- The analyst believes that altcoins could continue to underperform Bitcoin as the market breaks away from its previous pattern.

- Solana may be the reason why altcoin market caps haven’t formed a lower low.

Altcoins have underperformed Bitcoin (BTC) this year, including most of the top 10 altcoins. Binance Coin (BNB) and Toncoin (TON)It has not recovered its previous high.

In fact, according to Andrew Kang, partner at Mechanism Capital, the market has not followed the previous pattern. Traditionally, whenever Bitcoin makes a new all-time high, altcoins follow suit. However, when BTC hit an ATH of $73,000 on the charts earlier this year, most altcoins did not.

“Altcoin market caps (and ETH) should hit new highs in a new cycle. It’s becoming increasingly clear that this isn’t the case… Even if Bitcoin hits a new high, that doesn’t mean altcoins will catch up.”

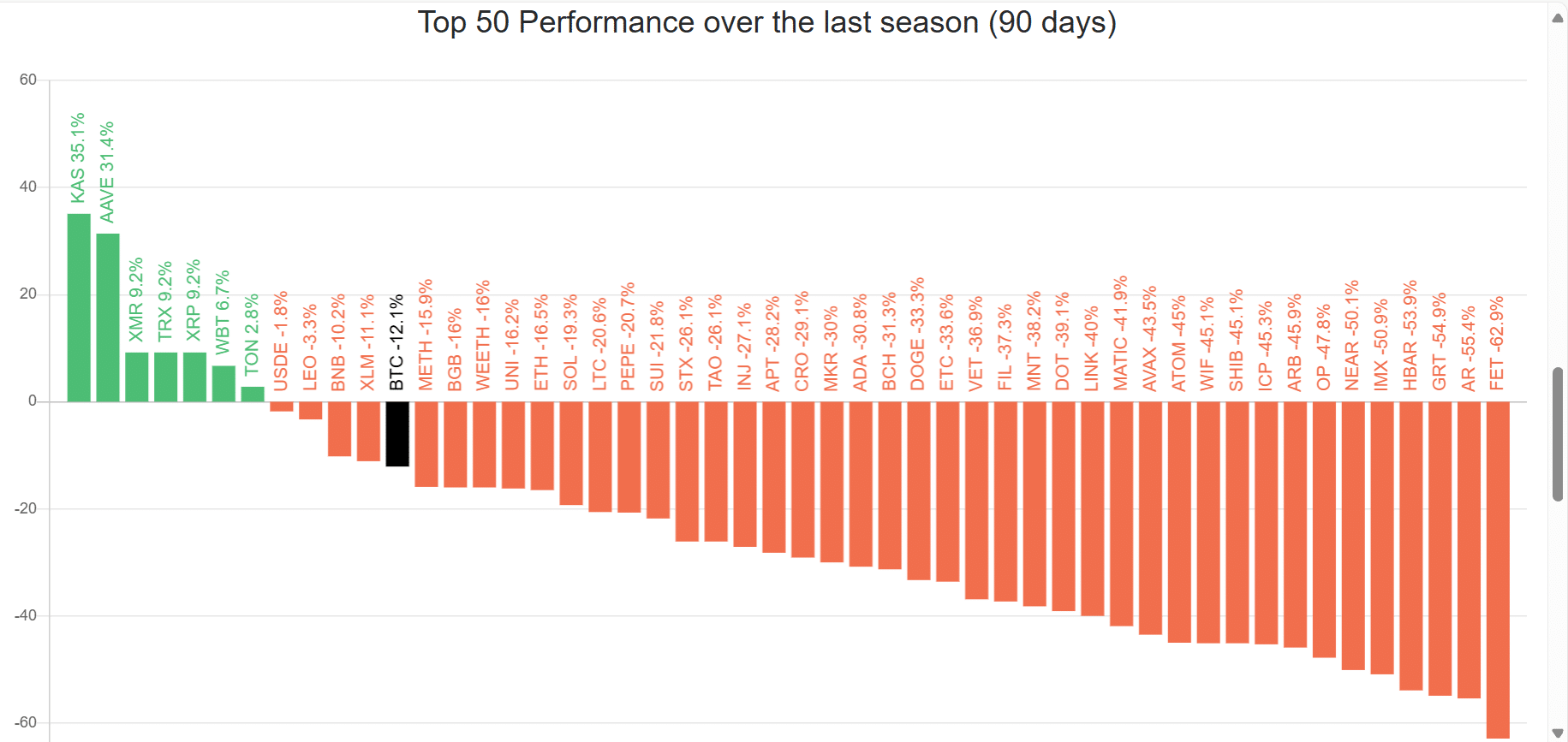

Looking at data from Blockchain Center, only 11 of the top 50 altcoins have outperformed Bitcoin over the past 90 days.

