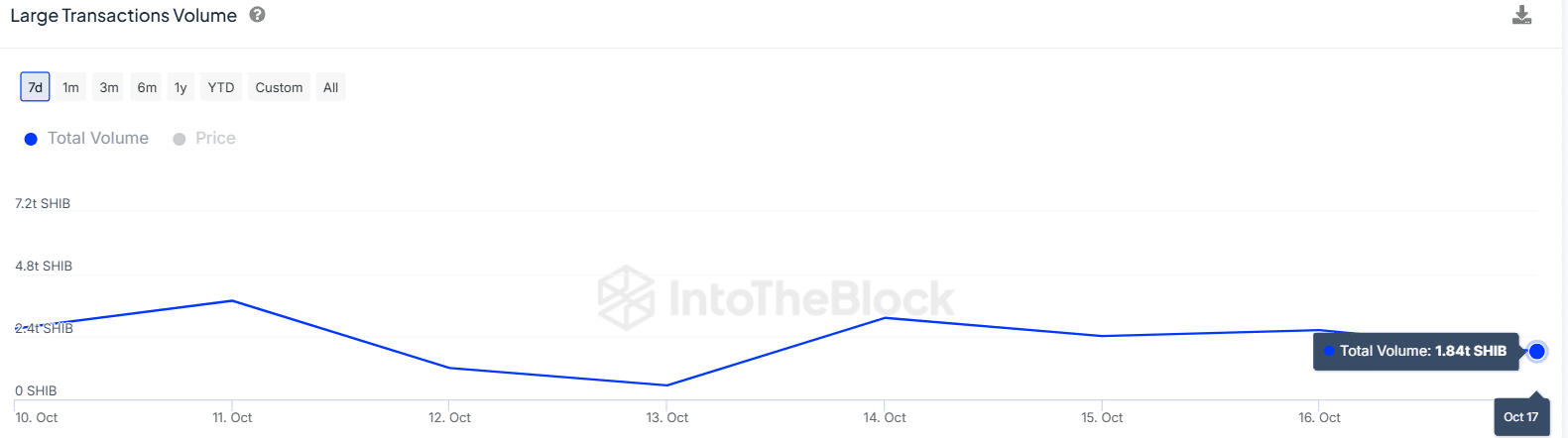

- Large SHIB trading volume decreased from 2.65 trillion to 1.84 trillion.

