- Spot Bitcoin ETF supportEd industryThe mainstream of Trustworthy.

- that much market Seems pessimistic about it Solana ETF At this point.

- short-term price movement Cannot be used for measurement ETF Approval.

The approval of a spot Bitcoin ETF in the US in January 2024 was a watershed moment for the cryptocurrency industry. Bitcoin hit a new all-time high just two months after the ETF’s launch, with unprecedented net inflows demonstrating pent-up demand and solidifying BTC’s status as a legitimate investment asset.

The success of the Bitcoin ETF has paved the way for altcoin ETF applications, and Ethereum products are next in line for potential approval. Riding on this optimism, investment managers have begun filing for Solana ETFs, with VanEck leading the way. However, unlike the excitement surrounding Bitcoin and Ethereum ETFs, the market response to the prospect of a Solana ETF has been noticeably muted.

Market skepticism surrounding Solana ETF

On June 27, VanEck’s Solana ETF filing sent SOL’s dollar value soaring 10%, closing the day at $149.30. However, that momentum has since waned amid widespread market uncertainty as SOL struggles to maintain gains in the days following the announcement.

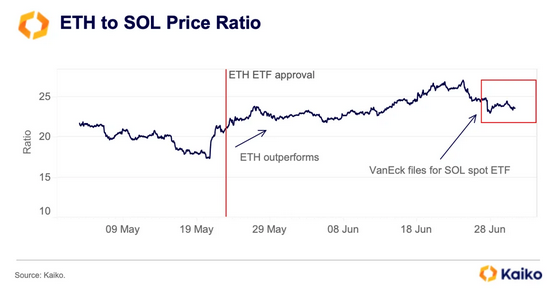

In the data Wharf The ETH to SOL ratio has remained relatively flat since VanEck’s filing, further highlighting the market’s muted reaction. Solana outperformed Ethereum in March, but the ratio has proven to have fallen sharply, although this trend has reversed since the Ethereum ETF application was approved.

Macro Now researcher Noel Acheson interpreted the stagnant ratio as a sign of market skepticism about the SEC’s willingness to approve the Solana ETF application. “The market doesn’t seem to have much confidence in the SOL spot ETF approval,” Acheson wrote in his analysis.

Despite this, Acheson maintains a cautiously optimistic outlook, saying the Solana ETF could become available in 2025 if the Republicans win the U.S. elections in November.

Matthew Siegel, head of digital asset research at VanEck, confirmed that the SEC has until March 2025 to decide on a Solana ETF. The market response to the spot Solana ETF has been muted so far, in contrast to the enthusiasm surrounding the Bitcoin ETF.

Bitcoin ETFs pave the way

The January 2024 Spot Bitcoin ETF approval was a watershed moment for the cryptocurrency industry following years of SEC rejection. BlackRock’s June 2023 filing was a turning point, leveraging the firm’s strong reputation and high ETF approval rate to inject new optimism into the market.

After seven months of intense speculation, the SEC (United States Securities and Exchange Commission) suddenly approved all BTC ETF applications, and the investment product launched on January 10th.

This groundbreaking development paves the way for altcoin ETFs, with Ethereum emerging as the next strong candidate. While an Ethereum ETF has yet to receive formal approval, the market received significant traction in May 2024 as applicants adjusted their submissions to suit SEC preferences.

The key change was the removal of Ethereum staking from ETF fund operations, a move that showed the industry’s willingness to adapt to regulatory concerns. The move was widely interpreted as a positive step toward eventual approval, further fueling market optimism.

Nate Jerassi, co-founder of ETF Labs, expects the SEC to approve an Ethereum ETF in mid-July.

On the other side

- Price fluctuations ~ Of Bitcoin, Ethereumand brushWhether dollar term or relatively each otherIt should not be used as. Indicators ~ Of ETF ApprovalOther various things Factors can affect price.

- guess Which one is mounted on? Altcoin The following are ETF products.

Why this matters

Regardless of whether or not it is approved, the Solana ETF application demonstrates the evolving relationship between traditional finance and crypto assets, and the delicate balance that regulators must strike between encouraging innovation and ensuring investor protection.

Solana DEX Volumes Twist Ethereum:

Solana Turns Ethereum Upside Down Again, This Time with Record Frequency

Polkadot’s massive financial spending has been met with criticism.

Why Polkadot’s Millions of Marketing Dollars Missed the Target