- Solana was testing support levels that had been in place for months at the time of writing due to persistent selling pressure and lack of buyer interest.

- Despite the price weakness, on-chain data remained positive, with Solana’s development activity surging 33% month-over-month.

Solana (SUN) It has fallen nearly 4% in the last 24 hours, with the bearish trend across the broader crypto markets adding to the headwind. The token was trading at $139 at the time of writing.

SOL had the biggest drop among the top 10 cryptocurrencies by market cap, with trading volume also down 12%. CoinMarketCap Data shows that market interest has declined and there is a lack of confidence among traders.

With Solana testing support levels for months, is a bullish reversal imminent or will the bearish trend continue?

Declining buyer interest

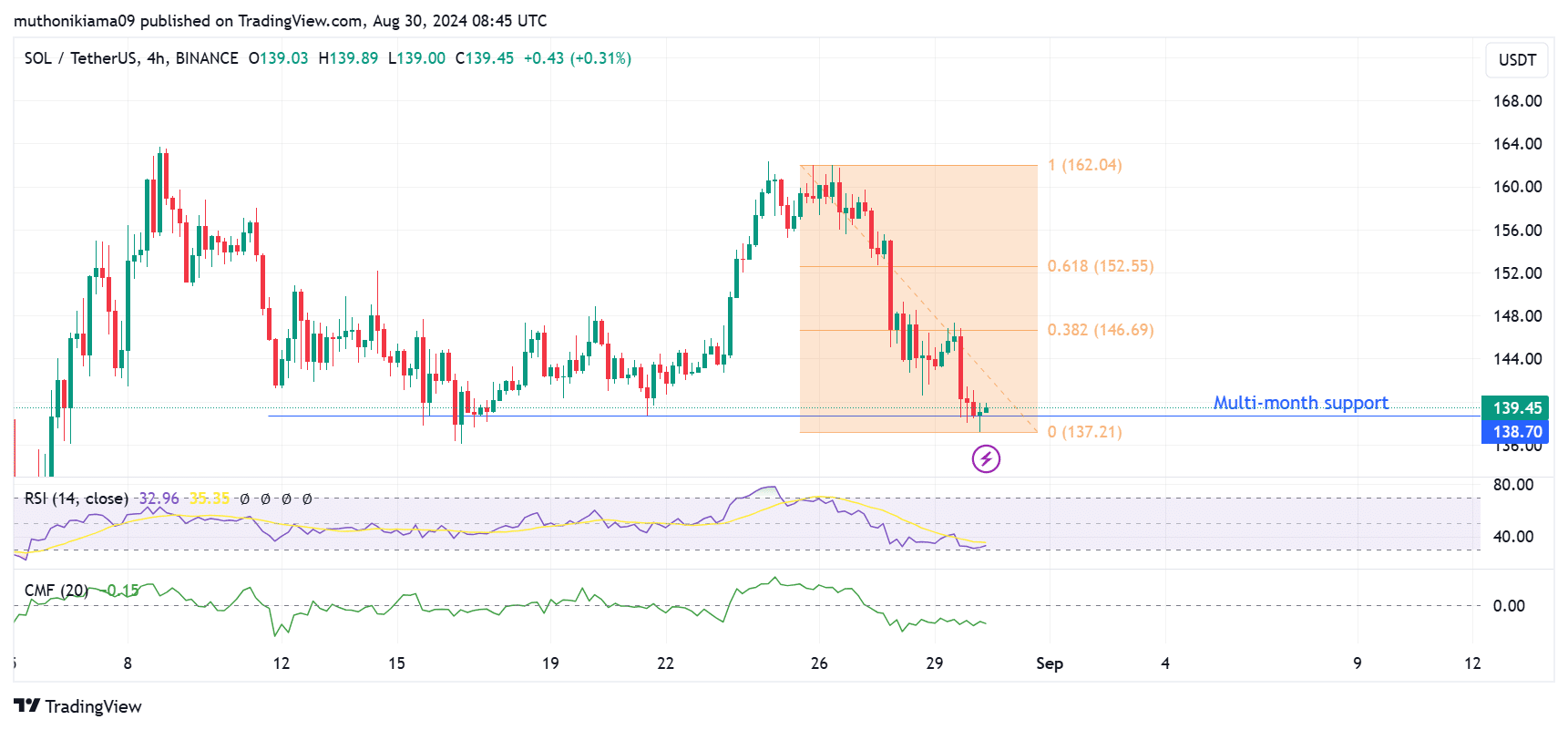

Solana’s technical indicators suggest a lack of buyer participation. Chaikin Money Flow (CMF) on the 4-hour chart has been oscillating in negative territory since the beginning of the week.

This trend indicates continued selling pressure and a lack of adequate buyer interest to absorb the tokens flooding the market.

The weak buying momentum around SOL is also reflected in the Relative Strength Index (RSI), which at the time of writing was at 33, indicating bearish momentum.

The RSI formed a lower low last week, showing that the bears were in the lead. However, the RSI line was now attempting a bullish cross above the signal line.

The potential crossover also coincided with two consecutive green candles after the price bounced back from testing multi-month support at $138, a level Solana has held since mid-August.

Source: TradingView

If Solana bounces off this support as it has in the past, the bulls will target the immediate resistance level of the 0.382 Fibonacci level ($146).

