Singapore, Singapore, April 10, 2024, Chainwire

April 4th, Binance Web3 Wallet Collaborates with BEVMLeading Bitcoin Layer2 and its ecosystem project Satoshi Protocol launches multi-million dollar airdrop campaign.

Users who link BTC to BEVM through Binance Web3 Wallet and borrow at least $10 SAT (USD-stablecoin) can share a pool of 500,000 OSHI and 10.5 million BEVM tokens. The campaign exceeded 30,000 people within 3 days of launch.

The Satoshi Protocol is the first CDP protocol built on BEVM and will be live on the BEVM mainnet on March 28th. In addition to the Binance campaign, there is also a referral program that allows early participants to accumulate points by borrowing SATs and inviting friends.

What makes BEVM unique?

BEVM is an EVM-compatible Bitcoin Layer 2 solution that stands out in a crowded market. By leveraging Taproot consensus, Schnorr signatures, MAST, and Bitcoin SPV, BEVM achieves the highest level of decentralization and security among all BTC layer 2 solutions.

Key features of BEVM:

- Native BTC Layer 2: BEVM utilizes BTC as network gas and stores transaction data on the BTC mainnet, ensuring compatibility with the original Bitcoin protocol.

- EVM Compatibility: Developers can seamlessly migrate Ethereum-based dApps to BEVM, extending the reach of these applications to the Bitcoin ecosystem.

- Decentralized and Secure: BEVM uses Musig2 multi-signature aggregation and Bitcoin Lite nodes to achieve a trustless and secure environment.

Satoshi Protocol: Secure Bitcoin Liquidity

The Satoshi Protocol is the first Collateralized Debt Position (CDP) protocol built on BEVM and aims to provide liquidity to BTC through the SAT dollar stablecoin and expand the scenarios of BTCFi. This move frees up trillions of dollars of liquidity within the Bitcoin ecosystem, giving users a way to maintain their Bitcoin holdings while ensuring liquidity.

The Bitcoin ecosystem is experiencing a renaissance. Recent advancements such as inscription and expansion solutions have revitalized the ecosystem. The Satoshi Protocol team sees the upcoming halving and launch of the Runes protocol as poised to attract new users.

However, the lack of a trustworthy, fiat-pegged cryptocurrency for seamless trading and efficient market pricing remains a significant challenge. This is where the Satoshi Protocol steps in. By allowing users to borrow SAT against Bitcoin, the Satoshi Protocol provides a reliable liquidity solution within the Bitcoin ecosystem.

Satoshi Protocol Milestones

Over the past month, Satoshi Protocol has built a strong community with over 60,000 followers. Twitter We have over 70,000 members across Telegram and Discord.

Let’s see what they achieved:

How does the Satoshi Protocol work?

The Satoshi Protocol utilizes a sophisticated system to maintain a stable peg of $1 against SAT. The system combines several mechanisms, including overcollateralization, permissionless liquidation, stability pools, and arbitrage. It also features OSHI, a utility token that grants holders 97.5% of protocol profits.

For more information about OSHI and sOSHI, see the official document OSHI & sOSHI.

OSHI distribution

The interaction between SAT and OSHI forms the core of the Satoshi Protocol. Here’s the full picture:

mortgage loan

When borrowing SAT, users must maintain a Minimum Collateral Ratio (MCR) of 110%. This means that the borrowed amount cannot exceed 90.9% of the deposited BTC value.

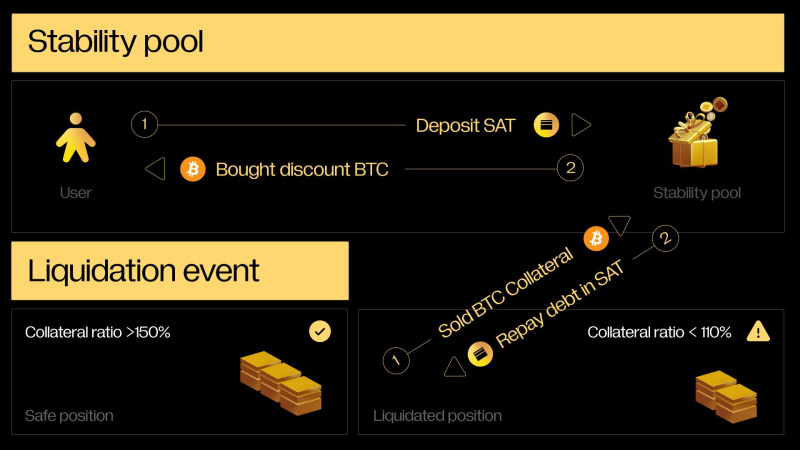

liquidation

Liquidation will begin when the value of a user’s collateral falls below 110% (MCR) due to price fluctuations. Users’ BTC collateral is sold at a discount to stability pool providers to repay SAT loans. This mechanism secures the protocol and prevents borrowers from taking on excessive debt.

