- The case of Ripple can end in a few days or weeks after signing a personal contract with the SEC.

- More betters and optional traders expect XRP to fall to less than $ 2 by the end of March.

In February, President Donald Trump’s new SEC suspended or permanently dismissed most of the password investigations that the BIDEN regime began.

however, Ripple (XRP) The incident was noticeably missing from the layout list.

The passage to exit the ripples case

According to the Fox Business Reporter Eleanor Teret, a report quoted people who are accustomed to this problem, saying that the Ripple case can end soon. She Sayed,,,

“The two well -placed sources say that the SEC vs. Ripple event is in the process of finishing and it can end soon.”

She added that the only stubborn problem was the judge of the Analisa Torres, which imposed a penalty for a permanent ban on selling XRP to Ripple $ 1,25m for the sales of XRP and selling XRP to the investor category.

Jeremy Hogan said, Jeremy Hogan, a professional XRP lawyer, would be possible only if the parties reached a personal contract with a sticky point.

“The only way to end this event is when Ripple and SEC reaches a personal agreement.”

What is the next step in XRP?

If dismissal occurs, it can increase the regulatory clarity that prevents Altcoin’s rise for more than four years.

Some claimed that Trump’s election victory and 500%of the rally claimed that XRP had set a regulatory clarity. ETF guess I was still playing.

