Main takeout

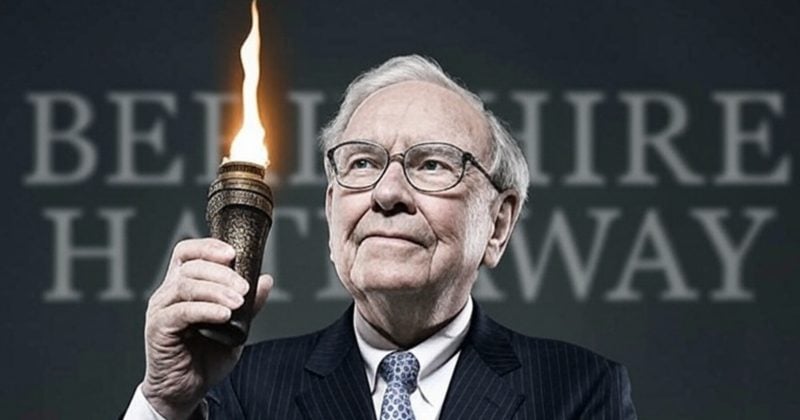

- Warren Buffett will withdraw to Berkshire Hathaway’s CEO by the end of the year as Greg Abel acquires.

- Under Buffett’s leadership, Berkshire was much better than the S & P 500, with 20% of annual profits from 1965 to 2024.

Share this article

Strategic Chairman Michael Saylor was called Berkshire Hathaway, a famous investor led by the legendary Warren Buffett in the 20th century.

Berkshire Hathaway is a 20th -century Bitcoin.

-Michael Saylor (@saylor) May 3, 2025

Saylor issued a statement on May 3, the same day as the annual shareholders’ meeting held in Nebraska in Berkshire Hathaway. Shortly afterwards, Buffett announced that he would withdraw as the CEO by the end of the year and told the torch to the vice chairman of Greg Abel.

Buffett said, “I think Greg has arrived at the end of the year.

CNBC said that the 94 -year -old billionaire, who led Berkshire for 60 years, would not sell Berkshire stocks.

This movement is the end of the era of one of the most symbolic people in global finance. Buffett has changed Berkshire into a $ 1 trillion large company and has become a symbol of trained long -term investments.

Buffett suggests diversifying with other calls

During the meeting, Buffett pointed out that Berkshire did not have assets related to the collapse. He said that if the US faces economic problems, the company can diversify into another currency.

“Obviously, we won’t want to own what we actually think of as a call to hell,” he said. “In the United States, things can happen.

Other major topics raised at the meeting included trade, US economy, investment and policies. In the trade policy, Buffett emphasized the value of a balanced world trade and warned that trade conflicts could serve as economic wars.

Buffett expressed his deep faith in the exception of the United States and called it the best place to be born and invested, but described it as a long -term impossible in the long term, expressing concerns about the fiscal deficit of the country.

He emphasized Berkshire’s opportunity investment approach, and the company has recently considered a $ 10 billion deal and can spend up to $ 100 billion in correct conditions.

Buffett insisted that securities offer a much better opportunity than the US real estate, and emphasized the unique ability of the company investing in large -scale energy infrastructure when national policy developed. He recently dismissed market volatility as a minor and urged investors to be not emotional.

Buffett avoids Bitcoin, but Berkshire has indirect exposure.

Warren Buffett has long been a vocal critic of Bitcoin and other encryption assets, and he described Bitcoin as “a rat poison square” and insisted that he and Berkshire Hathaway would not invest directly in cryptocurrency.

Despite this position, Berkshire Hathaway’s stocks were very low on Bitcoin.

Since 2015, the gap has widened, especially since 2020. Bitcoin has gained more than 780%of profits since 2020, compared to about 150%compared to about 150%of Berkshire during the same period.

At the time of writing, Bitcoin has traded more than $ 96,800, a slight drop in the last 24 hours, depending on Coingeko.

Buffett claims that Bitcoin lacks its essential value, but Berkshire nevertheless was indirectly exposed to digital asset space through a portfolio company.

In particular, Berkshire has a significant stake in Bank of America and has invested in several branch Bitcoin ETFs, including IBIT (IBIT) of Blackrock, according to FINTEL’s submission.

Large companies also invested more than $ 1 billion in Nu Holdings, a Brazilian digital bank that operates an encryption platform and provides various encryption services.

Berkshire also owns stocks at Jefferies Financial Group, which not only owns a stake in Ibit but also actively promotes Bitcoin as a fence for inflation.

Share this article