Source: Blockchain Center

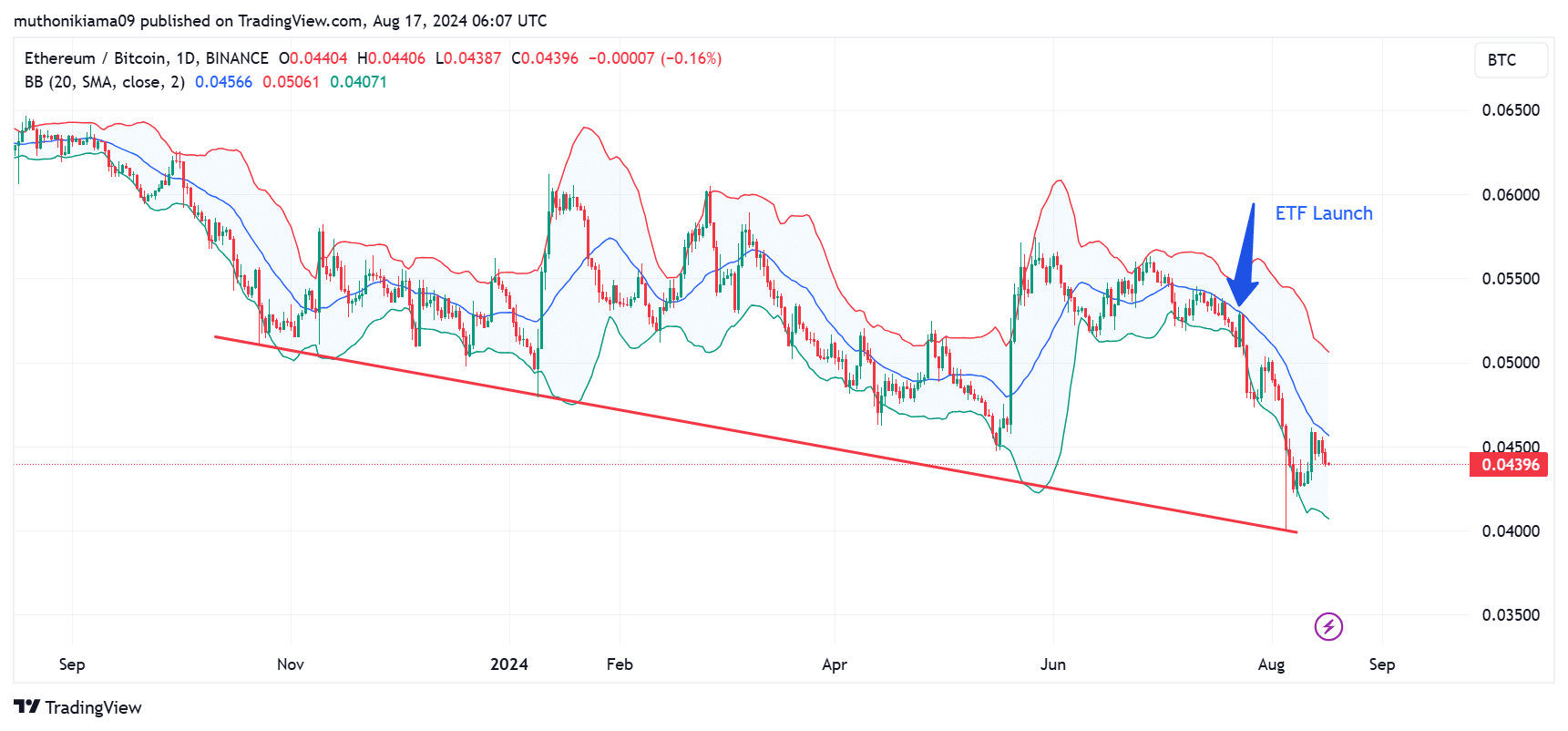

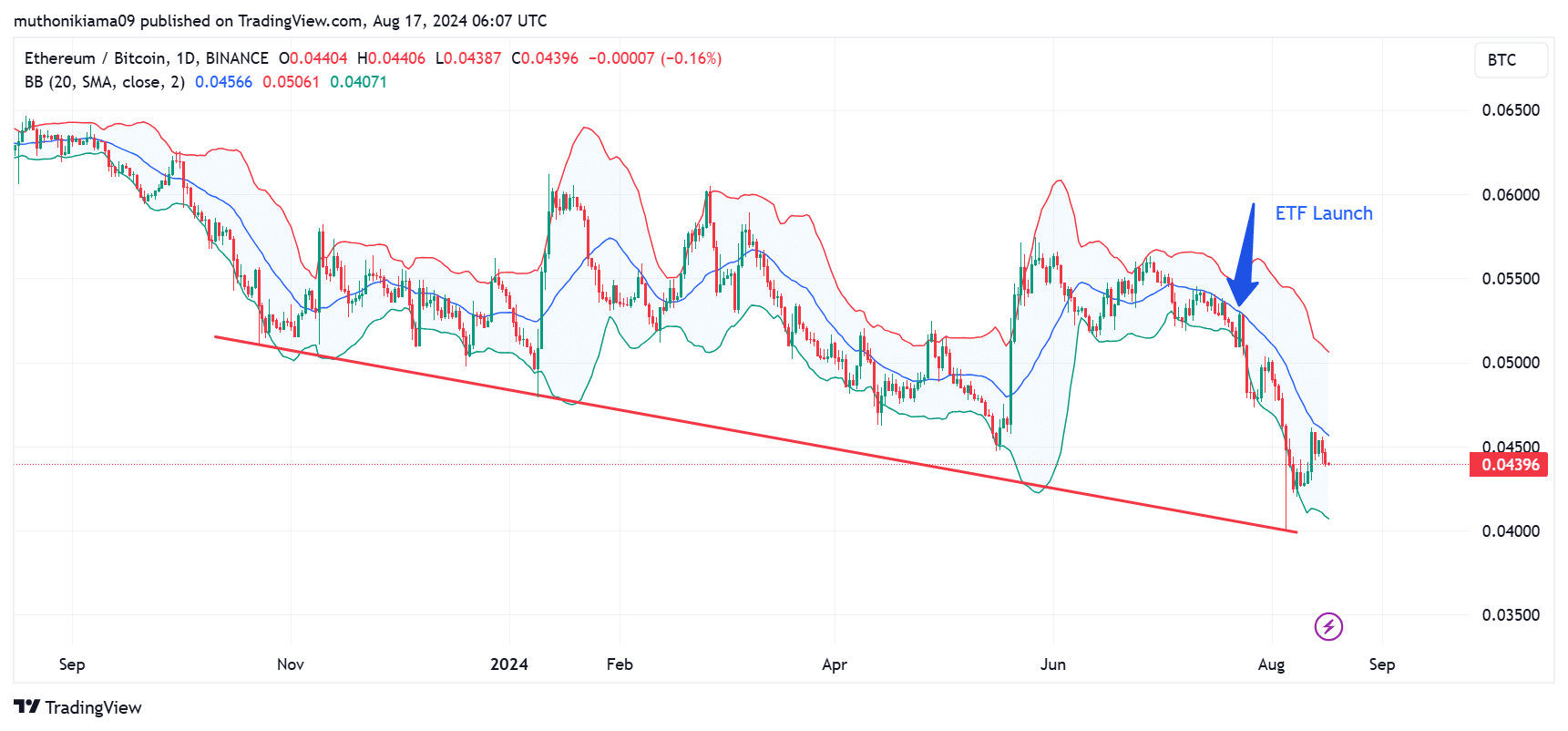

ETH hits yearly low against Bitcoin

Kang’s analysis comes as Ethereum formed a yearly low against Bitcoin on August 9. The ETH/BTC daily chart also showed that the largest altcoin has been forming a lower low against BTC since October of last year.

Moreover, since the spot Ether ETF (exchange-traded fund) started trading in July, ETH has not bounced above the middle of its Bollinger Bands (20-day simple moving average), which is just another sign of underperformance.

Source: ETH/BTC, TradingView

However, according to Kang, altcoins are likely to find a bottom in 2025 and then see a bullish rebound.

Is Solana a safety net?

But Kang believes that’s not all. Solana (SUN) The only reason why the altcoin market cap, currently at around $1 trillion, has not made lower lows on the charts.

