- The sharp decline suggested that interest in the Solana-based memecoin has cooled.

- If interest rates continue to decline, SOL’s price could test support levels as low as $145.90.

Daily trading volume on the Solana (SOL) decentralized exchange has decreased. As of May 26, AMBCrypto’s analysis of the Artemis dashboard found that it was worth $984 million.

Three days earlier, that number had surpassed $1.5 billion. This decline contrasts with the blockchain’s record in April. At that time, Solana’s DEX trading volume reached an all-time high of $60 billion per month.

Considering the recent fall and the end of May, the total volume for this month may decrease. The previous surge could be linked to the memecoin craze on the network.

No memecoins, no parties

Therefore, this decline could mean that interaction with memecoins launched on Solana is no longer as high as it used to be. Moreover, development seemed to have taken a backseat to SOL, the ecosystem’s native token.

At press time, the price of SOL was $161.49. A few days ago the price was close to $190. If DEX volumes continue to decline, SOL may follow suit.

This is because demand for cryptocurrencies is relatively tied to memecoin transactions. For those unfamiliar, some memecoins may allow exchange with USDC, but most require SOL.

Source: Artemis

Therefore, if memecoin purchases decrease, bids for SOL will likely also decrease. Apart from this, other indicators can also predict the next direction of Solana price, and AMBCrypto has taken a look at them.