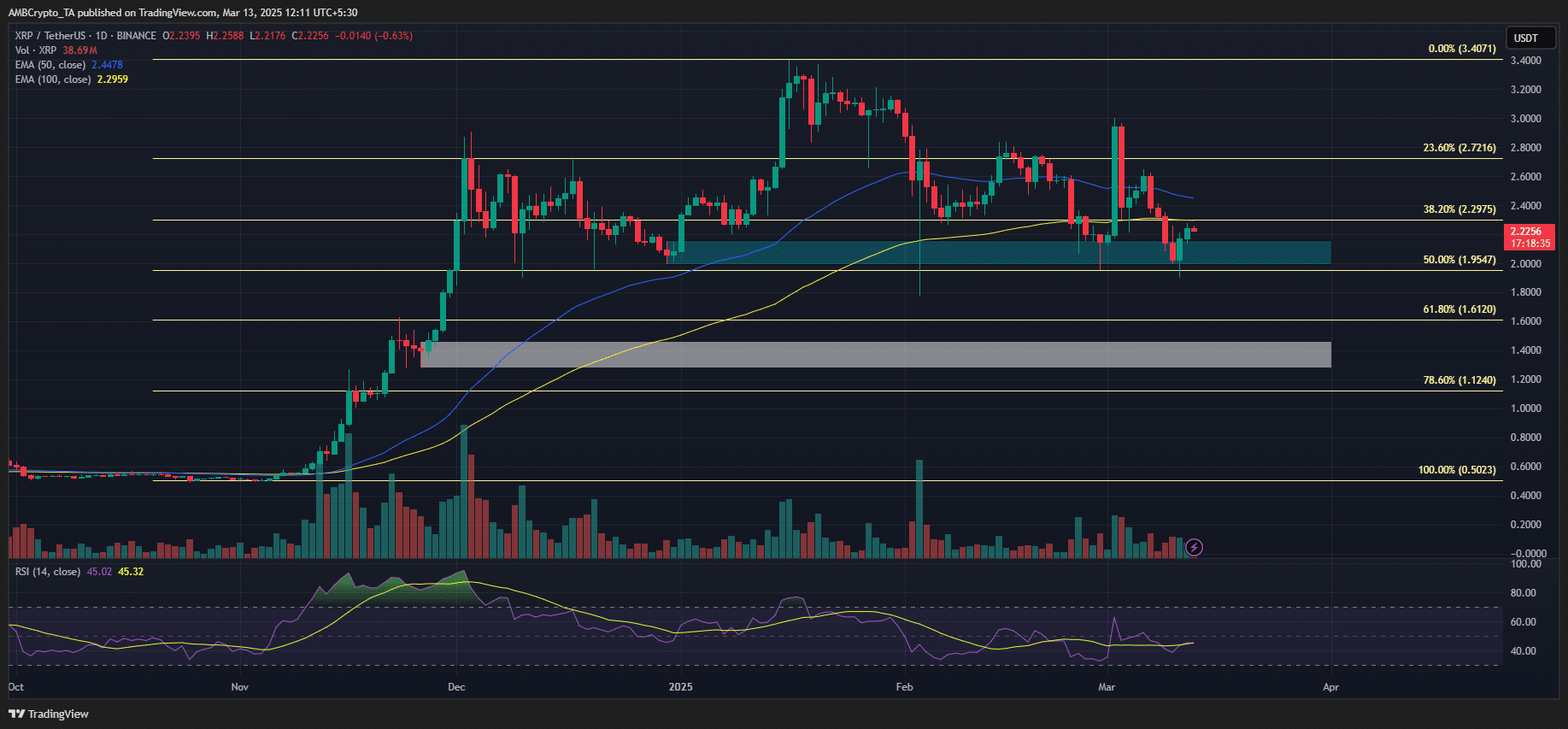

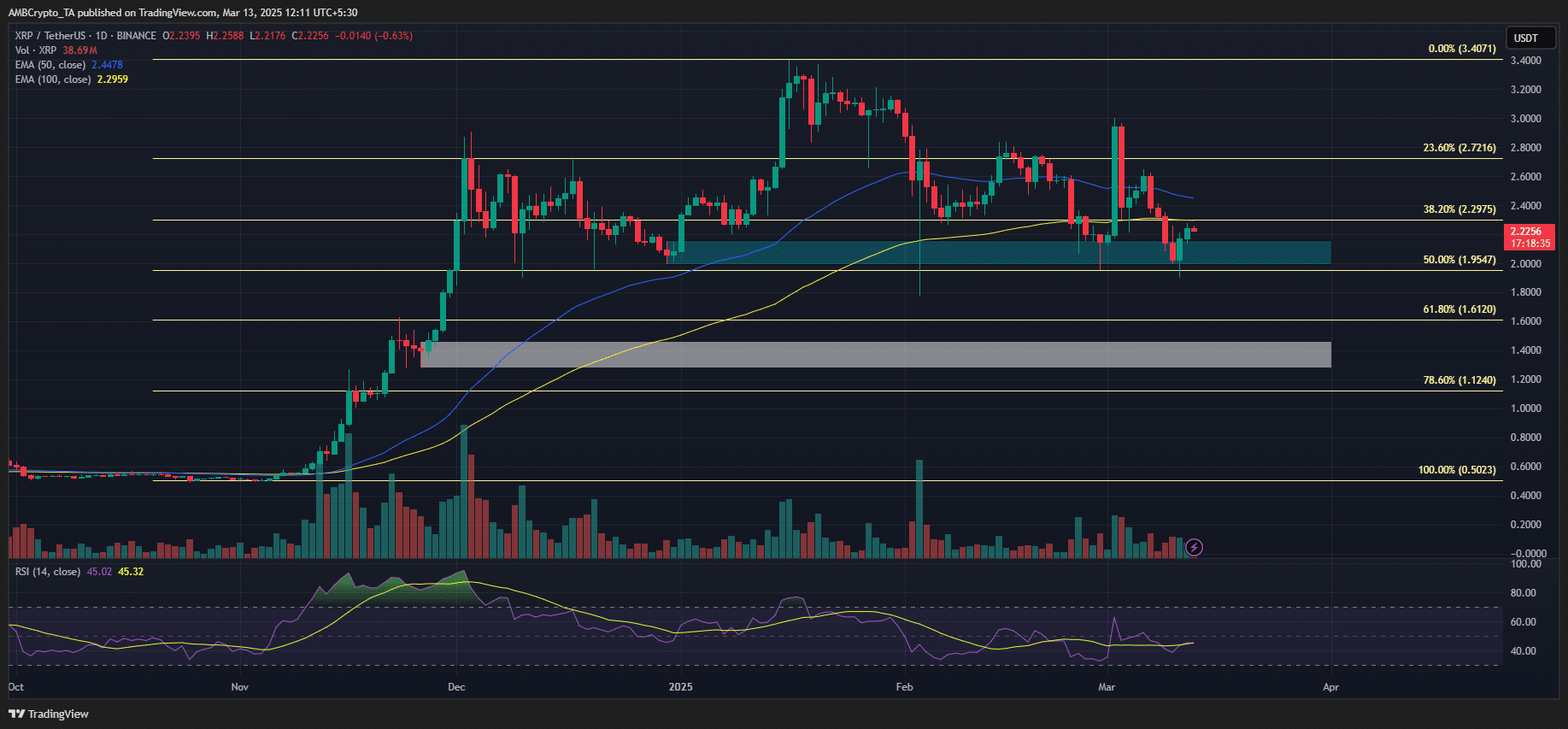

In the press time, the election profits since XRP have fallen to 340%, which was worth $ 2.2 on the price chart.

