Main takeout

- The strategy was purchased for 6,911 BTC for $ 584.1 million, increasing its total shares to 506,137 BTC.

- The company plans to raise $ 42 billion in capital to further expand its acquisition of Bitcoin.

Share this article

Michael Saylor, the chairman of the strategy, recently hinted the acquisition of the imminent Bitcoin and pushed the company’s total stake to more than 500,000 BTC.

On March 30, Saylor shared the Bitcoin portfolio tracker of the strategy with “Orange Needer Needer” in X.

This post is historically ahead of the announcement of a new Bitcoin acquisition next week.

You need more orange. pic.twitter.com/lv5qgup6oy

-Michael Saylor Lord (@saylor) March 30, 2025

On Monday, the strategy announced that it added 6,911 BTC, which is about $ 585 million. Purchasing was based on an average of $ 84,529 per bitcoin between March 17 and March 23.

The NASDAQ listed company has increased its stake in BITCOIN to 506,137 BTC with the latest acquisition, and is the first public trading company that surpassed 500,000 BTC.

According to Sayletracker’s data, the strategy acquired Bitcoin for $ 66,608 per BTC, and the total cost was about $ 33.7 billion, including commissions and costs.

Despite the recent price fluctuations, the company still has an unprecedented profit of $ 8.3 billion.

BITCOIN is currently trading at $ 83,000 and has a slight recovery at $ 82,100 on Saturday, according to the TradingView.

Strategic Strf Permanent Favorite Equity Opering

On March 21, the strategy announced the price of the 10.00% series a perpetual trife preferred store operating.

The company has increased its proposal from $ 500 million to $ 72.5 million, to increase its net proceeds of about $ 771 million in additional Bitcoin acquisition and support operation.

This product will be settled on March 25 in accordance with customary closure conditions. This measure is part of the company’s “21/21 plan”, targeting $ 42 billion in total capital hikes for the acquisition of Bitcoin.

The strategy has previously raised funds to the bitcoin plan using the net profit from STRK and MSTR stocks.

Earlier this month, the company sold 13,100 STRK stocks for about $ 1.1 million, and still sold $ 299.9 billion worth of STRK stocks for issuance and selling according to this program.