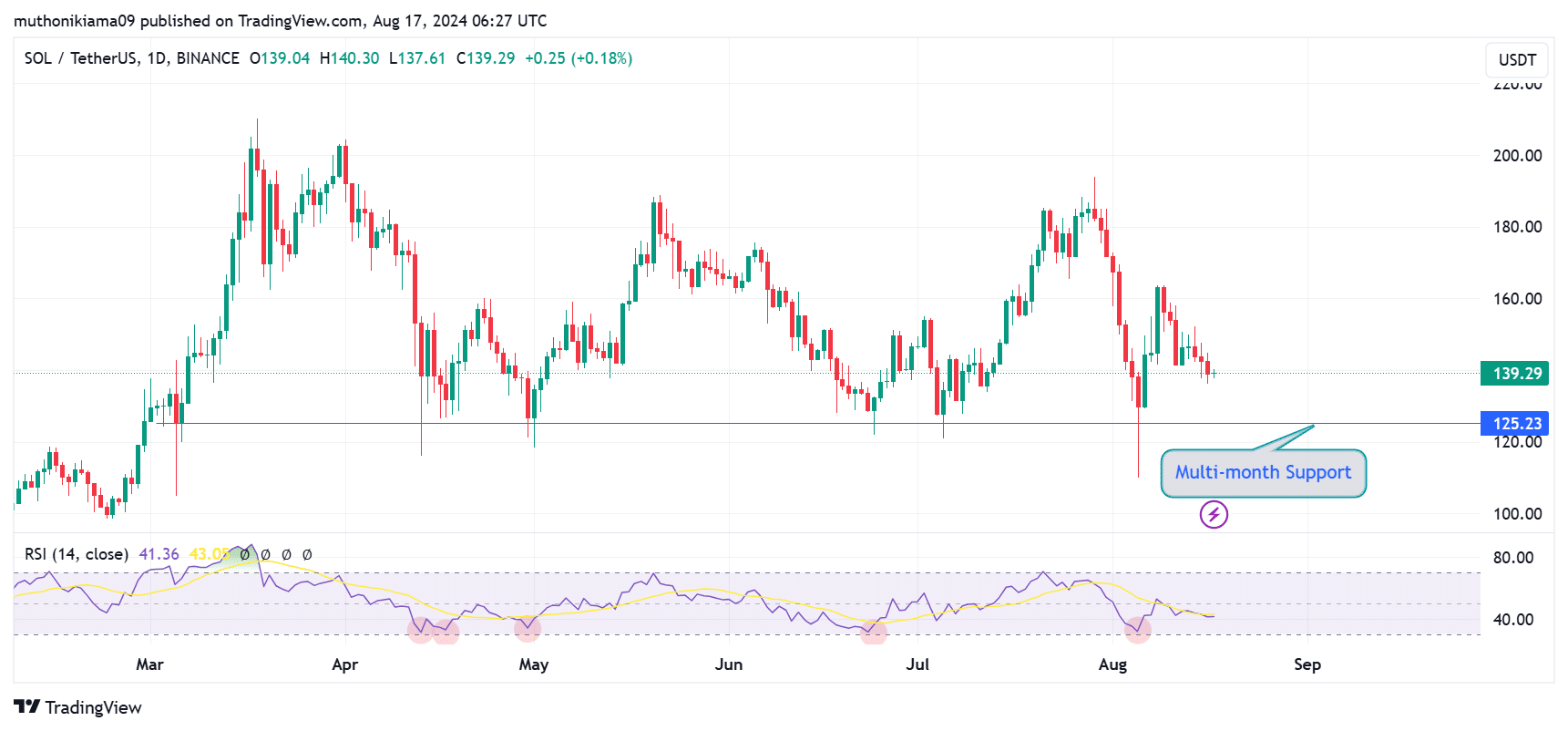

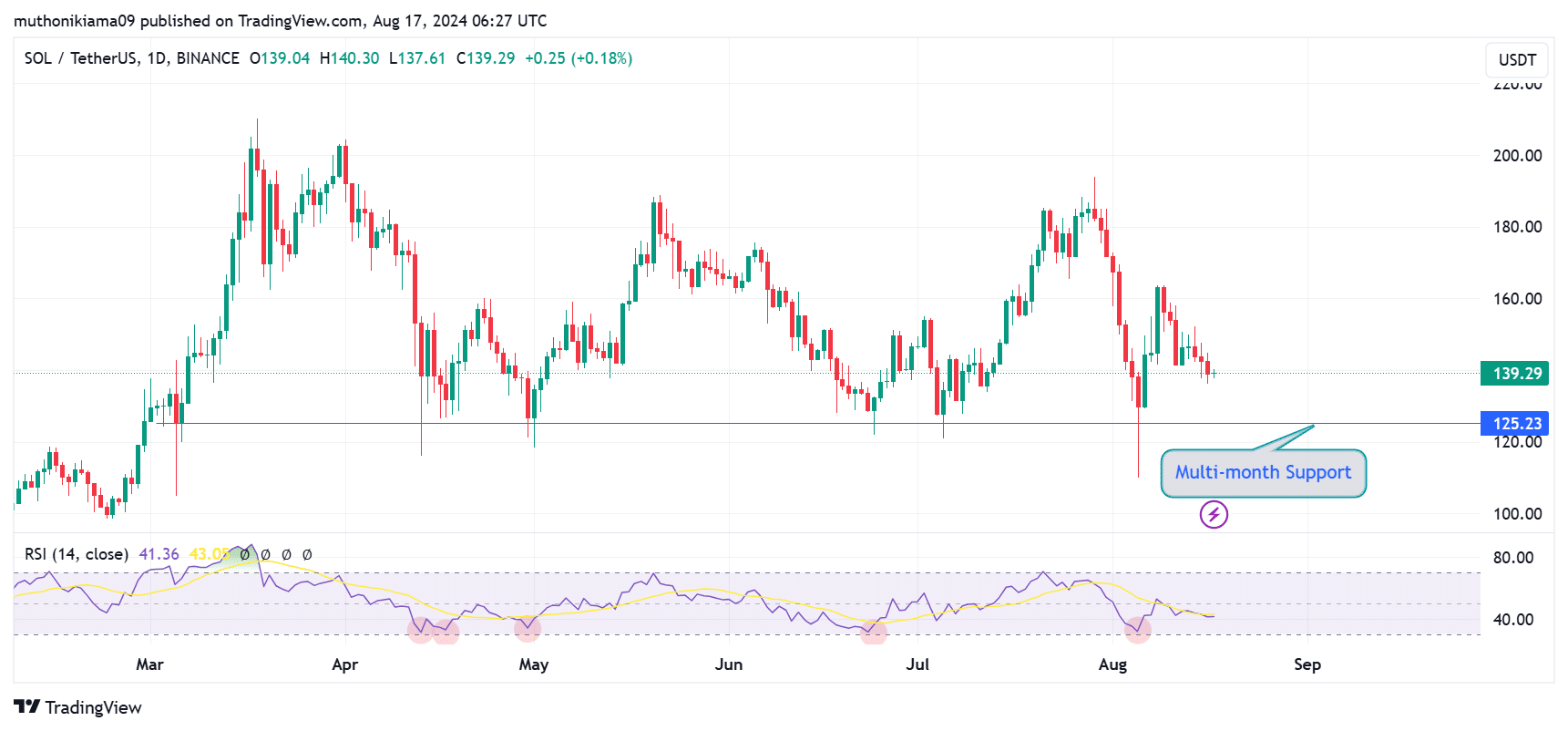

In fact, Solana has been defending the $125 support level for several months since March 2024.

Source: SOL/USDT, TradingView

The psychological level of $125 is an important price to watch as it shows that SOL has established a stable base that prevents a sharp decline despite downward pressure.

The Relative Strength Index (RSI) has also remained above 30 since March, a sign that SOL is not oversold for a prolonged period.

This trend indicates that buyers have taken significant downside risk. This strong support for SOL supports Kang’s argument that Solana’s price is unlikely to make a lower low.