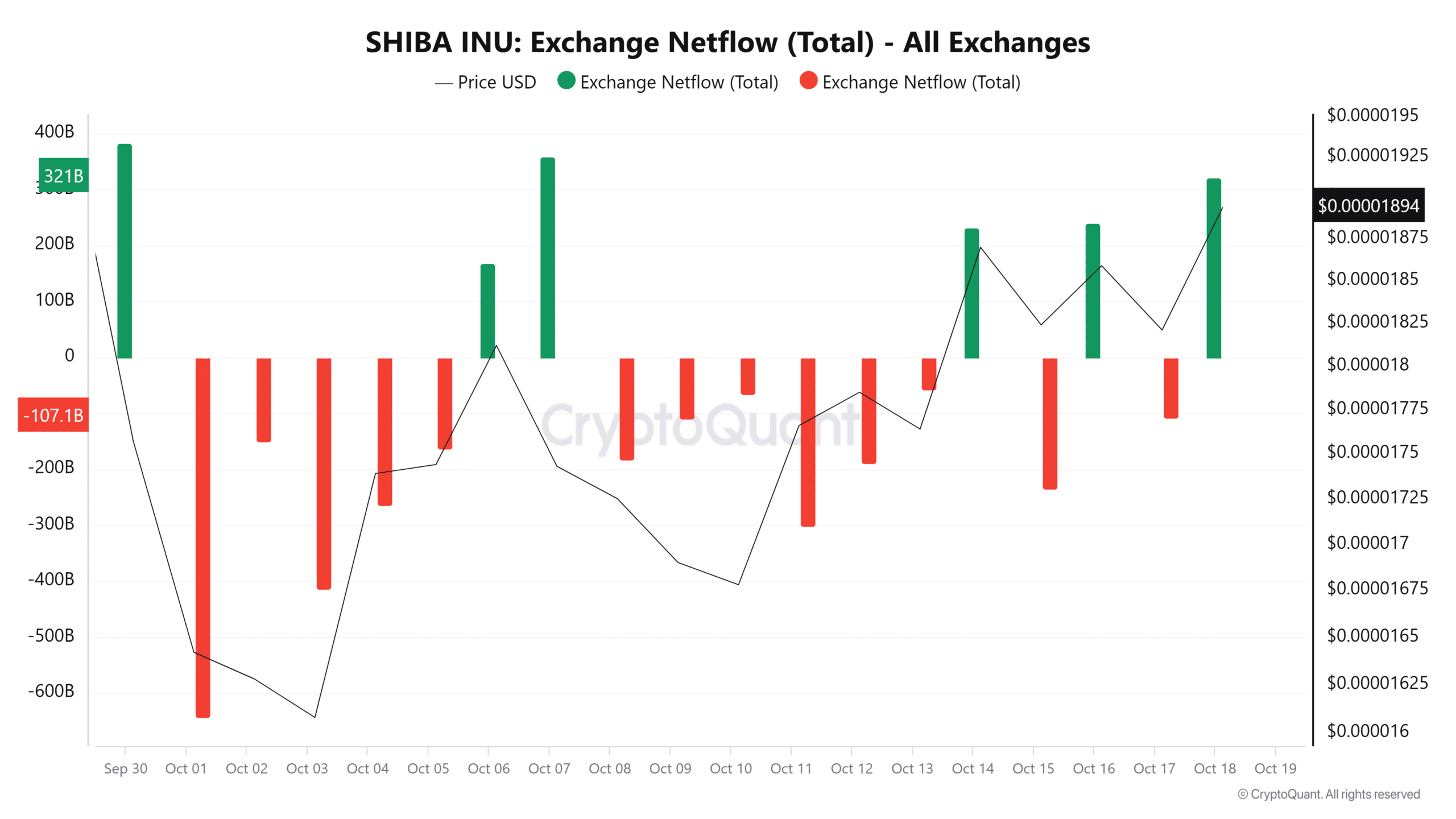

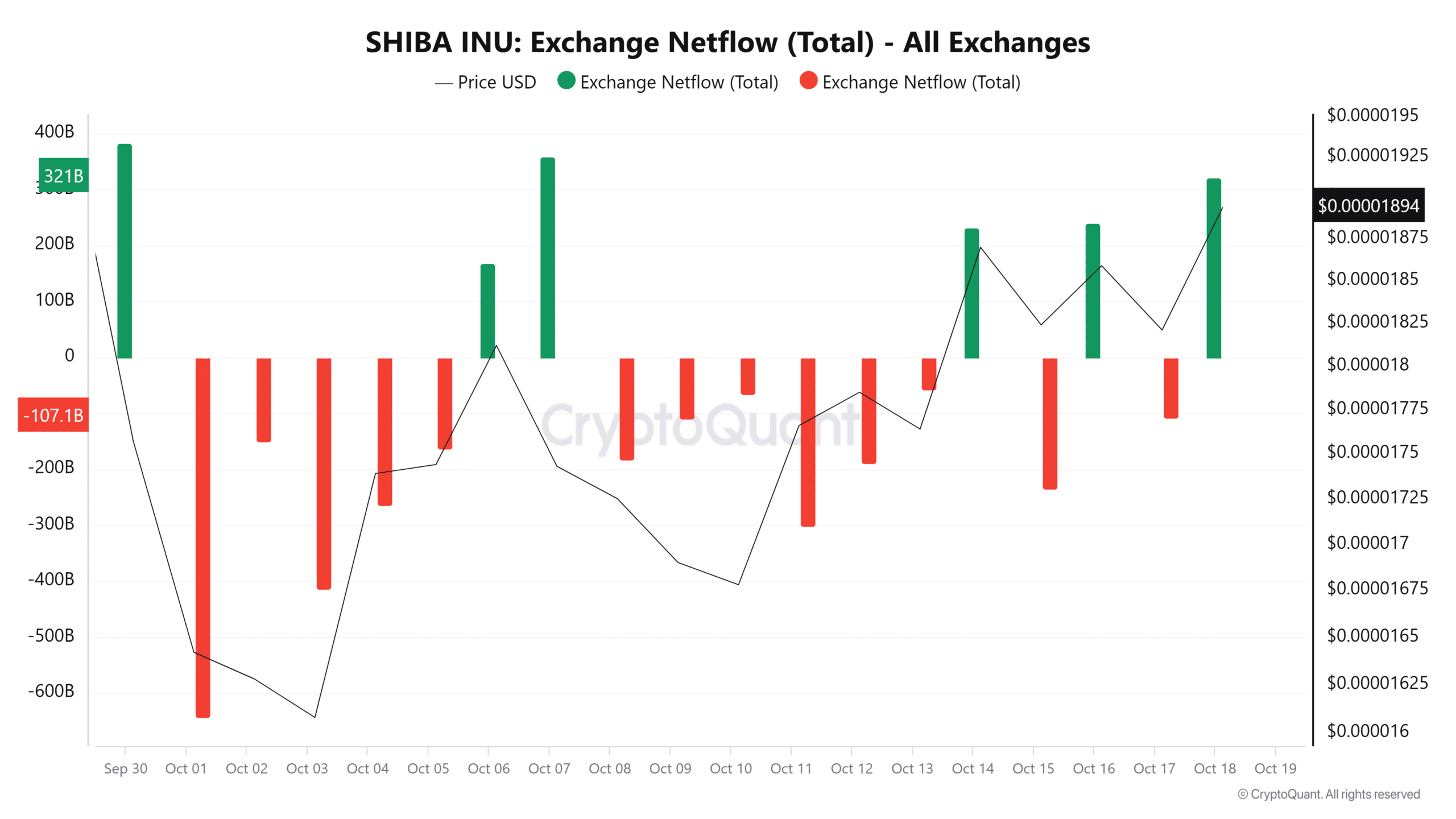

- SHIB’s net inflow to exchanges reached 321 billion tokens, the highest in a week.

Shiba Inu (SHIB) It was trading at $0.00001879 at press time after rising 3% in 24 hours. Trading volume plummeted 11% during this period, showing lackluster demand for SHIB at current prices.

The decline in demand may be due to a lack of whale activity. Looking at SHIB’s large trading volume over the past seven days, we can see that whale buying pressure has eased.

In fact, large-scale SHIB trading volume has decreased from 2.65 trillion to 1.84 trillion at press time.

Source: IntoTheBlock

Earlier this week we saw a surge in whale trading. Bitcoin (BTC) The price recovery has sparked optimism across cryptocurrency markets.

But whale trading has since declined, and the decline suggests they may be waiting for an opportunity to increase or decrease their holdings.

Exchange data shows that some SHIB holders are preparing to sell. Netflow to exchanges reached its highest level in a week, at 321 billion tokens at press time. These inflows are a significant increase compared to the previous day’s negative flows.

Source: CryptoQuant

When these tokens are sold, SHIB may experience spikes in volatility and low trading volume. However, a closer look at technical indicators shows that buyers are still in control.