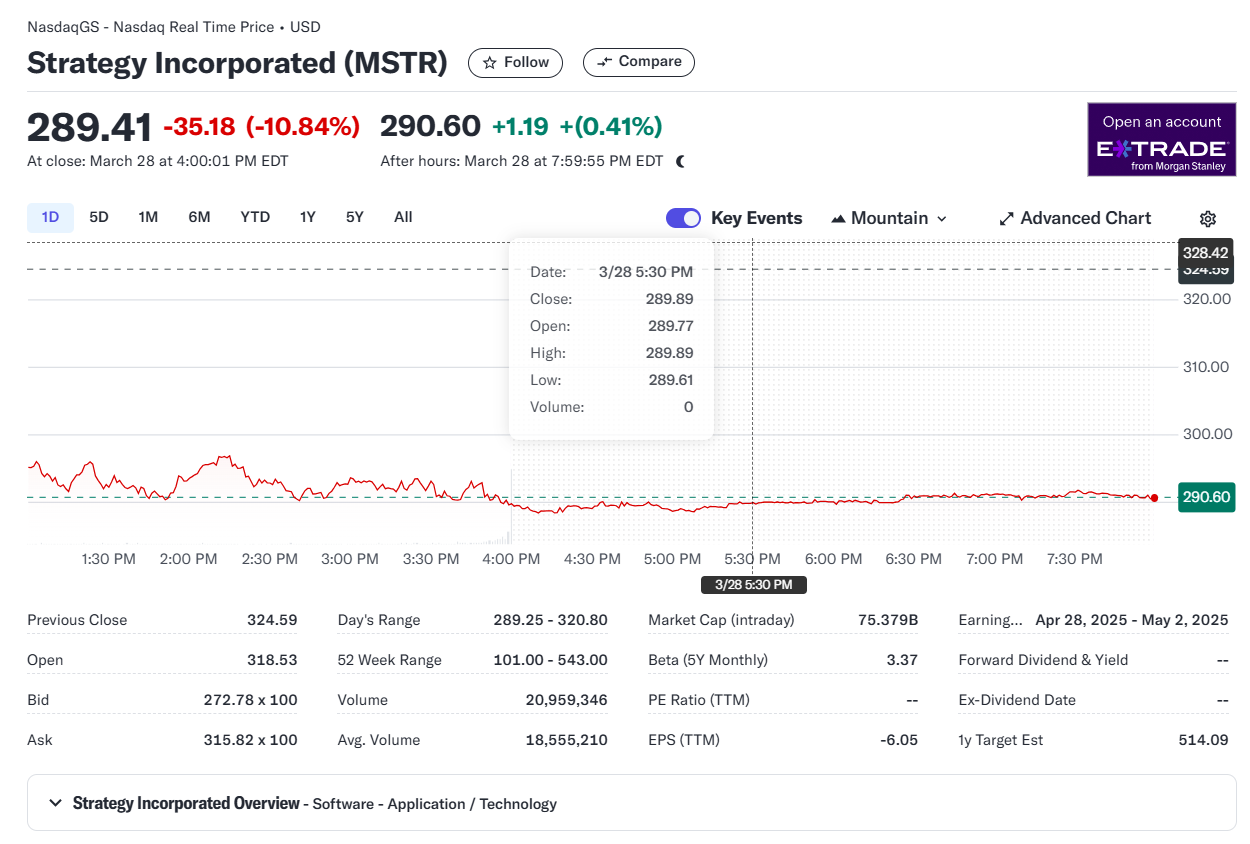

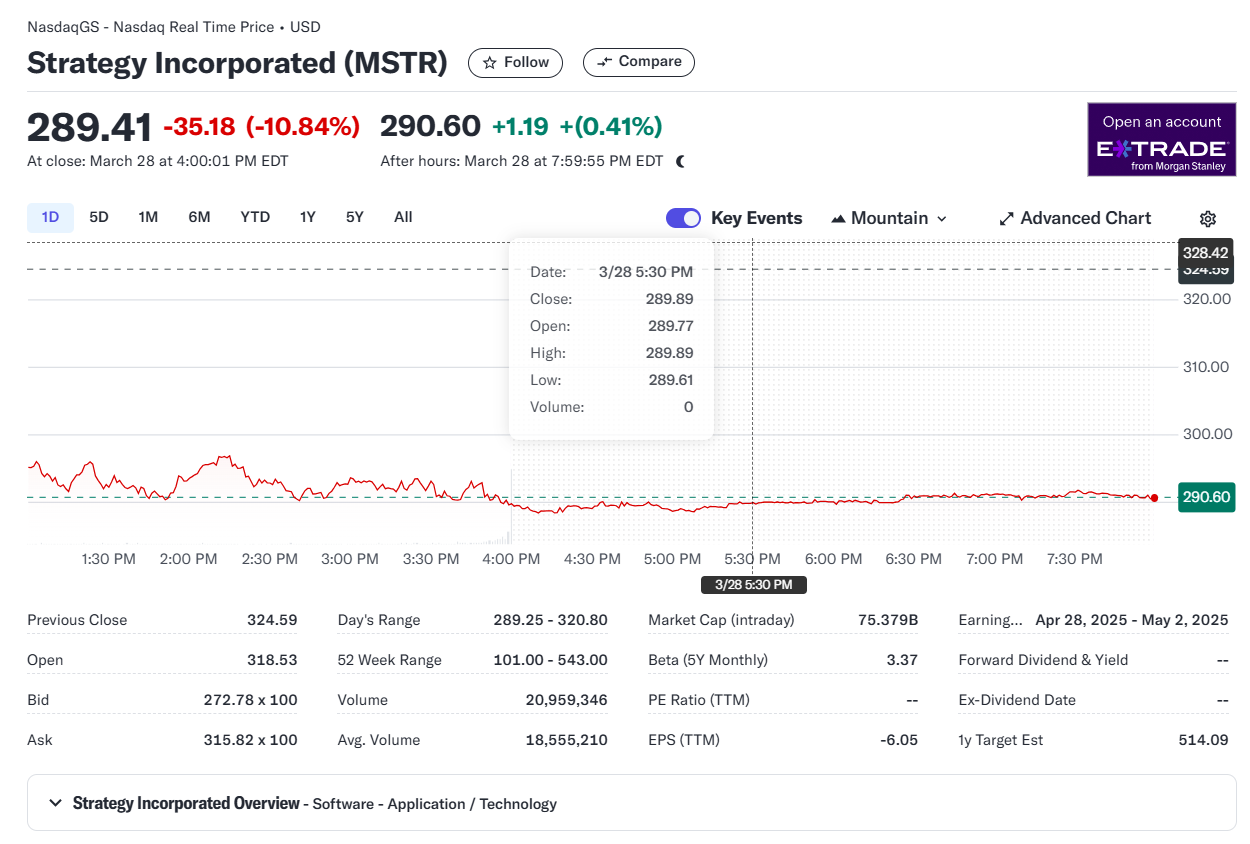

According to the Yahoo Finance Data, MSTR, a stock of strategy, fell almost 11% to $ 289 on Friday.

Last year, stocks surged about 70%, but each year was negative.

Share this article