Another key level to watch is $152, where SOL needs to break above to confirm an uptrend. If the uptrend fails, SOL may consolidate and trade within the range before determining the next trend.

Solana shows strength

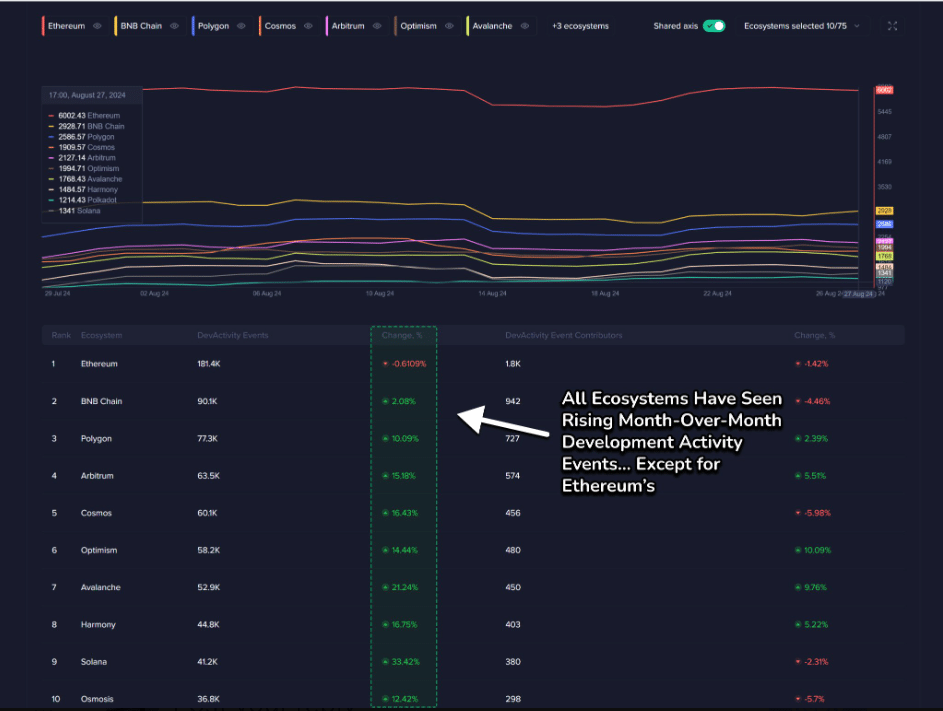

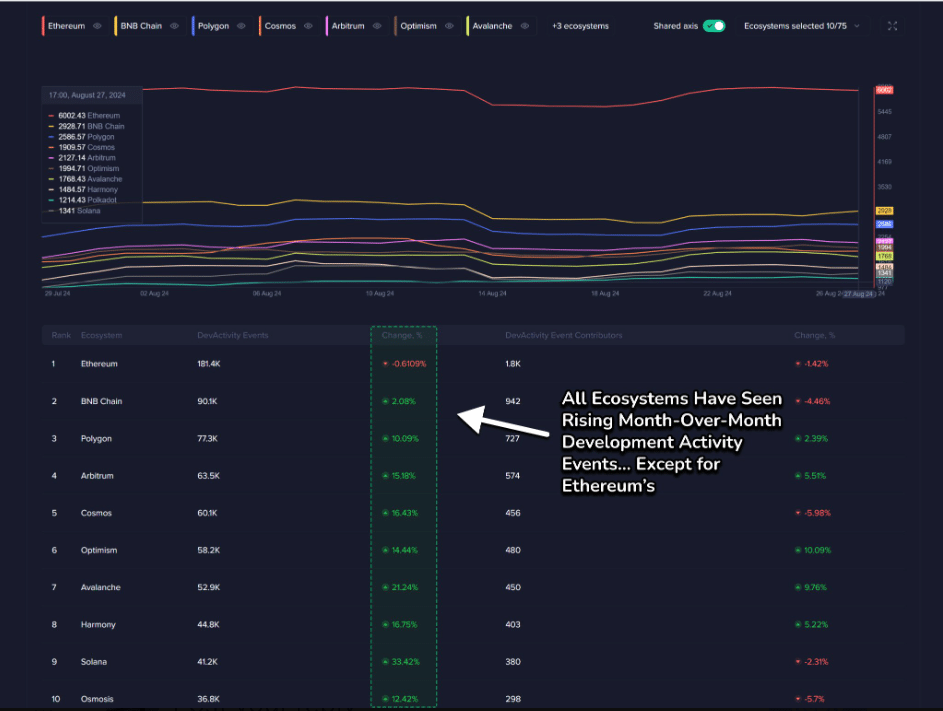

Although price action is still in a downtrend, Solana’s on-chain metrics paint a bullish picture.

According to Santiment’s recent X (formerly Twitter) post, the Solana network has seen the highest month-over-month growth in overall development activity.

This activity has surged by 33%, which is a positive sign of the network’s growth and improvement.

Source: X

In the data DeFiLlama Additionally, despite the pricing headwinds, Solana’s total value locked (TVL) grew by more than $1 billion last month.

Read Solana (SOL) price prediction for 2024-2025

Despite this, the positive network indicators did little to convince long traders.

Also, if the Long/Short ratio is less than 1 Coinglass This week has shown that short-term traders have been driving Solana’s price action for most of the week.