peg retention

A robust three-pronged system ensures that the value of the SAT remains pegged to the US dollar.

Salvation: Arbitrage activities help regulate SAT prices and keep them within a desired range. If SAT falls below $1, arbitrageurs can purchase discounted SAT and redeem it for $1 worth of BTC on the protocol. Conversely, if SAT exceeds $1.1, users can borrow SAT from MCR (110%) and sell it on a decentralized exchange (DEX) at a premium price to make a profit.

Overcollateralization: As mentioned earlier, excess collateral (MCR 110%) acts as a safety net. The protocol requires higher collateral values to prevent borrowers from defaulting and protect themselves from price fluctuations.

Stability Pool: This pool serves as a final safety measure. If a user’s collateralization ratio falls below the MCR, the stability pool triggers a liquidation event and provides the liquidity needed to maintain protocol stability.

Satoshi Protocol x BEVM airdrop (includes Binance wallet)

BEVM and Satoshi Protocol recently collaborated with Binance Web3 Wallet for a total $10.5 million BEVM and $500,000 $OSH token airdrop.

You can share rewards by using your Binance wallet to complete tasks such as BEVM bridges and create positions in the Satoshi protocol.

continue: 2024/04/04~2024/05/04

compensation: 10,500,000 BEVM and 500,000 OHSI

work:

- Use Binance Wallet

- Link BTC to BEVM (0.0004 BTC, ~$25)

- Create a position in Satoshi protocol (minimum 10 SAT)

Participate in the Binance Wallet Airdrop Campaign

How to participate in the campaign

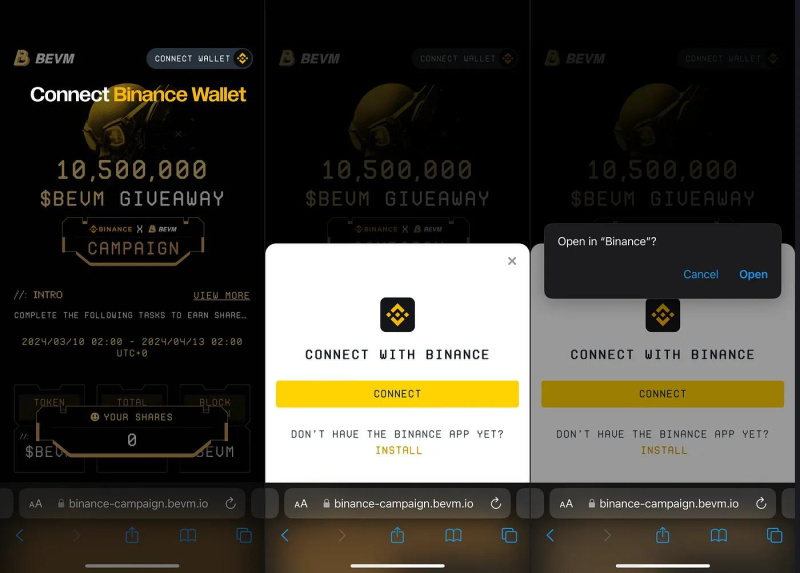

Step 1: Users must go to the campaign landing page and connect their Binance wallet.