In PolyMarket, betors stood at $ 3.5 at $ 257K volume for March. However, the level of $ 3.5 is only 7% chance, depending on the prediction site.

Source: Poly Market

Most betters with relatively small bets will fall to $ 1.7 this month.

Interestingly, most destruction Optional trader In addition, XRP is expected to fall to less than $ 2 and will surge more than $ 3 by the end of March.

The probability of getting $ 3 in the option platform was 15% for the prestime, and $ 1.7, and the DIP was 90% -100%.

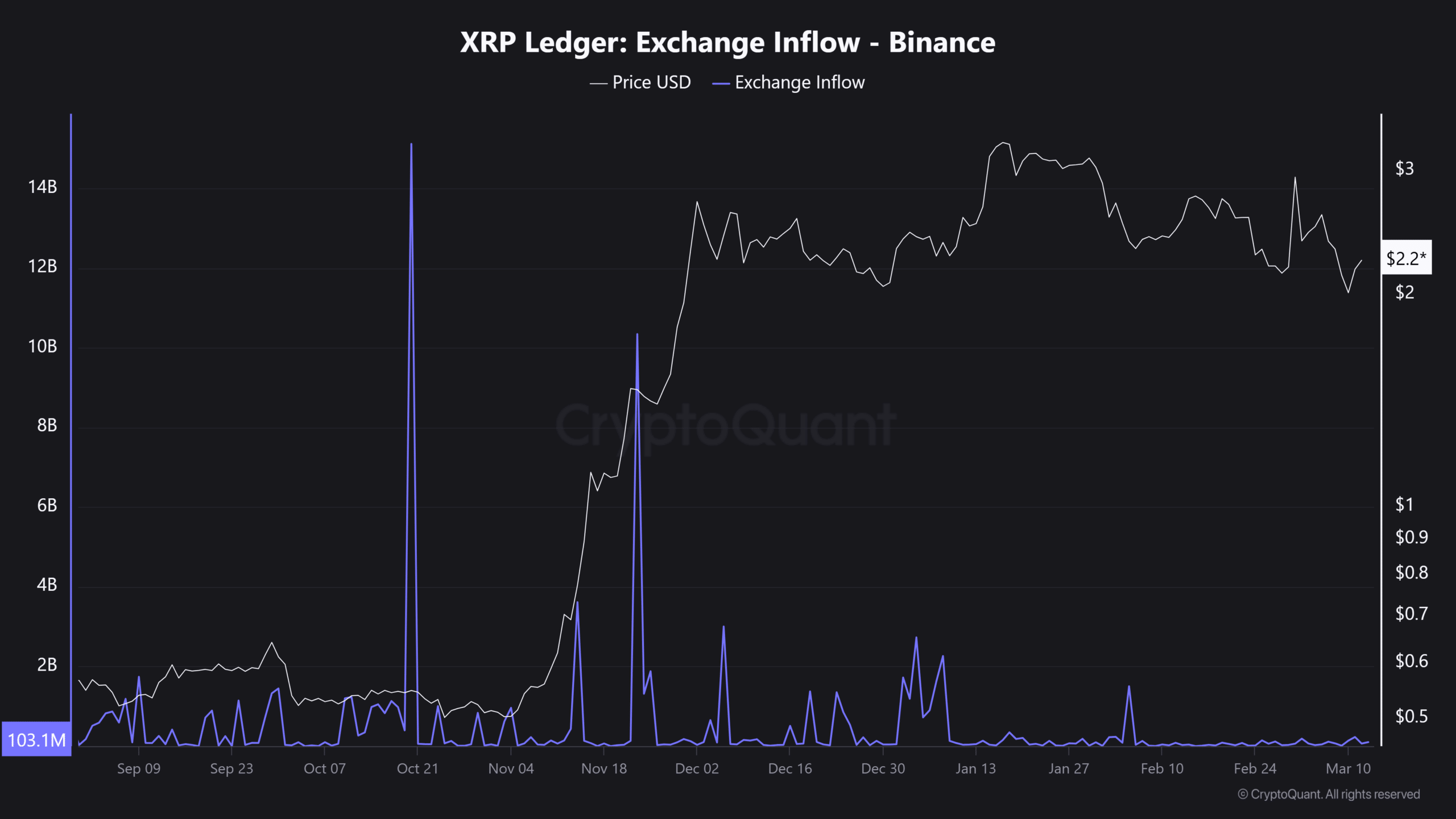

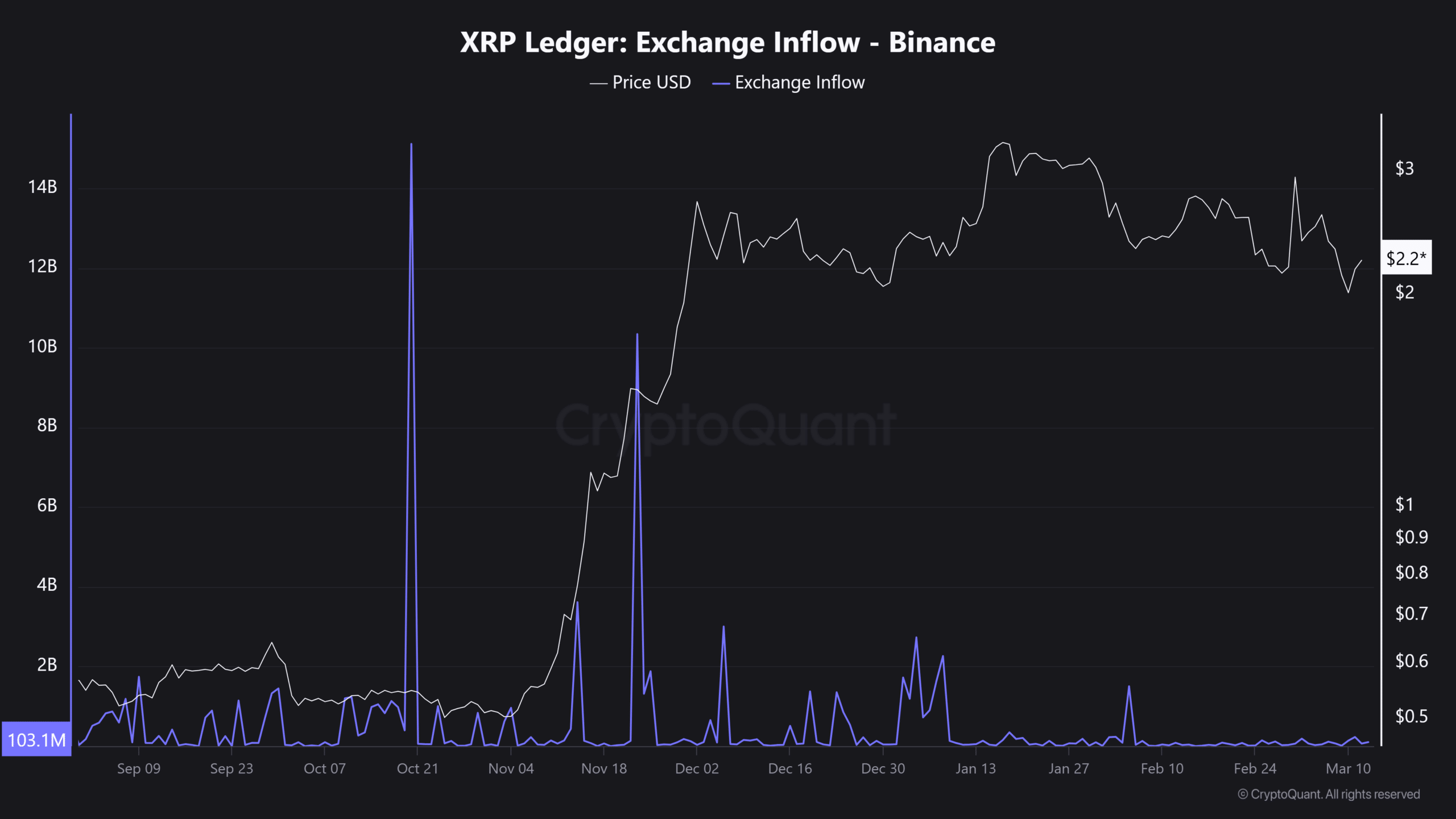

In other words, the sales pressure on CEXES (central exchange) measured by the inflow of Exchange has been flat since mid -January.

Source: cryptoquant

This can explain how XRP has maintained its large -scale elections, while most of them went back below November.

ETF approval or the dismissal of the Ripple case will still be a ‘seller’ event and it is still remaining to increase the sale of whales.

From the point of price analysis, the $ 2 was a major support since December. In addition, 50% fibonacci matched the level and the golden ratio of 61.8% is $ 1.6.

In short, if you lose $ 2, you can get $ 1.6 or $ 1.4 if you lose $ 2.

Source: XRP/USDT, TradingView