- Token holders decided to send a lot of their XRP to cold wallets shortly after Ripple’s action.

- The decline in trading volume and price suggested that altcoins could bounce back in the near term.

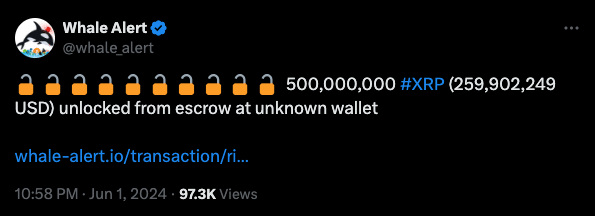

On June 1, Ripple performed the customary task of locking its tokens. This time, the blockchain payments company completed its activity with two 500 million XRP transactions, according to data from Whale Alert.

For those unfamiliar with the market landscape, Ripple has had this amount locked up since 2017. The idea behind this measure is to provide protection for a large token supply over 55 months. This means that 55% of the total XRP supply will participate in this scheme. For the most part, XRP’s reaction to these developments is generally negligible.

So the question is – was it like that this time too?

Source: X

Times have changed

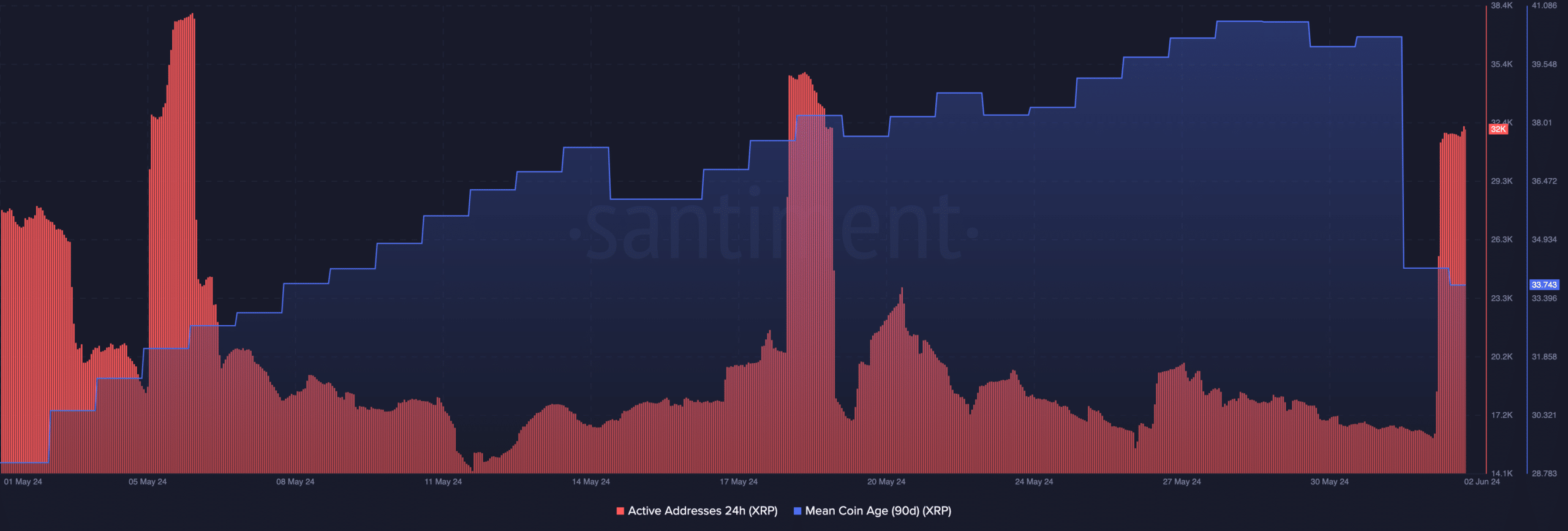

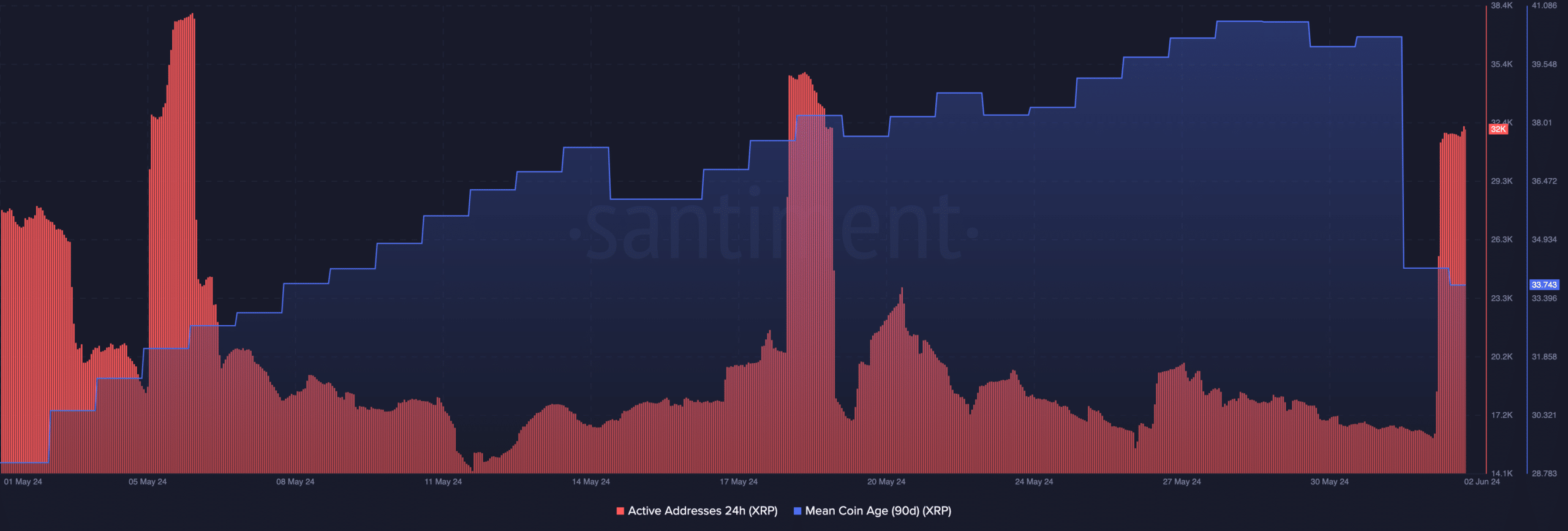

well. AMBCrypto discovered changes this time on the XRP Ledger. The first observation is that there is a noticeable increase in active addresses.

As of this writing, XRP’s 24-hour active addresses have increased to 32,000. This is almost double the number seen on June 1. The increase in active addresses showed that more participants were engaging in successful transactions using the token in the last 12-24 hours.

However, there are times when network activity increases and prices plateau or fall. The same was true here, with the price of XRP falling slightly on the charts to $0.51. But will this fix last? According to the Mean Money Age (MCA),

MCA is the average lifespan of all tokens on the blockchain. When the indicator is surging, it means older coins are moving, which can cause selling pressure and a drop in price.

However, the notable drop in XRP’s MCA indicates that more tokens are being dumped into cold wallets. At press time, XRP’s 90-day average coin age had fallen from 40.29 to 33.74.

Source: Santiment

Considering the “laws” mentioned above, it seems likely that the selling pressure on XRP will stop soon. After that, the price may rebound on the charts and may even rise to $0.55.