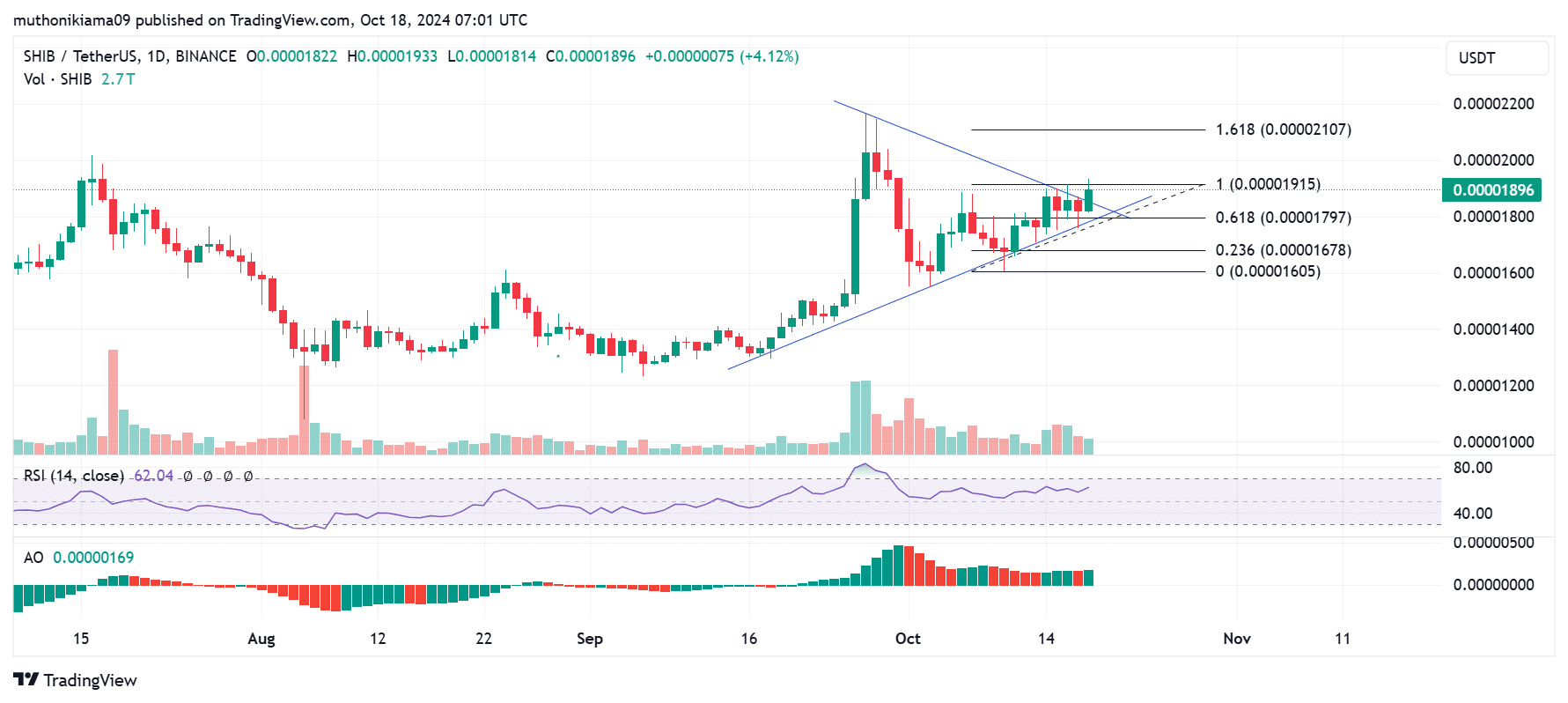

SHIB Technical Analysis

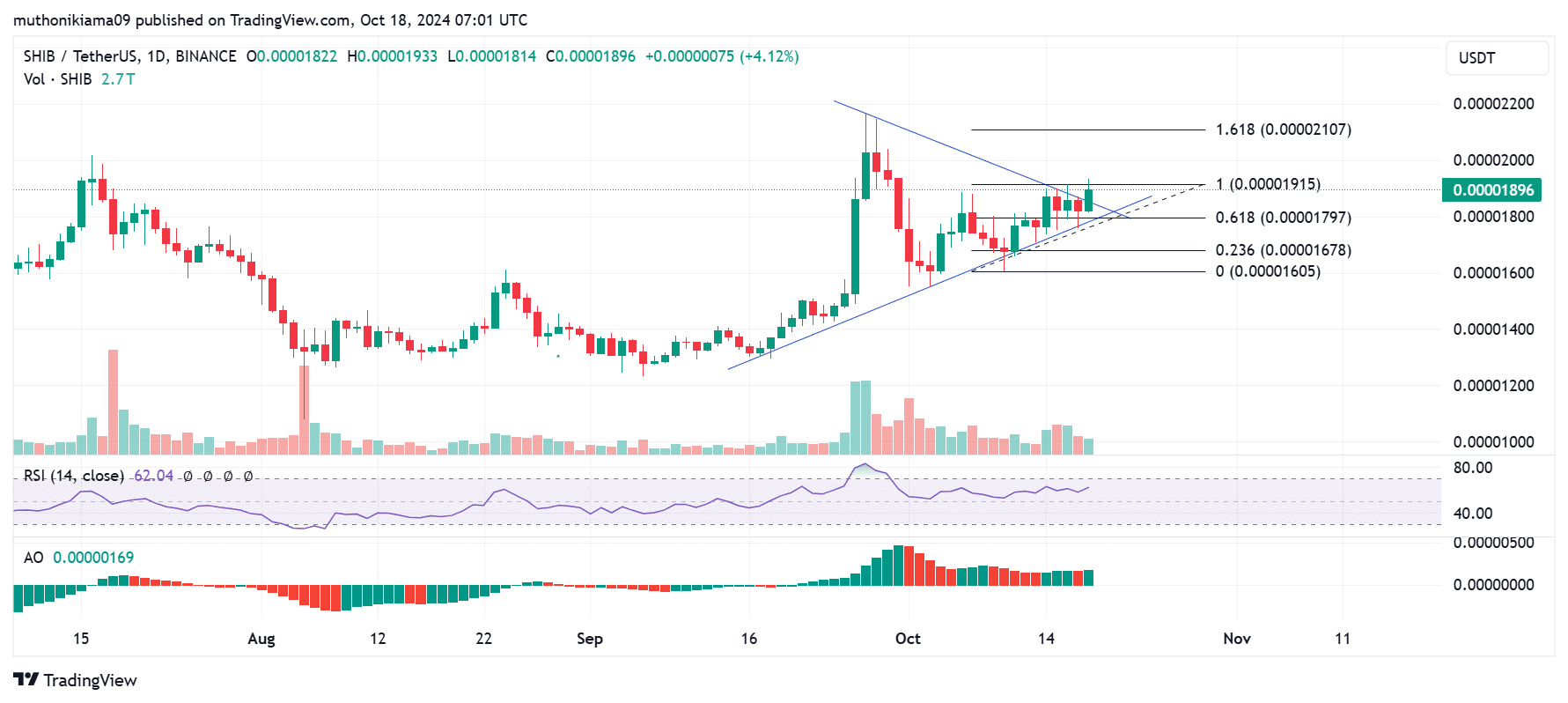

Shiba Inu has formed a bullish symmetrical triangle pattern on the daily chart, suggesting that the bulls may take the lead. The Awesome Oscillator turned green as SHIB attempted an upward breakout of this pattern. This indicates that momentum is shifting from bearish to bullish.

A relative strength index (RSI) of 61 shows that bullish momentum is at work. However, the RSI line showed minimal fluctuations and was oscillating at a nearly flat level, suggesting that SHIB may be in a consolidation phase.

Source: TradingView

Realistic or not, SHIB’s market cap in BTC terms is:

If Shiba Inu confirms a breakout of this symmetrical triangle pattern, it could trigger a bounce to the next resistance at the 100% Fibonacci level ($0.00001915). As a result, if this breakout fails, Mimcoin will test support at $0.0000179.

Data from Coinglass shows that 51% of traders have a long position in SHIB, up from 49% the previous day. On the other hand, short positions fell. The surge in traders betting on the uptrend highlights the positive sentiment.