- Exchange supply of ETH increased by 5% after Dencun.

- Whales were selling ETH on exchanges..

Ethereum (ETH) continued its downward trend, plummeting 9% over the past 24 hours.

The second-largest cryptocurrency has remained in the red since the Dencun upgrade went live, with weekly losses reaching 18% at press time, according to CoinMarketCap.

Whales are cashing in.

As the broader market sells off, concerns are growing that ETH’s bullish trend may be reversing.

According to Spot On Chain, an on-chain data tracker, the three whales reportedly liquidated a total of 26,946 ETH over the past four days, resulting in a profit of nearly $40 million.

Of note, he was one of the investors who transferred 8,870 ETH to Binance on March 16th. At that time, the price of ETH was $3,733. The sale netted Whale a total profit of more than $25 million.

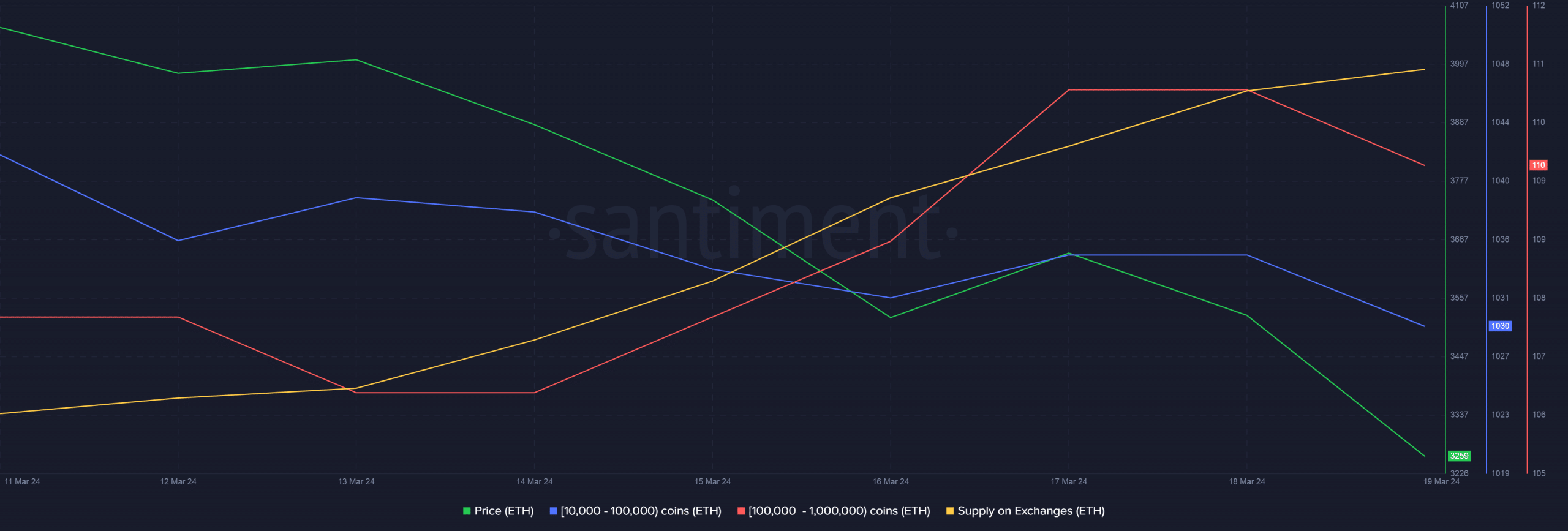

AMBCrypto used Santiment to examine other data sets to gauge broader market reaction.

Notably, ETH’s exchange supply increased by 5% after Dencun. Around the same time, major whale wallets holding between 10,000 and 1 million coins declined significantly.

Analysis of these two indicators shows that whales pursue profits.

Source: Santiment

These factors may be:

Typically, seasoned investors cash out when they do not see a positive catalyst for the asset in question.

Matrixport, a cryptocurrency investment service company, recently proposed selling ETH for buying Bitcoin (BTC). The proposal is rooted in two factors.

First, with Dencun running, one of the biggest drivers of ETH growth is now behind us.

Second, the likelihood of spot ETH exchange-traded fund (ETF) approval was decreasing by the day, something AMBCrypto previously reported.

Is your portfolio green? Check out our ETH Profit Calculator

These reasons may have prompted whale investors to become bearish on ETH as well.

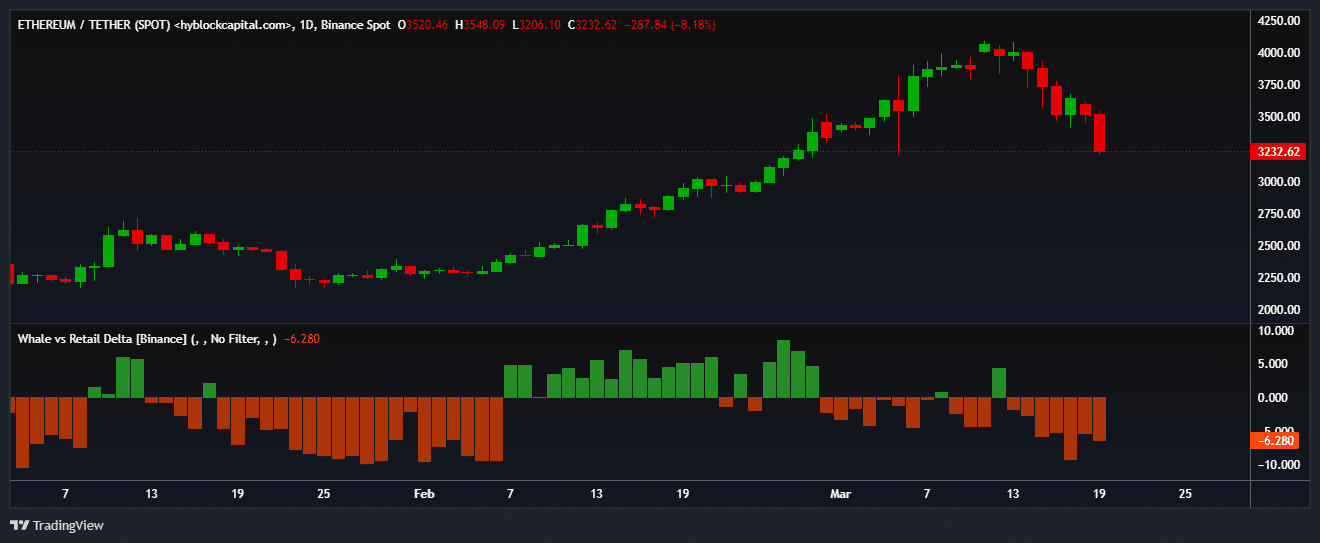

This is Hyblock Capital’s Whale vs. This is further illustrated by the Retail Delta indicator. As you can see below, whales have drastically reduced their long exposures over the past week.

Source: Hiblock Capital