Step 2: Withdraw BTC and connect to BEVM

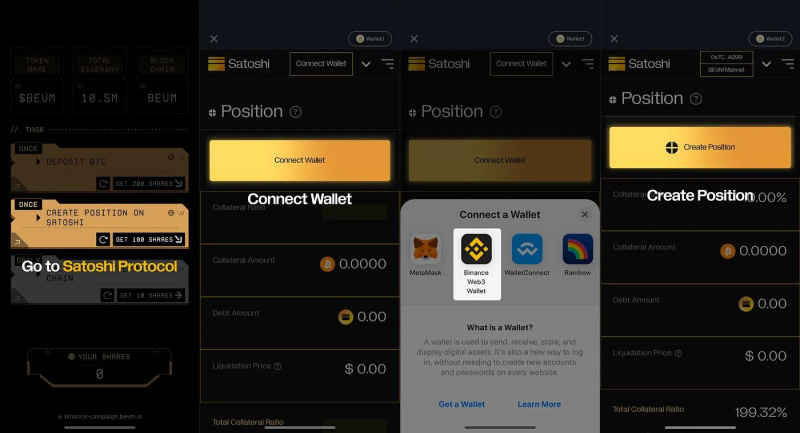

Step 3: Users must go to the Satoshi protocol and create a position.

Users will need to go to the Satoshi protocol and link their wallet.

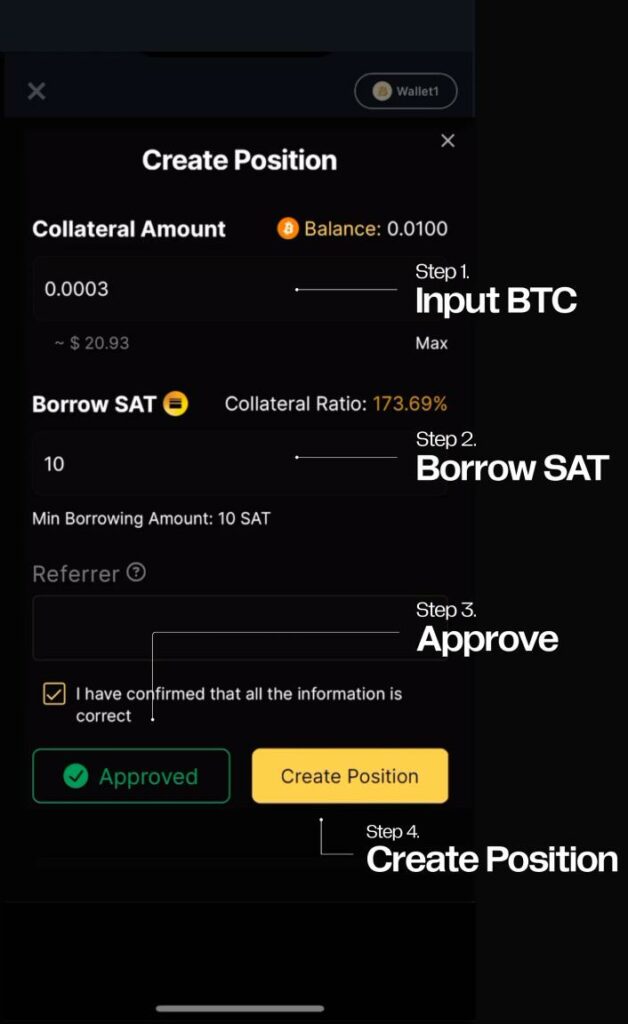

- Enter BTC amount

- SAT loan (minimum 10 SAT)

- (Optional) Enter your referral and receive 150+ points

- Click “Approve”

- Click ‘Create Position’.

Binance Wallet Mobile Tutorial: Create a position using Binance Web3 wallet

After completing all steps, users will be eligible for BEVM and OSHI airdrops!

Connecting the Future: Satoshi Protocol and Binance Wallet’s Airdrop Campaign

The Satoshi Protocol offers a glimpse into the future of Bitcoin finance. By leveraging BEVM and a powerful CDP model, users can expand the possibilities of the Bitcoin ecosystem by lending BTC-backed stablecoins SAT.

Binance Wallet has launched an airdrop campaign with a total of 10.5 million coins. $BEVM500K $OSHI It is for those who connect BTC to BEVM and create positions on the Satoshi Protocol, which is also the first integration of a Bitcoin Layer 2 solution with Binance Wallet. BTCFi is heading west.

Introduction to Satoshi Protocol

Built on BEVM, it is the first CDP protocol to leverage Bitcoin’s true potential. Unleash unprecedented liquidity with SAT, a stablecoin designed to power the fast-growing BTCFi market.

To learn about the Satoshi Protocol, users can:

Website | web app | Twitter | telegram | Dissension | document | blog

contact

marketing

hugo

satoshi protocol

marketing@satoshiprotocol.org