SOL has become weak

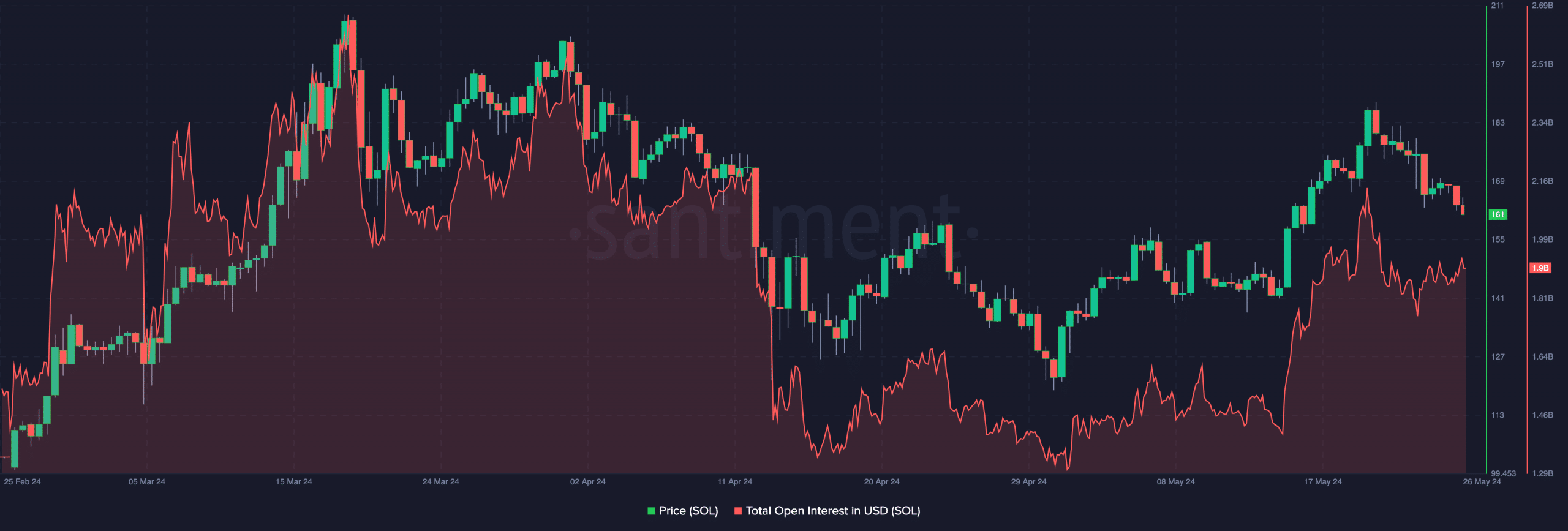

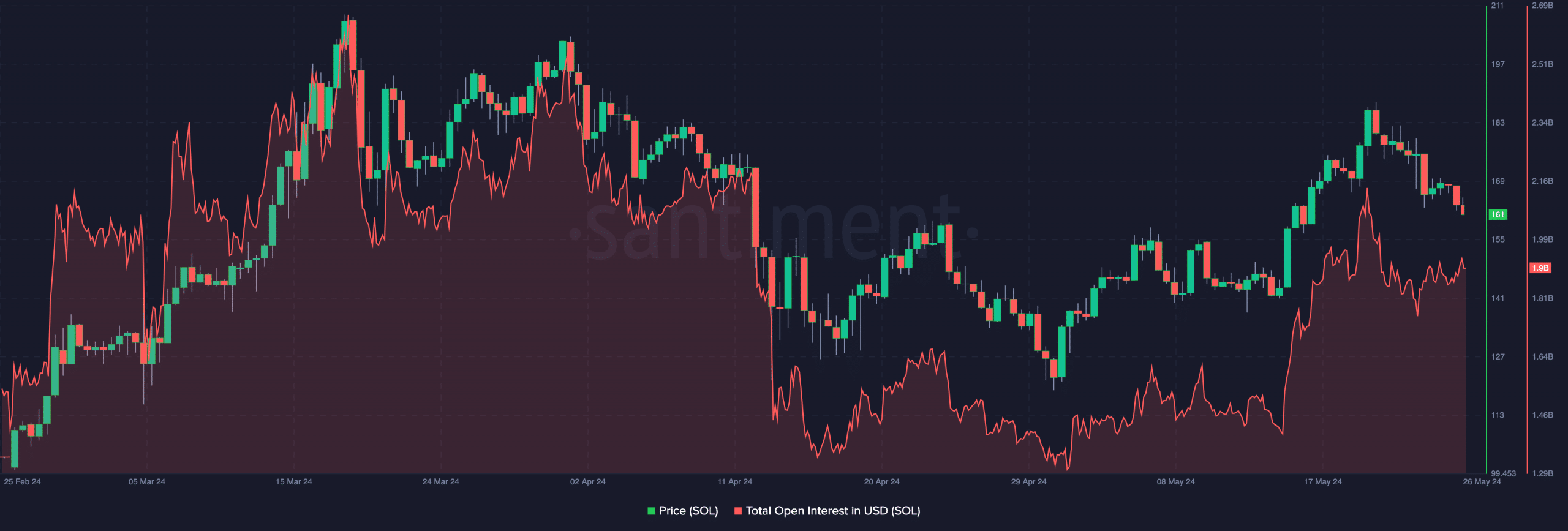

Another metric we analyzed was Solana’s Open Interest (OI). OI fell to $1.9 billion, according to data from Santiment. As of May 20, it was worth nearly $2.2 billion.

OI is the value of all open positions in a contract. An increase means the net position increases and more money flows into the market. In this case, the rise acts as a bullish signal.

A good example is shown in the chart below where the price of SOL rose to $188.45 as OI surged. However, this decrease means that the liquidity being withdrawn from SOL contracts has increased.

Source: Santiment

So the strength of the uptrend was waning. If this continues, the price of SOL may continue to decline and a move towards $145.90 may be possible.

AMBCrypto also reported that Solana is starting to lag behind other blockchains in terms of activity. Projects you can invest money in for Solana include Aptos (APT) and Sui (SUI).

Realistic or not, APT’s market capitalization at SOL is as follows:

However, it is unclear whether these projects will be able to consistently outperform the Solana deal and stand the test of time.

If this happens, Solana could lose not only its price but also some of its market value. If not, you can return to your winning ways.