XRP falls to $0.50 and then…

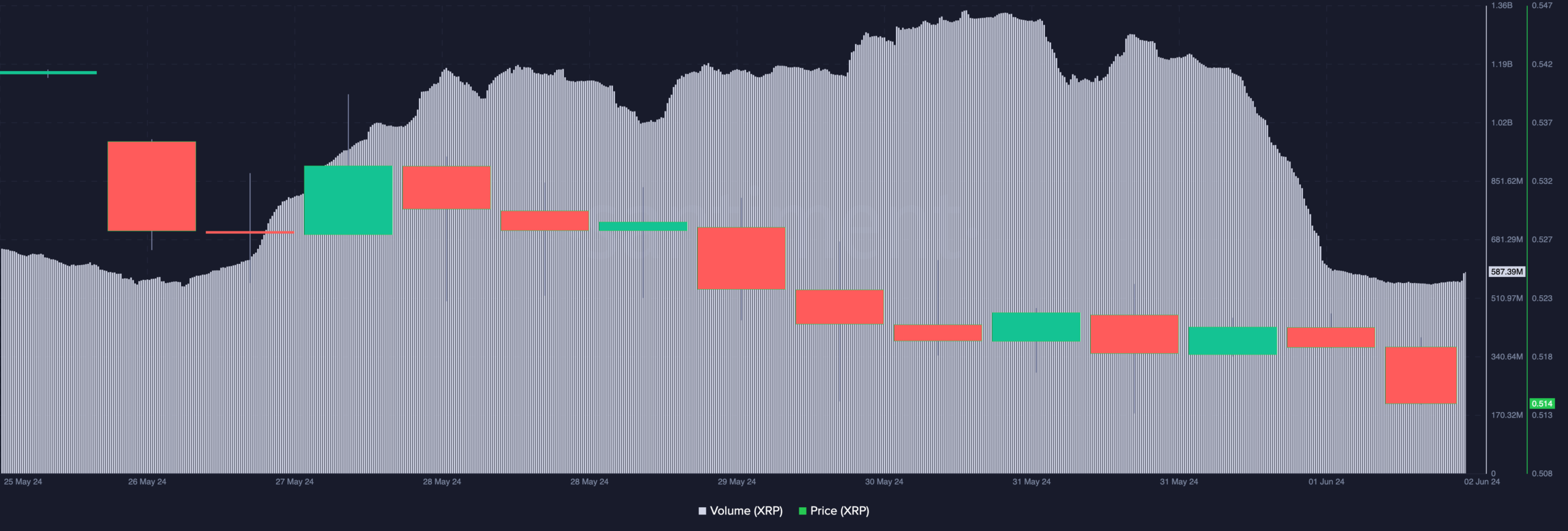

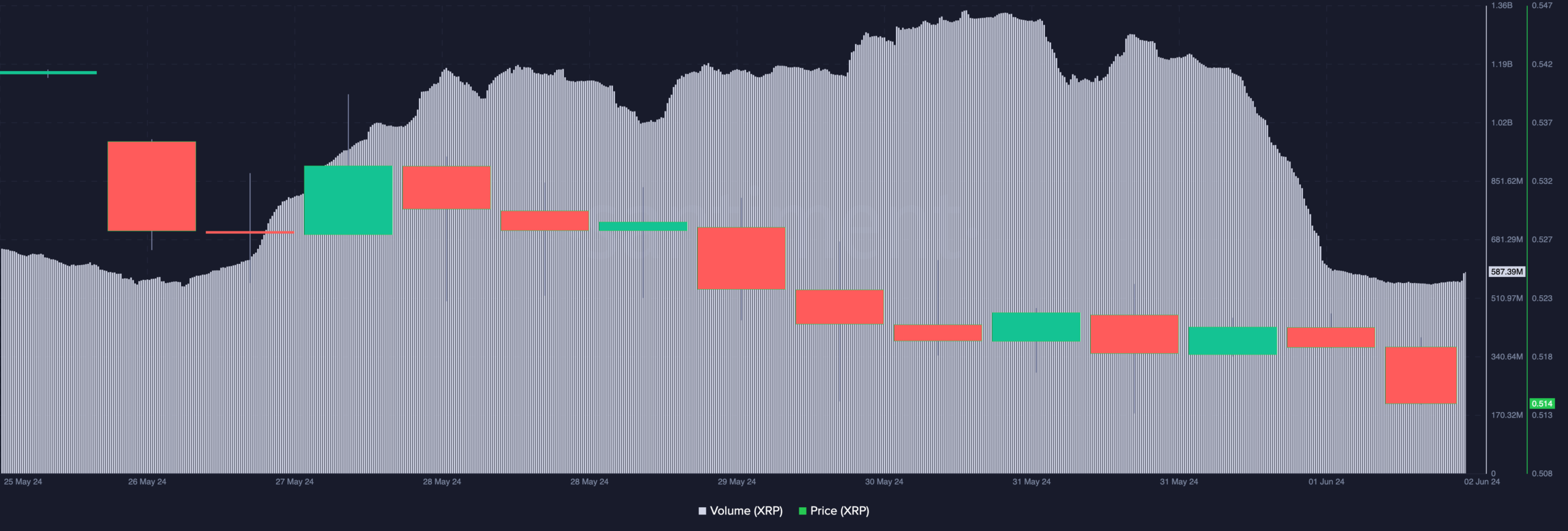

Traders may also need to pay attention to the trading volume of altcoins. At press time, this amount had also decreased to $587.39 million. Trading volume can be a strength for cryptocurrency prices.

Therefore, the same decline indicates that XRP’s downtrend is weakening. Although the value of

If XRP rebounds, the $0.55 prediction may come true. In a very optimistic situation, the price of the cryptocurrency may rise to $0.60.

Source: Santiment

Read Ripple (XRP) Price Forecast 2024-2025

However, despite the optimistic outlook, XRP holders need to be wary of market changes, especially the impact of Bitcoin (BTC).

If Bitcoin price rises on the charts, XRP may also rise. However, a collapse in BTC value could invalidate the arguments outlined above.