- SOL hit a new all-time high as optimistic sentiment continued.

- Solana reached all-time highs in TVL and open interest.

Solana (SOL) is poised to finish November as its best month of the year. This week was particularly exciting for the network as we achieved new milestones in several areas.

The Solana community is celebrating a new all-time high (ATH) for its cryptocurrency. Over the past 12 hours, SOL has extended its bullish momentum, rising to $264.39. This marked a new ATH for the cryptocurrency.

SOL was trading at $259.35 and in overbought territory at press time. The recent high represents a 69% rally from the low so far this month.

Source: TradingView

The cryptocurrency has formed a slight bearish divergence with the RSI. This could contribute to a surge in selling pressure. However, there was no sign of major selling pressure coming back as the market was generally strong and most traders did not want to go the other way.

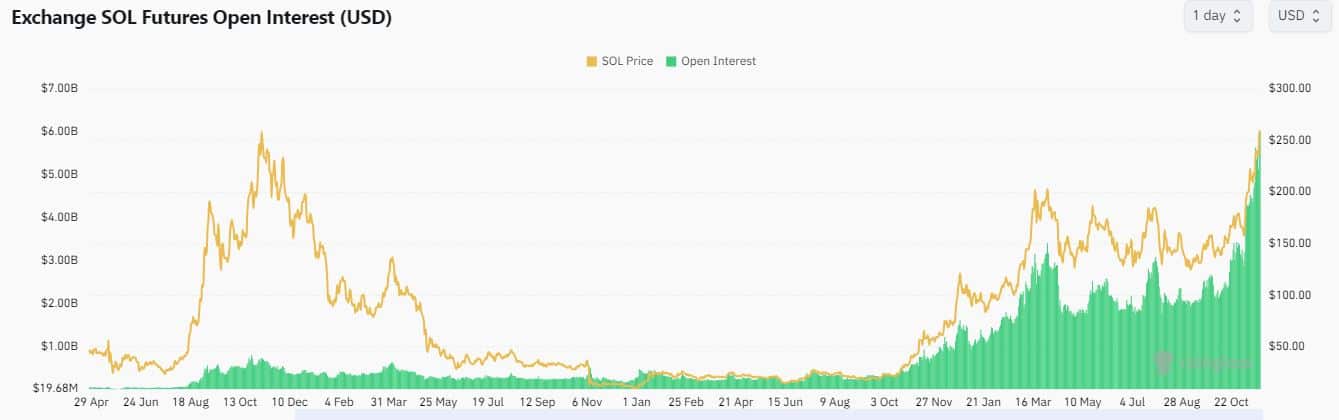

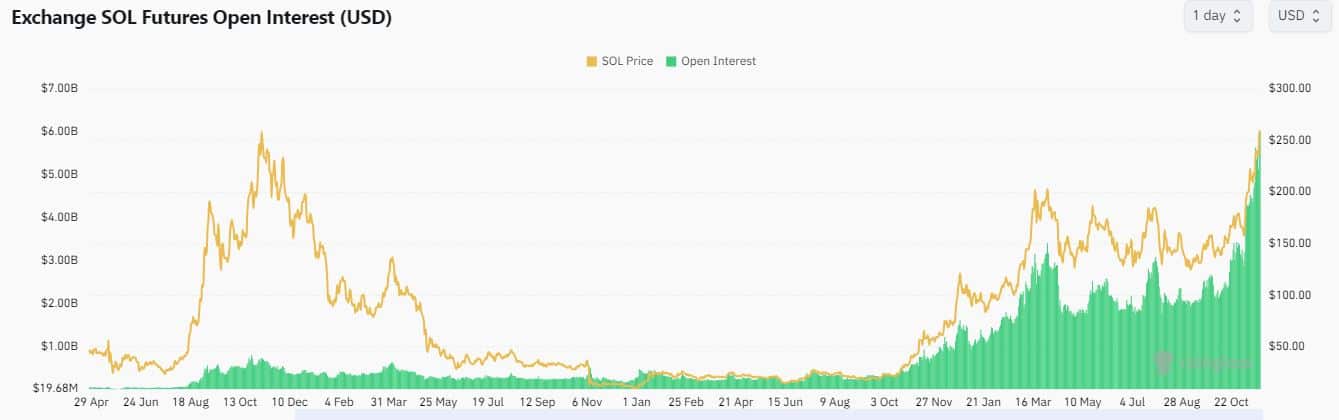

Demand for SOL has also soared to an all-time high. Open interest (OI) hit a high of $6.03 in the last 24 hours, the highest level in its entire history. This confirmed that derivatives demand, along with spot demand, also contributed significantly to SOL’s impressive price action.

Source: Coinglass

OI suggested that SOL may be sensitive to short selling, especially at high price levels. In the last 24 hours, SOL shorts are at 50.63%, which is higher than shorts at 49.37%. This could indicate a shift in sentiment and expectations of selling pressure.

Solana Network Activity Summary

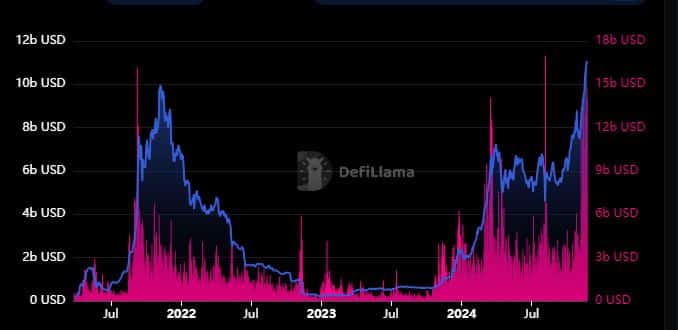

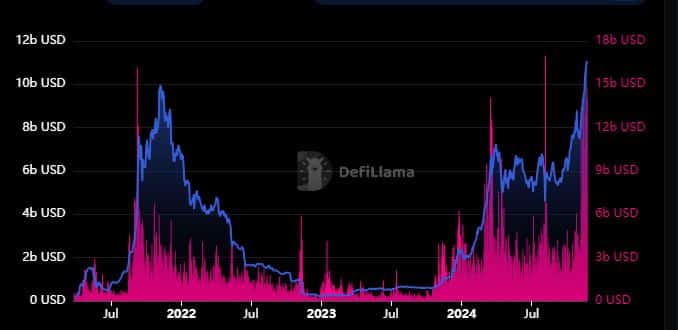

Solana also achieved new highs in some key performance indicators. For example, TVL soared to $11.08 billion in the last 24 hours, the highest TVL figure to date.

Source: DeFiLlama

Solana’s on-chain trading volume soared to $14.81 billion in the last 24 hours. This was the highest level of activity the network has achieved in the past 10 weeks.

Solana’s on-chain trading volume hit a record high on August 5, when the market plunged due to the liquidation of a Japanese carry trade.

Realistic or not, the SOL market cap in BTC terms is:

Can SOL maintain its bullish momentum?

Bullish market sentiment so far this month has pushed it to new highs, but at the time of writing, SOL is already overbought. The next major target for SOL is $300, which could happen soon if the market maintains its current momentum.

However, a downward trend is expected in the future, which could result in significant profit taking.