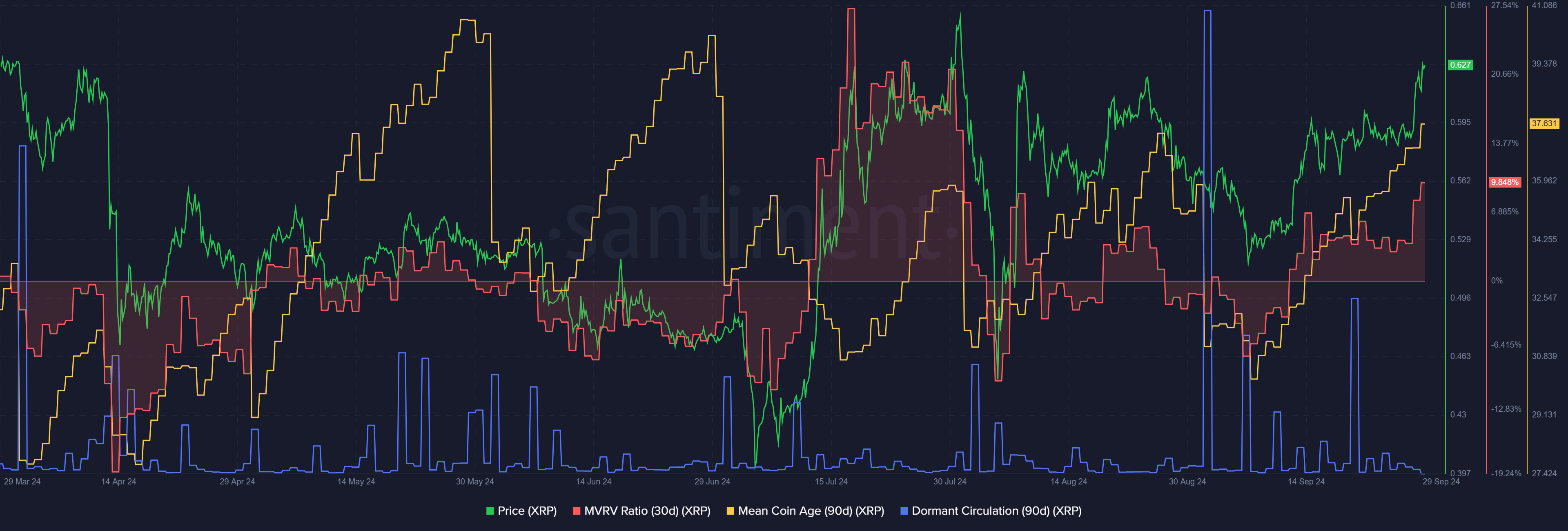

Source: Santiment

The average coin age trended upward throughout September. This was a sign of accumulation and reports of outflows from exchanges were another sign that the bulls were in control of the market.

After September 21, the dormancy cycle also calmed down. Due to the high activity at the time, there were no significant price adjustments.

Even before the recent price rise, short-term holders were making profits. The move higher has pushed the 30-day MVRV higher once again, which could see some selling pressure due to profit taking going forward.

Warning signs of on-site CVD

Source: XRP/USDT on TradingView

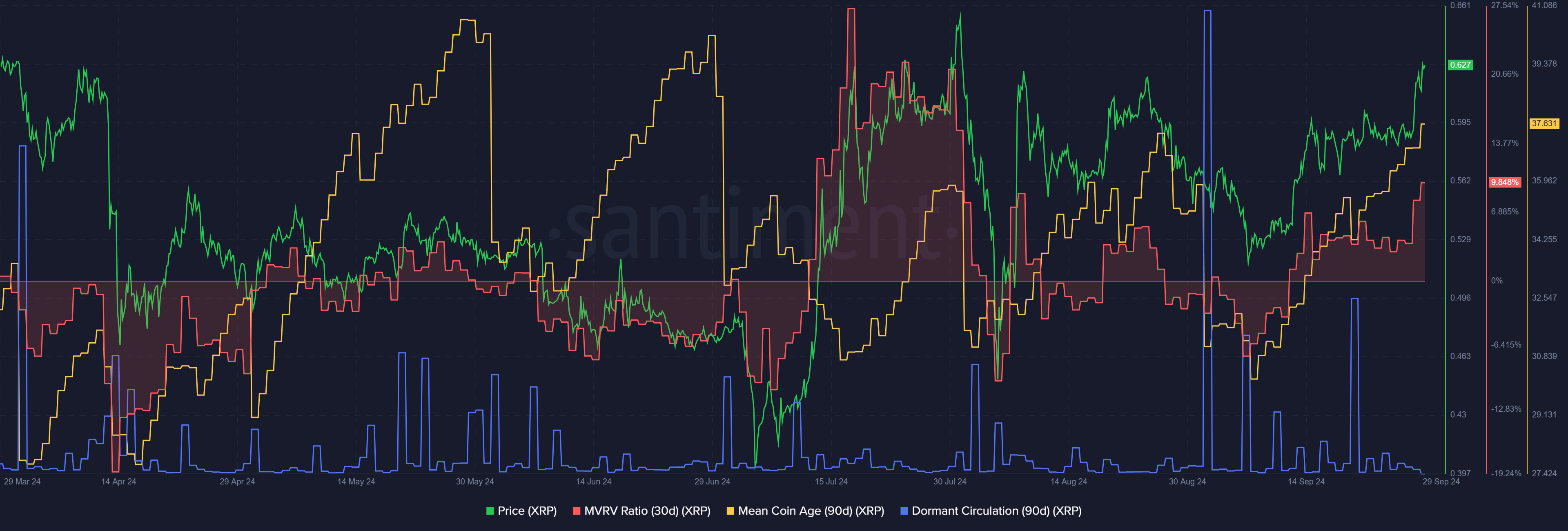

OBV has been hitting regional highs since mid-September. CMF was also well above +0.05, indicating strong capital flows into the market. MACD showed solid upward momentum on the daily chart.

Realistic or not, the market cap of XRP in BTC terms is:

This technical development comes after XRP broke above its 10-week resistance level of $0.62. Over the past three weeks, the token has lacked a trend compared to the rest of the market.

The XRP bull market is back, but this could be short-lived if the long-term range high of $0.71 turns off buyers once again.