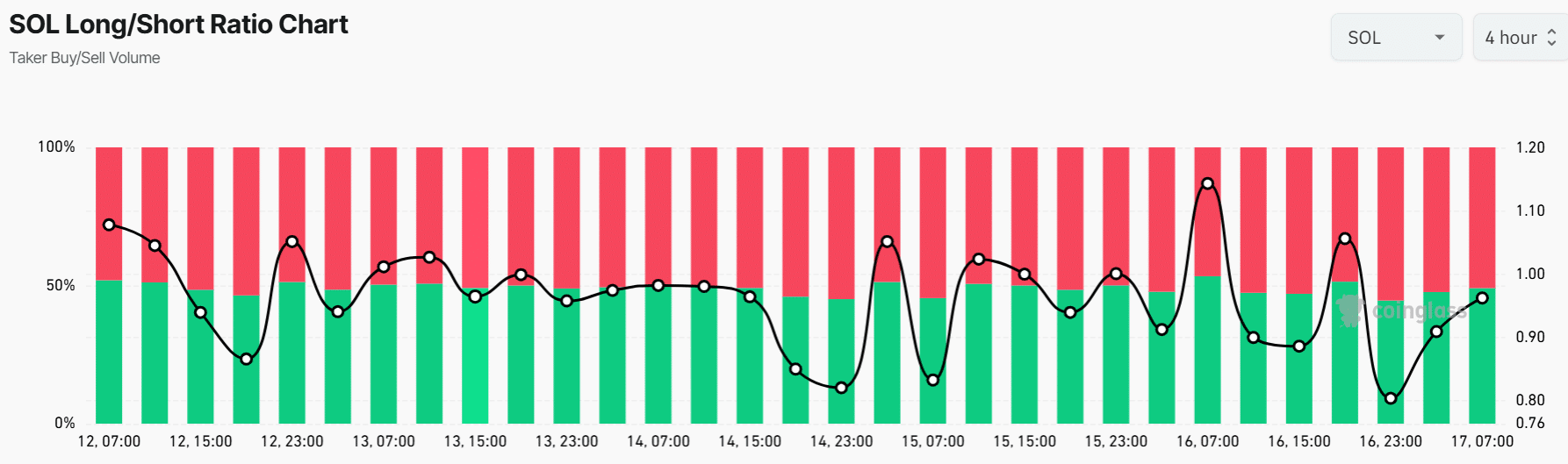

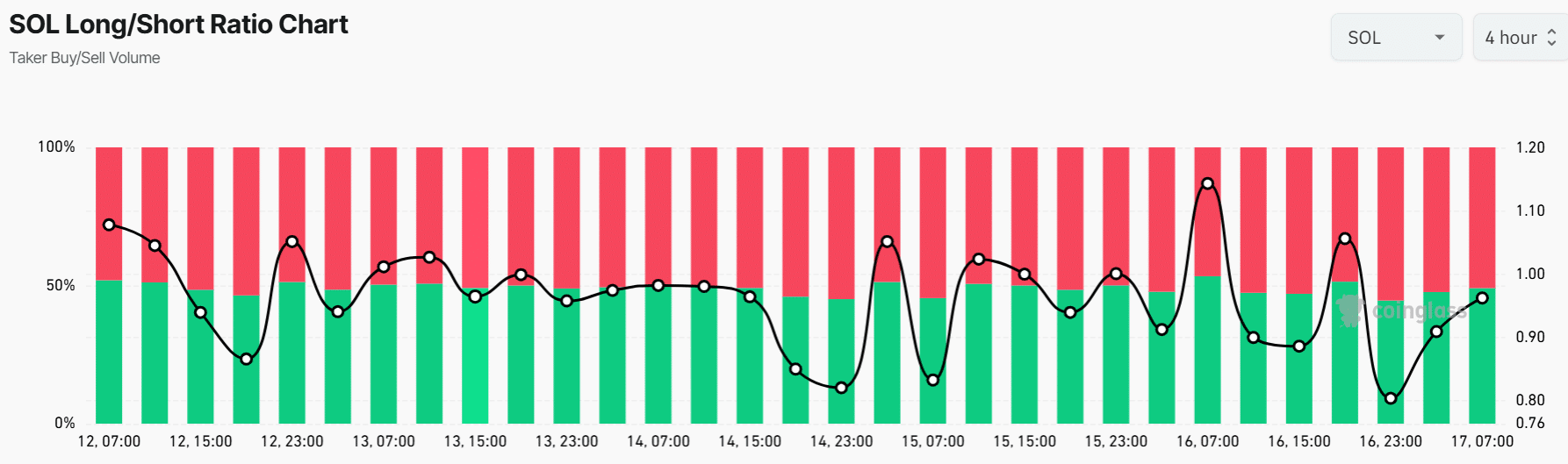

Also, the gift market showed a nearly balanced sentiment among traders around SOL. At the time of writing, the long/short ratio for SOL was 0.97, indicating that short positions were slightly higher than long positions.

Source: Coinglass

However, Solana’s strengths were not enough to support the altcoin market. At the time of writing, the Altcoin Season Index had a value of 22, which suggests that the market is currently favoring Bitcoin over altcoins.